"Double 11 this year sees e-commerce entering a new Nash equilibrium

![]() 11/13 2024

11/13 2024

![]() 568

568

The Double 11 shopping festival in 2024 is poised to become another real-life example of economic game theory.

If previous industry-wide celebrations, seen as economic barometers, made it difficult to discern whether growth was fueled by macroeconomic momentum or industry-driven initiative, the disappearance of GMV (Gross Merchandise Volume) from platform reports on Double 11 has made industry trends more straightforward.

It directly points to the main evolutionary trajectory of the e-commerce industry: from relentless competition for lower-tier consumers, to unlimited price wars on the supply side, to the abuse of platforms' full refund policies, leading the entire industry into vicious competition and a quagmire.

In economics, enduring a quagmire is also a form of Nash equilibrium: if other market participants do not change their optimal strategies, then none of them will change theirs either. In simple terms, if Player A acts, Player B will definitely act; if Player A does not act, neither will Player B. This equilibrium continues until a new variable disrupts it.

In the e-commerce industry, this new variable began with Taobao's introduction of an optimized 'full refund' policy in August this year. Since then, the industry has entered a new round of competition, with platforms shedding their previous chaotic business practices and seeking growth certainty through improved business environments.

Whether this industry consensus can be sustained depends on the outcome of this year's Double 11. Aggregated data from various platforms on November 12 indicates overall positive feedback. Tmall announced robust GMV growth during Double 11, with a record number of purchasing users and 589 brands achieving GMV exceeding RMB 100 million, a year-on-year increase of 46.5%. JD.com reported a year-on-year increase of over 20% in shopping users and over 30,000 small and medium-sized merchants achieved a year-on-year GMV growth of over 200%.

This may suggest that the e-commerce industry is entering a new Nash equilibrium. This makes the 16th Double 11 look remarkably different.

01

A new equilibrium emerges

Based on the Double 11 data dimensions already released by various e-commerce platforms, the unexpected growth in transaction volumes of small and medium-sized merchants during this year's Double 11 is a notable trend.

Shanmo Toy Store is one such example.

During the first hour of sales on Double 11 this year, Mr. Liu, the owner of Shanmo Toy Store, had mixed feelings. He was delighted that his products had doubled in sales on Taobao, but worried about insufficient inventory, making him hesitant to sell more.

Considering this year's macroeconomic forecasts and the store's performance during last year's Double 11, Mr. Liu had only intended to participate symbolically in the sales promotion. Unexpectedly, the traffic was so good that an underprepared Double 11 still brought him a tenfold year-on-year increase in sales.

Faced with this sudden surge in orders, merchants may feel somewhat like small investors who entered the A-share market at the end of September this year with only RMB 100 – happy to be on board amidst the stock market rally but regretting their conservative investment approach.

Objectively speaking, as Double 11 enters its 16th year, it is inevitable that it will evolve from a moment of miracle creation to an ordinary event. Although some merchants who cannot keep up with the intense competition choose to take it easy during this Double 11, many more still view it as the most important and certain growth opportunity of the year, the last push to achieve annual GMV targets, and an important reference for adjusting next year's business strategies. Supporting this, the number of new brands joining Tmall in September this year increased by 239% month-on-month.

This year's Double 11 is particularly special. Since the second half of the year, the focus of competition among e-commerce platforms has shifted from chaotic price wars to ecosystem building and service upgrades, placing greater emphasis on balancing the experiences and rights of both merchants and consumers. Whether it's Taobao linking store experience scores to traffic, untying full refunds, or Pinduoduo's new quality supply, the idea is to help merchants achieve more sustainable growth by improving the business environment.

As consensus gradually forms, many growths have exceeded expectations. For example, the apparel category, which has always been the foundation of Taobao, achieved double-digit growth during Double 11 that exceeded expectations, with 90 brands achieving GMV exceeding RMB 100 million and nearly 2,000 merchants experiencing growth of over 500%.

The surge in traffic at Shanmo Toy Store is also related to platform policy adjustments. On July 26 this year, Taobao announced the full launch of a new experience score system, directly linking service experience to traffic. The higher the experience score, the better the search ranking results. The platform's intention is clear: good service leads to good growth.

▲Staff sorting parcels during Double 11

Although Mr. Liu himself said that the store had only recently transitioned to selling original plush toys last year and did not have high growth expectations for this year's Double 11, we can see on the store's homepage that Shanmo has not only been selected for the 'Taobao Magic Store List' and 'Top 5 Healing Plush Toy Stores' but also boasts important consumer decision-making indicators such as '6,000 return customers in a year,' '96% customer service satisfaction,' and 'excellent product experience.' One of its popular products, the 'Lovable Fish Penguin Keychain,' has a recent three-month approval rate of 99.3%.

▲Shanmo Toy Store's Taobao homepage

According to Taobao's latest traffic allocation logic, the above-mentioned positive labels can all drive free organic traffic.

Previously, some merchants revealed that the cost of traffic during major e-commerce promotions has increased by an average of 5%-7% annually.

During this year's 618 shopping festival, a women's wear merchant in live streaming e-commerce shared with NoNoise that the CPM (cost per mille impressions) of their store during the first wave of 618 promotions tripled compared to last year.

Amid the increasing cost of paid traffic, e-commerce platforms allocate traffic through service experience scores, motivating merchants to upgrade their services. This approach to building a healthy ecosystem ultimately benefits consumers, merchants, and platforms.

Lechen Home, an Yiwu-based merchant specializing in household cleaning products on Taobao, saw its experience score rise from 4.4 to 4.8 this year, resulting in a 200% increase in traffic. Zi Xu, the owner, felt a significant difference in traffic flow between low-quality, low-priced products and those with a good quality-to-price ratio. Last year, due to supply chain issues with a custom shark pants product, the return and product defect rates remained high, coupled with promotion costs, resulting in losses of over RMB 1 million for the store.

▲Various small items sold by Lechen Home

By leveraging the 'experience score' to significantly reduce operating costs this year, Lechen not only turned things around but also achieved monthly sales of up to RMB 10 million. These explorations have given hope to many merchants who were still observing platform trends amidst ineffective internal competition. Before Double 11, several peers sought advice from Zi Xu.

According to official Taobao data, two months after the introduction of the store experience score, over 36% of merchants across the platform have achieved a score of 4.8 or above, indicating a continuous improvement in merchant service levels.

From an industry perspective, the re-examination of the merchant ecosystem is not a solo act by Taobao alone. As a platform-based e-commerce company, Pinduoduo also announced at the end of August this year that it would invest RMB 10 billion over the next year to support new-quality merchants and introduce measures such as 'RMB 10 billion fee exemption for quality merchants' to reduce their burden. Pinduoduo has long been controversial for its platform rules favoring consumers over merchants.

JD.com, which focuses on self-operation, injects hundreds of billions of new traffic into third-party merchants through subsidies for factory goods, live streaming subsidies, and advertising rewards.

TikTok E-commerce offered policies during Double 11 such as hundreds of millions of red packets, traffic tilt towards key industries, and benefits for new stores. On social media, an operator of a TikTok E-commerce food and daily necessities store claimed that the platform's targeted incentives on November 5 alone resulted in over 30% month-on-month traffic growth.

▲A social media user claiming that TikTok E-commerce provides traffic subsidies for food and beverage products

During Double 11, a crucial sales promotion period for the e-commerce industry, all platforms are no longer pursuing the absolute lowest prices but instead competing to improve the business environment. This itself suggests that a new Nash equilibrium in the e-commerce industry is emerging.

02

Escaping Ineffective Internal Competition

How did the turning point occur?

By examining the timeline of 'corrective actions' taken by various e-commerce platforms, it becomes clear that this shift towards 'optimal strategies' is not a single-point reflection but a continuously evolving system. This year's Double 11 represents a concentrated release of system benefits.

Ultimately, the price war that has lasted for nearly two years has been proven ineffective. Unlimited price competition not only drags down platform GMV but also leaves high-quality merchants in a difficult position. Apart from delaying the clearance of low-quality capacity, this internal competition has limited benefits for the e-commerce industry.

As for blanket policies such as full refunds, although the intention was to enhance user experience, the abuse of such rules also disrupted normal business order, especially amid this year's macroeconomic constraints on consumer demand, making business even more challenging than in previous years.

The essence of price wars and strategy imitation lies in the lack of differentiated value, plunging the entire industry into a 'prisoner's dilemma.'

In September this year, an e-commerce practitioner shared their journey with NoNoise: initially spending RMB 60,000 per month on platform promotion, they then began offering full refunds, experienced a downturn, encountered the phenomenon of bad money driving out good, closed two of their three stores (one of which switched platforms), reduced staff by three, and lowered promotion costs to RMB 30,000 per month. 'If we keep this up, we'll just give up.'

Regarding how to escape internal competition and find differentiated value, offline retailers have actually taught e-commerce a lesson this year. Sam's Club, Costco, Pangdonglai, and Aldi have successively become pilgrimage destinations and traffic hotspots in the domestic retail industry, and for good reason.

▲Sam's Club has become a benchmark for the domestic retail industry in recent years

Any of these retailers offers differentiated value in terms of products or services. Even as the term 'middle class' frequently wins out in media headlines comparing misfortunes, almost becoming a spokesperson for the disappointed in the economic downturn, only retail peers know where Sam's Club's annual revenue of RMB 80 billion and 5 million paid members come from.

Stories of differentiation are much more 'advanced' than those of absolute low prices. The former focuses on industrial chain symbiosis, cost reduction through efficiency, and user demand insight, and this business model itself holds greater profit potential.

In the e-commerce industry, Taobao was the first to respond. Rather than competing on price, it has focused on service. Since introducing the store experience score in July, Taobao has also untied 'full refunds' and upgraded shipping insurance (i.e., Return Bao), using a series of measures such as organic traffic allocation and reduced after-sales costs to optimize the business environment and help merchants achieve more sustainable growth.

▲A social media tutorial helping sellers sue unscrupulous buyers who abuse the 'full refund' policy

Since then, the e-commerce industry has gradually emerged from the quagmire of ineffective internal competition and returned to the right track of focusing on good products, good prices, and good services. We have noticed that since August this year, senior executives of Pinduoduo have frequently mentioned 'healthy and sustainable platform ecosystems' and 'ecosystem construction' in their public speeches, with 'ecosystem' replacing 'growth' as a key term. JD.com is also emphasizing 'both affordable and high-quality.'

Against the backdrop of e-commerce platforms working together to improve the business environment, there is reason to believe that the benefits enjoyed by Shanmo Toy Store and Lechen Home are not isolated cases.

Regarding the concrete effects of returning to the right development track, compared to the 'tens of billions' of virtualized figures often thrown around by internet platforms, we prefer to find references from quantifiable data.

Taking Taobao as an example, according to official figures, after untying 'full refunds' and upgrading the abnormal behavior recognition model, Taobao intercepts over 400,000 unreasonable 'full refund' requests daily. Extrapolating this, over 12 million are intercepted per month. Assuming an average price of RMB 9.9 per request, platform merchants reduce losses by RMB 120 million per month.

There is another cost-reduction aspect to e-commerce after-sales disputes: applying for platform reconsideration to obtain a compensation plan. Taobao revealed before Double 11 that the platform has currently provided over RMB 300 million in compensation.

According to Taobao's calculations, 'Return Bao,' launched to reduce merchants' return costs, is expected to save merchants at least RMB 2 billion annually, with an average reduction of 20% in merchants' overall return costs. On the eve of Double 11, Return Bao's service fees were further reduced by over 40%.

These tangible savings are just Taobao's dynamic 'ledger.' When combined with the progress of other e-commerce platforms, the scale of burden reduction for merchants cannot be underestimated.

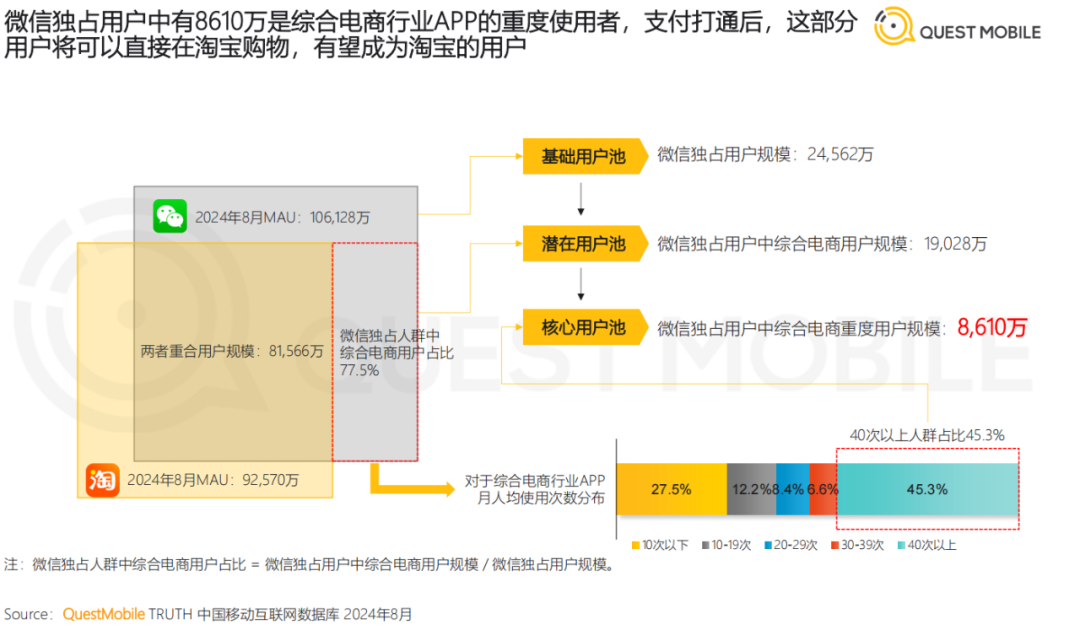

During the industry's return to the right development track, progress in interconnection has also brought new growth space to the industry. According to JP Morgan's calculations, the integration of Taobao and WeChat Pay is expected to increase Taobao's user base by over 20%. Similarly, actions such as JD Logistics accessing Taobao and Alipay accessing JD.com have also brought new increments to JD.com.

▲Quest Mobile predicts that payment integration is expected to bring 86.1 million WeChat users to Taobao

Deterministic growth can further resolve most of the unknown issues arising in the industry's development. The improvement in the business environment and the growth in user scale ultimately translate into tangible order growth for merchants. Merchants who regain profits follow a new path to further strengthen their advantages through quality services and products, stimulating and satisfying more consumer demand, which in turn nourishes the platform ecosystem.

We expect that the industry's willingness for healthy competition and development priority will continue after Double 11. Taobao has signaled that it will further optimize the business environment by increasing the coverage of return receipts, upgrading multiple after-sales tools, and closing the full refund evaluation entry. Other e-commerce platforms are also refining and adjusting rules to support merchants, and the business environment is expected to further improve.

Winston Churchill said, "I have no roadmap, but I know the direction." Merchants with long-term business aspirations may quickly follow the platform's trends, adjust their business focus, strive not to miss out on platform dividends in each wave of change, and patiently await the miracles in the ordinary.

The vastly different Double 11 in 2024 has concluded. We sincerely hope that as the leading force in the e-commerce ecosystem, the platform will place greater emphasis on balancing the experiences and rights of both merchants and consumers in the future, maintaining this emerging Nash equilibrium for a longer period.