Zhongbei Communications: Frequently Supervised for Computing Power Business, Funds on Account in Short Supply

![]() 11/13 2024

11/13 2024

![]() 668

668

Since deploying its computing power business, Zhongbei Communications (603220.SH) has been controversial. Recently, the company received another warning letter within the year for irregularities regarding two computing power order fulfillments and delayed disclosure of progress.

Securities Star noticed that the company is currently engaged in the construction of computing power servers and supporting projects. Due to the large construction scale and financial requirements of this project, the company's asset-liability ratio has continued to rise, and short-term debt repayment pressure has increased. In terms of performance, the computing power business contributes relatively little to Zhongbei Communications' overall revenue. Although the company achieved profit and revenue growth in the first three quarters, growth rates have slowed significantly, with both revenue and net profit declining quarter-on-quarter in Q3.

01. Received Another Letter Due to Information Disclosure Issues

On the evening of November 7, Zhongbei Communications received a warning letter from the Hubei Securities Regulatory Bureau for information disclosure violations. The warning letter indicated that the company had two computing power service contracts that had been unfulfilled for a long time and had delayed disclosing progress.

The first contract was signed with WILDLOOK TECH PTE.LTD. for USD 20 million, originally scheduled for delivery by December 31, 2023, but it has remained unfulfilled due to changes in customer demand and was only disclosed as terminated in the company's 2024 interim report. The second contract was signed with Beijing Zhongke Xinyuan Technology Co., Ltd. for RMB 346 million, originally scheduled for delivery by March 30, 2024, but it has remained unfulfilled due to external factors and was also delayed until the 2024 interim report to disclose contract progress.

The Hubei Securities Regulatory Bureau has taken administrative regulatory measures by issuing warning letters to Zhongbei Communications, then-Chairman and General Manager Li Liubing, and then-Board Secretary Lu Nianqing, and recorded this in the securities and futures market integrity records.

Securities Star noticed that Zhongbei Communications has frequently been named by regulators for information disclosure issues related to its computing power business this year.

As early as March this year, the company received a warning letter from the Hubei Securities Regulatory Bureau for failing to timely fulfill information disclosure requirements as stipulated. An investigation revealed two irregularities: firstly, the company prematurely disclosed investment details of the Hefei Smart Computing Center project on its official WeChat public account in August 2023 but did not officially announce it on the exchange website until August 28; secondly, the company was prematurely exposed as building a East China base in Hefei Shushan Economic Development Zone without an official contract or announcement.

Subsequently, on April 8, Zhongbei Communications caused considerable controversy with an announcement of a computing power service contract signed with Jinan Supercomputing Center Co., Ltd. Following the announcement, the Shandong Provincial Computing Center (National Supercomputing Jinan Center) "debunked" the news, clearly stating that it had no connection with Zhongbei Communications' partner. On April 12, Zhongbei Communications received a regulatory letter from the Shanghai Stock Exchange regarding this incident. Although Zhongbei Communications apologized afterward, some investors believed the company was "riding on" the hype surrounding the Shandong Provincial Computing Center.

02. Continuous Rise in Asset-Liability Ratio

Public information shows that Zhongbei Communications primarily focuses on communication network construction business while also engaging in communication and informatization system integration, communication network optimization and maintenance, and communication network planning and design services.

The company began deploying its computing power business in 2023 and established a subsidiary to handle daily operations and management of the computing power business and construct computing power clusters. From September last year to June 2024, Zhongbei Communications and its subsidiaries signed cooperation agreements with China United Network Communications Co., Ltd.'s Qinghai Branch, Beijing Zhongke Xinyuan Technology Co., Ltd., and others, securing six orders totaling RMB 2.231 billion.

In August this year, Zhongbei Communications won the bid for the "Lingang Computing Power 2024 Fifth Phase Computing Power Service Project" from Lingang Computing (Shanghai) Technology Co., Ltd., a wholly-owned subsidiary of China Telecom. The estimated bid amount was RMB 810 million, with a contract period of four years. However, the company has not yet announced official signing information.

Regarding the fulfillment of the above six orders, Zhongbei Communications stated that all announced computing power service contracts, except for the two terminated ones, have been delivered and are being normally fulfilled. However, in terms of revenue contribution, the impact of the computing power business on overall income is not significant.

According to the interim report, the company generated revenue of RMB 1.512 billion in the first half of the year, of which the computing power business contributed RMB 142 million, accounting for a relatively small proportion. In Q3 this year, Zhongbei Communications' revenue and net profit both declined quarter-on-quarter, with revenue and net profit at RMB 694 million and RMB 39.1067 million, respectively, down 11.41% and 33.63% quarter-on-quarter.

Overall, although the company achieved profit and revenue growth in the first three quarters, with operating revenue of RMB 2.206 billion, a year-on-year increase of 10.84%, and net profit attributable to shareholders of the listed company of RMB 144 million, a year-on-year increase of 43.41%, growth rates have slowed compared to the same period last year, when revenue and net profit attributable to shareholders of the listed company grew by 20.76% and 50.23%, respectively.

Furthermore, as the company deepens its deployment in the computing power business, the financial pressure on Zhongbei Communications has become increasingly apparent.

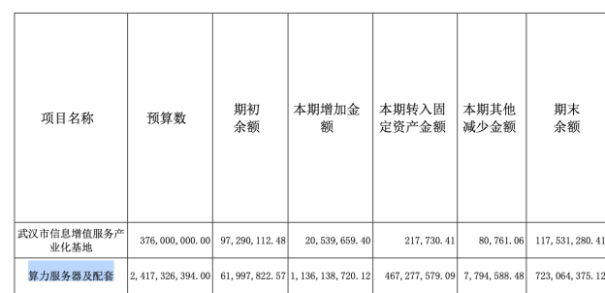

Securities Star noticed that the company is currently constructing computing power servers and supporting projects with a budget of RMB 2.417 billion. Due to the large construction scale and financial requirements of this project, the company has adopted multiple financing methods to raise funds to ensure the smooth implementation of key projects.

Against this backdrop, the company's asset-liability ratio has shown an upward trend. As of the end of September this year, Zhongbei Communications' asset-liability ratio increased from 67.28% at the beginning of the year to 72.48%, an increase of 5.2 percentage points, and an increase of 8.3 percentage points compared to the same period last year.

Among total assets, the company's accounts receivable and notes receivable account for a relatively high proportion. At the end of the reporting period, the company's total accounts receivable and notes receivable amounted to RMB 2.214 billion, accounting for 29% of total assets.

In contrast, the company's monetary funds account for a relatively low proportion and show a downward trend. At the beginning of this year, the company had RMB 1.166 billion in monetary funds, which had declined to RMB 570 million by the end of June. The company attributed this to payments for computing power clusters and new energy investments. As of the end of September 2024, its monetary funds were only RMB 359 million, while the company's short-term borrowings amounted to RMB 988 million, making it difficult for its funds on account to cover short-term borrowings.

Meanwhile, the company's long-term borrowings and non-current liabilities due within one year have increased significantly year-on-year, by 1701% and 393.39% respectively, reaching RMB 734 million and RMB 594 million.

In addition, due to substantial investments in smart computing clusters, the company's bank loans and finance lease borrowings have increased, leading to a significant increase in financial expenses. In the first three quarters of this year, the company's financial expenses amounted to RMB 65.8683 million, a year-on-year surge of 422.13%. (This article was originally published on Securities Star, written by Li Ruohan)

- End -