'Every day is Singles' Day' is becoming a reality

![]() 11/11 2024

11/11 2024

![]() 484

484

What changes are there in the 15th e-commerce Singles' Day in 2024?

In terms of duration, this year's Singles' Day will be the longest in history. On October 14th, Alibaba, Pinduoduo, and JD.com chose to start Singles' Day on the same day. Among them, Alibaba extended Singles' Day to 29 days, while JD.com and Pinduoduo's promotional periods, including the return period after Singles' Day, both exceeded 30 days.

Additionally, on October 12th, Xiaohongshu kicked off its 'Annual Shopping Frenzy'; on October 8th, Douyin E-commerce fully launched its Singles' Day shopping cycle, which will last until November 30th, setting a new record for the longest Singles' Day in history.

Regarding discounts, Alibaba claims that this year will be the most heavily invested Singles' Day, including 30 billion yuan in consumer vouchers and red packets, 3 billion yuan in merchant support subsidies, and over 10 billion yuan in traffic investment. JD.com continues its cross-store discount activity, offering a 50 yuan discount for every 300 yuan spent, with a maximum discount of 40,000 yuan, and a 20 yuan discount for every 200 yuan spent on the platform. Pinduoduo also introduced '10 billion yuan in consumer vouchers' for the first time this year.

Another change is that due to the introduction of national subsidies for home appliances in August, this is the first time that government subsidies for home appliances have been involved in such a large scale during the e-commerce Singles' Day. The discount amount for related product categories can reach 15-20%; taking JD.com as an example, during Singles' Day, buying home appliances and computers on JD.com can enjoy an 80% discount with government subsidies, with a maximum instant discount of 2,000 yuan per item.

While duration and subsidies have increased, some traditions have disappeared.

According to LatePost, the 'Singles' Day Cat Evening Gala', which has been held for eight years (with a one-year hiatus due to the pandemic), will officially be discontinued this year. Instead, Tmall will collaborate with Hunan Satellite TV's 'Hello, Saturday' to launch a special program called 'Tmall Double 11 Crazy Good Six Nights', featuring a six-hour live broadcast on November 10th.

Of course, the star power is far dimmer than the European and American superstars invited to the Cat Evening Gala in previous years.

Earlier, during the 2022 Singles' Day, both Alibaba and JD.com stopped publishing their final transaction volumes. The constantly flickering and growing Singles' Day data screen in the media center of Alibaba's Hangzhou campus has officially become a thing of the past.

Singles' Day is getting longer, stretching from one day to a month, but the festive atmosphere is gone. On the night of Singles' Day, the headquarters of Alibaba and JD.com will still be brightly lit and bustling, but the concentrated burst of discounts created by Singles' Day is becoming more routine.

From a micro perspective, a procurement and sales representative from JD.com's home appliance department told the author that due to the introduction of national subsidies for home appliances, the team has been in 'Singles' Day mode' since September, communicating with suppliers daily about products, prices, and promotions.

From a macro perspective, since 2019 when Pinduoduo first introduced the '10 billion subsidy' program, 2020 when Alibaba piloted the '10 billion subsidy' on Juhuasuan, and 2023 when JD.com launched a daily '10 billion subsidy' channel on its homepage, platforms have placed increasing emphasis on low-price strategies, making '10 billion subsidies' more routine.

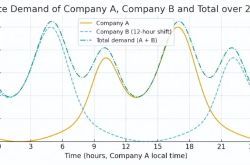

Brands and merchants once chose to release large discounts on a single day or within a short period. Now, due to various marketing strategies by e-commerce platforms and profound changes in consumer demand, discounts have become more stable and gradual, rather than pulsating.

As the bonus period of the consumer internet ends, competition among enterprises becomes more intense, and the entire industry lacks strategic innovation directions. The 'thousand models battle' in AI is unlikely to produce results as quickly as the battles for food delivery and ride-hailing services.

Changes in the competitive landscape reflect the new landscape of the mobile internet. When the entire market lacks a 'new cake' worth significant investment, this has contributed to a shift in the attitude of giant enterprises towards ecosystem openness. After all, growth and profitability are the unchanging truths of the internet industry, and the form of cooperation is less important.

In the past, the 'either-or' competition between Alibaba and JD.com spread from the platform to merchants, evolving from public relations wars to litigation wars. However, nowadays, Alipay will enter JD.com, and JD.com Logistics has been introduced into the Taobao ecosystem. The platforms have started to sheathe their swords and return to peace.

The phrase 'investing 100 points of resources to achieve 120 points of growth' has become a historical anecdote. The internet, with a more stable market structure, needs new competitive and cooperative relationships in the second half.

An e-commerce operation from a designer women's wear brand in Shanghai said that during the 2023 Singles' Day, Tmall required the brand's main items participating on the platform not to reveal prices and discounts on other live e-commerce platforms before pre-sales began; prices could only be released after pre-sales started.

According to a Goldman Sachs report, during this year's 618 promotion, Taobao and Tmall's GMV growth rate was between 10% and 15%, with a market share of 42%; JD.com saw single-digit growth with a market share of 22%; Pinduoduo's growth rate was 15%-20%, with a market share of 18%; and Douyin's growth rate exceeded 20%, with a market share of 15%.

Traditional e-commerce platforms maintain their market share advantages but no longer experience rapid growth. According to Alibaba's fiscal 2025 Q1 (Q2 2024) earnings report, Taobao and Tmall Group's revenue was 113.373 billion yuan, a year-on-year decrease of 1%, making it the only negative growth business among Alibaba's six major business segments; JD.com's retail revenue for Q2 2024 was 257.1 billion yuan, with a year-on-year increase of only 1.5%.

However, growth potential is the strongest aspect of new e-commerce platforms. In Q2 2024, Pinduoduo's total revenue reached 97.06 billion yuan, a year-on-year increase of 86%.

Regardless, the e-commerce industry has formed a quadruple power structure, with players like Xiaohongshu, Kuaishou, Bilibili, and others yet to fully mature. The newcomers and established players compete on the same stage but face a new market with profoundly changing consumer demands.

In August this year, a McKinsey ConsumerWise survey revealed that 59% of Chinese consumers expect the economy to rebound in the next 2-3 months, compared to only 41%, 30%, and 13% of consumers in the United States, the United Kingdom, and Japan, respectively.

Growth trends persist, but consumer demand has become more fragmented and segmented. Amid the routine nature of e-commerce discounts, it has also become more stable and gradual, rarely resembling the spectacle of 'chopping hands' on Singles' Day in the past.

A Bain & Company survey showed that in 2021, over 75% of Chinese consumers were excited about Singles' Day, but two years later, this proportion had dropped to only 53%. During the same period, the proportion of consumers willing to increase their spending on Singles' Day fell from 51% to 23%.

According to StarChart Data, during the 2023 Singles' Day period, the total sales of goods on the entire network were 1.14 trillion yuan, an increase of only 2%, which is lower than the growth rate of China's total retail sales of consumer goods that year (7.2%); the total sales during this year's 618 were down 7% year-on-year.

Festival-driven consumer demand is becoming less pronounced, being more evenly distributed across daily e-commerce consumption. The waning desire for concentrated consumption may also be an important factor contributing to the current state of Singles' Day.

The goal of e-commerce platforms to make 'every day like Singles' Day' is becoming a reality through new forms.

Regarding this year's Singles' Day, Daniel Zhang, Vice President of Alibaba Group and President of Taobao Platform Business Unit, said that blindly pursuing low prices would set back China's business environment, consumption, and manufacturing; Xu Ran, CEO of JD.com Group, also believes that in the current fiercely competitive market, there are still phenomena of 'vicious competition' and 'bad money driving out good' within the industry.

In fact, regarding the description of Singles' Day, Daniel Zhang, former Chairman and CEO of Alibaba Group, once said, 'Every year on Singles' Day, what I care about most is our technological peak. How many orders per second can we process without any money errors or incorrect inventory records? This ensures the smooth operation of the entire business.'

Of course, the technical systems of e-commerce have become increasingly mature, significantly improving the service experience for consumers and creating a more business-friendly environment for merchants. However, we must also recognize that when consumer demand temporarily declines, sensitivity to promotional spending decreases, platform discounts become routine, and merchants struggle with a lack of growth opportunities, changes in supply and demand are jointly driving transformations in Singles' Day e-commerce.

'Every day is Singles' Day' is becoming a reality, but platforms do not seem to welcome this reality.