"Making Friends" sets new record on Singles' Day, but is it still tied to Luo Yonghao?

![]() 11/13 2024

11/13 2024

![]() 632

632

Who needs whom more: "Making Friends" or Luo Yonghao?

The "longest Singles' Day in history" has finally come to an end.

On the morning of November 12, Tmall and JD.com both released their final sales reports, showing an increase in the number of purchasing users on both platforms. During Tmall's Singles' Day, 589 brands exceeded sales of 100 million yuan, an increase of 46.5% year-on-year; JD.com's shopping user base increased by over 20% year-on-year during Singles' Day, with over 17,000 brands seeing sales increases of over 500%, and over 30,000 small and medium-sized merchants seeing sales increases of over 200%.

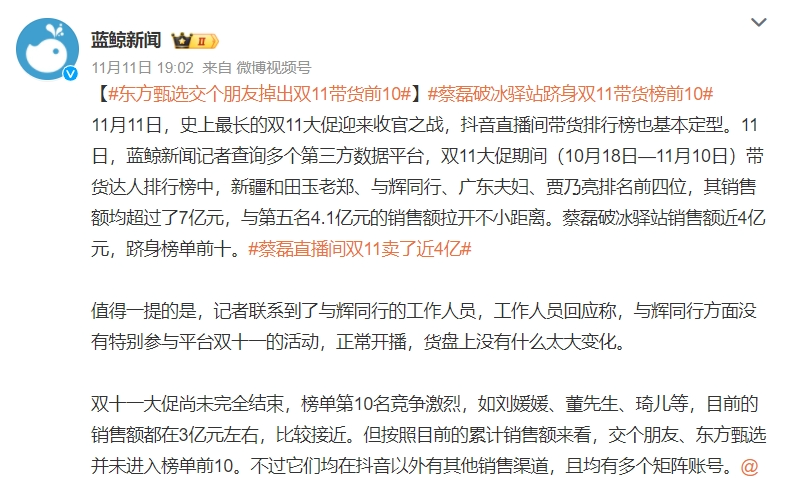

Notably, amidst recent incidents of top livestreamers struggling with product endorsements, Taobao Live's overall transaction volume and number of purchasing users during this year's Singles' Day increased significantly year-on-year. "Interesting Business Insights" observed that "Making Friends" was one of the few top MCN agencies still releasing sales reports.

Source: Weibo Screenshot

Since Luo Yonghao announced his return to entrepreneurship in 2022, he has become less visible in "Making Friends" live streams, and the brand has been "de-Luo Yonghao-ing"; however, Luo Yonghao's presence in live streams has increased recently. Before this year's Singles' Day, a "Making Friends" staff member mentioned that Luo Yonghao's frequency of appearing in live streams during Singles' Day was close to full attendance.

Source: Maimai

During this year's Singles' Day, "Making Friends" saw faster growth in Taobao live streaming sales compared to Douyin, and Luo Yonghao appeared more frequently on "Making Friends" Taobao live streams than on Douyin live streams during the promotional period.

Why is Luo Yonghao, who has already embarked on a new venture, still frequently engaging in livestream sales? Who needs whom more now: "Making Friends" or Luo Yonghao?

01. After "de-Luo Yonghao-ing", is "Making Friends" walking independently?

Even before Singles' Day ended, Cui Dongsheng, head of "Making Friends" Taobao live streams, had already shared the good news on his social media.

"Making Friends"'s final sales report showed that during the promotional period, its total GMV across all channels exceeded 6.4 billion yuan, a year-on-year increase of 158%, with a cumulative order volume of over 7.14 million, setting a new record for past promotional events; among them, the GMV of the main Douyin live stream account increased by 63% year-on-year, and the GMV of "Making Friends" Taobao live streams increased by 73% year-on-year.

Behind the growing GMV is the industry context where top MCN agencies, including Meiwai, Visionary, and "Making Friends", have been attempting to "de-topify" in recent years; and among these MCN agencies, "Making Friends" might be considered one of the most successful in this endeavor.

As early as 2021, founder Huang He mentioned that the ultimate goal of "Making Friends"'s business layout is for MCN agencies to account for only about 40% of the business, with Luo Yonghao's income accounting for about 10% of the company's total income.

"Making Friends" has indeed achieved a "separation" from Luo Yonghao. When Luo Yonghao officially announced his retirement from the internet to pursue entrepreneurship, Huang He said that Luo Yonghao's GMV share had dropped to around 3%~5%.

Source: Weibo Screenshot

"Interesting Business Insights" observed that after Luo Yonghao devoted himself to the new AR glasses project, his frequency of returning to "Making Friends" live streams for sales was about once or twice a month, which can only be considered as "friendly participation". However, Luo Yonghao usually returns during promotional periods. During this year's Singles' Day, Luo Yonghao appeared on "Making Friends" Taobao live streams for five days; on the first day of Tmall Singles' Day presales, the GMV of "Making Friends" live streams exceeded 230 million yuan that evening.

However, Luo Yonghao appeared on Douyin less frequently than on Taobao during this year's Singles' Day, but his appearances still significantly boosted the purchasing enthusiasm of Douyin users. On October 17, Luo Yonghao and stand-up comedian Liu Yang appeared together on the "Making Friends" live stream; according to "Youmi Cloud" data, the sales volume of "Making Friends" Douyin live stream that night reached 1-2.5 million yuan, currently ranking second among "Making Friends" Douyin Singles' Day live streams.

Source: Youmi Cloud Screenshot

Notably, since Luo Yonghao's departure, "Making Friends" has not made significant progress in building its personal IP but has instead achieved a "matrixed" live streaming business by expanding categories and platforms. Currently, "Making Friends" has over 50 live streams in various vertical consumer areas such as beauty, alcohol, and apparel; meanwhile, besides Taobao, Douyin, and JD.com, "Making Friends" has also successively entered new platforms such as WeChat Video and Xiaohongshu. As Huang He said, "Making Friends" aims to build a layered mall, "establishing multiple sub-accounts for different categories to form a stable live streaming model that does not rely on anchors."

A relevant responsible person from "Making Friends" said that compared to the male-dominated consumer group mainly composed of Luo Yonghao's fans in the early days of live streaming sales, the ratio of male and female consumers in "Making Friends" live streams has now basically reached a balanced state, with post-90s viewers accounting for over 60%.

Moreover, "Making Friends" is also attempting to collaborate with other celebrities and artists to explore new ways of monetizing artist traffic. In the first half of this year, after Li Dan became women's "electronic best friend" through emotional interpretations on Xiaohongshu, "Making Friends" quickly acquired the exclusive clip authorization business from Li Dan.

Source: Live Stream Screenshot

Nowadays, besides its own live streaming business, "Making Friends" also provides a series of integrated marketing services such as agency operations for other brands and influencers; additionally, it undertakes broadcasting and TV businesses such as event broadcasts and multimedia production.

In the two years since Luo Yonghao's departure, the performance of Making Friends Holdings (1450.HK) has gradually improved. In 2022 and 2023, the company's revenue growth rates were 109.55% and 152.42%, respectively, reaching 426 million yuan and 1.074 billion yuan. The company appears to have achieved "independent walking" after Luo Yonghao's departure.

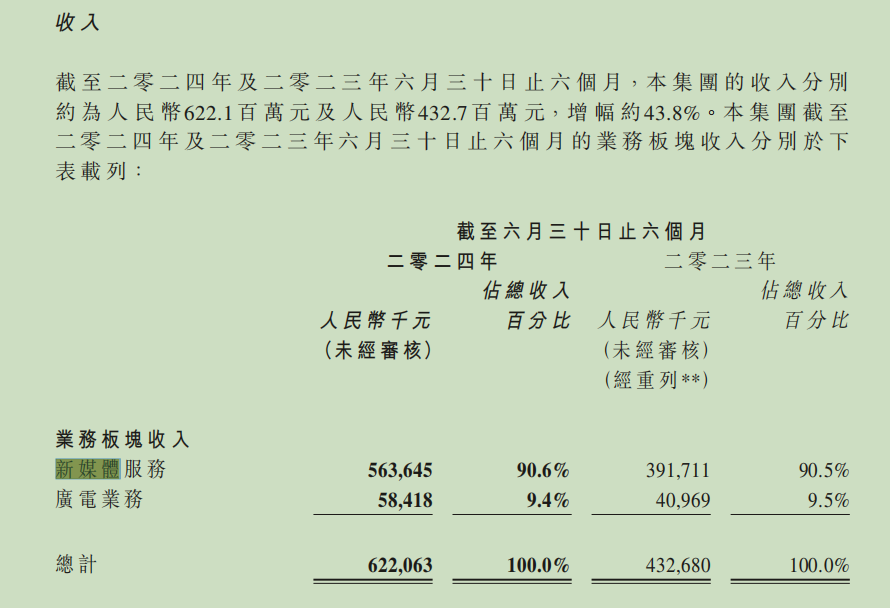

However, with the overall slowdown in the growth of live streaming e-commerce, Making Friends Holdings' soaring performance has also hit a speed bump this year. Financial reports show that in 2023, Making Friends' live streaming e-commerce GMV exceeded 12 billion yuan, with a year-on-year increase of over 70%, but in the first half and third quarter of this year, the growth rate of Making Friends' overall GMV fell to around 18%; meanwhile, the company's overall revenue growth rate also slowed to 43.8% in the first half of this year.

Source: Making Friends Financial Report Screenshot

However, this year's impressive Singles' Day results did not significantly boost Making Friends Holdings' share price; on November 12, Making Friends Holdings (1450.HK) fell 4.76% to close at 1 Hong Kong dollar per share, with a total market value of 1.386 billion Hong Kong dollars.

Source: Baidu Stock Market Screenshot

Bo Wenxi, chief economist for China Enterprise Capital Alliance in China, believes that factors such as slowing platform growth, declining trust in top internet celebrities, and user consumption behavior have collectively led to the slowdown in the revenue growth rate of Making Friends' live streaming e-commerce business.

02. In the second half of live streaming e-commerce, from "gold diggers" to "shovel sellers"

On the one hand, the industry is cooling down; on the other hand, according to "Interesting Business Insights" observations, without Luo Yonghao's "blessing", "Making Friends"'s performance on new platforms appears somewhat lukewarm.

In April and August of this year, "Making Friends" entered WeChat Video and Xiaohongshu, respectively, but after several months, "Making Friends" has not yet formed a stable live streaming presence on these two new platforms. When WeChat Video was first broadcast, Luo Yonghao did not participate, and the live stream attracted only over 20,000 viewers after an hour. Third-party platform NewTV data shows that the estimated sales volume of "Making Friends"'s first broadcast on WeChat Video was 1.2467 million yuan. This is obviously not comparable to Luo Yonghao's previous cross-platform debut performance. A relevant responsible person from "Making Friends" once responded that this was mainly because WeChat Video live streams are still in the exploratory stage.

When "Making Friends" entered Xiaohongshu, it told Beijing Business Daily that platform diversification, anchor diversification, and category diversification are the continuation of the "matrixed vertical live stream" operating model, aiming to further expand the user base. The main audiences of WeChat Video and Xiaohongshu are middle-aged and older adults and young women, respectively, which complements "Making Friends"'s mainly male audience.

However, expanding the audience base means a comprehensive adjustment from categories to live streaming styles, which is also a gradual adaptation process for "Making Friends". Currently, "Making Friends" has not yet established matrixed category live streams on WeChat Video and Xiaohongshu; among them, WeChat Video live streams occur about once a week, mainly featuring collaborative specials.

Source: WeChat Video Screenshot

Besides the "unsuccessful debut" on new platforms, "Making Friends" also "flipped over" in terms of the products it promoted this year.

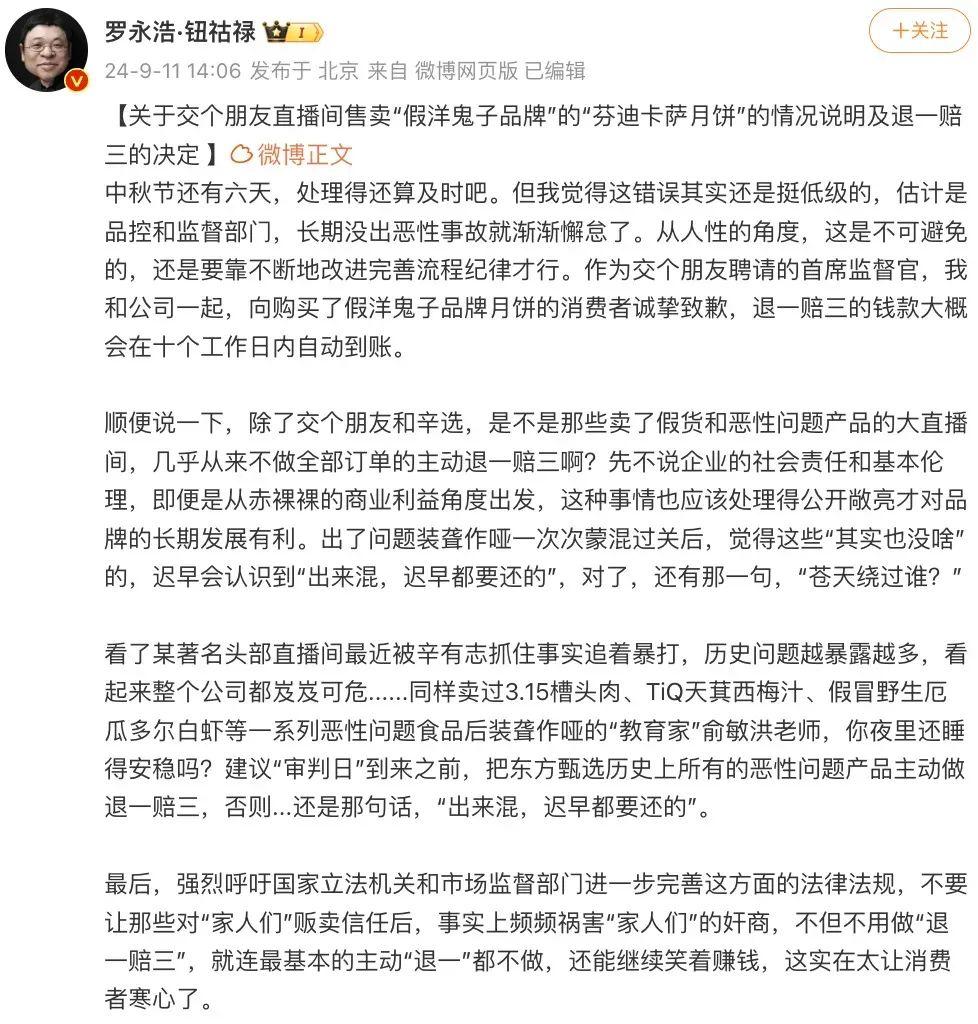

In September, the "FENDI CASA Mooncake Gift Set" promoted by Luo Yonghao was exposed for having brand associations with the luxury brand "FENDI" and being suspected of fraud. After the incident broke out, "Making Friends" decided to offer compensation of "one refund and three times the value" to users who purchased the mooncakes.

In response to the mooncake controversy, Luo Yonghao frequently mentioned Yu Minhong in his blog posts, citing a series of problematic food items sold by Yu, such as 3.15 pork neck meat, TiQ plum juice, and fake wild Ecuadorian white shrimp; coupled with the fact that Luo Yonghao had just made headlines for "bashing" Yu Minhong not long ago, many netizens began to criticize Luo Yonghao for being "small-minded" and "riding on the popularity wave".

Source: Weibo Screenshot

In addition, Luo Yonghao also mentioned in his relevant responses that as the "supervisor" of "Making Friends", he could only ensure that the company does not sell fake or inferior products but could not prevent the company from selling "intelligence tax" products.

Various controversial remarks are gradually eroding Luo Yonghao's "popularity". Many netizens have criticized Luo Yonghao on social platforms, and these negative sentiments towards Luo Yonghao are not good news for "Making Friends".

Bo Wenxi said that although Luo Yonghao, as the soul of "Making Friends", has retired from management, he still participates in live streams as an anchor, and his personal image is closely related to the brand; incidents such as quarrels and fake mooncakes may affect consumers' trust in Luo Yonghao personally and the "Making Friends" brand, thereby affecting consumers' purchasing decisions.

Source: Weibo Screenshot

Last month, Cui Dongsheng, vice president of "Making Friends", told the media that the explosive growth period of live streaming e-commerce has passed, and the industry has entered an era requiring standardization and large-scale operation.

As live streaming e-commerce enters its second half, to avoid risks and further strengthen the company's own brand power, top MCN agencies have been exploring new business transformations in recent years, and "Making Friends" is no exception. However, while live streaming agencies like to brand themselves as retail companies, "Making Friends" emphasizes its technological background on this basis.

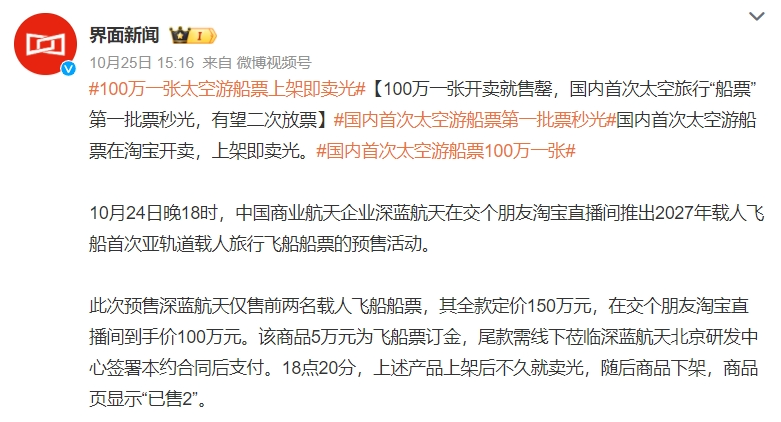

In "Making Friends" live streams, one can often see astonishingly expensive technological products, such as spaceship tickets worth 1.5 million yuan, domestically produced commercial satellites worth 2 million yuan, and unmanned aerial buses worth 1.99 million yuan...

Source: Weibo Screenshot

Luo Yonghao once said that for "Making Friends" to achieve its goal of 10 billion yuan, it would not only rely on live streaming e-commerce but also on agency operations, integrated marketing and sales promotion, training services, and supply chain operations. "Making Friends" is also attempting to use its technology to help other similar companies with agency operations, becoming a "shovel seller" in live streaming e-commerce.

As early as 2022, "Making Friends" launched cross-border e-commerce live streaming training courses, and within less than half a year after the training courses were launched, they nearly completed the expected first-year revenue target of 30-40 million yuan.

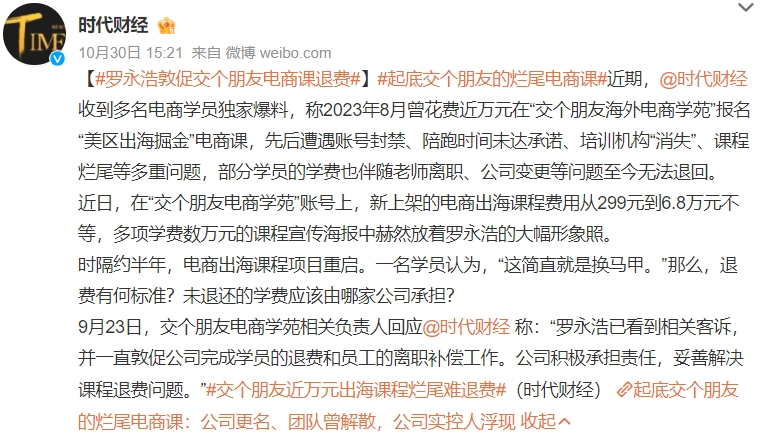

Many MCN agencies aspire to be "shovel sellers", and Qianxun, Sanzhiyang, and Visionary have all opened related training academies, priced at several thousand yuan or even tens of thousands. However, as uneven knowledge payment courses emerge in clusters, doubts about "cutting the mustard" are inevitable.

Recently, "Making Friends"' overseas e-commerce courses have been exposed to issues such as "unfinished projects" and "inability to refund fees". According to Times Finance reports, "Making Friends"' overseas e-commerce foundation course costs 299 yuan, and after students are directed to private domains, there are higher-priced courses starting at 8800 yuan. Some students said that 30 days after the course began, their US region accounts successively experienced issues such as limited traffic, banned payment accounts, and inability to link products; meanwhile, the "accompanying teachers" gradually left their positions and disappeared, leaving the courses unfinished. At the same time, due to "Making Friends"' adjustments to its overseas course business, it has become difficult for students to obtain refunds.

Image Source: Weibo Screenshot

In response, "Make Friends" stated that they have properly handled all student refund requests and will continue to optimize their business model in the future. "Interesting Business Interpretation" observed that overseas e-commerce courses have been relisted on the Douyin store of "Make Friends E-commerce Academy".

A relevant responsible person from Make Friends said that as the domestic e-commerce market becomes saturated, more and more merchants are seeking opportunities to go overseas. Cross-border e-commerce involves differences in laws, regulations, and policies among different countries, as well as challenges related to the popularity and market education of live e-commerce, along with differences in language, culture, and consumer habits.

03. New Growth for "Make Friends": Offline or Online?

In recent years, developing offline has also become a new direction for many MCN agencies to attempt transformation. Xin Selection Group and Three Sheep have both opened offline supermarkets, and Perfect Diary has also opened cafes offline; Make Friends is no exception.

This year, opening offline stores for private brands is one of Make Friends' biggest business moves. Make Friends has multiple private brands, such as "Reload", "Ozone", and "Same Destination", covering various categories such as home furnishings, accessories, fashion shoes, and apparel. According to "Interesting Business Interpretation", among these brands, only "Reload", which focuses on cost-effective men's wear, has opened offline stores this year, while the main sales channels for other brands remain online.

"Reload" officially announced the launch of offline investment promotion in June this year, aiming to open over 3,000 offline stores nationwide. Last month, "Reload" opened a new store in Mentougou District, Beijing. According to the Beijing Business Daily, the store has an area of at least 60 square meters and over 500 SKUs, targeting men aged 18-38 as its primary customer base, with a men's and women's wear ratio of 7:3. Most of the products are produced by OEM factories in Guangdong and other places.

Image Source: Xiaohongshu Screenshot

A relevant responsible person from Make Friends said that the company's offline layout is mainly based on changes in market trends and consumer habits. "Offline stores are not only sales venues but also platforms for establishing deep connections with consumers. Consumers tend to get a real experience of products in offline stores."

Make Friends is very optimistic about the new retail model that integrates online and offline. "We can leverage the fan base and exposure advantages accumulated on the Douyin platform, attract traffic through online promotion, and then guide online users to offline stores to achieve more efficient conversions."

In terms of location selection, "Reload" favors busy commercial districts, shopping centers, or transportation hubs. The demand for men's wear is relatively stable, and some practitioners have expressed concerns about "Reload's" revenue. "The pricing of 'Reload's' apparel meets the current consumer trend of pursuing cost-effectiveness. However, due to its proximity to busy commercial areas, rental costs and other investments will be relatively high, so a balance must be struck.""Make Friends" responded that the company also pursues cost-effectiveness in rental costs, "balancing investment returns with the long-term development potential of stores and choosing locations with growth potential for layout. Therefore, there is no concern that offline operations will affect profitability."

Offline is a territory that many men's wear brands have been deeply involved in for many years. Although "Reload" has achieved remarkable sales breakthroughs online, compared with many more well-known men's wear brands, its voice is still insufficient. How much new offline space "Reload," which is accelerating its store expansion, can create for "Make Friends" remains to be tested by the market.

Image Source: Xiaohongshu Screenshot

According to Make Friends, private brands and live streaming are two separate business lines. "Reload's" initial goal was to become an independent brand, so it chose an independent corporate entity and operating team at its inception and has developed relatively independently. The main battlefield for Make Friends' core live streaming business is still online.

It seems that in the future, live streaming rooms will remain the primary channel for Make Friends to connect with consumers. According to Make Friends' holding company's financial report data, its new media business, including live streaming, still accounts for over 90% of the company's total revenue.

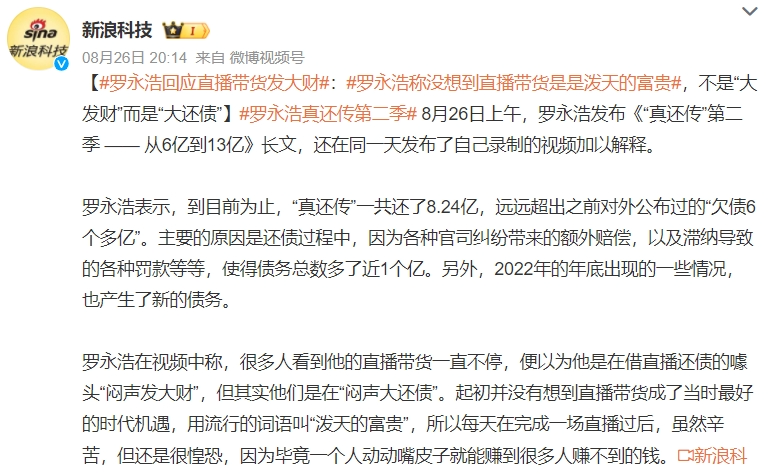

In August this year, Luo Yonghao announced that he had completed the first round of his "True Repayment Story" and still had around 600 million yuan in state-owned capital debts to repay. He will continue to "repay debts through methods such as recording variety shows, accepting advertisements and endorsements, and inviting cultural celebrities and movie stars to communicate and sell goods in live streaming rooms." This may also be one of the reasons for the recent increase in Luo Yonghao's live streaming frequency.

Image Source: Weibo Screenshot

It seems that Luo Yonghao needs "Make Friends," and "Make Friends," which is still exploring new avenues, will certainly not reject the traffic that Luo Yonghao naturally brings.

However, traffic has always been a "double-edged sword." How to achieve a "two-way journey" is still a required course for "Make Friends."