New entrant in the property insurance market, Xiaomi may break the ice on car insurance prices

![]() 11/08 2024

11/08 2024

![]() 731

731

Faced with such a vast prospect for new energy vehicle insurance, major new energy vehicle manufacturers naturally won't miss this excellent business opportunity. NIO, Xpeng, Li Auto, BYD, Xiaomi, etc., have already laid out insurance companies or insurance brokerages.

@TechInsights posted

Xiaomi's shareholding in a property insurance company approved, potentially entering the car insurance market!

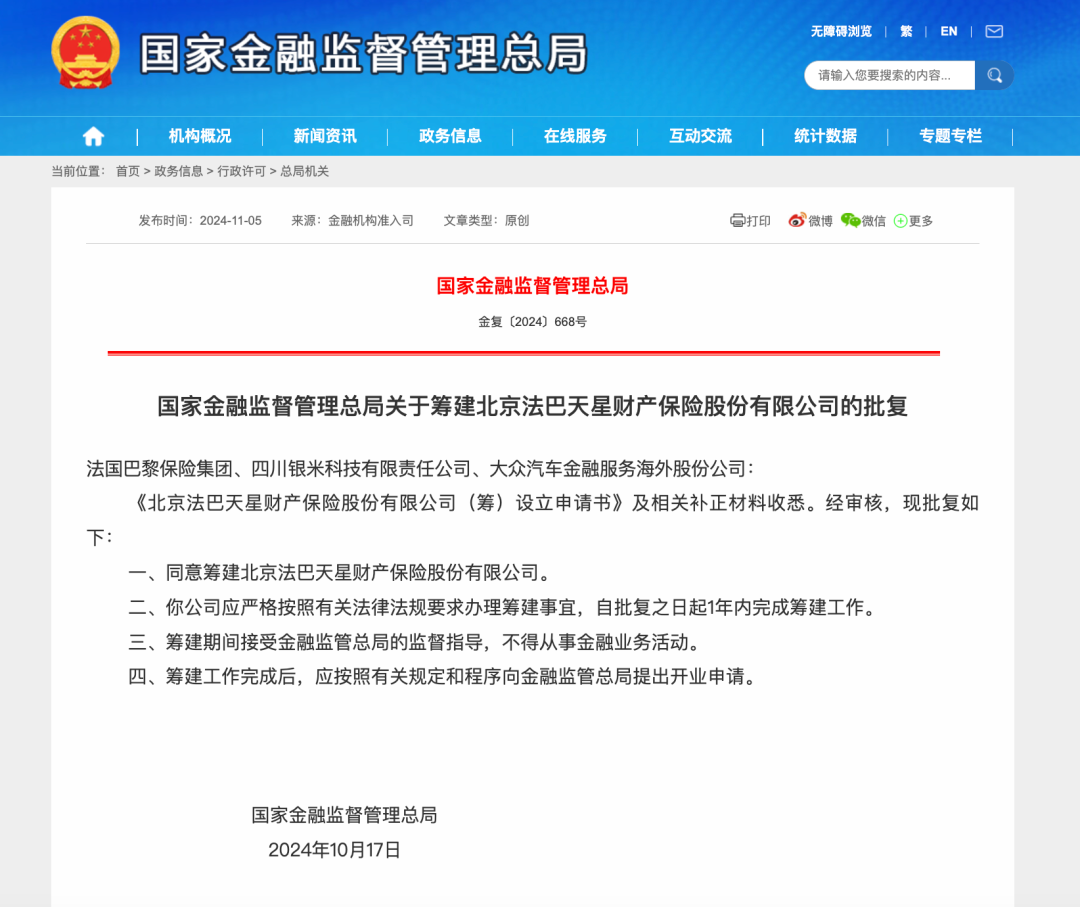

On November 6, the official website of the State Administration of Financial Supervision announced approval documents, agreeing to the establishment of Beijing BNP Paribas Tianxing Property and Casualty Insurance Co., Ltd. The list of shareholders shows that the company is comprised of BNP Paribas, Sichuan Yinmi Technology Co., Ltd., and Volkswagen Financial Services AG. Among them, Sichuan Yinmi Technology Co., Ltd. (abbreviated as "Yinmi Technology") is a member of the Xiaomi Group.

Backed by three major forces – an international insurance giant, a domestic technology giant/new force in car manufacturing, and a traditional automotive giant – Beijing BNP Paribas Tianxing Property and Casualty Insurance will become China's 91st property insurance company. The industry generally believes that Xiaomi's participation in a property insurance company is primarily aimed at entering the Chinese car insurance market. It should be noted that the approval document does not provide details on the registered capital of this new property insurance company or the shareholding ratios of its shareholders.

Currently, China's new energy vehicle industry is developing rapidly. According to data from the China Passenger Car Association, from January to September this year, retail sales of new energy passenger vehicles reached 7.132 million units, a year-on-year increase of 37.4%. Especially since July this year, the domestic retail penetration rate of new energy vehicles has exceeded 50% for three consecutive months. The booming new energy vehicle market has made new energy vehicle insurance a new growth point in the industry.

According to research reports from Soochow Securities, by 2025, new energy vehicle sales are expected to climb to 11.67 million units, with a total number of new energy vehicles reaching 36.93 million. The scale of car insurance premiums will increase accordingly, reaching 186.5 billion yuan, accounting for approximately 18.7% of total car insurance premiums; it is estimated that by 2030, the premium scale will expand to 530.9 billion yuan, accounting for about 34.9% of total car insurance premiums.

Faced with such a vast prospect for new energy vehicle insurance, major new energy vehicle manufacturers naturally won't miss this excellent business opportunity. NIO, Xpeng, Li Auto, BYD, Xiaomi, etc., have already laid out insurance companies or insurance brokerages.

As early as 2016, Xiaomi acquired Beijing Hongyuan Insurance Brokerage Co., Ltd. through its subsidiary Sichuan Yinmi Technology, which is now renamed Beijing Houji Insurance Brokerage Co., Ltd., obtaining an insurance brokerage license. It is worth mentioning that in 2019, Xiaomi Group had planned to apply for the establishment of a property insurance company, but it failed due to tightened regulatory approval of insurance licenses.

In March of this year, Beijing Houji Insurance Brokerage established a cooperation with Cheche Technology, announcing that the two parties will provide comprehensive car insurance service solutions for car owners in Beijing, Shenzhen, Hangzhou, and other cities nationwide. Xiaomi's shareholding in BNP Paribas Tianxing Property and Casualty Insurance further deepens its layout and influence in the financial sector.

Recently, many car owners have complained on various social platforms about the increase in car insurance premiums this year, especially for new energy vehicles. According to the "New Energy Vehicle Insurance Market Analysis Report" released by China Banking and Insurance Information Technology Co., Ltd., in 2023, the average premium for new energy vehicles was actually about 21% higher than that for gasoline vehicles. Among them, the annual premium for pure electric vehicles was on average 1,687 yuan more than that for gasoline vehicles, equivalent to about 1.8 times the annual premium for gasoline vehicles.

Regarding the phenomenon that new energy vehicle insurance premiums are generally higher than those for traditional gasoline vehicles, according to an analysis by upstream news quoting Yang Weibin, an expert on new energy vehicles and power batteries: on the one hand, over the past few years, new energy vehicles of the same size have been sold at much higher prices compared to gasoline vehicles, and the inertia of higher base prices and premiums has continued to this day; on the other hand, although the ignition rate of new energy vehicles is similar to that of gasoline vehicles, the public still tends to subjectively believe that the safety performance of electric vehicles is relatively low, resulting in relatively higher insurance premiums.

At this stage, insurance companies face a shortage of talent when handling new energy vehicle damage assessment. Unable to accurately determine the cause of damage, insurance companies can only increase premiums to ensure their profitability. New energy vehicle manufacturers have a competitive advantage in this regard. Leveraging their technological expertise, they can improve the efficiency of claims processing, tailor car insurance products that better suit the characteristics of new energy vehicles, and directly reach out to potential customers.

After entering the insurance industry, car manufacturers integrate car insurance services with sales, after-sales, and other complex links to form a complete vehicle ecosystem, which can eliminate many unnecessary steps. However, it is still unclear whether this can effectively reduce the purchase costs for insurance consumers.

With Xiaomi's shareholding in a property insurance company approved, consumers naturally hope that Xiaomi can reduce car insurance prices. However, some property insurance professionals hold a relatively cautious attitude towards new energy vehicle manufacturers' participation in property insurance companies.

A property insurance executive analyzed to Securities Daily that there are significant differences between the manufacturing and financial industries. Manufacturing enterprises attach great importance to cost control, while insurance companies are capital-intensive. It is "uneconomical" for manufacturing enterprises to invest in insurance companies. The executive stated that it would be a more reasonable approach for automobile manufacturers to obtain intermediary licenses to connect with insurance entities.

Currently, most internet giants use intermediaries as the carrier for their insurance license layout when conducting business. Property insurance companies represent a new field for Xiaomi, which will face more challenges in the future.

- The end -