Why is Ctrip, with improving performance, facing share reductions?

![]() 11/22 2024

11/22 2024

![]() 472

472

Click 'Short, Concise and Quick Interpretation' to follow us. For exposés, please @ our editor

In 2024, Ctrip has been highly profitable.

In the first three quarters, Ctrip reported significant revenue and net profit growth, albeit at a slower pace compared to the previous year. Whether this slowdown will continue remains to be seen.

The company's strong performance fueled a significant rise in its share price, which increased by approximately 80% within the year. Many securities firms gave the stock 'Buy' or 'Accumulate' ratings, but company executives and shareholders engaged in share reduction operations to cash out.

Revenue and net profit both increased

In the third quarter, Ctrip reported revenue of 1.552 billion yuan, a year-on-year increase of 15.52%, and net profit of 6.765 billion yuan, a year-on-year increase of 46.59%, showing robust growth momentum.

Ctrip's Chairman of the Board, Liang Jianzhang, stated that in the third quarter of 2024, both domestic and international travel exhibited strong growth momentum. With the boost in consumer confidence and enthusiasm for travel, we are optimistic about the sustained growth of the tourism industry.

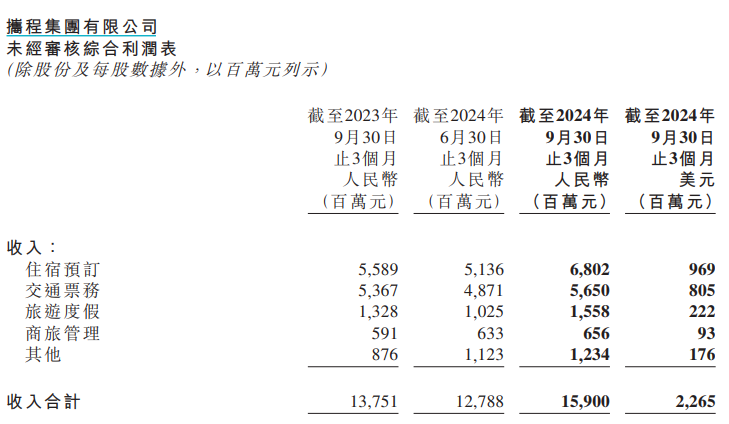

Breaking down by business segments, accommodation booking revenue was 6.802 billion yuan, up 22% year-on-year; transportation ticketing revenue was 5.65 billion yuan, up only 5% year-on-year; tourism and vacation revenue was 1.558 billion yuan, up 17% year-on-year; and business travel management revenue was 656 million yuan, up 11% year-on-year.

Clearly, the tourism industry's healthy development has greatly benefited Ctrip.

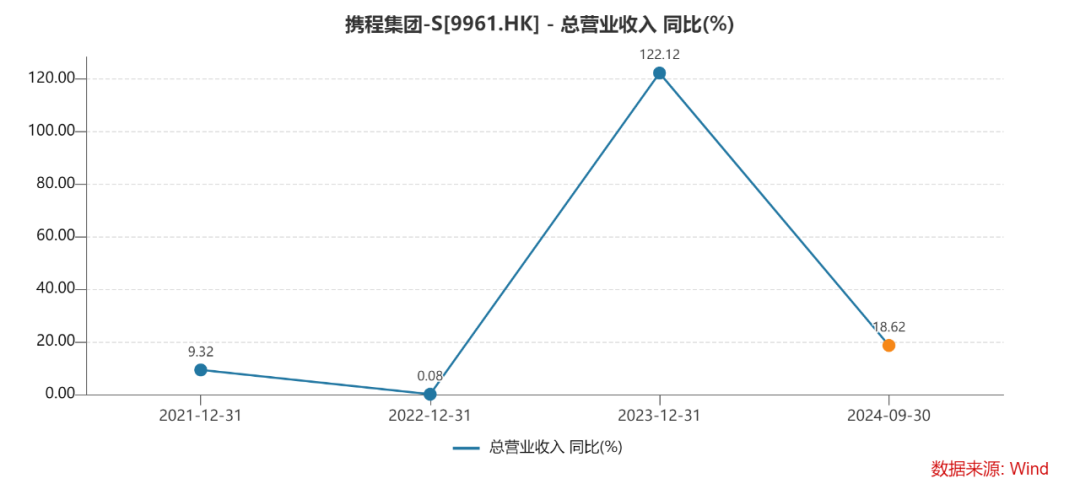

According to Short, Concise and Quick Interpretation, in the first three quarters, Ctrip generated revenue of 40.55 billion yuan, up 18.62% year-on-year, a notable slowdown from the 122.12% growth rate in 2023. Net profit was 14.91 billion yuan, up 72.95% year-on-year, following previous three-year growth rates of 83.06%, 355.09%, and 606.91%.

Despite Ctrip's strong revenue and profit performance in the first three quarters, it inevitably faces a slowdown in growth.

From an expense perspective, Ctrip's sales and marketing expenses surged the most in the third quarter, reaching 3.382 billion yuan, up 23% year-on-year, far exceeding revenue during the same period, indicating increased marketing investment. R&D expenses and general and administrative expenses were 3.64 billion yuan and 1.045 billion yuan, respectively, up 2% and 2% year-on-year.

As of September 30, Ctrip's cash and cash equivalents, restricted cash, short-term investments, and time deposits and wealth management products held to maturity amounted to 86.9 billion yuan, demonstrating strong financial strength.

It should be noted that the company's fundraising amount within the year was not insignificant.

On June 10, Ctrip announced the completion of the sale of US$1.5 billion principal in cash-settled convertible senior notes. The proceeds will be used to repay existing financial debts, expand overseas operations, and meet operational capital requirements.

The notes will bear interest at an annual rate of 0.75%, payable semi-annually on June 15 and December 15 each year, starting from December 15, 2024, with a maturity date of June 15, 2029.

In the first three quarters, Ctrip's interest expenses amounted to 1.412 billion yuan, while interest income was 1.824 billion yuan, resulting in a net interest income of 412 million yuan.

Executives and shareholder reductions

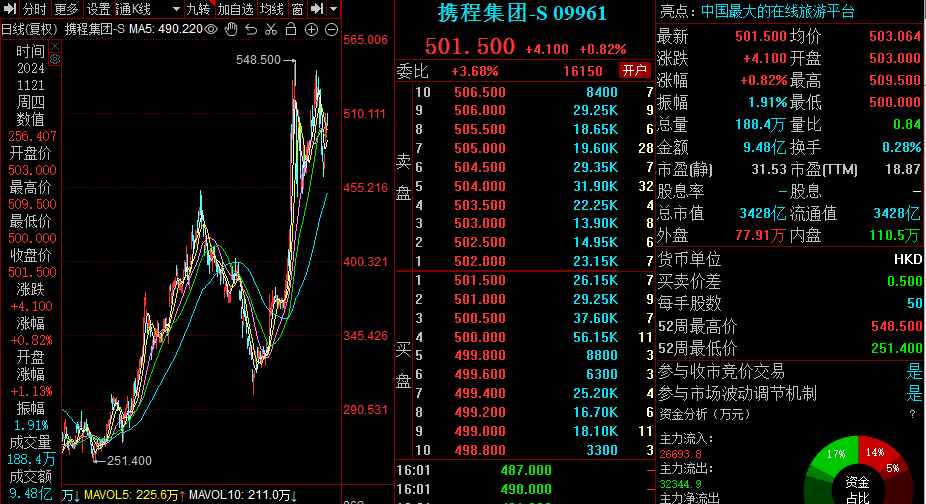

Ctrip's share price soared amid robust performance. As of November 21's close, the company's Hong Kong shares were priced at HK$501.5 per share, with a total market capitalization of HK$342.8 billion and a trailing twelve-month (TTM) P/E ratio of 18.87. Its U.S. shares were priced at US$64.79 per share, with a total market capitalization of US$42.19 billion (approximately RMB 305.5 billion) and a TTM P/E ratio of 18.27, slightly lower than its Hong Kong shares.

According to Wind data, Ctrip's Hong Kong shares increased by 80.66% and its U.S. shares by 79.92% within the year, achieving both performance and share price gains.

After the release of Ctrip's Q3 report, multiple securities firms expressed optimism about its future performance, with China Galaxy Securities, Huachuang Securities, Founder Securities, and Minsheng Securities giving it a 'Buy' rating. Morgan Stanley maintained its 'Accumulate' rating, stating that the company is expected to achieve sustainable revenue growth over the next three to five years, with a compound annual growth rate of double digits.

Contrary to the optimism of the above-mentioned firms, several Ctrip executives and shareholder Prosus reduced their shareholdings amid the soaring share price.

According to incomplete statistics, Ctrip's co-founder, Vice Chairman of the Board, and President Fan Min conducted multiple share reductions throughout the year, selling a total of 2.124 million shares worth over US$100 million. The last reduction was in August, when Fan Min sold 250,000 shares worth US$10.585 million.

According to Beijing News, on February 27, Ctrip's Chief Financial Officer Wang Xiaofan planned to sell 500,000 shares worth approximately US$22.335 million. On March 6, Chief Operating Officer Xiong Xing planned to sell 450,000 shares worth approximately US$20.2095 million. On March 8, Independent Director Gan Jianping planned to sell 40,000 shares worth approximately US$1.7964 million.

On September 5, internet investment giant Prosus sold 14.5 million Ctrip shares at US$51.40 per share, cashing out US$743 million. Bloomberg quoted sources as saying that this transaction marked Prosus' complete exit from its investment in Ctrip. A representative from Prosus confirmed the sale, stating that it reflected the company's 'active portfolio management approach.'

Ctrip has not responded to this.

Ultimately, Ctrip's continued success in the secondary market will hinge on its performance. We will have to wait for the disclosure of the Q4 report to find out more.

High complaint volume

Accommodation booking and transportation ticketing are significant revenue contributors for Ctrip, essentially involving hotel and accommodation reservations, as well as ticket sales for trains and flights. The company has received numerous complaints regarding these services.

According to HeiMa Complaints, as of November 21, there were 82,328 complaints about Ctrip travel, with 72,420 resolved, resulting in a complaint resolution rate of approximately 88% and a decent response speed. In the past month, there were 1,595 complaints, with 432 resolved, resulting in a complaint resolution rate of approximately 27%, mainly involving refund issues such as refund difficulties and deduction of refund fees.

For comparison, Tongcheng Travel received 2,211 complaints in the past month, with 1,312 resolved, resulting in a complaint resolution rate of 59%, significantly higher than Ctrip's, indicating that the latter needs to further enhance its response and handling of consumer complaints.

Additionally, according to 12315, Shanghai Ctrip Business Co., Ltd. received 18 complaints in the past month, with a mediation success rate of 27.78%, a decrease of 28.57% from the previous month.

In fact, OTA platforms, including Ctrip, have often been questioned by the outside world for 'price discrimination against familiar customers,' although there is no official confirmation of its existence.

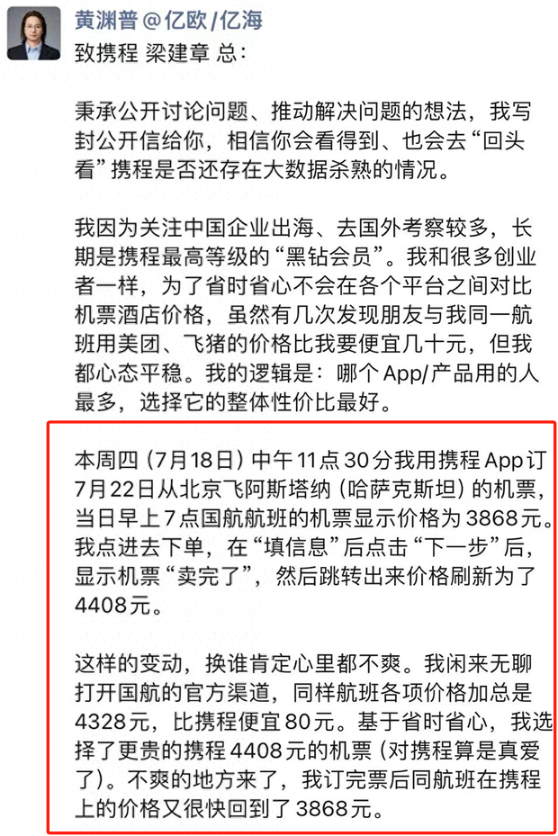

In July, Huang Yuanpu, the founder of ECIO, claimed to be a 'Black Diamond Member,' Ctrip's highest membership tier. When booking a flight ticket on the Ctrip App on July 18, he noticed that the ticket price was displayed as 3,868 yuan at 7 AM that day. However, after clicking to place the order and filling in the information, he was shown that the tickets were 'sold out.' Upon clicking 'Next,' the price jumped to 4,408 yuan.

After booking the ticket on Ctrip, the price for the same flight returned to 3,868 yuan.

Huang Yuanpu posted on WeChat Moments, addressing Ctrip's Liang Jianzhang and requesting a reasonable explanation.

In response, Ctrip denied 'price discrimination based on big data.' A Ctrip public relations representative explained that international ticket prices fluctuate, and the prices received may be cached, resulting in price changes upon returning to the page, which is normal.

'Price discrimination based on big data' primarily occurs on various internet platforms due to their possession of extensive user data. Currently, relevant authorities have not introduced specific regulatory measures, leaving consumers with no recourse for complaints. How to determine, manage, and protect consumer rights is an issue that relevant authorities need to seriously consider.

(Short, Concise and Quick Interpretation - Original Work. Do not reproduce without permission! PS: If the article infringes upon copyright or contains erroneous data, please contact us promptly for correction.)