Green Cloud Software's IPO Dream Shattered

![]() 11/14 2024

11/14 2024

![]() 590

590

1

Hangzhou Green Cloud Software Co., Ltd. (abbreviated as: Green Cloud Software) has temporarily shattered its IPO dream.

Recently, media reports revealed that according to the National Equities Exchange and Quotations (NEEQ), Green Cloud Software, which had undergone two rounds of inquiries, withdrew its listing application. As a result, Green Cloud Software's IPO journey, which spanned over a year, from dreaming of a direct listing on the main board to seeking a listing on the Beijing Stock Exchange through the NEEQ, has come to a temporary halt.

The official reason for the withdrawal has not been clearly disclosed, but an article cited sources close to Green Cloud Software stating that the withdrawal was due to issues related to the historical equity changes of its subsidiary, Green Cloud Technology. Based on the company's development needs, it was decided to adjust the company's equity structure and listing plans.

This so-called historical equity issue was indeed a key focus during the two inquiries. However, the cause and effect of this issue were quite dramatic, and it can be said that Green Cloud Software's Chairman Yang Mingkui was outsmarted by his own cleverness.

Before founding Green Cloud Software, Yang Mingkui had previously established another company called Hangzhou West Lake Software (abbreviated as: WestSoft). After selling his equity in WestSoft to Shiji Information, he still wanted to pursue a similar venture, leading to the establishment of Green Cloud Software.

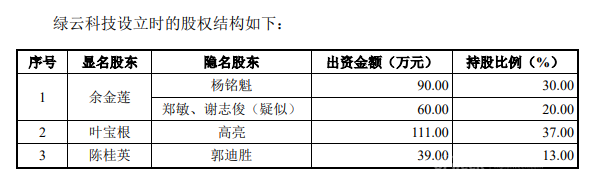

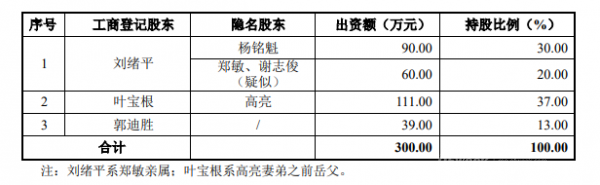

The predecessor of Green Cloud Software was Green Cloud Technology. This company was established in July 2010 with investments of 900,000 yuan, 1.11 million yuan, 390,000 yuan, 300,000 yuan, and 300,000 yuan from Yang Mingkui, Gao Liang, Guo Disheng, Zheng Min, and Xie Zhijun, respectively.

However, due to various reasons, these individuals could not serve as publicly acknowledged shareholders at the company's inception. For example, Yang Mingkui was unable to participate due to a non-compete agreement with Shiji Information. Similarly, Zheng Min and Xie Zhijun were employed by WestSoft, a subsidiary of Shiji Information. Therefore, these individuals each found relatives to hold shares on their behalf, allowing them to remain anonymous.

Perhaps fearing that the actual controllers would be discovered, these individuals engaged in some deceptive practices. From July 2010 to June 2014, Green Cloud Technology underwent three equity transfers and one capital increase.

Apart from Guo Disheng becoming a publicly acknowledged shareholder, the other four individuals continuously changed their nominee shareholders. For instance, Gao Liang's arrangement for nominees was quite intricate. His wife's brother's ex-father-in-law and his brother's mother-in-law both held shares on his behalf at different times.

Yang Mingkui's maneuvers were even more elaborate. Due to his non-compete agreement, any exposure could lead to litigation. Therefore, he did not even use his own relatives as nominees, instead relying on relatives of Xie Zhijun and Zheng Min.

In December 2012, Green Cloud Technology solely established a one-person company, Hangzhou Green Cloud Software Co., Ltd. (abbreviated as: Green Cloud Limited), with Guo Disheng serving as the legal representative.

At this time, Yang Mingkui obtained a new, partially unlocked non-compete agreement from Shiji Information, stipulating that within five years from April 22, 2011, he should comply with relevant commitments when directly or indirectly engaging in related businesses. This included not replacing Shiji's and its subsidiaries' products being used by hotel customers, not selling competing products to hotel groups and their hotels that had chosen Shiji's and its subsidiaries' products as group standards, and not hiring employees who had left WestSoft within one year. Otherwise, the defendant would be liable for the corresponding breach.

Therefore, on April 26, 2013, Yang Mingkui acquired all the equity of Green Cloud Limited for 1 million yuan and served as the legal representative. Since Shiji Information's customers were primarily mid-to-high-end star-rated hotels, Yang Mingkui also managed to circumvent the restrictions in the non-compete agreement in his business operations.

Specifically, Green Cloud Limited focused on developing the express hotel information system market, while Green Cloud Technology focused on the research, development, and sales of information management systems for mid-to-high-end star-rated hotels. Leveraging their "know your enemy and know yourself" advantage, Green Cloud Technology and Green Cloud Limited led by Yang Mingkui captured many customers from WestSoft.

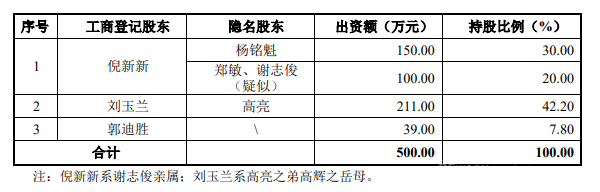

Finally, in August 2016, after the five-year non-compete period expired, the two Green Cloud companies underwent a reorganization. Green Cloud Technology became a wholly-owned subsidiary of Green Cloud Limited, and the original shareholders of Green Cloud Technology became shareholders of Green Cloud Limited. Yang Mingkui became the actual controller of both companies.

Subsequently, through various financing changes, Green Cloud Limited transformed into the current Green Cloud Software, attempting to launch an IPO.

2

While Yang Mingkui was showcasing his equity maneuvering and business acumen, Shiji Information also became aware of the situation and sued Yang Mingkui in court at the end of 2015.

As a result, in June 2015, during the fifth equity transfer of Green Cloud Technology, Zheng Min and Xie Zhijun withdrew from the Green Cloud group under anonymous status.

After withdrawing, Zheng Min and Xie Zhijun continued to engage in the sales or distribution of hotel information products for Shiji Information's WestSoft subsidiary.

This is quite interesting. Normally, Zheng Min and Xie Zhijun, who conspired with Yang Mingkui, should have set up a trap for their own company, Shiji Information. However, after the incident came to light, why were they not held accountable and able to return to their original company?

No explanation is currently available in public information. However, during Green Cloud Software's IPO process, these two individuals posed an obstacle for Yang Mingkui.

Relatives of Zheng Min and Xie Zhijun had previously held shares on behalf of Yang Mingkui. However, during the IPO, these relatives did not confirm the formation and termination of the nominee shareholding arrangements.

According to Green Cloud Software, Yang Mingkui repeatedly contacted Zheng Min and Xie Zhijun for assistance in interviews to confirm the historical nominee shareholding arrangements of Green Cloud Technology. However, due to personal reasons, Zheng Min and Xie Zhijun were unwilling to cooperate.

In other words, the equity contributions of the original shareholders of Green Cloud Technology may involve unrecognized principal shareholdings. Furthermore, there is a risk of future litigation against Yang Mingkui. Although Green Cloud Software explained in its prospectus that it has sufficient evidence and that the nominees have not yet filed any lawsuits or objections, this remains a potential risk that could explode at any time.

It is unclear whether Shiji Information was involved behind this risk. Even if they were, it was Yang Mingkui who initiated the scheme to backstab Shiji Information. Therefore, it is not entirely wrong for Shiji Information to retaliate by resolving issues with Yang Mingkui's former partners.

This can only be attributed to the karma sown by Yang Mingkui himself.

3

Even without this dramatic saga, it would not have been easy for Green Cloud Software to successfully complete its IPO.

Another key point of concern in the inquiry letter was whether Green Cloud Software has a dependency on Oracle as a single supplier and the stability of their cooperation.

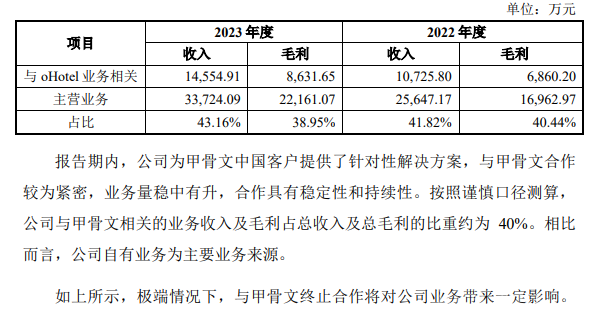

It is well-known that the confidence behind Green Cloud Software's IPO stems from its replacement of Shiji Information as the new agent for Oracle's domestic largest international high-star hotel PMS opera. In 2007, Shiji Information successfully listed on the Shenzhen Stock Exchange by virtue of its exclusive agency for this product.

Although Green Cloud Software stated in its response letter that its own business was the main source of revenue in terms of overall revenue proportion. From specific data, its revenue and gross profit related to Oracle account for approximately 40% of its total revenue and gross profit. Among these, there is also a 0.01 yuan bidding project involving Green Cloud Software and Oracle to suppress Shiji Information.

Historically, when Oracle terminated its contract with Shiji Information in 2020, the Oracle agency business contributed nearly a quarter of Shiji Information's profits, causing significant fluctuations in its stock price. Currently, Green Cloud Software's dependence on Oracle is much greater than that of Shiji Information at that time.

Green Cloud Software's withdrawal of its listing application this time may trigger a series of consequences, such as gambling agreements.

Green Cloud Software had already painted a grand picture for investors and revised a gambling agreement for this NEEQ IPO. At the end of last year, realizing the futility of an A-share listing, Green Cloud Software abolished the original gambling agreement. It also had investors and other special shareholders, excluding Green Cloud Software, sign a "Termination Agreement Regarding Special Rights Clauses for Shareholders of Hangzhou Green Cloud Software Co., Ltd."

According to the agreement, if Green Cloud Software fails to submit an application for an initial public offering and listing on a domestic stock exchange by June 30, 2025, or if Green Cloud Software withdraws its listing application from the exchange or the China Securities Regulatory Commission (CSRC), or if the exchange or CSRC does not approve or register the listing application, shareholders under the agreement may choose to transfer their shares in Green Cloud Software to other investors or require relevant special rights and obligations holders to repurchase these shares at the repurchase price stipulated in the original investment agreement.

The shift to the NEEQ was also a preparation for a listing on the Beijing Stock Exchange or the Hong Kong Stock Exchange by June 30, 2025.

However, currently, it is unrealistic to submit an IPO application to either the Beijing Stock Exchange or the Hong Kong Stock Exchange by June 30, 2025. Perhaps, as stated in the response letter, the senior management team of Green Cloud Software will have to sell properties and land to repay debts. Alternatively, Yang Mingkui may once again rely on his eloquent speech to update the gambling agreement. However, it remains to be seen whether investors will still recognize this time.

With Green Cloud Software's IPO in disarray, Shiji Information is likely to be the most pleased. As for Yang Mingkui, who "outsmarted himself with excessive cunning, only to ruin his own future," this retreat may have unknowingly trapped many hidden individuals who dreamed of making a fortune from this venture.

Images sourced from Shutterstock and web screenshots