Kuaishou: An 'Incremental Financial Report in the Era of Stock'

![]() 11/21 2024

11/21 2024

![]() 634

634

This article is written based on publicly available information and is intended for information exchange only, not constituting any investment advice.

In the era of stock economy, the most important business signals to closely observe and track undoubtedly come from those samples that can continuously and stably obtain increments. The incremental information they carry represents the possibility of opening a new cycle. For example, Kuaishou, which has just released its third-quarter report, continues to maintain steady revenue and profit growth. Its future guidance still presents a consistently cautious and optimistic tone, making it a worthy "incremental financial report in the era of stock," with great significance for study.

It is worth mentioning that Kuaishou's latest financial report also unlocked a new milestone: the company's average DAU officially exceeded 400 million. In the first half of 2022, Cheng Yixiao, CEO of Kuaishou Technology, first proposed the medium- and long-term goal of exceeding 400 million DAU. Today, two years later, this aspiration has been realized.

It should be noted that in the first half of 2024, the growth rate of monthly active users in China's mobile internet industry was less than 2%. Kuaishou's achievement of this milestone against this backdrop is significant.

In fact, if we connect multiple quarterly reports, we will also find that for a long period, Kuaishou's logic has not been simply about user growth. Instead, it has been continuously refining operational mechanisms and advanced technologies centered around content and products, building a multi-faceted positive flywheel that enables organic and coordinated growth in user numbers, usage duration, activity frequency, and commercial value.

With this latest 'incremental financial report in the era of stock,' it is time for us to delve into how Kuaishou continuously acquires incremental wealth in the era of stock through its business model.

01 Incremental Financial Report in the Era of Stock

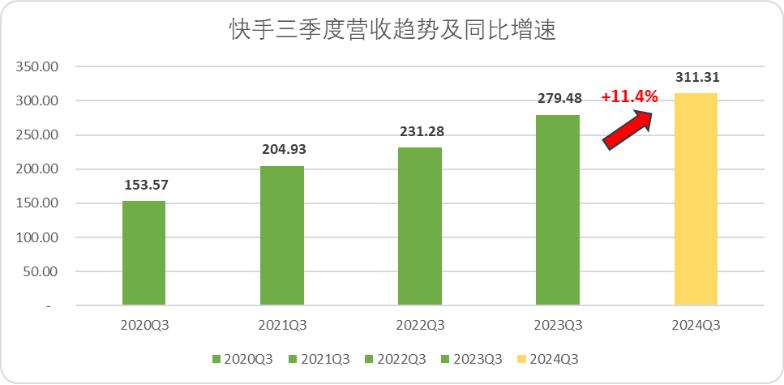

The third-quarter report shows that Kuaishou recorded revenue of 31.1 billion yuan, a year-on-year increase of 11.4%, and adjusted net profit of 3.9 billion yuan, a year-on-year increase of 24.4%.

Figure: Kuaishou's third-quarter revenue trend and year-on-year growth rate, source: corporate financial report

Kuaishou's e-commerce GMV reached 334.2 billion yuan, with a year-on-year increase of 15.1%.

This marks the 16th consecutive quarter of positive growth for both Kuaishou's revenue and GMV. Core business revenue, including income from online marketing services and other services (including e-commerce), increased by nearly 20% year-on-year, with a continuous increase in market share.

In overseas markets, revenue for the third quarter was 1.3 billion yuan, a year-on-year increase of 104.1%.

At the same time, the attractiveness of Kuaishou's products is gradually being amplified. The number of daily active users reached 408 million, a year-on-year increase of 5.4%, officially surpassing the 400 million milestone and also recording positive growth for the 16th consecutive quarter.

The number of monthly active users reached 714 million, a year-on-year increase of 4.3%, with both daily and monthly active users hitting record highs.

Figure: Changes in Kuaishou's active user base in the third quarter, source: corporate financial report

In addition to the excellent performance in daily active users, total user engagement time increased by 7.3% year-on-year.

Individual indicators may not be convincing. If we place Kuaishou's third-quarter report on a coordinate axis, everyone may better understand the value of this report:

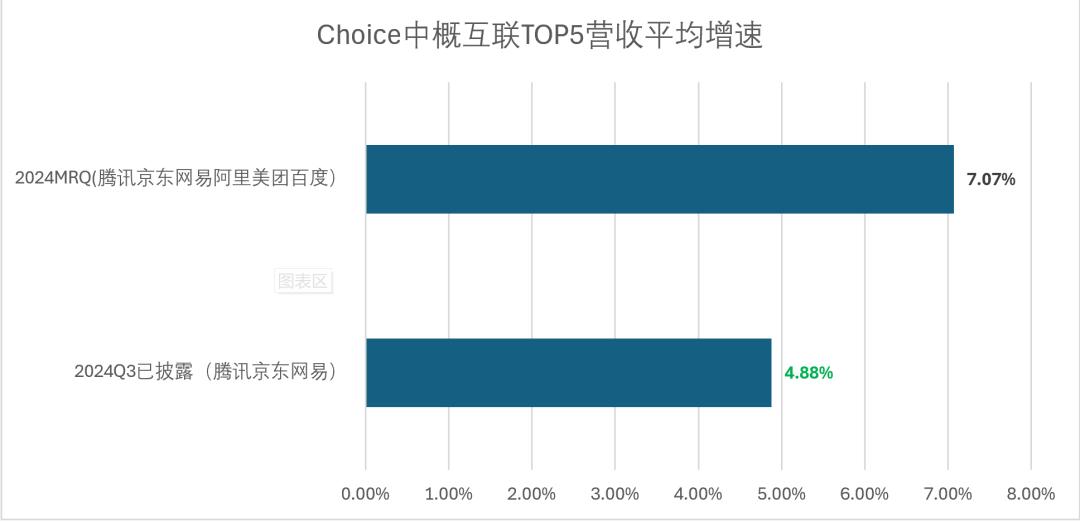

Among the top five Chinese companies listed in the U.S. with disclosed third-quarter reports, the average revenue growth rate is only 4.88%.

According to data from QuestMobile's "2024 Mobile Internet Autumn Report," the average growth rate of monthly active users for top apps in various sectors (excluding pure tool-type weather and input method apps) in the first three quarters was -0.52%.

Figure: Average revenue growth rate of the top five Chinese companies listed in the U.S. (based on market capitalization, already disclosed) (Due to fluctuations in market capitalization within the quarter, the ranking changed, so MRQ data includes Baidu + Netease), source: Choice Financial Client.

Both financial performance and the number of active users indicate that Kuaishou is one of the few companies that can still achieve incremental growth in the current era of stock.

Behind all phenomenal performances lie the most basic common-sense rules. Just as in the current era of stock economy, the generation of all economic increments implies that this economy has inherent vitality surpassing other economies: just like Brownian motion, only sufficient interaction can generate heat and activity, thereby realizing a thriving business ecosystem, and ultimately boiling products, enterprises, and even industries.

How did Kuaishou achieve this?

02 Heating Up the Content Ecosystem

By looking at the essence through phenomena, one of the core reasons why Kuaishou can continuously acquire increments in the era of stock is that, for a long time, centered around the closed-loop business chain integrating content, traffic, and supply, Kuaishou has built a business value flywheel with comparative advantages.

Let's first look at content and traffic.

Undoubtedly, Kuaishou inherently possesses advanced productivity endowments of the times—content + e-commerce is the optimal solution for the current business model + traffic. Both traditional content platforms and e-commerce platforms are reshaping the entire business chain around this concept.

In addition, Kuaishou also possesses unique endowments that do not conform to the times: the community background of semi-acquaintances.

How to organically combine the two has long been the primary question facing Kuaishou. Kuaishou's solution is to break the traditional definition of fans and shorten the distance between people.

As can be seen from the third-quarter earnings call, in Kuaishou's view, the specific solution is divided into three dimensions:

1) By mixing traffic, Kuaishou promotes natural alignment between commerce and content, expanding the user base while continuously increasing user product usage frequency, enhancing the efficiency of global traffic allocation. At the same time, in addition to following relationships, users' private interactions such as searching, commenting, and engaging will form positive feedback, enhancing the public domain traffic allocation of corresponding content, respecting users rather than guiding them, and improving user retention.

2) By enhancing users' private domain links through product design, optimizing comment section sorting, improving the community interaction atmosphere, optimizing user private messaging scenarios, and introducing innovative features like "Fire Cubs" to strengthen links, Kuaishou builds a moat for the semi-acquaintance community.

3) Support benchmark creators with Kuaishou characteristics and build a unique and rich content ecosystem through high-profile event operations, forming differentiated vertical content.

For example, the recent popularity of "Auntie Wheat" on Kuaishou, who moved countless netizens to tears with the line "After harvesting the wheat, I'll head south" during a live Lianmai with Da Bing. Multiple cultural and tourism bureaus have reached out, welcoming "Auntie Wheat" to visit. In recent days, with the relay escort of creators like "Waste Material" and "Hobo Xiao Hei," friends of Da Bing, "Auntie Wheat" embarked on her journey to Xishuangbanna. Auntie's poetic yet simple words struck a chord, and the magical connection from online to offline also demonstrated the warmth unique to the Kuaishou community.

While 400 million DAU is undoubtedly an important milestone, Kuaishou is obviously thinking more and farther: According to the latest guidance given by Cheng Yixiao at the earnings call, while continuing to maintain stable traffic growth, Kuaishou will utilize high-quality and diverse content supply, product, and algorithm optimization iterations, hoping to create more product usage scenarios for users.

Beyond basic traffic, why does Kuaishou still need to put in more effort to enhance usage scenarios? In our view, this is the key driver for Kuaishou's incremental growth:

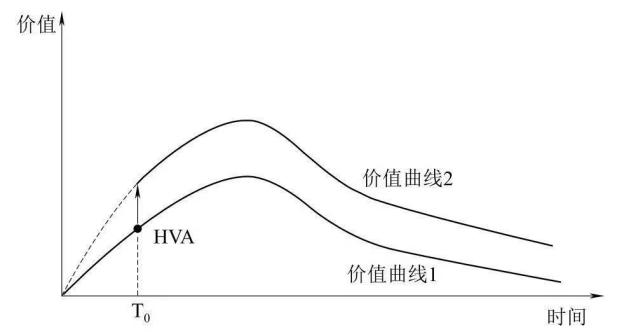

Yang Hanqing, a professional operations manager who has worked for well-known internet companies like Amazon and is the author of "I Do User Growth on the Front Lines," mentions the concept of HVA (High-Value Action) in his book.

'After starting to use a product, users will continuously contribute value over time. If a user generates a high-value action at a certain point in time, their value contribution trajectory will undergo a transition.'"

Figure: HVA model, user value curve transition, source: Yang Hanqing, "I Do User Growth on the Front Lines"

For short video content, interaction between people is actually HVA. Every search, like, comment, and interaction creates credit, and credit is the source of transaction behavior.

By mixing traffic, emphasizing private domain links, and supporting distinctive content, Kuaishou has built a thriving content ecosystem at this stage, realizing a transition in the HVA value curve through the complementary nature of these three elements.

As a result, the content ecosystem continuously gains momentum, which is directly reflected in operational outcomes:

In the third quarter, Kuaishou's average daily active user engagement time reached 132.2 minutes, with total user engagement time increasing by 7.3% year-on-year (daily active users * average daily active user engagement time), and the average daily live streaming and short video playback count approached 110 billion.

The increase in total user engagement time also indirectly proves that when facing medium- and long-term milestone goals, Kuaishou did not rush for quick success and overly focus on paper figures. Surpassing the mid-term goal milestone for daily active users was a natural outcome.

03 Heating Up Commodity Supply

If the answer to the content ecosystem is shortening the distance between people, then for commodity supply, Kuaishou's solution is to minimize all unnecessary friction costs to shorten the distance between goods and people.

Similar to the logic of building the content system, the logical starting point for Kuaishou's commodity supply is also to maintain vitality. The supply-side school, represented by Mundell, Laffer, and Gilder, believes that rationality automatically regulates the supply and utilization of production factors, and the linker (channel or platform) should eliminate factors that hinder market regulation.

For e-commerce merchants, ROI is paramount in the era of stock. Therefore, the difficulty in hindering consumer market regulation lies in low-frequency reach and high marketing costs.

Regarding such industrial challenges, based on our observations, Kuaishou's solution lies in utilizing product infrastructure and AI technology to form a systematic solution:

First, live streaming has always been a resource endowment of Kuaishou. Kuaishou's e-commerce live streaming can bring very high monetization efficiency, which is high-value traffic. For Kuaishou, what other areas can find increments around live streaming? The answer is new product infrastructure.

Shopping Groups is a private domain operation tool launched by the platform for e-commerce anchors. Users' accumulated shopping, liking, and sharing intimacy in live streaming rooms will increase, thereby obtaining exclusive coupons, red packets, welfare products, etc.

Group Buy is a tool that helps users efficiently obtain commodity discounts. Merchants or anchors can set a "rush order target" for a product. When the actual sales volume of the product reaches the target sales volume, the product will automatically drop to the preset discounted price. The platform will process partial refunds for purchased users, returning the price difference, and users can directly obtain the commodity price discount for that portion.

These two tools directly drove new increments in Kuaishou's e-commerce live streaming:

During the 818 promotion, after using the Shopping Groups feature, the single-session GMV proportion of Shopping Groups members exceeded 50%, and the average transaction value of Shopping Groups members was also significantly higher than the overall user average.

Anchor Fei Yi used the Group Buy feature to list an order of jade jewelry. With an expected sales volume of 200 units, a high discount was set through the Group Buy feature. Ultimately, this jade product sold over 900 units in one hour, far exceeding the sales expectation of 200 units, with a GMV exceeding 4 million.

During the 818 promotion, the GMV of e-commerce influencer business increased by over 24% year-on-year.

Second, in addition to live streaming themes, centered around a thriving content ecosystem, Kuaishou has strengthened the construction of multi-theme ecosystems such as second creations, short videos, images, and texts.

Through AI tools, exciting moments of product explanations can be automatically edited into short videos. Second creations and live streaming clips can continuously reach users outside live streaming rooms for 24 hours, significantly improving commercial conversion.

In the third quarter, the year-on-year growth of short video e-commerce exceeded 40%.

Finally, AI is a focus of Kuaishou's development, and technological investment is also explicitly reflected in Kuaishou's supply side, effectively empowering merchants' content production.

Taking the application of the Kuaiyi large language model as an example, in commercial scenarios, full-process AIGC services such as digital human script creation, digital human rendering, and digital human real-time interaction, built based on the Kuaishou large model, enable commercial advertisers to generate high-quality video and live streaming content at low cost.

In the first half of 2024, nearly 20,000 merchants achieved intelligent operation with the help of the large model capability on the Kuaishou platform. In the third quarter of this year, the average daily consumption of AIGC marketing materials from marketing clients exceeded 20 million yuan.

At the same time, AI products and more user feedback (interaction behavior) and product infrastructure mentioned earlier work together to enable Kuaishou to better understand users and significantly improve the platform's matching efficiency and merchant conversion. Merchants on the supply side voted with their feet: In the third quarter, Kuaishou's online marketing revenue reached 17.6 billion yuan, with growth rates exceeding 20% for six consecutive quarters. Monthly active merchants in the internal cycle increased by 50% year-on-year.

On the one hand, commodity reach is enhanced through tools like Shopping Groups and second creations. On the other hand, large models and AI technology improve the accuracy of traffic investment and conversion efficiency.

Combining these two aspects shortens the consumer decision-making chain and bidirectionally shortens the distance between people and goods. Similar to the content ecosystem, by utilizing product infrastructure and AI technology, Kuaishou's supply side has also heated up: In the third quarter, the average monthly number of active merchants increased by 40% year-on-year, new merchants increased by 30% year-on-year, and the number of commodity categories increased by over 20% year-on-year.

The common prosperity of traffic, content, and supply has shaped the vitality of Kuaishou's business ecosystem, ultimately becoming the company's comparative advantage. The incremental financial report in the era of stock has also become a natural outcome.

04 Conclusion

Kuaishou's financial reports that continuously surpass market expectations prove to us that even in the era of stock, effective growth can still be achieved as long as the vitality of the internal ecosystem can be continuously stimulated.

Kuaishou's business model and operational strategy have also received positive feedback from a vast number of users:

If increment (financial performance) is the result of traffic prosperity, then traffic (user engagement time) is the reward for winning people's hearts.

After continuous breakthroughs, Kuaishou's long-term value based on valuation will inevitably be revised by the capital market.