Nokia gone? Motorola hits a decade-high, is there a spring for old-school phones?

![]() 11/07 2024

11/07 2024

![]() 615

615

In the 2005 song "I Made Money" by the WuKu duo, the first thing to do after making money is to buy a Nokia with the left hand and a Motorola with the right. Indeed, in that era, Nokia and Motorola were the overlords of the mobile phone industry. However, no dynasty lasts forever, and after the advent of the smartphone era, the dynasties of Nokia and Motorola, which were not sensitive enough to industry changes, collapsed abruptly.

Today, Nokia's smartphone sales are extremely low, and it can only make ends meet in the low-end smartphone and feature phone markets. Unlike Nokia, Motorola, which has experienced a downturn, has unexpectedly ushered in a second spring after being acquired by Lenovo.

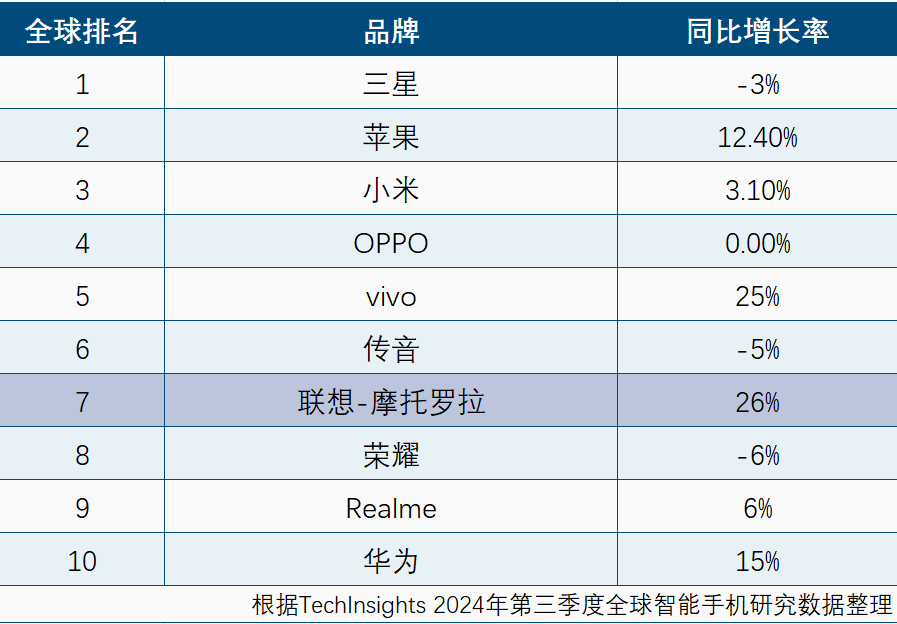

The latest report from market research and technical analysis company TechInsights shows that global smartphone shipments in the third quarter of 2024 increased by 3.8% year-on-year to 307.7 million units. Among them, Lenovo-Motorola ranked seventh globally in sales and led the pack with a 26% growth rate, setting a new record for market share in nearly a decade.

(Source: Lenovo-Motorola)

As kings of the old era, Nokia has all but disappeared in the smartphone sector, and even Microsoft could not save it. So how did Motorola manage to enter the top ten globally in sales and achieve a sales revival?

Is Motorola's comeback solely due to "relying on Lenovo for shelter"?

After the Symbian system lost its competitiveness, Nokia also chose to embrace Android, but large companies generally face difficulties in turning around due to their size. Transformation is not solely decided by the CEO but requires shareholder support. Sometimes, internal departments within the company may also hinder each other, leading to obstacles in the company's business development. Looking at the mobile phone industry, similar situations have occurred in companies such as Nokia, Motorola, and Sony.

Undoubtedly, facing industry competition and change, choice is as important as strength, and this is why Motorola was able to transform and succeed. Lenovo-Motorola's choice and strength are reflected in two major aspects: market layout and product planning.

Lenovo's acquisition of Motorola is comparable to Geely's acquisition of Volvo and SAIC's acquisition of MG, successfully helping it open up overseas markets. It is worth noting that although domestic brands continue to expand into overseas markets, their current overseas sales are mainly concentrated in Asia, particularly Southeast Asia and South Asia. With the influence of Motorola, Lenovo-Motorola has achieved impressive sales results in Latin America, Africa, the Middle East, and the Asia-Pacific region, and ranks third in North America with a 12% market share.

(Source: Photographed by Leikeji)

Additionally, Lenovo-Motorola has entered the Japanese market and acquired the local mobile phone brand Fujitsu. Leveraging Fujitsu's local influence and the strength of Lenovo-Motorola, Fujitsu's brand entered the top four in smartphone sales in the Japanese market for the first time. Acquiring and integrating local brands in overseas markets can quickly enhance brand influence, reduce the time and cost required for marketing, and, combined with Lenovo-Motorola's technological strength, significantly reduce the difficulty of expanding into overseas markets.

In terms of products, Lenovo-Motorola may no longer have the same depth in the mobile phone sector as giants like Apple, Samsung, Xiaomi, OPPO, and vivo. However, having experienced the pain of transitioning to the smartphone era, Motorola is more proactive in embracing new things compared to most smartphone giants.

(Source: Photographed by Leikeji)

Taking foldable phones as an example, when foldable phones were first introduced in 2019, Lenovo-Motorola quickly followed suit, solving the hinge problem and launching the vertically folding moto razr 2019. For several years afterward, horizontally folding phones were the mainstream, with vertically folding phones being rare and having average sales. As technology evolves, vertically folding phones are increasingly recognized by consumers, and in the third quarter, Xiaomi entered the top three in domestic foldable phone sales with the vertically folding MIX Flip.

After years of operation, Lenovo-Motorola, which entered the market early, ranked first globally in vertically folding phone sales with a 30.8% market share in the second quarter of this year. Today, multiple series such as moto S/X/G/razr cover products of different prices and types.

Based on the technological strength and influence of both Lenovo and Motorola, Motorola seems to be touching the hope of returning to its peak. Currently ranking fourth globally in sales, it is only an intermediate step in Lenovo-Motorola's revival. The entire smartphone market is moving towards the AI era, and the industry is about to undergo new changes. By seizing the opportunities of the times, Motorola can rise with the tide.

Can Motorola usher in a second spring by doubling down on AI?

After experiencing multiple eras such as smartphones, 3G, 4G, and 5G, the current mobile phone industry has entered the AI era. Facing many challenges in this new era, Lenovo-Motorola has also timely incorporated AI capabilities into its products. Taking the moto razr 50 Ultra AI Yuanqi Edition as an example, its built-in AI agent Lenovo Xiaotian can accurately recognize natural language, perform settings and application operations, and can also continue, summarize, polish, and translate documents.

Functions such as AI painter, AI calling, and AI travel can calculate travel times and summarize call content based on users' living habits, improving work efficiency and convenience in daily life. Additionally, Motorola will deeply invest in AI PCs, AI tablets, AI headphones, and other categories to enhance the cross-platform and cross-device collaborative capabilities of smart devices, providing users with a "one device, multiple terminals" experience.

(Source: Lenovo-Motorola)

At the Lenovo Tech World 2024 conference, Lenovo-Motorola also revealed information about integrating Large Action Models (LAM) with moto AI. Based on this technology, Lenovo-Motorola's LAM will be able to learn user behavior and provide personalized interaction and assistance capabilities.

Specifically in terms of products, Lenovo-Motorola's mobile phones, laptops, and other devices are already interconnected. PCs can access mobile phone apps, enabling multi-screen operations and cross-device file transfers on the PC platform. With the support of more devices and AI technology, Lenovo-Motorola's AI agents will better understand users in the future, creating the ultimate AI assistant that aligns with users' habits.

(Source: Lenovo-Motorola)

Compared to some leading mobile phone brands such as OPPO and vivo, Motorola, backed by Lenovo, actually has an advantage in terms of ecosystem, especially in tablets and PCs, two powerful tools for work and study, where traditional mobile phone manufacturers lack brand influence and technological foundation. A full product line layout will be an important factor in further increasing Motorola's global market share in the future.

In terms of market layout, Motorola still has an advantage. Expanding into markets outside Asia is difficult, and entering the North American market is even more challenging. However, Motorola is one of the few brands that can operate unhindered globally. In the United States, its home base, Motorola has a 12% market share. Centered in China, it expands into Southeast Asia, South Asia, and the Middle East, and centered in the United States, it expands into Latin America before moving on to Europe. Lenovo-Motorola may have more room for development than domestic leading mobile phone brands.

Evaluating a company's resilience is not just about how high it can climb when it is at its peak but also about whether it can climb back up after falling to its lowest point. Both Motorola and Nokia have experienced glory and Low valley . Today, Nokia's mobile phone business is beyond repair, but it can still survive by relying on patented technology and communication services. Motorola, which has been reborn from adversity, has the opportunity to climb new peaks again.

To return to the center stage, Motorola needs to redouble its efforts

According to statistics from Fortune magazine, 62% of US companies have a lifespan of less than five years, and only 2% survive for more than 50 years. However, for today's entrepreneurs, this data may be too optimistic. Before the 21st century, global technology and the economy developed rapidly, and there were fewer giants hindering the development of small enterprises. Now, with fierce competition in various industries worldwide, every giant has ambitions to monopolize the industry, making it more difficult for small and medium-sized enterprises to grow and develop.

Starting a business is difficult, and the same is true for ZTE. Leveraging the influence of Lenovo and Motorola, Lenovo-Motorola ranks seventh globally in mobile phone sales, with a growth rate that is second to none among the top ten brands. However, this also means that for Lenovo-Motorola to make further progress, it needs to defeat giants such as Samsung, Apple, Xiaomi, OPPO, vivo, and Transsion, the king of Africa, in the smartphone market.

(Source: Photographed by Leikeji)

Which of these leading companies in the mobile phone industry does not have its strengths? Even with the combined forces of the old-school mobile phone manufacturer Motorola and PC manufacturer Lenovo, surpassing them is extremely challenging. Fortunately, Lenovo-Motorola, with its market advantage, has more room for development than other domestic brands.

After acquiring Fujitsu, Lenovo-Motorola will likely also enter the Japanese market. The inflexible Japanese market has always been considered an island in the smartphone industry. Domestic brands such as OPPO and Huawei have also entered the Japanese market but have not achieved significant results so far. With Fujitsu as its alias, Lenovo-Motorola has successfully ranked fourth in the Japanese market, second only to Apple, Google, and Sharp. With the technology of Lenovo and Motorola, it is only a matter of time before it surpasses Sharp and Google in sales in Japan.

However, the mobile phone industry is fiercely competitive and full of variables. Whether Lenovo-Motorola can overcome numerous difficulties and return to its peak remains to be verified by time.

Source: Leikeji