Lenovo sues ZTE, flying to the UK for a legal battle?

![]() 11/12 2024

11/12 2024

![]() 631

631

The news that Lenovo flew to the UK to sue ZTE has suddenly become the focus of public opinion.

The incident arose when Lenovo filed an intellectual property lawsuit against ZTE Corporation in the High Court of Justice of England and Wales on October 21, 2024, local time.

Public information shows that the plaintiffs in this lawsuit involve six companies, including Lenovo Group Limited, Lenovo (USA) Inc., Lenovo Technology (UK) Limited, Motorola Mobility LLC, Motorola Mobility UK Limited, and Lenovo Innovations Hong Kong Limited. The defendants involve six companies, including ZTE Corporation, ZTE (UK) Limited, Nubia Technology Co., Ltd., and three UK distributors: Gamegeek Limited, Livewire Telecom Limited, and EFones.Com Limited.

On the morning of October 30, ZTE Corporation responded officially, stating, "We have always respected the legitimate actions of any enterprise within the legal framework but deeply regret Lenovo's actions. We have been negotiating with Lenovo on patent licensing issues for years, and ZTE has always upheld the utmost goodwill, seeking reasonable returns for our R&D innovations. We hope both parties can resolve their disputes through efficient and reasonable means. It is difficult for us to understand why Lenovo has chosen to file a lawsuit in the UK, but we respect their decision. This lawsuit will not change ZTE's determination to protect its legitimate rights and interests."

As of now, more information about the case, including the patents involved and the details of the claims, has not been released, and neither party has made further statements on the matter. The public's focus on this lawsuit is mainly on two aspects:

First, why did Lenovo sue ZTE? Second, why did Lenovo choose to sue in the UK?

1

Patent Dispute?

Lawsuits related to patent licensing in the mobile phone industry are not uncommon.

Previously, OPPO and Nokia's patent licensing negotiations lasted from 2018 to 2024; Qualcomm and Apple's patent agreement negotiations regarding basebands also stretched on for years, culminating in Apple's concession. Earlier, Xiaomi and Ericsson engaged in global patent licensing lawsuits for many years before finally reaching a settlement.

The focus of controversy has always been patent fees.

Generally, patent disputes aim to compete for market resources and maintain technological discourse power. They are also a form of protection and compensation for the huge amounts of funds companies invest in R&D.

Take ZTE, the defendant in this case, as an example. It has invested heavily in R&D in the field of communication standards. In the past five years, ZTE's R&D expenses as a percentage of revenue have steadily increased from 13.8% in 2019 to 20.7% in Q3 2024. In 2023 alone, ZTE's R&D expenses exceeded 25 billion yuan, ranking first among listed companies in China with a revenue scale of over 100 billion yuan in terms of R&D intensity.

According to the "Global 5G Standard Essential Patents and Standard Proposal Research Report (2024)" released by the China Academy of Information and Communications Technology in September this year, ZTE ranks fifth globally in the latest ranking of 5G standard essential patents.

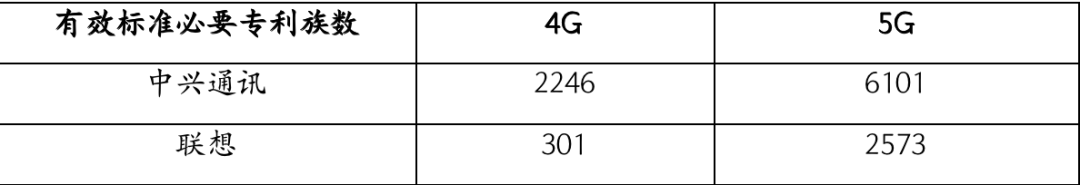

Compared to Lenovo, ZTE's patent portfolio far surpasses that of Lenovo in both 4G and 5G fields.

As the eighth-largest mobile phone manufacturer globally, Lenovo holds about 5% of the global market share. Especially in North America, Lenovo-Motorola's market share reaches 13%, ranking among the top three. According to the latest Counterpoint Q3 2024 market data, Lenovo's moto phone sales increased by nearly 30%, making it the fastest-growing brand among the top ten manufacturers and achieving its highest quarterly sales ever.

This means that Lenovo must address patent licensing fees from various patent holders worldwide.

In fact, since 2014, Lenovo has reached patent licensing agreements with multiple companies, including Unwired Planet, Qualcomm, Microsoft, Nokia, IPCom (Germany), and InterDigital.

Moreover, some of these agreements involved lawsuits. For instance, Lenovo's negotiations with InterDigital spanned 16 years, beginning in 2008 and only partially concluding in 2023, with some patents still in litigation. Negotiations with Ericsson have also lasted 17 years, starting in 2008, and have yet to result in a licensing agreement.

If negotiations fail, the worst-case scenario is product delisting. Apple, for example, lost a patent lawsuit to the medical technology company Masimo, leading to the withdrawal of the Apple Watch Series 9 and Apple Watch Ultra 2 from its official website.

However, the original purpose of patent wars is to promote technological progress and commercial competition through litigation as a means, not an end. As pointed out by China Business News, unlike previous lawsuits involving Ericsson and Nokia, Lenovo did not seek an injunction in this case, indicating that it is not an offensive lawsuit against ZTE.

ZTE's response first indicates, "Based on trust in Lenovo as a Chinese company, we have always been cautious and restrained in taking legal actions beyond negotiation. It is difficult for us to understand why Lenovo has chosen to file a lawsuit in the UK, but we respect their decision."

In other words, as a fellow Chinese company, ZTE exercises restraint in using legal means, while Lenovo's choice to sue in the UK appears somewhat unethical.

Furthermore, it is peculiar that while Lenovo has reached patent licensing agreements with multiple overseas entities, no such agreements have been seen with Chinese entities. As a Chinese enterprise, Lenovo's approach to domestic and foreign entities' innovations differs.

2

Why the UK?

This is another puzzling and difficult-to-understand aspect of this lawsuit. As fellow Chinese companies, why did Lenovo choose to sue ZTE in the UK?

Neither Lenovo nor ZTE considers the UK as their primary market.

From Lenovo's financial data released in August 2024, the combined revenue from Europe, the Middle East, and Africa accounts for only 25% of its total revenue, while China alone accounts for 22%. In the cellular field, Lenovo's mobile phone shipments in the UK accounted for only 1.52% of its total shipments in 2023. It is evident that Lenovo's primary market is still domestic rather than the UK. Similarly, China accounts for 68.91% of ZTE's revenue, while Europe, the Americas, and Oceania combined account for only 14.23%. The UK is not a primary market for ZTE, contributing minimally to its revenue in recent years.

Industry insiders speculate that this may be related to Lenovo's previous significant standard-essential patent licensing disputes, which were also conducted in the UK, with the hope of securing a time window for rate decisions.

Lenovo has indeed initiated related lawsuits in the UK. Public information shows that in 2019, InterDigital filed a lawsuit against Lenovo over patent issues. Besides 4G and 5G patent licensing, the previous appeal also included 3G patent licensing. As of 2023, five independent trials have been conducted.

Last March, a judge at the High Court of Justice of England and Wales stated in a written ruling that neither Lenovo nor InterDigital's previous offers complied with FRAND terms. InterDigital had offered a six-year patent license to Lenovo for $337 million, but the court ultimately ruled that Lenovo should make a one-time payment of $138.7 million to cover past and future mobile device sales (from 2007 to the end of 2023).

Regarding this outcome, Lenovo issued a statement claiming that the UK court supported Lenovo as the "overall winner" and established a license fee of $0.175. However, InterDigital's Chief Legal Officer also announced an intention to appeal at the same time. Additionally, Lenovo also won a favorable judgment against Ericsson in the UK Court of Appeal.

Some analysts believe that the UK courts may not fully consider the realities of the Chinese communications market when making rulings. If this case becomes a precedent, it could lead to more overseas lawsuits targeting Chinese communications entities while ignoring the realities of the Chinese market, potentially causing losses to the development of the communications industry.

Considering that China has established jurisdiction over global licensing disputes involving standard-essential patents through typical cases and has successful handling experience.

In cases involving standard-essential patent infringement disputes between Huawei and Xiaomi, the National Intellectual Property Administration of China heard the cases in accordance with laws and regulations, organized administrative mediations multiple times, guided both parties to conduct multiple rounds of negotiations on related patent licenses, including standard-essential patents, and ultimately reached patent cross-licensing agreements. This demonstrates the efficiency, professionalism, and authority of China's administrative adjudication procedures for major patent infringement disputes.

In the case of OPPO vs. Sharp, the Supreme People's Court clarified that the jurisdiction over standard-essential patents should comprehensively consider factors such as the main place of implementation, main place of business or main source of revenue of the standard-essential patent implementer, the place of patent licensing negotiation, or the place where the patent licensing contract is signed. Chinese courts can rule on the licensing conditions of the standard-essential patents involved in the case globally.

From the perspective of China's global governance discourse power in intellectual property rights, some analysts believe that, given the development of intellectual property protection in China and the joint efforts of the Chinese intellectual property industry to showcase China's image to the world and enhance China's discourse power, abandoning the existing domestic system and seeking overseas relief will set a poor precedent for resolving disputes in China's standard-essential patent field.

Disclaimer: This article is written based on publicly available information or information provided by interviewees, but Decode and the article's author do not guarantee the completeness or accuracy of this information. Under no circumstances does the information or opinions expressed in this article constitute investment advice for anyone.