The longest Double 11 in history has come to an end, with major e-commerce platforms delivering more optimistic results than expected

![]() 11/13 2024

11/13 2024

![]() 471

471

Blue Whale News, November 12 (Reporter Wu Jingjing) - The 2024 Double 11 shopping festival has concluded, marking the longest-ever event spanning 35 days, kicking off on October 14.

Since Alibaba and JD.com stopped disclosing total sales figures for Double 11 after 2021, we can only observe industry changes through third-party data. In October 2024, VO2 Asia Pacific, a digital economy consulting firm, projected that Double 11 sales would reach RMB 1.2 trillion, a 15% year-on-year increase.

The actual situation may be more optimistic than predicted, with live streaming e-commerce showing significant growth momentum. According to a report by Star Chart Data, from the start of promotional activities on various platforms to 23:59 on November 11, cumulative sales on integrated e-commerce and live streaming e-commerce platforms reached RMB 1.4418 trillion, up 26.6% year-on-year, the highest growth rate in four years, slightly lower than the 29% growth in 2020. It should be noted that due to the extended Double 11 promotional period this year, year-on-year growth rates can only be used as a reference compared to previous years.

Among them, integrated e-commerce platforms (excluding Tmall Light Lux) reported total sales of RMB 1.1093 trillion, up 20.1% year-on-year, outperforming last year; live streaming e-commerce sales reached RMB 332.5 billion, up 54.6% year-on-year, demonstrating a clear growth trend.

Farewell to price wars; cost-effectiveness, quality, and service become new focal points

Behind the data growth lies a shift in platforms' narrative. This year, platforms have shifted focus from low prices to creating a favorable business environment and enhancing consumer experience. JD.com's Double 11 theme is "cheap and good," while Tmall emphasizes quality and enhances merchant and user experiences through various initiatives.

Moreover, interconnectivity has become a key factor driving new user growth for platforms. With Tmall and JD.com integrating WeChat Pay and Alipay, respectively, user and capital flows are expected to bring new growth. Earlier, JP Morgan released a report stating that interconnectivity could potentially bring 20-30% incremental users to Tmall, totaling 200-300 million.

Both Tmall and JD.com announced their Double 11 data on November 12, highlighting the growth in total transaction value, user base, and brand sales:

Tmall data shows robust growth in total transaction value during Double 11 2024, with a record-high number of purchasing users. During the period, 589 brands achieved sales exceeding RMB 100 million, up 46.5% year-on-year, setting a new record.

JD.com reported a year-on-year increase of over 20% in the number of Double 11 shoppers, with procurement and sales live streaming orders surging 3.8 times.

Specifically, Tmall data revealed that 45 brands, including Apple, Haier, Midea, Xiaomi, Nike, and Wuliangye, surpassed RMB 1 billion in sales, while Mihoyo, Tom Ford, Collagen, CT, and WHC Fish Oil exceeded RMB 100 million for the first time. Additionally, Tmall's 88VIP membership base continues to expand, with the number of 88VIP members placing orders up over 50% year-on-year as of 00:00 on November 11. Over the past year, 88VIP membership has maintained double-digit growth, exceeding 42 million members as of June.

JD.com primarily shared growth data, highlighting impressive sales performance among small and medium-sized merchants. Over 17,000 brands saw sales increase by more than five times year-on-year, while over 30,000 small and medium-sized merchants witnessed more than double the sales growth.

Live streaming e-commerce shows strong growth momentum with emerging trends

Live shopping has become a part of many people's daily lives. In terms of data, both Taobao and JD.com's live streaming sales performed well. As of 24:00 on November 11, Taobao had 119 live streaming rooms with sales exceeding RMB 100 million, a record high, including 49 that grew by over 100% year-on-year. Additionally, Taobao's overall live streaming sales and number of buyers during Double 11 increased significantly year-on-year. JD.com data shows a 3.8-fold increase in procurement and sales live streaming orders year-on-year.

Kuaishou E-commerce achieved better results than last year, with notable GMV growth. Over 84,000 merchants in the general merchandise section surpassed last year's Double 11 peak GMV in a single day. General merchandise GMV increased by 110% year-on-year, while search GMV grew by 119%. During Double 11, the number of Kuaishou E-commerce products with sales exceeding RMB 100 million increased by 200% year-on-year, and GMV for products priced above RMB 1,000 grew by 110%.

A Kuaishou insider told Blue Whale News, "Compared to 618, this year's Double 11 performed better than internal expectations from the early stages."

Douyin E-commerce did not disclose GMV-related data but announced record-breaking brand sales. From October 8 to November 11, over 33,000 brands on Douyin doubled their sales year-on-year, nearly 17,000 brands saw sales growth exceeding 500%, and over 2,000 products surpassed RMB 10 million in sales. Additionally, during Double 11, 275 brands surpassed RMB 100 million in sales on Douyin, and 250,000 e-commerce creators witnessed sales growth exceeding 500%.

Visionary Technologies, a live streaming e-commerce service provider, told Blue Whale News that content and quality are the keywords for live streaming e-commerce this year. "Innovative IP content is crucial for live streaming success. High-quality and novel content can attract more traffic and ensure long-term development for IPs. Therefore, instead of emphasizing data-driven strategies, we focused on the theme of 'making every IP better' this year." Data shows that Visionary Technologies drove over 11.77 million orders through "content-driven sales" during Double 11.

Live streaming e-commerce is also witnessing diverse emerging trends. For instance, short dramas, variety shows, and other diversified content are integrated with live streaming to create a complete commercialization chain. Taking Visionary Technologies' case of Huang Youming's collaboration with Hansu on the custom short drama "A Bouquet of Moonlight Illuminates the Rose" as an example, within half a month, it drove an increase of 2.23 million A3 users and generated over RMB 512.5 million GMV for the customized gift box, exploring a diversified commercial model integrating short dramas and live streaming.

Categories: Home appliances and electronics dominate, with IPs and tech toys gaining traction

In addition to overall platform data, insights into new consumption trends can also be gained from merchant and category data on different platforms.

From a macro perspective, compared to previous years, there have been minor changes this year, with digital appliances, beauty products, apparel, and other categories still occupying a significant share.

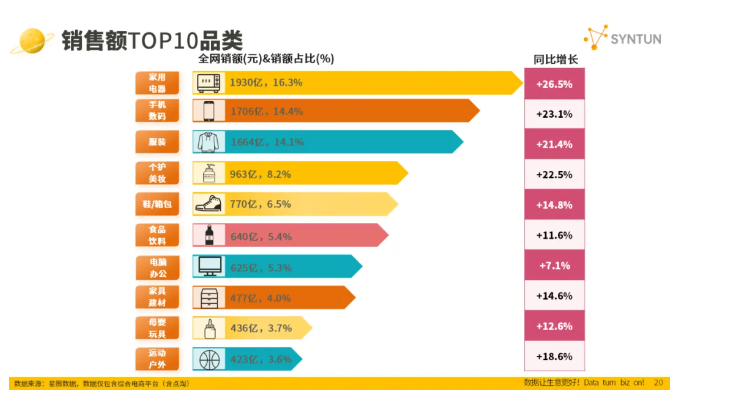

According to Star Chart Data, the top five sales categories during this year's Double 11 were home appliances, mobile phones and electronics, clothing, personal care and beauty, and footwear/luggage. Among them, home appliance sales amounted to RMB 193 billion, accounting for 16.3% of total sales and increasing by 26.5% year-on-year; mobile phone and electronics sales reached RMB 170.6 billion, accounting for 14.4% and growing by 23.1% year-on-year; and clothing sales totaled RMB 166.4 billion, accounting for 14.1% and increasing by 21.4% year-on-year.

Data Source: Star Chart Data

Due to the government's subsidy policy, which could be stacked with Double 11 discounts for the first time, offering a subsidy of up to 20%, many people chose to purchase "major home appliances" during Double 11.

JD.com data shows that sales of 519 home appliance and furniture categories, including energy-efficient air conditioners, robot vacuums, dryers, and zero-water-pressure smart toilets, increased by over 200% year-on-year. Over 90% of county and rural areas participated in the trade-in program, with large-screen TVs being the preferred choice for replacements. Additionally, sales of multiple AI hardware categories, including AI computers and AI smartphones, grew by over 100%.

On the Tmall platform, as of 00:00 on November 11, 139 brands, including Haier, Midea, Zume, and Dyson, surpassed RMB 100 million in sales; over 9,600 brands, such as Toshiba and Adore Home, doubled their sales. In the 3C and digital sector, 34 brands, including Apple, Xiaomi, Huawei, and OPPO, exceeded RMB 100 million in sales; over 1,100 brands, including vivo, iQOO, Mechanical Revolution, and Insta360, doubled their sales year-on-year.

Furthermore, some innovative products also performed well. On Tmall, many consumers were willing to pay for emotional value, making IP-derived merchandise a new popular billion-yuan track on Taobao. Mihoyo became the first flagship store to surpass RMB 100 million in sales, followed by Pop Mart, Papergames, and Jellycat. Over 70 brands, including BabyBus, Codename: Eagle, Coolbike, Bruco, and Jiyikawa, exceeded RMB 10 million in sales.

JD.com's sales report also mentioned that new technologies like AI are driving new consumption growth. On the JD.com platform, potentially benefiting from the large model, AI learning machine sales increased by over 10 times year-on-year. Sales of AI computers, AI smartphones, AI keyboards and mice, and AI speakers all grew by over 100% year-on-year, while AI smart glasses sales surged by 200%. Additionally, sales of tech trend products such as gaming CPUs, over-ear headphones, and action cameras increased by over 100% year-on-year.

From the overall market and category perspectives, platforms and policy incentives are further promoting consumption. Emerging trends and new brands continue to add vibrancy to the market and unlock new potential. After bidding farewell to last year's extreme price wars, major e-commerce platforms in China are embracing new possibilities.