Multiple institutions have raised their ratings, and Ctrip, which has stabilized above the HK$500 mark, is beginning to tell a new story?

![]() 11/08 2024

11/08 2024

![]() 569

569

During the National Day holiday, Ctrip's share price surged to a high of HK$548.5 before experiencing a significant pullback. Recently, Ctrip has regained momentum and once again surpassed the HK$500 threshold.

Meanwhile, China's further expansion of visa-free travel may be one of the strongest drivers behind the recent surge. On November 1, Foreign Ministry spokesperson Lin Jian announced that China has decided to expand the scope of visa-free countries, implementing a visa-free policy for holders of ordinary passports from Slovakia, Norway, Finland, Denmark, Iceland, Andorra, Monaco, Liechtenstein, and South Korea starting from November 8, 2024.

Moreover, Ctrip has received recognition from multiple institutions. Among them, China International Capital Corporation (CICC) raised its target prices for Ctrip's American Depositary Shares (ADS) and Hong Kong shares by 20%, to $75.9 and HK$588.5, respectively, maintaining an outperform rating; Morgan Stanley analyst Yang Liu CFA maintained a buy rating on Ctrip with a raised target price of $73; AllianceBernstein analyst Boris Van also initiated a buy rating on Ctrip with a target price of $85.

With favorable market conditions and widespread recognition, what has Ctrip done right to sustain its soaring share price?

By capitalizing on the inbound and outbound travel boom, Ctrip has correctly identified this year's 'trend'.

Judging from the frequent visa-free policies in recent months, the market signal is clear. Inbound and outbound travel is the hottest travel mode this year.

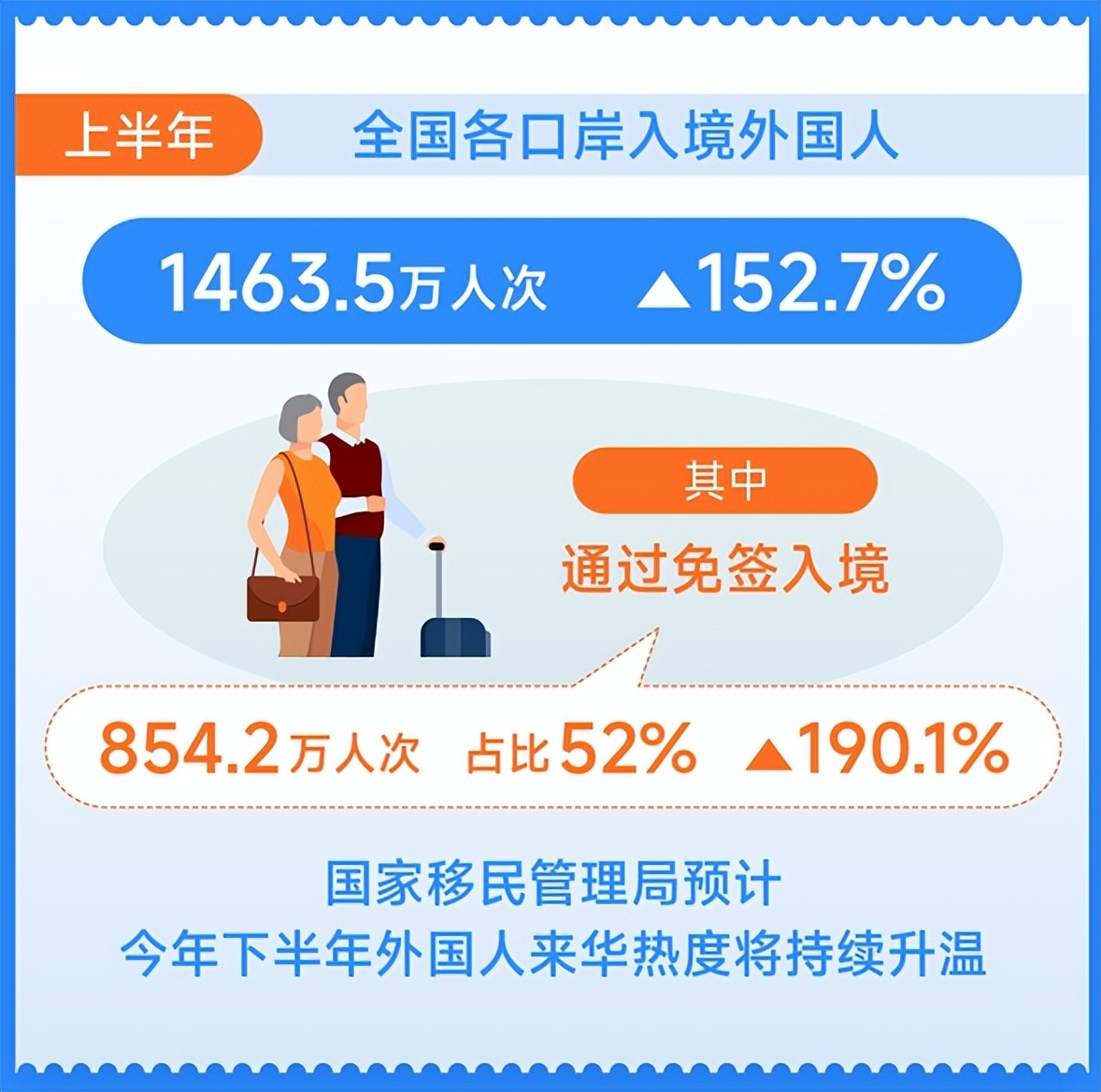

According to data from the National Immigration Administration, in the first half of 2024, national immigration management agencies inspected a total of 287 million entries and exits, a year-on-year increase of 70.9%. Among them, there were 137 million mainland residents, 121 million residents from China's Hong Kong, Macao, and Taiwan, and 29.22 million foreigners.

In particular, the total number of entries and exits in the first quarter exceeded those of every quarter in 2023, being 2.2 times that of the same period in 2023 and recovering to 92% of the same period in 2019.

Image source: Xinhua News Agency

Behind the surge in inbound and outbound tourism, there are two notable phenomena. One is the 'withdrawal symptoms' experienced by returnees and foreigners after visiting China, as China's charm is so great that word-of-mouth attraction further drives inbound tourism. The other is that Chinese people, having been cooped up for too long, want to travel farther and see more of the world. In the past few years, outbound travel was the most difficult to achieve, but now that restrictions have been lifted, a 'bottom-bouncing' recovery has begun.

With demand on the rise, the market is taking up the slack. So, how is Ctrip capitalizing on this immense inbound and outbound travel boom?

For outbound travel, Ctrip prioritizes focusing on the Asian market. Currently, Ctrip has established direct and efficient first-party relationships with airlines and hotels in the Asian market, giving it stronger control on the supply side.

Moreover, according to the annual report of the Pacific Asia Travel Association (PATA), after a strong rebound last year, the Asian Pacific tourism market continues to show good growth momentum in 2024, driven by destinations such as China. The strong growth potential of the Asian market provides a solid foundation for Ctrip's outbound tourism development.

Furthermore, since Asian countries differ from developed countries in having a lower rate of online adoption, there is still significant room for improvement. In terms of competition, the market concentration in the tourism sector in East and Southeast Asia is not high, and the proportion of chain hotels is also low, which is conducive to the integration by Online Travel Agencies (OTAs). Therefore, Ctrip has ample opportunity to gain greater bargaining power in the Asian market.

For inbound tourism, the primary source countries include Japan, Malaysia, South Korea, the United States, Australia, the United Kingdom, Thailand, Vietnam, Canada, and Russia, covering a wide geographical span.

Therefore, service and experience are key. It is crucial not to overlook the common issues faced by inbound tourists. In response, Ctrip has launched several innovative initiatives covering the entire inbound tourism chain, including promotion, payment, ticketing, internet access, accommodation, and more.

Currently, Ctrip's international version, Trip.com, has launched an online reservation function in collaboration with over 600 popular scenic spots in China, covering 39 countries and regions worldwide and supporting 24 languages and 29 currencies. For offline channels, Ctrip has introduced international ticket vending machines. Additionally, for issues such as international roaming charges, Ctrip Group has joined forces with China Unicom to provide targeted solutions for inbound tourists.

By grasping the current hot trend of inbound and outbound tourism, Ctrip, as a leading player, naturally has stronger potential for upward momentum.

'Breaking through' the domestic market: Ctrip's 'transformation' begins to take effect

While overseas markets are thriving, the intense competition in the domestic market is also a topic that cannot be ignored.

As OTA platforms have intensified competition in recent years, the entire industry has gradually evolved into a competitive landscape led by Ctrip with 'one superpower and multiple strong players,' and the sound of 'price wars' has continued to emerge.

As a leader, Ctrip has maintained its leading position due to its deep cultivation of the mid-to-high-end tourism market, abundant high-end hotel resources, and strong service capabilities. Meanwhile, Qunar, as its subsidiary, has also effectively attracted and weakened the vitality of attacks related to 'price wars' and 'cost-effectiveness.'

However, platforms such as Meituan, Fliggy, and Douyin are also accelerating their pursuit by leveraging their respective advantages.

As a platform with a strong local lifestyle presence, Meituan has integrated lifestyle services with hotel and travel, scenic spot tickets, dine-in restaurants, takeout, and other businesses. Benefiting from the traffic generated by high-frequency consumption such as dining, Meituan has achieved the effect of feeding back into its low-frequency travel business.

Its threat and influence cannot be underestimated. According to the "Q1 2024 China Tourism Consumption Trends Insight Report" released by TravelDaily and Data 100, approximately 41.6% of respondents chose Meituan for booking destination entertainment, far exceeding other OTA platforms.

As a travel platform under Alibaba, Fliggy is supported by Alibaba's huge traffic pool. Unlike other deeply self-operated platforms, Fliggy primarily connects merchants and users through services such as technical support and data analysis.

From Alibaba's perspective, services like Huabei provided by Alipay and the 88VIP membership offered by Taobao directly support Fliggy's traffic system, providing a smoother user experience in terms of usage and consumption. The advantages lie in more transparent information and a more diverse service ecosystem.

After this stage of chaos, Ctrip clearly perceived the source of its helplessness in the domestic market.

This Double 11, the busy Ctrip introduced the 'buy now, pay later' feature. Originally, this segment was completely dominated by Fliggy. However, as Meituan began considering the feasibility of this solution and Douyin started implementing it earlier this year, Ctrip has finally entered the fray.

Ctrip's 'buy now, pay later' feature not only levels the 'starting line' in terms of consumer experience but also further expands its financial offerings.

From Ctrip's consumption logic of 'buy now, pay later,' consumers can 'freely' stock up on 'goods' in the initial stage of hesitation by purchasing the delivery rights of the corresponding products, similar to a free option. Repayment only begins after the completion of on-site verification and billing.

Crucially, using this feature requires agreeing to the 'Take it, Credit Purchase Related Agreement,' which can only be used after activation. Therefore, this opens up a path for low-cost customer acquisition for cash loans. The introduction of 'buy now, pay later' is clearly a new attempt by Ctrip to break through its own limitations. After this battle, a bolder and more flexible Ctrip may bring even more innovations and changes.

The 'common ailment' of OTA platforms: the unavoidable role of the 'middleman'

Ctrip, which is gradually mastering both domestic and foreign markets, seems to be regaining its home court. Nevertheless, Ctrip is still in a passive position of 'relying on external conditions,' with the cyclical nature of tourism seasons being one aspect. Moreover, while Ctrip holds an absolute advantage in the mid-to-high-end hotel segment, fragmentation is also intensifying.

As the Matthew Effect becomes more pronounced among mid-to-high-end hotels, the trend of 'the strong getting stronger' is increasingly apparent, and the discourse power of many leading hotel chains is continuously increasing.

According to the "2024 China Hotel Industry Development Report," the hotel chain rate increased from 38.75% in 2022 to 40.95% in terms of the number of chain rooms, with mid-range and luxury hotel chain rates exceeding 55%.

Taking Huazhu Hotel Group and Marriott International as examples, by the end of the first quarter of 2024, Huazhu had 686 mid-to-high-end hotels in operation, a year-on-year increase of 28%; 430 hotels were awaiting opening, a year-on-year increase of 81%. As of the end of 2023, Marriott had 8,785 hotels worldwide with a total of over 1.597 million rooms, representing an annual net increase of 4.7%.

Moreover, large hotel chains have begun to build their own channels and improve the entire pre-sales, customer service, and after-sales chain, attempting to establish direct links with consumers. From this perspective, hotel chains that continue to expand their influence are trying to regain the initiative, and the drawbacks of OTAs as middlemen are once again prominent.

Having secured a foothold in peer competition, Ctrip is also beginning to face pressure from upstream hotel and travel suppliers. It has become particularly important to reconcile the countermeasures of upstream suppliers against the role of 'middlemen.'

In addition, as consumer demand becomes more personalized and diversified, the consumption preferences of different segments of the population are also changing accordingly. If ordinary consumers and the middle class value 'cost-effectiveness' when traveling, high-net-worth individuals place more emphasis on the authentic experience and feelings brought by a trip.

Image source: Pixabay

The inherent 'standardization' of OTA platforms, to a certain extent, limits the scope for personalization. According to feedback from relevant high-end travel agencies, providing rarer experiences than ordinary luxury travel is what attracts high-net-worth users the most. Moreover, some high-net-worth users who enjoy niche adventure travel place great emphasis on privacy, with some requiring confidentiality agreements.

In this way, personalization and confidentiality to some extent hinder the pace at which OTA platforms can cover more segments of the population, creating a mismatch with actual demand.

From a macro perspective, both Ctrip and the entire OTA industry still seem to be in a passive market position. They have to closely follow market trends and frequent changes and must carefully maintain the 'fragile' relationships between upstream and downstream players.

Nevertheless, OTAs, which connect various parties, remain indispensable. After the test of time, will Ctrip, as a leader, forge a different path? Only time will tell.

Source: HK Stock Research Society