Is the AI capital expenditure of US tech giants approaching a 'danger zone'?

![]() 11/18 2024

11/18 2024

![]() 588

588

At this moment, NVIDIA is the world's largest company by market capitalization (approximately $3.48 trillion), and generative AI is the core driving force behind the US market rally. The AI-driven bull market has lasted for about two years, creating wealth exceeding $10 trillion (or a bubble, depending on your perspective) and successfully defeating all bearish investors. However, there is no stock market that only rises and never falls; a bull market as hot as this one will eventually take a break, and the only uncertainty is when. Emphasize that taking a break does not necessarily mean a bear market; it could also mean a sideways adjustment or a short- to medium-term, manageable decline.

There is no doubt that generative AI will change the future of humanity. As a user who has been paying for GPT continuously for half a year (Note: Please pay me advertisement fees after reading this, Sam Altman), I can't do my daily work without AI now, and I believe that at least millions of people worldwide share my sentiment. Our parents' generation may be the last one to work without relying on AI, just as our grandparents' generation was the last to work without relying on computers and the internet. However, these are long-term grand narratives. Investors are increasingly anxious about one issue: For US tech giants, the incremental revenue generated by AI is far from keeping pace with the incremental capital expenditure, a trend that is likely to continue for at least a few more years. They burn a large amount of cash on data center construction every quarter, much of which ends up in the pockets of NVIDIA and TSMC. This is certainly good news for NVIDIA and TSMC but not for the US tech industry as a whole.

Just how terrifying is this cash-burning race? A glance at the financial statements reveals all. In the third quarter of the 2024 calendar year, the capital expenditure figures for the four major US tech giants are as follows:

Microsoft: $20 billion.

Google: $13.1 billion.

Amazon: $21.4 billion.

Meta: $9.2 billion.

It should be noted that Meta's figure is significantly lower because a large number of server orders were delayed until the fourth quarter for delivery, so the capital expenditure for the fourth quarter will suddenly increase to $15-17 billion. Averaging the two quarters, it can be concluded that Meta's quarterly capital expenditure should actually exceed $12 billion, not far behind Google's.

We also need to clarify the concept of 'capital expenditure,' which mainly consists of three components: First, expenditures on fixed assets such as land, property, and equipment (typically the largest component); second, mergers and acquisitions or strategic investments for business purposes; and third, financial leasing, which is easily overlooked because it does not directly appear in the current financial statements. US tech giants typically disclose the 'capital expenditure including financial leasing' figure in their quarterly reports and disclose details in their annual reports.

A company's operating cash flow minus its capital expenditure is called free cash flow, which is the cash a company can freely dispose of. In theory, the fundamental goal of a company's operations is to generate free cash flow – 'profit' is merely an accounting perspective, while cash is real and reliable. The stronger a company's free cash flow, the stronger its risk resistance, and the more cash rewards shareholders can receive. In fact, the long-term Nasdaq bull market over the past years (with only brief interruptions) has been largely supported by dividend payments and share repurchases by listed companies. Taking the previous quarter as an example, Google returned a total of $17.8 billion in cash to shareholders, and Meta returned $10.1 billion, both close to 1% of the company's total market capitalization.

As a mature capital market, the US stock market attaches great importance to dividends and buybacks, and any reduction in dividends or buybacks is seen as an extremely ominous sign. A recent typical example is Intel, which announced the suspension of cash dividends after its second-quarter results fell short of expectations, suffering a significant hit to its market value. The same applies to Chinese stocks listed in the US; although Pinduoduo's performance is very impressive, its valuation has remained low due to the lack of a dividend and buyback plan. Other popular Chinese stocks often see an immediate valuation repair once they announce dividend and buyback plans that exceed market expectations.

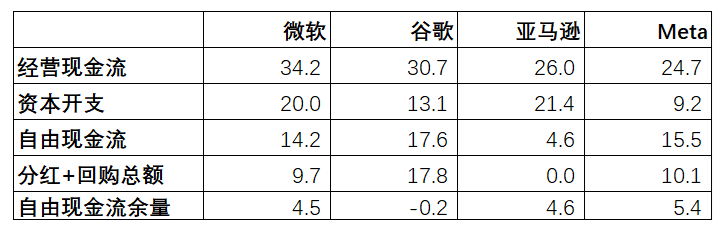

Therefore, we can set a 'danger zone' for the capital expenditure of US tech giants: When the scale of capital expenditure expands to the point where it may squeeze the scale of dividends and buybacks, the patience of US stock investors may reach a critical point, putting a temporary end to the 'AI-driven bull market.' Disturbingly, based on the latest quarterly data, this 'danger zone' does not seem too far away. Please refer to the table below.

Data for the third quarter of the 2024 calendar year (unit: billions of dollars)

Please note that quarterly dividend and buyback data may not be representative. For example, Google's total dividends and buybacks were particularly high in the previous quarter mainly due to aggressive buyback plans; Amazon has not conducted any buybacks in the past two years, but it did so in 2022, and it is not ruled out that it will do so again in 2025. On average over the past two years, it has been relatively normal for US tech giants to return around $10 billion in cash to shareholders per quarter. For companies like Microsoft and Google, with market capitalizations of $2-3 trillion, returning an average of $10 billion in cash to shareholders each quarter translates to an annualized cash return rate (total dividends and buybacks divided by total market capitalization) of 1.3-2.0%, which most shareholders should find satisfactory; if significantly lower, it may lead to shareholder dissatisfaction.

As a side note, Apple is not included in the table above because a significant portion of its capital expenditure is conducted through suppliers and is not included in its own financial statements, making it less comparable. In fact, Apple's free cash flow is quite strong, and it returned $29 billion in cash to shareholders in the previous quarter, a record high for the entire US stock market.

The question now is: If AI-driven capital expenditure continues to expand, US tech giants may encounter insufficient free cash flow and have to reduce the total amount of dividends and buybacks as early as 2025. For example, Microsoft and Meta have both clearly stated that their capital expenditure for the next fiscal year will increase significantly from the current level; Amazon has indicated that it is 'highly likely' to spend more on capital expenditure next year. As for the specific amount, some companies (such as Microsoft) do not provide specific guidance, while others (such as Meta) will provide guidance only when disclosing their fourth-quarter results. However, Wall Street is already concerned, and some analysts have predicted that the capital expenditure of Microsoft and Amazon may exceed the $100 billion mark in the next fiscal year!

(Note: The fiscal years of US companies do not necessarily end at the end of the calendar year; for example, Microsoft's fiscal year ends on June 30, so direct comparisons may not be accurate. A more scientific approach is to compare calendar year data, but companies' earnings guidance is generally based on fiscal years rather than calendar years, causing some inconvenience for comparative research. However, detailed consideration is not necessary for rough comparisons.)

Let's assume that in a quarter of the 2025 calendar year, Microsoft's capital expenditure rises to $25 billion, and Meta's rises to $15 billion (which is very possible); simultaneously, assume that their operating cash flow grows by around 10% year-on-year (which is relatively optimistic). In this scenario, their free cash flow will be compressed to around $12 billion, significantly lower than the current level. They will still be able to conduct dividends and buybacks of around $10 billion per quarter, although their 'margin of safety' will have shrunk considerably. But what if the AI arms race worsens further? For example, what if Microsoft has to spend $30 billion on capital expenditure in a quarter, and Meta has to spend $20 billion?

Don't think the above assumptions are too extreme. Considering the uncertainty in fixed asset procurement, significant fluctuations in a single quarter are quite possible – remember, due to delays in AI server delivery, Meta's capital expenditure will surge from $9.2 billion in the third quarter of this year to $15-17 billion in the fourth quarter! Fairly speaking, we also need to consider TSMC's capacity constraints; if capacity lags too much, some giants may not be able to spend even if they want to. However, whenever possible, giants will certainly prefer to buy 3,001 high-performance AI servers rather than 2,999.

If you pay attention to the earnings calls of US tech giants, you will find that analysts constantly raise questions about capital expenditure, complaining about the lack of 'visibility' provided by management. But how could management know how much will be spent on AI servers a year from now? Even Huang Renxian, the CEO of NVIDIA, probably doesn't know what he will sell to the market and at what price next year at this time. Just three years ago, the capital market considered quarterly capital expenditure of $10 billion to be high for a Silicon Valley tech giant; now, $20 billion is considered acceptable. Is it hard to understand if it evolves to $30 billion or even higher in the future?

According to traditional value investment theory, this means that US tech giants have transformed from 'cash cows' into 'capital addicts' – the former have ample cash to distribute, while the latter are in a constant state of cash strain. Previously, only Amazon fit the definition of a 'capital addict,' and even then, it was not strictly 'cash-strapped'; its cash flow was just highly unstable each quarter. Light-asset and heavy-asset companies cannot use the same valuation system, so how should tech giants with significantly heavier assets be valued? In short, it will not be good news.

Let me emphasize again: Generative AI represents the future of humanity, and anyone who questions this is foolish. When the current US tech stock bull market ends, a large number of 'Monday morning quarterbacks' will surely emerge, gleefully declaring that 'AI has been disproven.' When the first Nasdaq bubble burst in 2000, a large group of people also came out gleefully declaring that 'the internet has been disproven' – yet you are reading this article via the internet today, clearly indicating that the internet has not been disproven. From the very first day of ChatGPT's birth, I fully believed that it would determine the fate of the entire world; it just needs more time, and the current market is moving a bit too fast. In the short term, the market is a voting machine; in the long term, it is a weighing machine. Regardless of what happens next, the market's long-term prediction is correct, and those who ridicule generative AI during market adjustments will ultimately not even qualify to be ridiculed (because no one ridicules those who have been eliminated).