JD.com Q3 Report: Dispelling the Myth of 'No Growth in E-commerce'

![]() 11/18 2024

11/18 2024

![]() 502

502

Text & Image | Tangjie

The entire capital market has been using the standard of 'consumption downgrading' to measure all platform companies since the third quarter of 2022; low-price competition has also, to some extent, become the only impression of society on e-commerce platforms. Whether it is reasonable or not varies from person to person, but under this single standard, all platforms will inevitably be labeled as 'non-growing'. It's not surprising that Charlie Munger criticized Chinese e-commerce platforms as 'unrewarding' before his death.

JD.com, which led off this earnings season, dispelled the myth of 'no growth in e-commerce' with a resounding improvement. In the third quarter, when the entire industry was relatively stable, the company's revenue, adjusted net profit, and other key indicators exceeded market expectations and the overall retail sales; during the entire 11.11 period, the company also achieved significant progress on both the merchant and consumer sides, with initial success in its offensive on weak categories like apparel, announcing the return of the combative JD.com.

Currently, JD.com's Non-GAAP P/E ratio (TTM) is less than 8 times, reflecting significant valuation bias; however, during the earnings call, the company still confidently announced its belief in achieving double-digit growth in gross profit for the entire year and reiterated its commitment to high-level share repurchases. This shows that they are responding to market doubts with vitality rather than stagnation.

The latest news reveals that Michael Burry, the fund manager known for shorting during the 2008 US subprime mortgage crisis and for his role in the film 'The Big Short,' doubled his holding in JD.com in the third quarter of this year through his hedge fund Scion, increasing his holding of JD.com ADRs from 250,000 to 500,000 shares.

The layout of these 'smart money' overseas indicates that the current biased underestimation is unsustainable. Overseas single-digit PE ratios, strong repurchase intentions, and growth in performance will create a huge margin of safety, making JD.com the most noteworthy e-commerce company today.

01 Competitive Barriers Created by Three Major Drivers

With '618' before and '11.11' after, the just-concluded third quarter, under the siphon effect of these two shopping festivals, would generally be difficult to deliver above-expectations performance, but JD.com managed to do so.

During the reporting period, JD.com achieved revenue of 260.4 billion yuan, a year-on-year increase of 5.1%; adjusted net profit of 13.2 billion yuan, a year-on-year increase of 24%; and core business revenue of JD Retail of 225 billion yuan, a year-on-year increase of 6.1%. Compared with market expectations, these three key indicators all significantly exceeded them. During the earnings call, JD.com executives explained the company's growth drivers as follows:

First, JD.com's scale and efficiency advantages in the supply chain; second, there is still room for growth in many categories; third, the company's commitment to investing in user experience to build consumer perception. These three factors complement each other, collectively constituting the driving forces behind JD.com's high growth in the first three quarters of this year and giving the company a leading position in the competition among platforms.

As one of the most well-known e-commerce enterprises in China, JD.com encompasses both a direct sales model (1P) and a platform model (3P) that supports third-party merchants to open stores. From the consumer perspective, which is most easily perceived, JD.com's biggest comparative advantage has always been its investment in self-owned logistics infrastructure, giving JD.com a nearly unassailable lead in timeliness and overall service quality.

However, both delivery timeliness and door-to-door delivery commitments are only part of the entire consumer shopping experience related to 'after-sales.' If consumers don't buy your products, these advantages are meaningless; this has also led many people to have a stereotype of JD.com, believing that in the era of 'value-for-money' consumption, their pricing power is weak.

In reality, whether compared to itself or its peers, JD.com's pricing power advantage has actually increased this year.

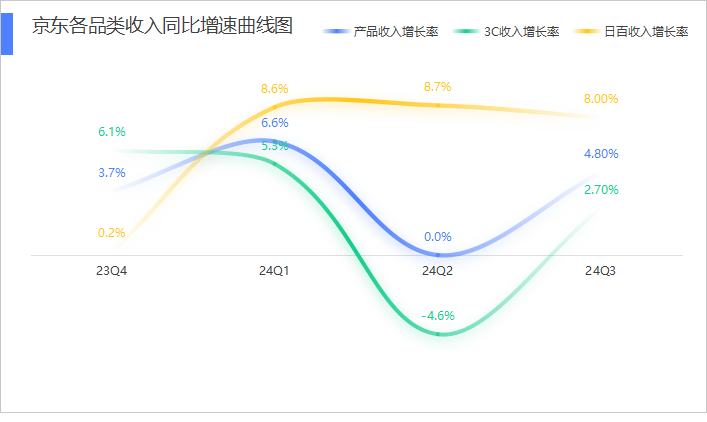

Source: JD.com Financial Report, Tangping Index Compilation

Breaking down JD.com's revenue, its main source is merchandise sales revenue, which reached 225 billion yuan in the third quarter of this year, a year-on-year increase of over 6%, accounting for 86% of total revenue; of this, the two largest components are 3C products, with revenue of 122.6 billion yuan, a year-on-year increase of 2.7%, exceeding market expectations, and daily necessities, with revenue of 82.1 billion yuan, reversing the negative growth trend of the previous three quarters and achieving year-on-year growth of over 8% for three consecutive quarters this year.

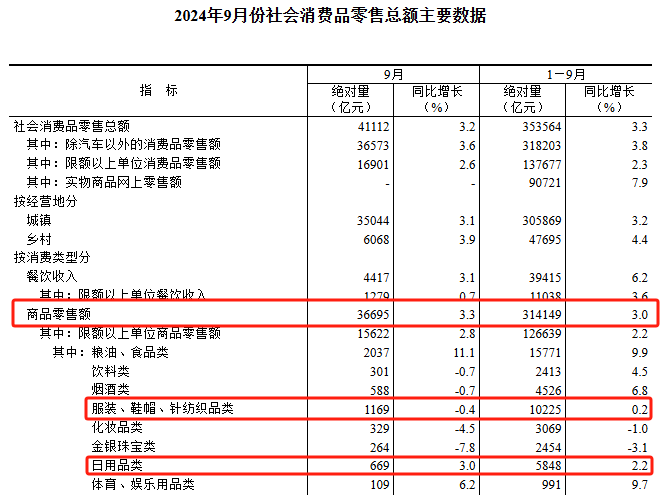

Source: National Bureau of Statistics, Tangping Index Compilation

According to the National Bureau of Statistics, from January to September this year, the year-on-year growth rate of total retail sales of consumer goods was only 3%, lower than JD.com's revenue growth rate of 4.3% over the same period; for high-frequency consumer goods related to daily necessities, the growth rate was only in the low single digits; among physical online retail sales over the same period, the sales growth rate of 'use' commodities was 7.2%. No matter how it is compared, JD.com's 8.4% year-on-year revenue growth rate for daily necessities over the same period is leading.

As everyone knows, for high-value goods like mobile phones and home appliances, no platform merchant can casually choose any courier company for shipment; especially for mainstream branded phones, SF Express is the starting point, and there is not much perceived difference in service quality among them. But for relatively low-value daily necessities, when the price is the same or there is only a single-digit price difference, JD.com can deliver to the door the next day or even the same day, with complete and clean product packaging.

Consumers are not foolish either, especially in second- and third-tier cities, where the main channel for receiving daily necessities deliveries has become self-pickup at courier stations. Faced with almost identical or even cheaper prices, the convenience of service becomes an important basis for choice. As a result, in the cluster of 'white-label' goods for daily necessities, JD.com has achieved continuous high growth surpassing the overall online shopping market and successfully established a user perception of 'low price and high quality' by providing superior service at the same or lower prices.

It can be seen that, faced with competition from other platforms, under the combined effect of JD.com's strong supply chain capabilities, a multi-category layout strategy, and a firm commitment to investing in the consumer experience, the company has successfully established its competitive advantage in daily necessities, a category with relatively higher frequency, lower average order value, and consumers who are more price-conscious. This quality consumption based on pricing power is the source of their growth.

The rumor that competition in the e-commerce industry is solidifying and there is no room for growth in the future is already unfounded when viewed from JD.com's perspective.

02 Using 'Trust' to Break Through the Ceiling

With growth potential established, can the company's profit margins be further improved? Faced with similar doubts, JD.com's response is:

Yes, they can.

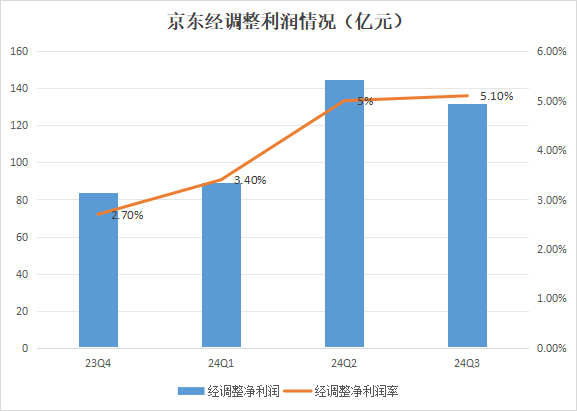

Source: JD.com Financial Report, Tangping Index Compilation

Over the past four quarters, JD.com's adjusted net profits were 8.4 billion yuan, 8.9 billion yuan, 14.5 billion yuan, and 13.2 billion yuan, respectively, with adjusted net profit margins of 2.7%, 3.4%, 5%, and 5.1%, showing a gradually increasing trend; at the gross margin level, the past four quarters were 14.2%, 15%, 15.1%, and 17.3%, respectively, and according to the company's earnings call, there has been year-on-year growth for ten consecutive quarters.

The problem is that this state seems somewhat counterintuitive: in most cases, growth comes through 'concessions,' whether through direct subsidies to consumers or indirect support for merchants through marketing expenses, and growth poses a significant threat to a company's ability to maintain profitability. JD.com has found the best way to address this threat - by breaking through its own growth 'ceiling.'

The threat of growth can only be addressed through even higher growth. Consolidating advantages in 1P categories such as traditional 3C and daily necessities, coupled with growth in 3P businesses with more high-margin categories, can lead to increased profitability for JD.com. The key to breaking through its own ceiling is the establishment of 'trust.'

Trust comes from both consumers and merchants, and the best proof of this is JD.com Merchandising's impressive performance in the past two 11.11 shopping festivals. Last year's 11.11 shopping festival saw JD.com Merchandising 'take on' Li Jiaqi and suddenly surge to trending topics, becoming one of the few bright spots in the entire industry; this year, despite a high base from last year, JD.com Merchandising's live streaming orders still increased by 3.8 times year-on-year, with multiple traditional weak categories of JD.com rising rapidly.

Source: JD.com Blackboard News

What wins the trust of users? In short, it's professionalism. It's not hard to see that after tasting success with live streaming in merchandising last year, JD.com has been leveraging its merchandising strengths throughout this year: compared to exaggerated performances and overstated promotions in other live streams, what stands out in JD.com Merchandising's live streams is its professional product selection capabilities, which are currently the rarest in the market.

As far as we know, all JD.com Merchandising anchors come from the front-line merchandising team, who often delve deep into factories and production sites to select products, going through layers of screening based on functionality, cost-effectiveness, and quality. They are not only proficient in products but also able to control every aspect from the supply chain to after-sales service, ensuring that the products recommended in live streams are of good quality and come with impeccable service, while also passing on savings squeezed out of excess links to consumers.

The growth effect brought about by professionalism is concentrated in JD.com's relatively weak discretionary consumption categories. From 8 pm on October 10 to 9 pm on October 31 this year, the number of new users making transactions in JD.com's apparel and beauty categories increased by over 140% year-on-year; in the first eight months, JD.com's beauty sales were 27.01 billion yuan, a year-on-year increase of 11.37%, while national cosmetics sales decreased by 0.5% over the same period.

More category breakthroughs and more attractive growth space will attract more merchants to trust JD.com. Nowadays, no brand merchant can ignore the importance of online channels. With the year-on-year growth rate of physical online retail reaching 8.6% in the first nine months of this year, while the growth rate of total commodity retail sales was only 3.6%, e-commerce remains the most important incremental sales channel for merchants.

What criteria do merchants use to choose a platform? It's price, service, and, more crucially, content. There's no need to mention price; no matter which platform is chosen, it cannot be high, otherwise, nothing will sell; there's also no need to mention service; JD.com has never lagged behind in this regard. As for content, JD.com has successfully established a user perception of high professionalism and low-price quality, naturally attracting more merchants to choose to cooperate with JD.com.

Once two-way trust is established, JD.com's growth will be accelerated, and the logic of the company's long-standing underestimation will also collapse. It's important to note that both home appliances and daily necessities are not strictly discretionary consumer goods, with very limited room for gross margin growth and a clear ceiling; the accelerated rise of categories like apparel and beauty can provide more momentum for the company's future profitability growth.

As company executives said during the earnings call: 'There is still significant room for improvement in profit margins for many of our categories, including supermarkets, and changes in category structure will also lead to increased profits. From the structure of our self-operated and 3P businesses, the long-term increasing proportion of 3P businesses can drive a continuous increase in profit margins.'

03 Conclusion

Today, many people must admit that competition among e-commerce platforms has shifted from intense and overt to subtle and profound. A consensus has emerged: whether it's consumers, merchants, regulators, or the capital market, they have begun to Disgusting simplicity “ Consumption downgrade ” narrate . Before platform companies can make business difficult for everyone and involve the entire society in a spiral of competition, they must first try to find another path.

After Liu Qiangdong's thorough reorganization, JD.com has obviously embarked on this 'other path': through the evolution of its organizational capabilities, it has internally improved execution to quickly bring the company's pricing power up to the market's first tier and amplify competitive advantages through service; externally, it has improved professionalism, establishing a perception of quality and professionalism on both the merchant and consumer sides, and successfully turning the expansion flywheel through the chain of trust.

Over the past four quarters, JD.com's total adjusted net profit reached 45 billion yuan, equivalent to 6.23 billion US dollars. As of the close of trading on November 14 local time, JD.com's total market capitalization was 48.34 billion US dollars, with a comprehensive trailing twelve-month P/E ratio of less than 7.8 times; in addition, the company completed a share repurchase of 390 million US dollars in the third quarter and initiated a new three-year share repurchase plan worth up to 5 billion US dollars, approximately 10% of the company's current market capitalization.

Therefore, this undervaluation with extreme bias under high repurchases is hard to break. Moreover, as macroeconomic stimulus gradually increases, consumer enterprises, which are more sensitive to marginal changes in the environment, coupled with a continuously improving fundamentals, JD.com deserves higher market attention.

Disclaimer: This article is for learning and exchange purposes only and does not constitute investment advice. Welcome to like, view, and share. Your support is our motivation to update!