Double 11, an era of shopping spree is over

![]() 11/11 2024

11/11 2024

![]() 501

501

Editor | Ji Ran

This year's Double 11 seems somewhat subdued.

Unlike in the past, the Tmall Double 11 Gala, which once garnered immense attention, will not be held this year. According to LatePost, insiders at Taobao said, "At this point, we must spend money wisely, subsidizing merchants and consumers."

In addition to Tmall, other e-commerce platforms like JD.com, Pinduoduo, Douyin, etc., have also reduced their promotion efforts during Double 11. None of them are hosting galas, inviting media coverage, or releasing transaction data.

As a result, there are likely no Flood the screen ( Flood the screen : overwhelmed with posts) Double 11 achievements in today's social media feeds.

Many people lament that an era of shopping spree is over.

What changes in the e-commerce industry does the transition from a lively Double 11 gala to a more low-key approach reflect? How should e-commerce platforms spend their money wisely? Can they truly pass on benefits to merchants and consumers?

01

Aggressiveness and helplessness behind canceling the gala

The Tmall Double 11 Gala originated in 2015.

To celebrate the Double 11 shopping festival, Alibaba collaborated with Hunan Satellite TV to host a gala, turning it into a nationwide "shopping spree" festival by spending heavily and inviting celebrities. Since then, the Double 11 gala has become a standard feature in the e-commerce industry, with JD.com, Pinduoduo, and Douyin joining in.

In 2020, the Double 11 gala reached its peak, with four galas held simultaneously, each featuring over 50 domestic and international celebrities, overshadowing even the Spring Festival galas on major TV stations.

The most exciting moment of the Double 11 gala was the announcement of transaction volumes. In 2015, Taobao's transaction volume was 91.217 billion yuan, surpassing the 100 billion mark for the first time in 2016, reaching 120.7 billion yuan, and further increasing to 168.2 billion yuan and 213.5 billion yuan in 2017 and 2018, respectively.

The rising transaction volumes reflected a rapidly growing e-commerce era. The Double 11 gala was a symbol of a fervent consumer era and an excellent showcase for e-commerce platforms to demonstrate their strength.

So, why has such a showcase been discontinued?

Firstly, the festive atmosphere of the Double 11 gala has faded.

After nearly a decade, consumers have become accustomed to Double 11, and the gala, in particular, has caused aesthetic fatigue.

A survey by Bain & Company showed that over 75% of Chinese consumers were still excited about Double 11 in 2021, but this proportion dropped to only 53% two years later. Meanwhile, the percentage of consumers willing to increase their spending on Double 11 dropped from 51% to 23%.

Secondly, the appeal of discounts has decreased.

Originally, the most attractive aspect of Double 11 for consumers was the discounts. However, in recent years, major e-commerce platforms have used strategies such as "lowest price on the internet" to attract consumers, significantly reducing the allure of Double 11 discounts. Some consumers have even found that ordering on Double 11 is more expensive than usual. Netizens have joked, "Even the cheapest deals on Double 11 can't compete with Pinduoduo."

Another crucial reason is that e-commerce platforms are under increasing pressure and competition, becoming more cautious with various marketing investments.

In 2014, the combined GMV of Alibaba and JD.com accounted for 80% of the e-commerce industry, significantly ahead of other competitors. However, a decade later, the duopoly has turned into a melee: the number of companies accounting for 80% of the total has expanded to five – Alibaba (32%), Pinduoduo (17%), JD.com (15%), and Douyin (11%).

Alibaba and JD.com's leading edges have diminished, with Pinduoduo and Douyin stealing much of their market share. Pinduoduo's market value even surpassed Alibaba's at one point, prompting even Alibaba employees to remark, "That unassuming 'cut a price' feature is almost the big brother now."

During the era of aggressive expansion, money could be spent recklessly. However, as competition intensifies, funds must be used for e-commerce transactions themselves rather than flashy marketing. Therefore, it is reasonable for Alibaba to cancel the Double 11 gala, aligning with Jack Ma's strategic direction proposed last year of "returning to Taobao, returning to users, returning to the internet."

Although Pinduoduo and Douyin have outperformed Alibaba and JD.com, they have also shown signs of weakness this year.

Compared to the first quarter, Pinduoduo's revenue and net profit growth rates declined in the second quarter. Following the second-quarter earnings release, Pinduoduo's share price plummeted, dropping over 30% at one point. Pinduoduo's Chairman, Lei Chen, bluntly stated that the general direction of gradually declining profits is inevitable.

Throughout 2023, Douyin E-commerce's monthly GMV growth rate generally remained above 50%. However, in March of this year, the year-on-year growth rate fell below 40% for the first time. After the second quarter, the growth rate dropped even further, to below 30%.

Clearly, both Pinduoduo and Douyin E-commerce are facing significant pressure from declining performance.

Externally, consumers are becoming less impressed. Internally, performance pressure is increasing daily. Each e-commerce platform has begun to scrutinize expenses, cutting out "chicken ribs" like the Double 11 gala and spending money wisely.

So, where is the "blade's edge"? Or where is the crucial place to spend money?

02

Where is the "blade's edge"?

Whether it's established players like Alibaba and JD.com or up-and-coming ones like Pinduoduo and Douyin E-commerce, their business models are essentially the same, relying on network effects.

If an e-commerce platform is compared to a network, then consumers and merchants are crucial nodes on this network. The more nodes, the greater the value of the network and the stronger the platform's competitiveness. So, how can the network value of e-commerce platforms be enhanced? The key is to attract more consumers and merchants.

The current issue is that the platform's experience for consumers and merchants has deteriorated, reducing its appeal to them. This has become the biggest obstacle to the development of e-commerce platforms and where platforms need to spend money wisely.

1. Deteriorating consumer experience

A media outlet conducted a survey on Double 11 shopping spree consumption. Most people still believe that Double 11 has value but requires sincerity and tangible benefits. Fifty-nine percent of consumers believe, "I'm sincere about buying on Double 11, so please sell with sincerity. Don't just shout slogans in ads; please be honest, sincere, and provide real benefits."

It is evident that consumers' primary concern about Double 11 is sincerity. It also implies that the platform's "lack of sincerity" has affected the consumer experience, mainly manifested in complex discount rules and price drops after purchase.

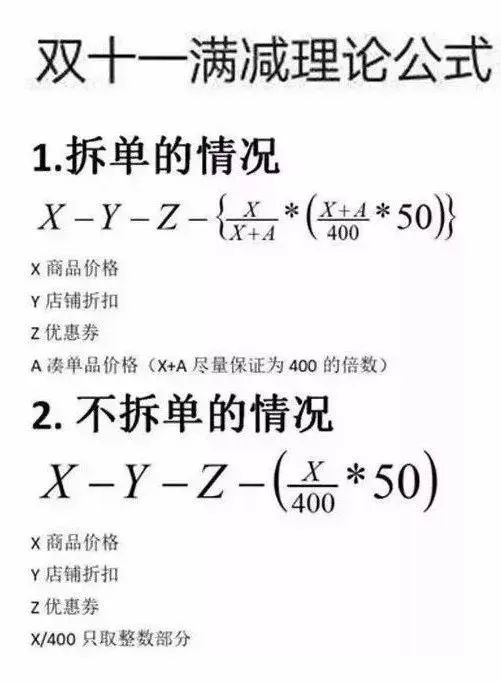

Every Double 11, although platforms promote various discounts and benefits, the rules for obtaining them become increasingly complex, making it challenging to successfully claim benefits, akin to solving advanced math problems. For example:

Spend XXXX and get XXX off

Prepay and get an instant discount

Pay a deposit and get a X% discount

Crazy grab X yuan coupons

Some netizens even created an Excel spreadsheet this year to precisely use each coupon for stockpiling. Most netizens lamented, "Keep it simple; make the discounts straightforward."

Many consumers have also found that some merchants often have inconsistent product prices during promotions and final payments, with a single product sometimes listing three or four prices, confusing consumers.

In short, consumers have long been weary of tricks in e-commerce, and they need to see the platform's sincerity in truly passing on benefits to them.

2. Deteriorating merchant experience

In addition to consumers, participating merchants are also complaining about a worsening experience on Double 11.

Many merchants, especially small and medium-sized ones, find it increasingly difficult to do business on e-commerce platforms, mainly due to two pain points: rising traffic costs, putting enormous pressure on profit growth, and increasing operating costs with insignificant incremental effects.

Many people believe that the cost of opening an online store is lower than that of a physical store. However, in actual operations, personnel costs, operation and maintenance expenses, warehousing and logistics fees, and especially the increasingly expensive traffic acquisition costs can make the total cost for merchants even higher than that of physical stores, causing significant pressure.

After announcing the closure of its stores in May this year, the founder of the women's wear brand Lola Password admitted in an interview with the media that the high cost of traffic was the primary reason for the closure, "Traffic costs have increased tenfold. Fewer people were doing it before, but now more people are competing for traffic, driving up costs."

Additionally, the head of a lighting factory told the media that it used to cost only 100 yuan per day to promote on the platform but has now risen to 400-500 yuan. In the past 30 days, the promotion cost for their store reached 11,400 yuan, almost consuming 70% of their profits.

In summary, there are still many areas for improvement in the experiences of both consumers and merchants, which tests the courage and ability of e-commerce platforms to innovate. Without enhancing these experiences, platforms will gradually reach a dead end amidst fierce competition.

03

How to spend money wisely?

This year's Double 11 has seen some e-commerce platforms making changes to enhance the experience, with many commendable aspects.

For consumers, Tmall is offering discounts including 30 billion yuan in coupons and red packets, as well as 3 billion yuan in merchant support subsidies, which is quite substantial.

To improve the accuracy of displaying post-coupon and post-discount prices, Taobao and Tmall specifically integrated and upgraded their existing pricing regulations before Double 11.

Specifically, Taobao coins, red packets, and other user assets will be included in the discount calculation for post-coupon and post-discount prices, which will be automatically calculated and displayed in real-time on the product detail page. In simple terms, the price displayed by the system is the price consumers will pay.

This can be seen as the platform reducing the "tricky feeling" in consumers' minds.

This Double 11, JD.com introduced a policy of offering users an additional 60 yuan subsidy daily on top of cross-store discounts. Pinduoduo launched the "10 Billion Consumer Coupons" campaign for the first time and upgraded its "10 Billion Doubled Subsidy" to "Super Doubled Subsidy". Douyin introduced a full discount activity of "spend 200 yuan and get 30 yuan off" and services such as "return if damaged, inspect before shipping."

For merchants, Tmall is offering discounts such as commission-free sales, red packets, coupons, and traffic support during this year's Double 11. For example, merchants can enjoy commission-free sales promotions and live streaming to comprehensively reduce operating costs.

JD.com upgraded its "Spring Dawn Plan", increasing support for third-party merchants from three dimensions: traffic support, AI technology efficiency enhancement, and ultra-light asset operation. Pinduoduo launched the "10 Billion Reduction" and "New Quality Merchant Support Plan". Douyin reduced its service fees to lower merchants' operating costs.

However, although e-commerce platforms are trying to show more sincerity and enhance the experiences of consumers and merchants, some plans still make them suffer.

For instance, this year's Double 11 started on October 24, ten days earlier than last year, making it the "longest Double 11 in history". However, this extended period has caused several issues.

For consumers, an excessively long timeframe can cause "promotion fatigue" and "ordering fatigue". Many people have to set different time nodes in advance to place orders, which can be cumbersome. Moreover, the prolonged preheating and promotion period has bored some consumers, reducing their desire to spend.

Additionally, the extended timeframe poses a significant challenge to merchants' operational and service capabilities. Due to the long activity period, consumers may wait and see during the preheating phase. If order volumes surge during the promotion, merchants may struggle to handle the demand, causing concern among many of them.

In fact, the duration of the promotion is not important; what matters is making consumers and merchants feel sincere.

Overall, this year's Double 11 is significantly different from previous years, with less hustle and bustle and more down-to-earth and prudent approaches, which is actually a positive sign.

Looking ahead, the logic of the e-commerce industry is undergoing profound changes. Double 11 is no longer a one-time window for explosive transactions but an opportunity for platforms to enhance their service capabilities and showcase their quality image. Compared to price wars, competing on experience is a more crucial and long-term battle.