Flash Express' 'One-on-One' Service: The Killer App in Instant Delivery

![]() 11/13 2024

11/13 2024

![]() 452

452

On October 4, Flash Express successfully listed on the Nasdaq stock market in the United States, raising $66 million.

As China's largest independent instant delivery service provider, Flash Express will further enhance its core competitiveness and growth potential after completing its listing puzzle. It will also gain increasing recognition from capital markets, society, and users.

【Focus on 'One-on-One'】

Since its inception in 2014, Flash Express has always focused on the 'one-on-one' urgent delivery service model, directly addressing the core pain points faced by consumers, including speed, safety, and service. Compared to the order-pooling model chosen by most other same-city delivery platforms, Flash Express's advantages are more prominent.

In terms of speed, the 'one-on-one' model ensures a quick response. Flash Express has a total of 2.7 million couriers nationwide, covering 295 cities. On average, a courier arrives at the customer's location within 7 minutes after placing an order, and the entire city can be delivered within 27 minutes.

Flash Express delivers only one order at a time, so delivery is faster and more punctual. In contrast, the order-pooling model delivers multiple orders at once, which is less time-efficient and may compromise user experience.

Since its first delivery of a key to a user in an emergency, Flash Express has adhered to the 'one-on-one' urgent delivery model for 10 years, establishing a brand image in consumers' minds as the go-to choice for urgent deliveries during important moments.

In critical situations, such as forgetting an ID card before a college entrance exam or needing medicine urgently for a family member, consumers always think of Flash Express first. With just one order, a Flash Express courier responds and delivers with lightning speed, demonstrating what true urgency and empathy look like in action.

In terms of safety, the 'one-on-one' model reduces transit time and avoids item transfers by not pooling orders, thereby enhancing safety. In contrast, the order-pooling model may lead to contamination, misdelivery, and other safety issues.

This model has established a consumer habit of using Flash Express for delivering important items. Whether it's essential documents like contracts and tenders in business settings or valuable electronics like phones and computers, Flash Express is trustworthy and reliable.

In terms of exclusive services, compared to common meal and package deliveries, Flash Express better meets users' diverse and customized service needs, especially for gift-giving occasions to important people. The 'one-on-one' model better conveys users' exclusive respect and thoughtfulness.

One representative user story comes from Beijing's Fengtai District. On Valentine's Day, a Flash Express courier received an order to deliver flowers. The sender and recipient lived in the same building. The shy man chose Flash Express to convey his love to his girlfriend. The courier not only delivered the flowers on time but also successfully conveyed the man's heartfelt message, leaving everyone satisfied.

Of course, users can also ask Flash Express couriers to purchase specific items and deliver them to designated locations, help with trash disposal, pick up packages, accompany the elderly and children, and more. These customized services are promptly responded to.

After more than a decade of deep cultivation, Flash Express's 'one-on-one' business model has established a brand image of 'urgent delivery,' 'safety,' and 'exclusive services' in consumers' minds. This not only demonstrates Flash Express's competitive strength but is also crucial for the company's long-term development.

【Getting the Flywheel Spinning】

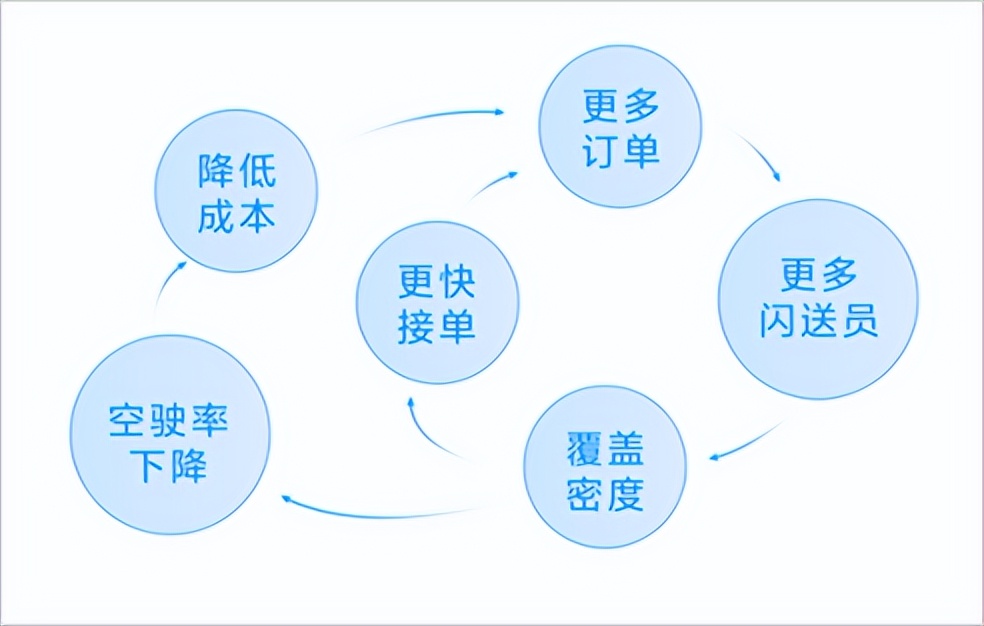

Under its unique 'one-on-one' business model, Flash Express has entered a virtuous cycle known as the 'flywheel effect.'

Over the past decade, Flash Express has accumulated a solid brand reputation and a considerable user base, built a unique algorithm model, and gradually formed three digital systems: order matching, dynamic intelligent scheduling, and security. For example, the order matching system uses big data analysis to match couriers with corresponding characteristics for different orders, enhancing their motivation and service quality.

With a user base and continuous technological innovation, Flash Express's delivery efficiency and service quality continue to improve, attracting more users and riders, forming a virtuous cycle.

Currently, Flash Express has 2.7 million riders. This large and professional one-on-one urgent delivery capacity ensures fast, safe delivery services for users. With its large-scale and high-density delivery capacity, Flash Express responds, arrives, and delivers faster after an order is placed, enhancing the customer experience and increasing demand.

As the user base expands and order volume increases, operational costs decrease, and operational efficiency improves. For consumers, this means shorter pickup and delivery times and continuously improving service quality.

▲Flash Express's 'Flywheel Effect'

Driven by the 'flywheel effect,' Flash Express has achieved impressive business results. As of the first half of 2024, Flash Express had 88.9 million registered users, a 180% increase from 31.1 million in 2021. The number of registered riders also increased from 1.1 million in 2021 to 2.7 million, a 145% increase.

According to the prospectus, Flash Express's order volume has been increasing continuously from 2021 to the first half of 2024, with the daily order volume per active rider increasing from 7.2 in 2021 to 9.3 in the first half of 2024.

The continuous increase in order volume has driven the continuous expansion of Flash Express's revenue scale. From 2021 to 2023, revenues were 3.04 billion yuan, 4.003 billion yuan, and 4.529 billion yuan, with year-on-year growth rates of 50.9%, 31.7%, and 13.1%, respectively, and a compound annual growth rate of 22%. In 2023, the company achieved an annual profit of 110 million yuan, turning the tide from loss to profit, which further increased to 124 million yuan in the first half of 2024, achieving seven consecutive quarters of profitability.

Flash Express's profitability has also continued to strengthen. From 2021 to 2023 and the first half of 2024, gross profit margins were 6.22%, 6.48%, 8.7%, and 11.26%, respectively. Net profit margins also continued to increase, reaching 5.4% in the first half of 2024. Notably, Flash Express's gross and net profit margins are the highest in the industry.

As operations continue to improve and profits turn positive, Flash Express's cash flow situation has significantly improved. In 2023, net cash flow from operating activities was 46 million yuan, turning positive for the first time in recent years. This figure was 21 million yuan in the first half of 2024.

Overall, Flash Express's 'one-on-one' operating model has been validated by the market, with increasingly apparent scale effects, improving operational and management efficiency, and continuously enhancing profitability and cash flow. The positive flywheel of the business has begun to spin rapidly.

【Growth Drivers】

In the future, Flash Express's medium- and long-term revenue growth will depend on the vigorous development of the instant delivery industry.

The pandemic over the past three years has transformed the 'lazy economy' into a 'daily necessity,' accelerating China's instant delivery market. During the pandemic, same-city instant delivery services became an integral part of people's lives, and this demand continues to grow even after the pandemic.

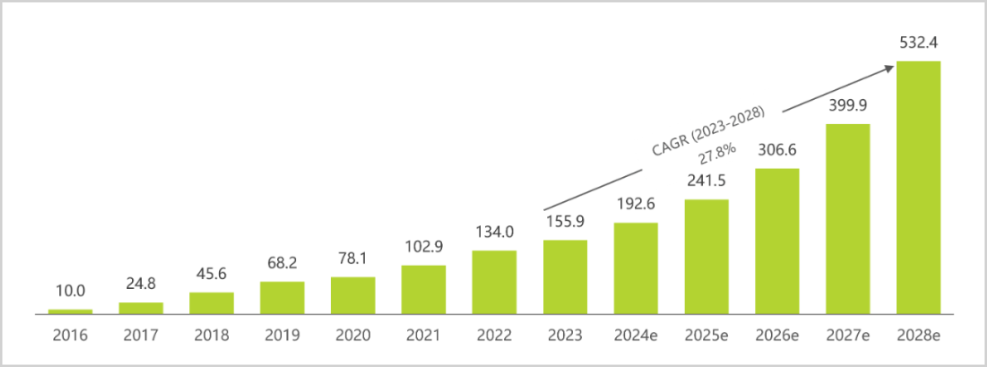

According to iResearch Consulting, China's instant delivery industry was worth 338.5 billion yuan in 2023, with a compound annual growth rate of 19.8% from 2019 to 2023. By 2028, the market size is expected to expand to 809.64 billion yuan, with a compound annual growth rate of 19.1% from 2023 to 2028.

▲Scale of China's Instant Delivery Industry, 2016-2028, Source: iResearch Consulting

China's instant delivery industry primarily includes traditional logistics providers (represented by STO Express, YTO Express, ZTO Express, and SF Express), platform-based instant delivery service providers (represented by Meituan, Ele.me, Dada, etc.), and third-party instant delivery service providers (represented by Flash Express, SF Express City, UU Running, etc.). The first two categories account for a larger proportion of the entire industry.

Notably, profound changes are occurring in the instant delivery market. With the rise of short video platforms led by Douyin, Kuaishou, and Xiaohongshu, the online e-commerce market cake has been dispersed from traditional e-commerce platforms to various emerging traffic platforms, driving the evolution of consumption scenarios towards non-standardization and low penetration.

This provides expansion opportunities for the third-party independent instant delivery service segment. According to iResearch Consulting, the scale of this segment is expected to exceed 50 billion yuan by 2028, reaching 53.24 billion yuan, with a compound annual growth rate of 27.8% from 2023 to 2028, significantly faster than the overall instant delivery industry's growth rate.

▲Trend of China's Independent Instant Delivery Market Scale, Source: iResearch Consulting

According to iResearch Consulting, based on 2023 revenue, Flash Express accounted for approximately 33.9% of China's independent 'one-on-one' express delivery service market. This indicates that Flash Express has an absolute advantage in the third-party instant delivery segment and is expected to benefit from the industry's continued expansion in the future.

Besides the common C2C model, instant new retail, characterized by 'e-commerce shopping with takeout delivery experience,' covers various industries such as 3C electronics, home appliances, fresh produce, maternity and child products, supermarkets, and more, showing robust development momentum with immense potential in the B2C model.

According to a research report released by China Merchants Securities in September 2023, instant retail is a high-efficiency home delivery consumption format based on the instant delivery system, a typical new retail format and consumption model. The market size is expected to reach 1 trillion yuan by 2027.

For the B2C business model, there are certain operational thresholds, including brand power and instant fulfillment capabilities. With over a decade of deep cultivation in the same-city instant delivery field, Flash Express has established brand recognition and a vast delivery network, gaining high recognition from numerous B-end enterprise customers.

Currently, Flash Express is one of Douyin's hourly delivery service providers and has partnered with key accounts such as Tuhu Auto Service, Chow Tai Fook, and SKP. It also cooperates extensively with upstream and downstream platforms like China Railway Express, fully leveraging the benefits of the B2C market.

Whether in the C2C or B2C market, Flash Express demonstrates strong competitive strength, enabling it to maintain a leading position in the market. This is all thanks to Flash Express's decade-long focus on the 'one-on-one' model, establishing a brand image of speed, safety, and exclusive services.

This core competitiveness of Flash Express is highly valued and recognized by the capital market. Companies that can better address consumers' core pain points will have stronger pricing power and profitability, providing a solid foundation and imagination space for capital value.

Disclaimer

This article contains content related to listed companies, based on the author's personal analysis and judgment of information publicly disclosed by the listed companies in accordance with legal requirements (including but not limited to temporary announcements, periodic reports, and official interaction platforms). The information or opinions in this article do not constitute any investment or other business advice. Market Value Observation does not bear any responsibility for any actions taken based on this article.

——END——