China Mobile becomes the de facto controller of Venustech, with related transactions increasing by 80% but performance declining

![]() 11/14 2024

11/14 2024

![]() 499

499

Produced by | Entrepreneurship Frontline

Art Director | Xing Jing

Editor | Song Wen

After China Mobile became the de facto controller of Venustech Information Technology Group Co., Ltd. (hereinafter referred to as "Venustech") through private placement, Venustech's performance declined.

On October 30, Venustech disclosed its third-quarter report for 2024, showing that the company achieved operating revenue of RMB 2.326 billion in the first three quarters, a year-on-year decrease of 8.19%; net profit attributable to shareholders of the parent company was -RMB 210 million, a year-on-year decrease of 187.03%.

It is noteworthy that Wang Jia and Yan Li, the founders of Venustech, have been busy reducing their shareholdings and cashing out more than RMB 1 billion after the lock-up period for their initial public offering shares expired. This year, Wang Jia and Yan Li officially transferred their status as de facto controllers to China Mobile through additional share issuances.

Whether China Mobile's takeover will bring new directions and changes to Venustech remains to be seen over time.

1. The former de facto controller reduces shareholdings after listing, cashing out more than RMB 1 billion in total

In June 2010, Venustech officially listed on the Shenzhen Stock Exchange's main board and was hailed as the first domestic cybersec stock.

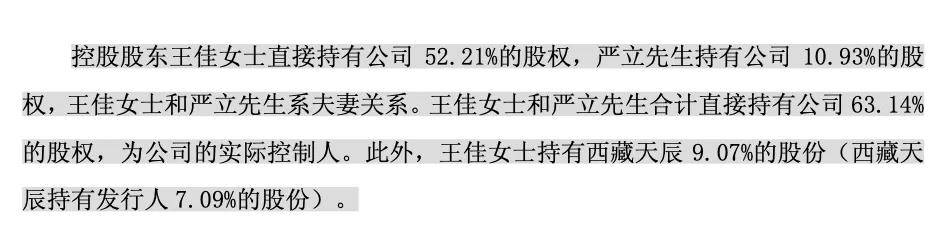

According to Venustech's listing announcement, the company's de facto controllers were Wang Jia and Yan Li, who held 52.21% and 10.93% of Venustech's shares, respectively, totaling 63.14%.

Additionally, Wang Jia indirectly held shares in Venustech through Tibet Tianchen.

(Image / Venustech's "Prospectus for Initial Public Offering")

The announcement showed that after the IPO on the Shenzhen Stock Exchange's main board, Wang Jia and Yan Li's shareholding percentages were diluted to 38.99% and 8.16%, respectively, totaling 47.15%.

(Image / Venustech's "Prospectus for Initial Public Offering")

"ECNS Entrepreneurship Frontline" noticed that after the 36-month lock-up period ended for Wang Jia and Yan Li, they couldn't wait to start reducing their shareholdings.

On August 20, 2013, Venustech announced that Wang Jia and Yan Li jointly reduced their shareholdings by 3.3 million shares, accounting for 1.59% of the total shares. Based on the average reduction price, it is estimated that the couple cashed out RMB 86.377 million in total.

(Image / Venustech Announcement)

From August 2013 to May 26, 2021, Wang Jia and Yan Li never stopped reducing their shareholdings, with the company issuing nine announcements regarding their shareholding reductions.

"ECNS Entrepreneurship Frontline" estimates that, except for the reduction in shareholdings from May 6, 2020, to May 26, 2021, for which no price was disclosed, from the IPO to May 26, 2021, Wang Jia and Yan Li cashed out approximately RMB 1.242 billion in total through share reductions.

Judging from the fact of share reductions, is Venustech merely a cash cow for Wang Jia and Yan Li? It may be difficult to know the answer to this question. However, generally speaking, frequent share reductions by de facto controllers are interpreted by the market as a negative signal regarding the company's future prospects, which may weaken investor confidence and trigger a series of adverse effects such as stock price declines.

In response, Venustech told "ECNS Entrepreneurship Frontline" that Wang Jia and Yan Li had no other sources of income besides Venustech and reduced their shareholdings due to personal financial needs. In 2022, China Mobile and Venustech signed a cooperation agreement with clear restrictions on the share reductions by Wang Jia and Yan Li, which they will strictly adhere to.

Moreover, the regulatory authorities have also issued many policies targeting frequent share reductions by de facto controllers.

On May 24, 2024, the China Securities Regulatory Commission issued the "Interim Measures for the Administration of Share Reductions by Shareholders of Listed Companies" and related supporting rules. These rules clearly stipulate restrictions on major shareholders' (shareholders holding more than 5% of a listed company's shares or the de facto controllers) share reductions, including the method, quantity, and timing of reductions.

It can be seen that the regulatory authorities are also strengthening control over share reductions for cash extraction.

2. China Mobile becomes the de facto controller, and the stock price continues to decline

Wang Jia and Yan Li not only continuously reduced their shareholdings in Venustech but also gave up their status as the company's de facto controllers.

On June 17, 2022, Venustech released the "2022 Non-public Issuance of A-share Stock Plan," agreeing that China Mobile Capital, as a specific object, would subscribe for the company's non-publicly issued shares in cash.

It is reported that China Mobile Capital is a wholly-owned subsidiary of China Mobile. After the subscription is completed, the de facto controller of Venustech will change from Wang Jia and Yan Li to China Mobile.

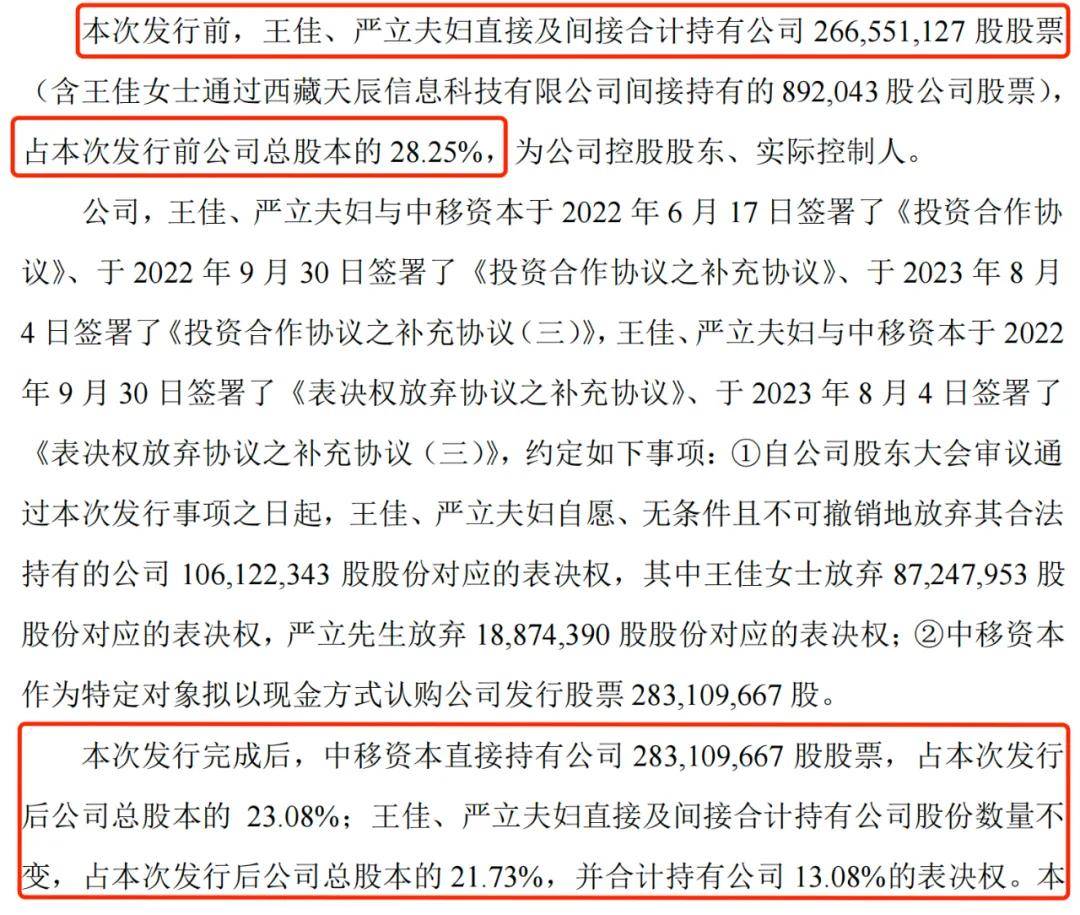

On January 5, 2024, Venustech issued new shares to specific objects, and China Mobile officially became the de facto controller of Venustech.

The announcement showed that after this issuance, China Mobile Capital held 23.08% of Venustech's total share capital. Wang Jia and Yan Li's shareholding percentages decreased from 28.25% before the issuance to 21.73% after the issuance, and they jointly held 13.08% of the company's voting rights.

(Image / Venustech Announcement)

On May 6, 2024, Venustech held its 2023 annual general meeting of shareholders, and the company's chairman and legal representative changed from Wang Jia to Wei Bing.

In his early years, Wei Bing worked on network technology research and development at China Mobile Research Institute and successively held positions such as deputy director of the Network Technology Research Office and director of the Network Institute. In 2010, Wei Bing was promoted to deputy general manager of the China Mobile Group Technology Department; in 2014, he was transferred to the position of deputy general manager of China Mobile's Government and Enterprise Customer Branch (now the Government and Enterprise Customer Business Department).

Venustech is very confident in the company's development after China Mobile's entry. Relevant personnel from Venustech told "ECNS Entrepreneurship Frontline" that after cooperating with China Mobile, Venustech will complement the cybersecurity segment of China Mobile's business system, providing a strong security foundation for China Mobile's transformation into a new type of technology company. This will also become Venustech's "second growth curve," helping to break through its existing performance scale.

However, investors do not seem to be buying into the change in control to China Mobile and Wei Bing taking over as chairman.

It is reported that China Mobile subscribed to Venustech shares at a price of RMB 14.35 per share. On January 5, 2024, when China Mobile officially took control, the company's closing price was RMB 24.76 per share.

However, Venustech's stock price has since slid continuously. On September 18, Venustech's intraday low reached RMB 12.19, a new low since December 5, 2014, and even lower than China Mobile's subscription price.

As of November 13, Venustech's closing price was RMB 19.71 per share, which, although increased, was still lower than the price when China Mobile officially took control. From the beginning of this year to date, the company's stock price has declined by more than 25%.

Many investors are also concerned about Venustech's stock price. Some investors have expressed concerns that since 2024, the company's stock price has been on a downward trend, almost hitting a ten-year low, performing worse than some ST stocks. Therefore, they inquired whether there are any unknown issues and risks in the company's operations that small and medium investors are unaware of and whether the company has considered repurchasing shares to boost investor confidence.

(Image / Venustech Investor Q&A (Source: Wind))

In response, Venustech did not provide a direct answer but stated that the company would delve deeper into market value management methods and increase investment in research and development to enhance its core competitiveness.

3. Large losses in the first three quarters, with negative cash flow for consecutive years

Venustech's main business covers the provision of cybersecurity products, trusted security management platforms, professional security services, and solutions.

It is noteworthy that in the first quarterly report after Wei Bing took office, Venustech did not present impressive performance.

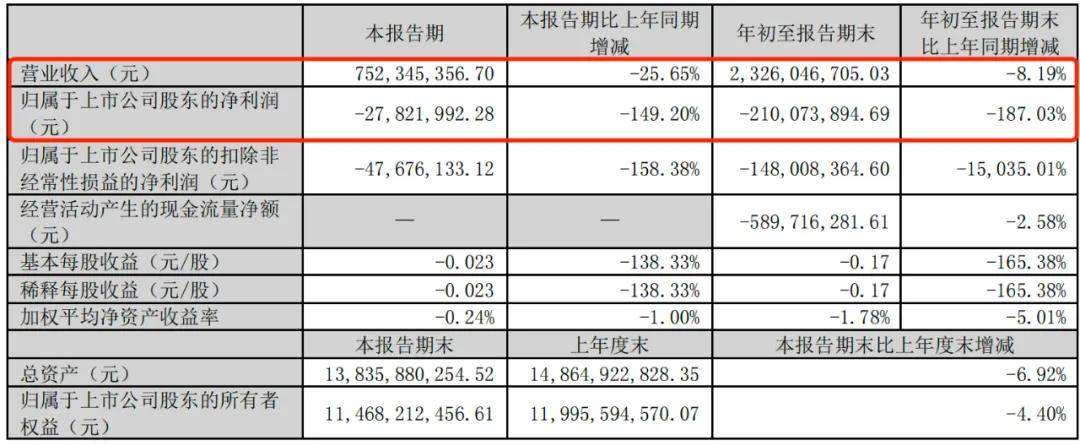

In the first three quarters of 2024, Venustech achieved operating revenue of RMB 2.326 billion, a year-on-year decrease of 8.19%. In its third-quarter report, the company attributed the decline in revenue to pressure on the growth of the cybersecurity industry and reduced or delayed customer budgets.

During the same period, Venustech's net profit attributable to shareholders of the parent company was -RMB 210 million, a year-on-year decrease of 187.03%, mainly affected by non-recurring profit and loss items.

(Image / Venustech's 2024 Third-quarter Report)

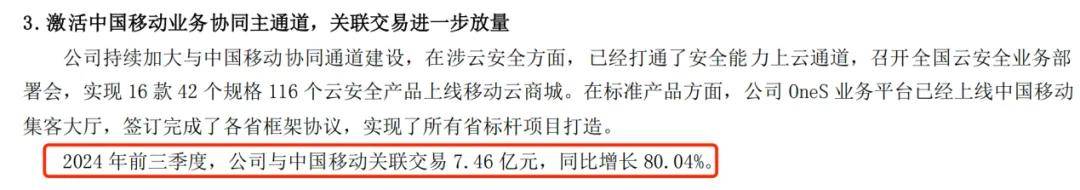

Despite the decline in revenue, in the first three quarters of 2024, Venustech's related transactions with China Mobile amounted to RMB 746 million, an increase of 80.04% year-on-year.

(Image / Venustech's 2024 Third-quarter Report)

It is worth mentioning that in September 2022, China Mobile and Venustech signed a strategic cooperation agreement. In terms of jointly expanding the security business market, both parties will enter each other's shortlists for cooperation and give priority to cooperating under market principles.

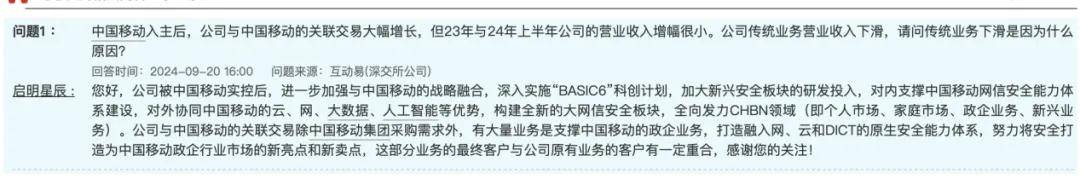

Despite the significant increase in related transactions with China Mobile, Venustech's performance did not improve, and the company's traditional business may have been hindered to some extent. This has also attracted investors' attention.

(Image / Venustech Investor Q&A (Source: Wind))

"ECNS Entrepreneurship Frontline" also noticed that after signing the strategic cooperation agreement with China Mobile, Venustech's gross profit margin on sales declined.

From 2022 to the first three quarters of 2024, Venustech's gross profit margins on sales were 62.66%, 57.76%, and 54.78%, respectively, showing a declining trend.

(Image / Wind)

Moreover, since 2022, Venustech's cash flow has been consistently negative. In 2022 and 2023, the net cash flow generated from the company's operating activities was -RMB 11.0461 million and -RMB 393 million, respectively.

In the first three quarters of 2024, Venustech's cash flow further "bled" to -RMB 590 million.

(Image / Wind (Unit: 10,000 yuan))

It can be seen that after China Mobile became the de facto controller of Venustech, Wei Bing still faces many challenges.

However, the deep integration with China Mobile also brings new vitality to Venustech from another perspective.

It is reported that Venustech will focus on developing AI+security and other fields as part of China Mobile's "BASIC6" scientific and technological innovation plan. Wei Bing has also publicly stated that Venustech will continue to deeply explore AI applications in security scenarios.

It is noteworthy that although Venustech is leaning on China Mobile, the company still needs to expand into other areas.

Recently, in response to the security needs of HarmonyOS applications, Venustech launched a HarmonyOS application security reinforcement system, providing comprehensive and multi-layered reinforcement protection for HarmonyOS applications. Therefore, the future cooperation between Venustech and Huawei is also worth looking forward to.

Additionally, Venustech told "ECNS Entrepreneurship Frontline" that the company adopts a "general manager responsibility system" for its daily operations, and Wang Jia continues to serve as the company's general manager.

It can be seen that although Wang Jia has stepped down as chairman, he will still significantly impact Venustech's operations. As for the changes Wei Bing will bring to Venustech as chairman and whether the company's performance in 2024 as a whole can be turned around, "ECNS Entrepreneurship Frontline" will continue to pay close attention.

*Note: The lead image in the article is from Shotstock and based on the VRF agreement.