Sea: Is the "Little Tencent" of Southeast Asia becoming a "sweetheart" again?

![]() 11/13 2024

11/13 2024

![]() 516

516

Before the US stock market closed on the evening of November 12, Beijing time, Sea, the "Little Tencent" of Southeast Asia, released its third-quarter 2024 financial report. All indicators exceeded expectations, marking an impressive performance. The key points are as follows:

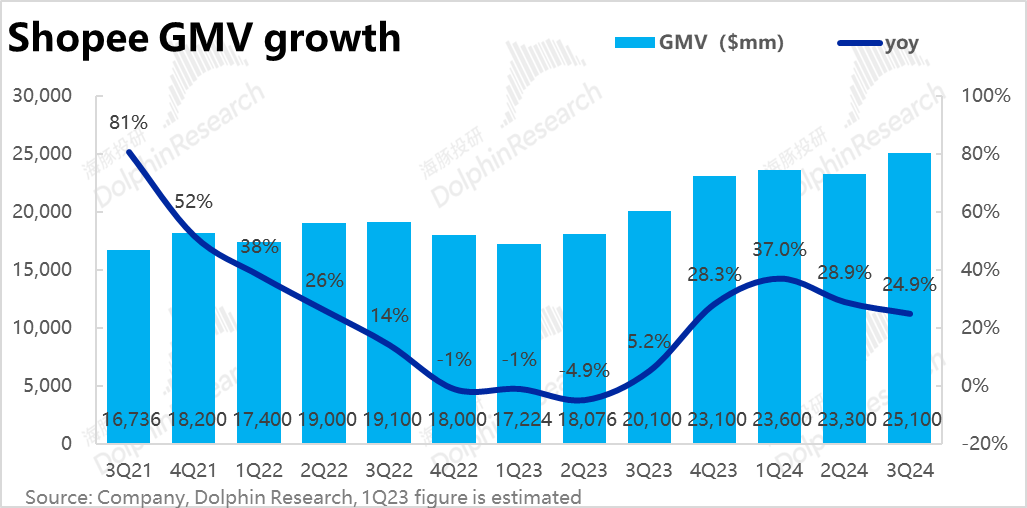

1. In the critical Shopee e-commerce segment, GMV reached 24.1 billion this quarter, representing a year-on-year growth of nearly 25%, significantly better than the market's expected growth rate of 22%. Despite a slight decrease of about 4 percentage points from the previous quarter, considering the increasing base effect, this can be considered as no slowdown. Based on the company's guidance for full-year 2024 GMV growth in the "mid-twenties", we take the upper limit of 27%, implying a GMV growth rate of about 20% in Q4. Considering that GMV growth was already significantly recovering in Q4 last year, this guidance is also impressive.

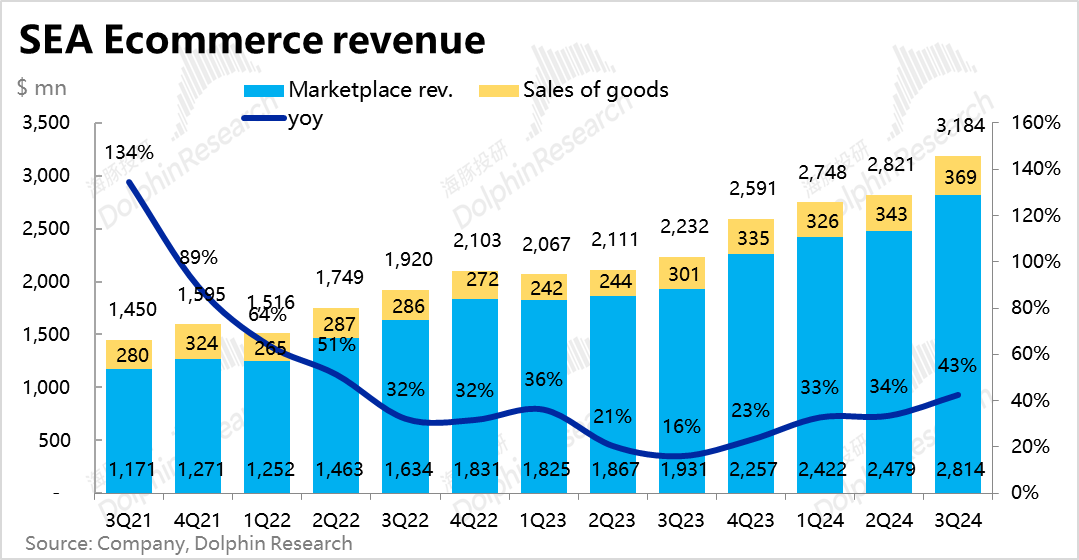

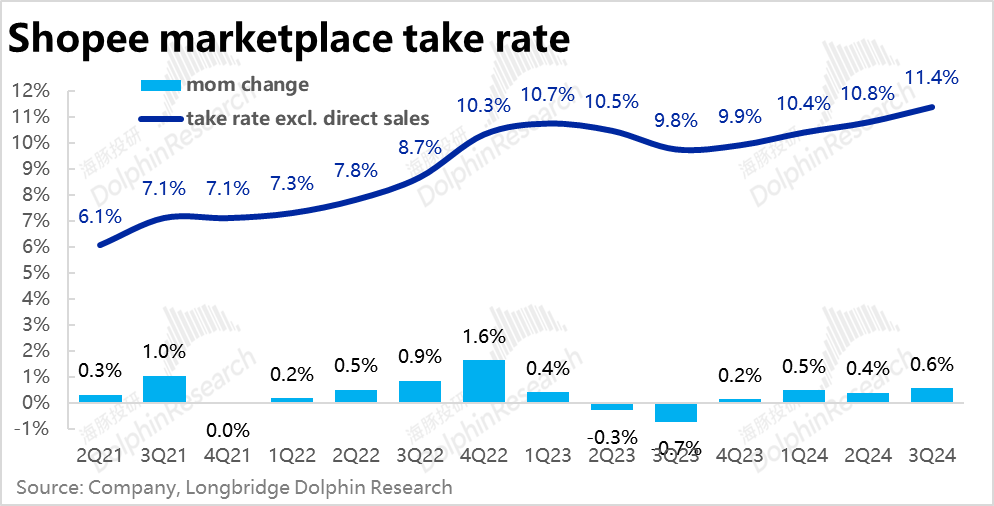

On the revenue front, Shopee's year-on-year revenue growth reached a high of 43%, significantly outpacing GMV growth. Compared to the previous quarter, revenue growth accelerated by a full 9 percentage points, demonstrating robust performance. A significant contributing factor was Shopee's recent (the second time this year) broad increase in monetization rates across various markets. It is estimated that Shopee's monetization rate increased by about 0.6 percentage points to 11.6% quarter-on-quarter, marking a new high since 2023. Fundamentally, the competition in Southeast Asian e-commerce is becoming more rational, with players collaborating to increase monetization and generate profits, creating favorable conditions.

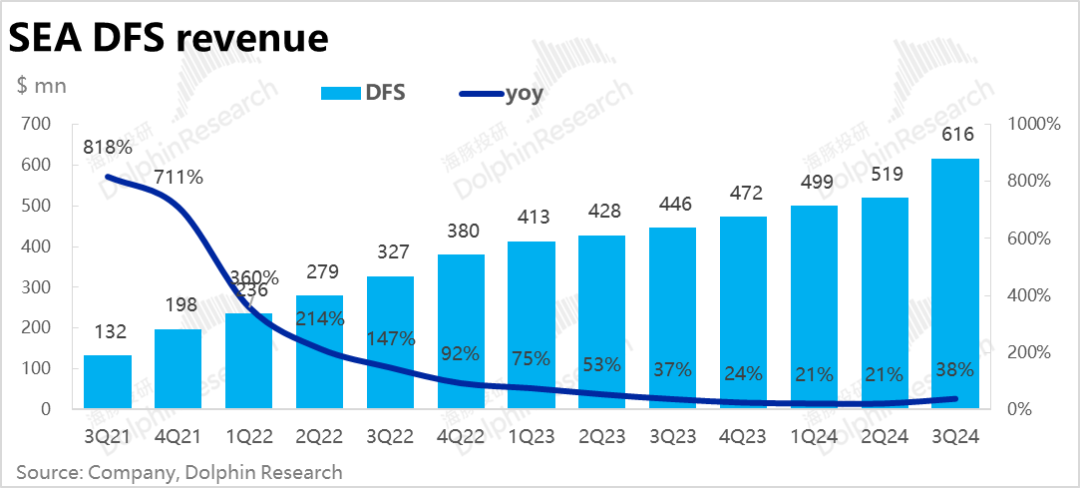

2. The SeaMoney segment was the standout performer this quarter. Revenue surged 38% year-on-year to nearly $620 million, with growth accelerating by a full 17 percentage points quarter-on-quarter. Actual revenue exceeded expectations by nearly 13%. According to the company, the strong performance was underpinned by an outstanding loan balance of $4.6 billion this quarter, a year-on-year surge of 73% (less than 40% year-on-year growth in the previous quarter). The promotion of BNPL (Buy Now, Pay Later) services likely contributed significantly. Meanwhile, the proportion of non-performing loans overdue for more than 90 days continued to decline quarter-on-quarter by 0.1 percentage points to 1.2% (1.6% in the same period last year). Despite a significant increase in loan volume, loan quality has improved.

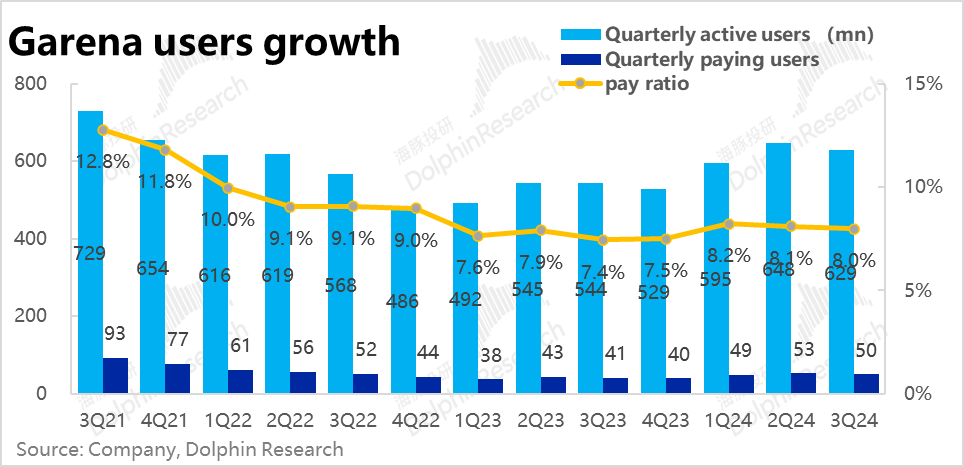

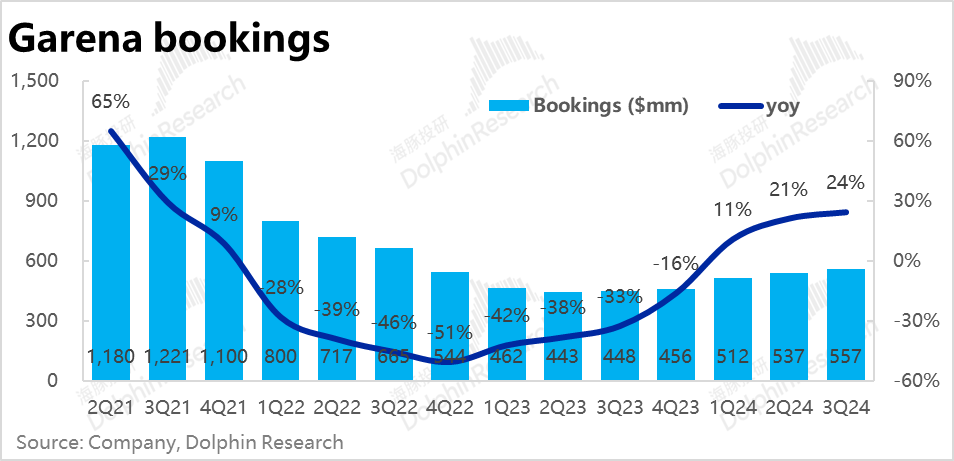

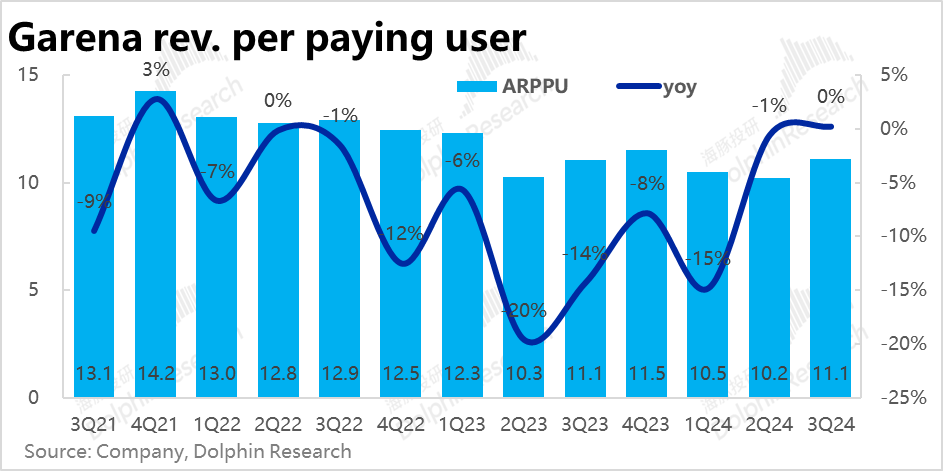

3. Compared to the other two segments, Garena's gaming business performed slightly less impressively. Active users totaled approximately 630 million this quarter, with 50 million paying users, both slightly lower than the previous quarter and slightly below market expectations. However, the user base still grew significantly year-on-year, and revenue per paying user stabilized, resulting in a 24% year-on-year increase in key gaming revenue, accelerating by 3 percentage points from the previous quarter and slightly exceeding market expectations.

While the unexpected decline in user numbers may be a potential negative signal, the gaming segment's performance remained relatively stable this quarter.

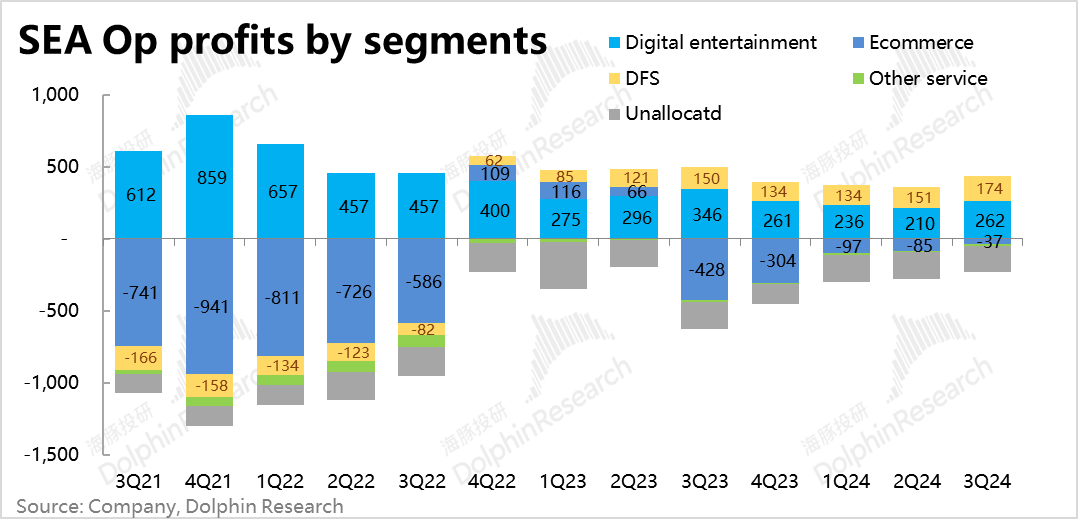

4. In terms of segment profitability, the most closely watched e-commerce segment incurred a loss of $37 million this quarter, narrower than expected and less than the market's forecast of $48 million. While not outstanding, it validates the trend of Shopee's business gradually turning profitable.

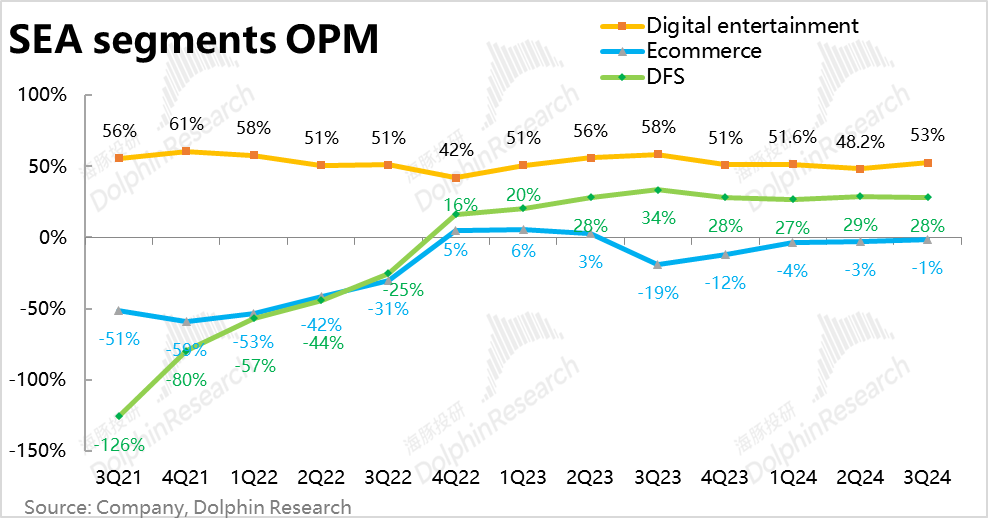

The gaming segment generated a profit of $260 million this quarter, a nearly 25% quarter-on-quarter increase. The profit margin of the gaming business improved (from 48% in the previous quarter to nearly 53%), likely due to significant cost reductions.

The DFS financial segment maintained a relatively stable profit margin (28.3% this quarter vs. 29.1% in the previous quarter), achieving an operating profit of $170 million, a new high.

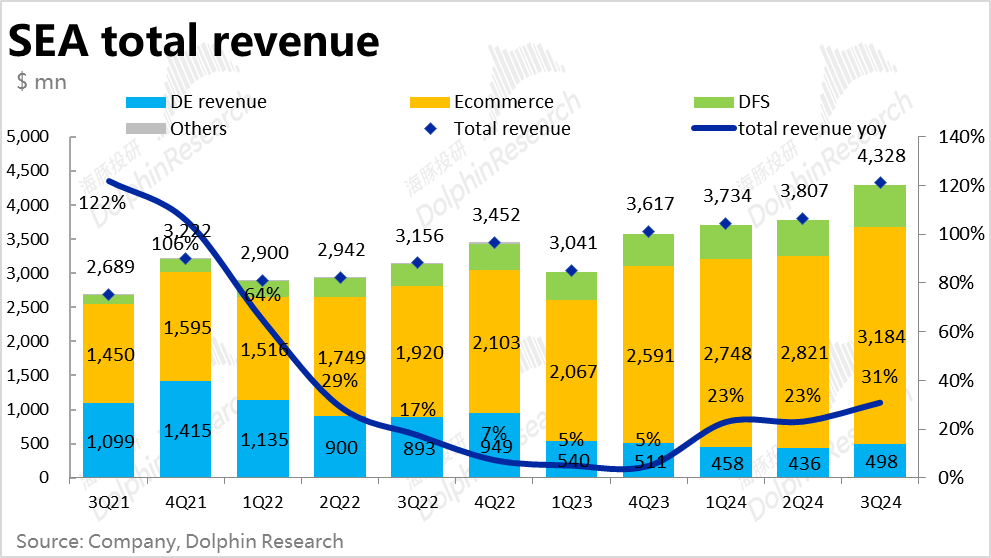

5. Overall, due to impressive performances across all segments, Sea's total revenue reached $3.81 billion this quarter, a year-on-year increase of 31% and a quarter-on-quarter acceleration of about 8 percentage points, exceeding expectations by about 6.4%.

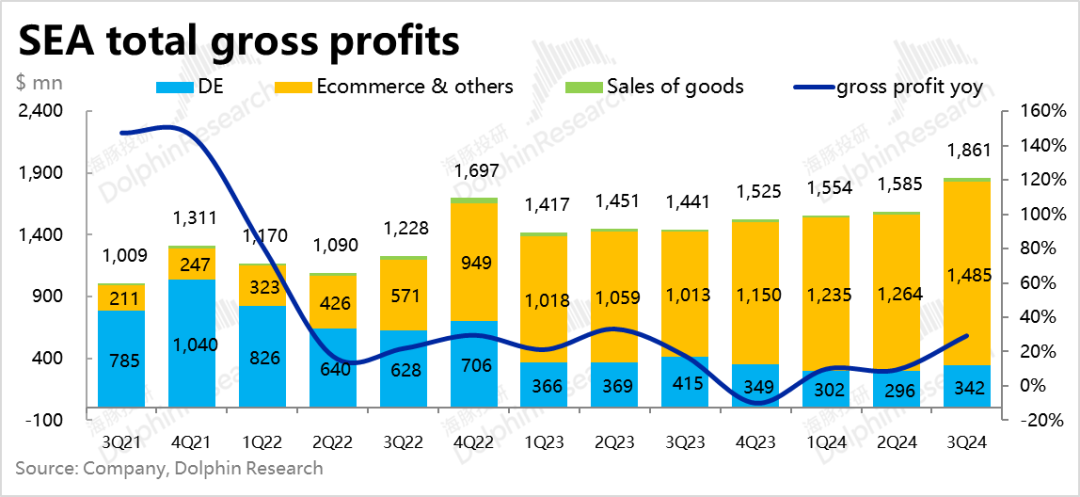

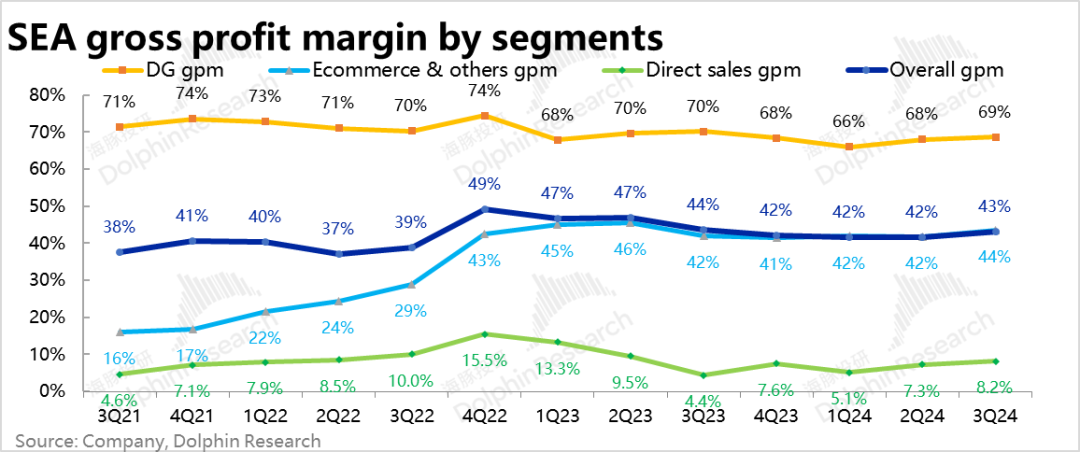

On the gross profit front, the gross margin increased from less than 42% to 43% quarter-on-quarter, with all segments experiencing slight quarter-on-quarter increases in gross margins. Due to the slight increase in gross margin, actual gross profit exceeded expectations by a larger margin of 7.9%.

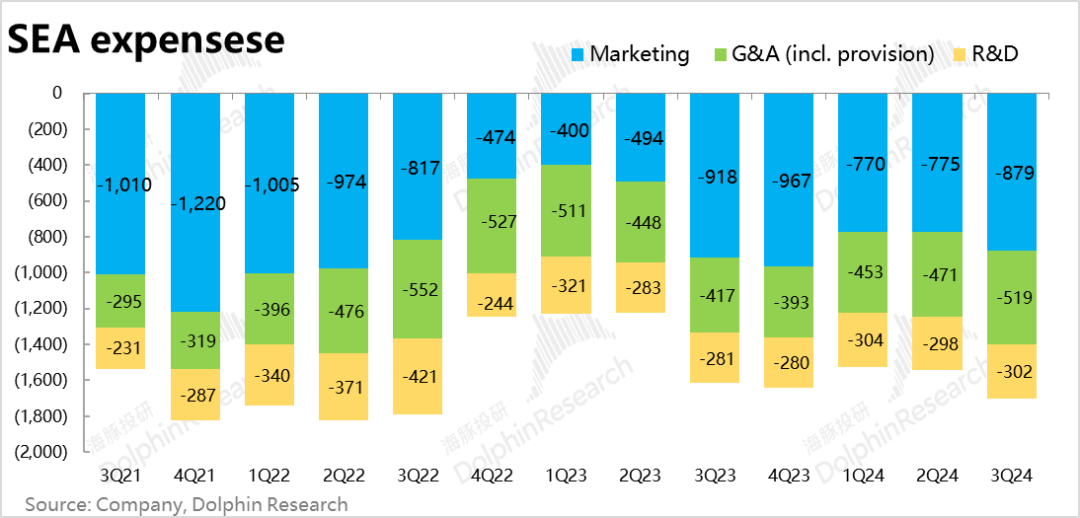

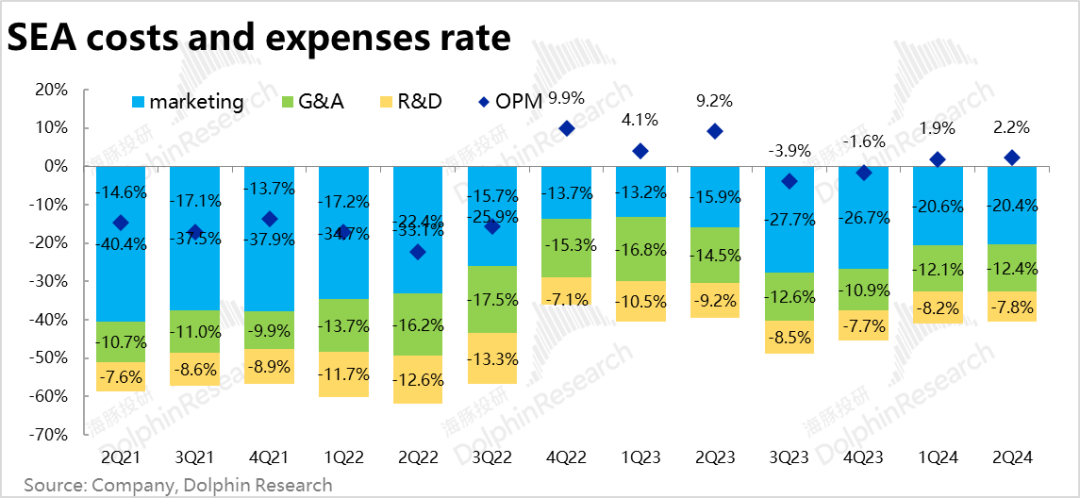

In terms of expenses, total operating expenses amounted to nearly $1.7 billion, a year-on-year increase of about 5%, with the expense ratio continuing to decline passively due to higher revenue growth. Quarter-on-quarter, the combined expense ratio decreased from 40.6% to 39.3%.

Notably, marketing expenses for the Shopee business (accounting for about 87% of the total) decreased by about 4% this quarter despite the increase in overall expenses.

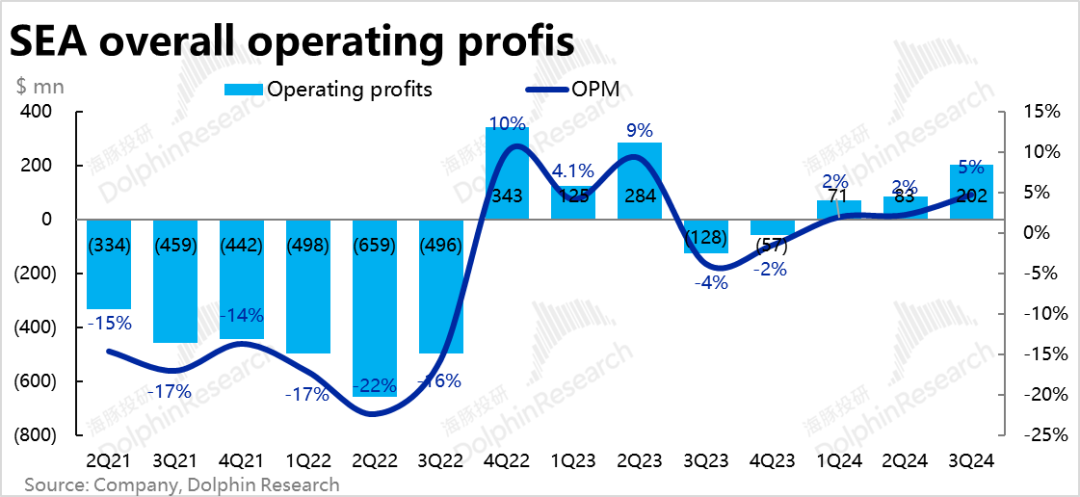

Ultimately, Sea's operating profit reached $200 million this quarter, far exceeding expectations of $160 million, with an operating profit margin of 5%. According to the company's more focused adj. ebitda metric, it amounted to $520 million this quarter, exceeding expectations by about 8%, with a slightly larger beat margin compared to gross profit.

Dolphin Investment Research Perspective:

Sea's performance this quarter was undoubtedly impressive. Except for a slightly higher quarter-on-quarter decline in user numbers in the gaming segment, all other indicators exceeded expectations, leaving little room for criticism.

Beyond the numbers, from the perspective of each segment's development, the financial segment appears to be entering another period of strong performance driven by the promotion of BNPL services, with both revenue and profit accelerating once again. Financial lending businesses inherently have the characteristics of "low cost, high leverage, and high profit." While it is unclear which new monetization channels/businesses the company will explore, the potential for growth is undoubtedly considerable.

Although the gaming business is still heavily reliant on the single game Free Fire and currently has no apparent upside, at least with the stabilization of revenue and user numbers, this segment will no longer hinder the group's overall performance.

Regarding the critical e-commerce business, while we believe that the competition in Southeast Asian e-commerce will eventually come to an end and the truce will be temporary, the current situation, where Shopee, Lazada, and TikTok have collaboratively increased monetization over the past few quarters, resulting in significant improvements in their profits, validates that the Southeast Asian e-commerce industry is indeed in a period of rational competition and shared prosperity. Recently, the Indonesian government announced a ban on cross-border e-commerce platforms like Temu and Shein, creating a temporary protective period for existing players (it is highly likely that Temu will enter Indonesia through partnerships with local platforms).

From a valuation perspective, as the Shopee segment is still on the brink of profitability, there is considerable variation in market judgments about its future profitability prospects. Using the most commonly applied PE valuation metric, Sea's pre-market capitalization corresponds to a PE valuation of approximately 22+ to 30+ times its net profit in 2026. Clearly, the current valuation already reflects a significant portion of expectations for future growth. However, due to the market's lack of a clear grasp of the company's medium- and long-term profitability prospects, Sea's share price movements in the short term will depend more on the direction of marginal changes in performance.

Below is a detailed interpretation of the financial report

I. Increasing monetization without sacrificing growth: Is Southeast Asian e-commerce back in its "sweet spot"?

First, in the critical Shopee e-commerce segment, GMV reached 24.1 billion this quarter, representing a year-on-year growth of nearly 25%, significantly better than the market's expected growth rate of 22%. Despite a slight decrease of about 4 percentage points from the previous quarter, considering the increasing base effect, there are no signs of slowdown. Based on the company's guidance for full-year 2024 GMV growth in the "mid-twenties," we take the upper limit of 27%, implying a GMV growth rate of about 20% in Q4. Considering that the base in Q4 last year was already significantly higher, this is still a remarkable growth guidance.

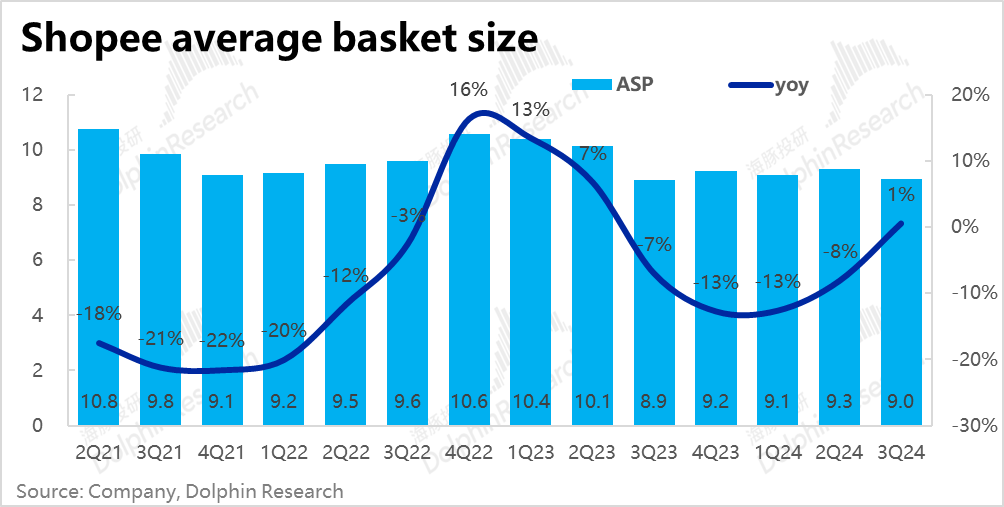

Breaking down the price and volume, the year-on-year growth rate of order volume was 24% this quarter, a significant slowdown from 40% in the previous quarter. Fortunately, the downward trend in average order value due to live streaming e-commerce and price subsidies ended this quarter, with a 1% increase (compared to -8% in the previous quarter). Therefore, despite the significant slowdown in sales growth, GMV growth remained robust.

On the revenue front, Shopee's year-on-year revenue growth reached a high of 43% this quarter, significantly outpacing GMV growth. Compared to the previous quarter, revenue growth accelerated by a full 9 percentage points, demonstrating robust performance.

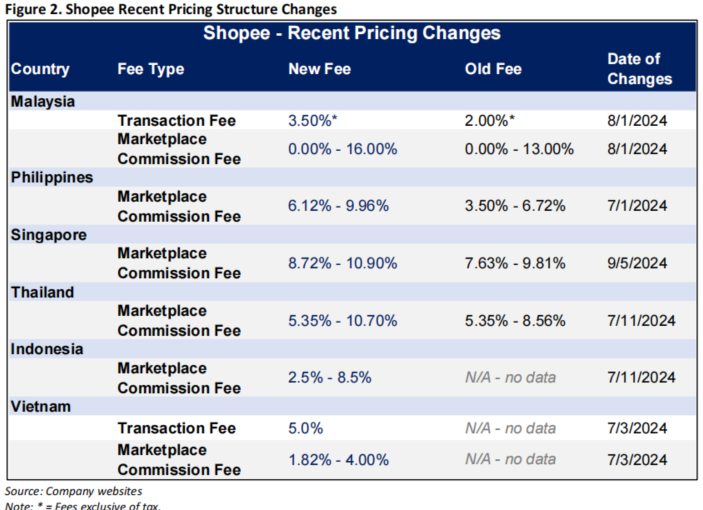

It is understood that jointly increasing monetization rates is one of the consensuses among Southeast Asian e-commerce platforms. Since 2024, Shopee has comprehensively increased the monetization rates across various markets twice, once at the beginning of the year and another time between July and September. Theoretically, continuously increasing monetization rates would raise costs for merchants or consumers, which is not conducive to the growth of the platform's transaction volume.

However, as shown in the table below, even after multiple increases in monetization rates, Shopee's current take rate is roughly the same as that of its competitor Lazada, which does not result in a competitive disadvantage. According to research, while increasing the monetization rate in the Singapore market by about 150 basis points, Shopee reduced the service fee for Coin Cashback by 200 basis points and increased the distribution of free shipping coupons. This shows that Shopee is not unilaterally increasing the platform's monetization level but is reinvesting part of the incremental revenue in improving consumer experience or merchant operating costs.

Due to these adjustments, it is estimated that Shopee's monetization rate increased by about 0.6 percentage points to 11.6% quarter-on-quarter, marking a new high since 2023. Furthermore, the increase in monetization rates was almost entirely driven by marketplace services (high-profit margins) rather than VAS (such as delivery fees) and other low-profit-margin fee items. Therefore, the quality of monetization has also improved.

II. Explosive growth in SeaMoney financial services: The standout performer this quarter

The standout performer this quarter was the SeaMoney segment. Revenue surged 38% year-on-year to nearly $620 million, with growth accelerating by a full 17 percentage points quarter-on-quarter. Actual revenue exceeded expectations by nearly 13%, making it the segment with the largest beat this quarter. According to the company, the strong performance of the financial business was underpinned by an outstanding loan balance of $4.6 billion this quarter, a year-on-year surge of 73% (less than 40% year-on-year growth in the previous quarter). Combined with the company's explanation, the promotion of BNPL (Buy Now, Pay Later) services likely contributed significantly.

In addition, the proportion of non-performing loans overdue for more than 90 days continued to decline quarter-on-quarter by 0.1 percentage points to 1.2% this quarter (1.6% in the same period last year), indicating that loan quality has improved despite a significant increase in loan volume.

III. The Garena gaming segment was not outstanding but also not disappointing

Although the Garena gaming business performed slightly less impressively compared to the other two segments, it still exceeded expectations.

In terms of key operating indicators, active users totaled approximately 630 million this quarter, with 50 million paying users, both slightly lower than the previous quarter and slightly below market expectations of 637 million and 52 million, respectively.

However, despite the unexpected difference, the user base still grew significantly year-on-year, and revenue per paying user stabilized at $11.1, ending the year-on-year decline. As a result, key gaming revenue increased by 24% year-on-year this quarter, accelerating by 3 percentage points from the previous quarter and slightly exceeding market expectations.

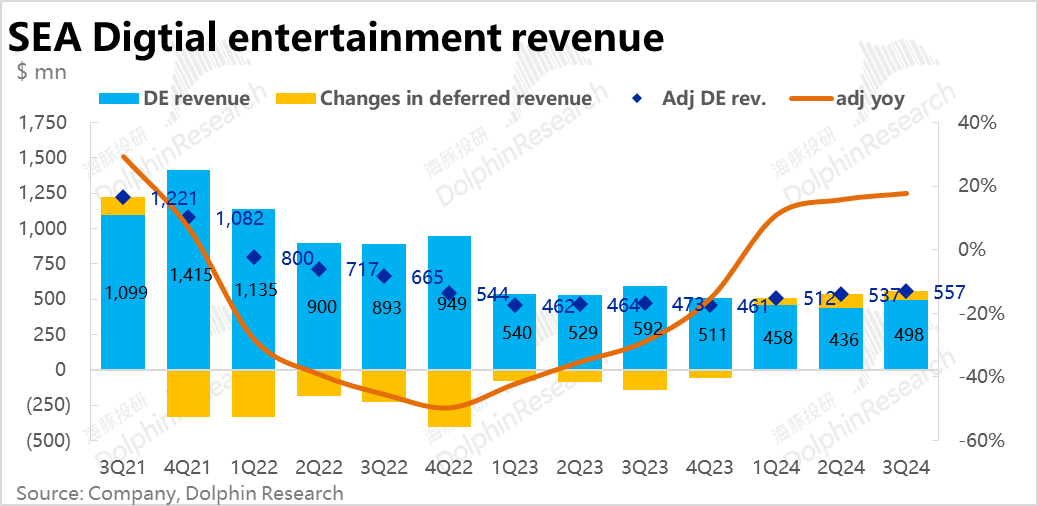

Due to the accelerated growth in gaming revenue, Garena's revenue under GAAP declined by 16% year-on-year this quarter, narrowing by 2 percentage points from the previous quarter and exceeding expectations by about 5%. The primary reason for the year-on-year decline in GAAP revenue is the resurgence of game deferrals. While the unexpected decline in user numbers may be a potential negative signal, the gaming segment's performance still demonstrated marginal improvement this quarter.

4. E-commerce segment loss narrows as expected, and profits across all segments exceed expectations

In summary, from the revenue perspective, the financial sector performed the strongest, followed by the e-commerce and gaming sectors, all outperforming expectations. So, how did each business perform in terms of profitability?

The most closely watched e-commerce segment incurred a loss of $37 million this quarter, with the loss margin narrowing as expected and being lower than the market expectation of $48 million. While not very impressive, it crucially validated the trend of Shopee's business gradually turning losses into profits.

The gaming segment reported a profit of $260 million this quarter, representing a nearly 25% quarter-over-quarter increase (with GAAP revenue increasing by 14% quarter-over-quarter). This indicates an improvement in the gaming business's profit margin this quarter (from 48% last quarter to nearly 53% this quarter). Dolphin Research speculates that there was a significant reduction in expense investments.

The DFS financial segment maintained a relatively stable profit margin (28.3% this quarter vs. 29.1% last quarter), achieving an operating profit of $170 million, continuously setting new highs.

From an expectation perspective, except for the e-commerce segment, which is not comparable due to negative profits, the actual profits of the gaming and financial segments were about 8% to 9% higher than expected.

5. Revenue, gross profit, and profit all beat expectations with increasing margins

Revenues from the main e-commerce, financial, and gaming segments all exceeded expectations, especially with the significant contribution from the accelerated growth of the financial segment. This quarter, Sea achieved overall revenue of $3.81 billion, a year-over-year increase of 31%, with a quarter-over-quarter growth rate of about 8 percentage points higher and about 6.4% higher than expectations.

At the gross profit level, the company achieved overall gross profit of $1.86 billion this quarter, with the gross margin increasing from less than 42% to 43% quarter-over-quarter. When broken down, the gross margins of all segments increased slightly quarter-over-quarter. Due to the impressive revenue growth and a slight increase in the gross margin, the actual gross profit exceeded expectations by a magnified margin of 7.9%.

At the expense level, the total expenditure for the four operating expenses was nearly $1.7 billion, a year-over-year increase of about 5%, lagging behind revenue growth, resulting in a continued decline in the expense ratio. Quarter-over-quarter, the combined expense ratio for the four expenses decreased from 40.6% to 39.3%.

Notably, the marketing expense for the Shopee business this quarter (accounting for about 87% of the total) decreased by about 4% instead of increasing. Combined with the stabilization and rebound in average order value, it can be inferred that the company is indeed facing reduced competitive pressure and has reduced subsidies.

Due to the passive dilution of expense expenditures amid higher revenue growth, Sea achieved an operating profit of $200 million this quarter, far exceeding the expectation of $160 million, with an operating profit margin of 5%.

However, according to the company's more closely watched adj. ebitda metric, it was $520 million this quarter, about 8% higher than expected, with a beat margin roughly similar to and slightly higher than that of gross profit.

- END -

// Reprint Authorization

This is an original article by Dolphin Research. For reprinting, please obtain authorization.