After 'exile' for three years, Jiang Fan will compete globally with Pinduoduo and Douyin

![]() 11/22 2024

11/22 2024

![]() 682

682

After a three-year hiatus, Jiang Fan returns to the power center of Alibaba.

Yesterday, Wu Yongming, CEO of Alibaba Group, sent an email to all employees announcing the establishment of the Alibaba E-commerce Business Group, appointing Jiang Fan to head it and report to Wu Yongming. The new E-commerce Business Group will fully integrate e-commerce businesses such as Taobao, Tmall, the International Digital Commerce Group, 1688, and Xianyu, forming a business cluster covering the entire domestic and international industry chain.

In summary, after leaving the core business of Taobao and Tmall and being 'exiled' overseas for three years, Jiang Fan, relying on his strong business capabilities, has returned to the power center of Alibaba. Moreover, this time, he is in charge of all domestic and international e-commerce businesses.

This is the result of Jiang Fan's three years of fierce competition in overseas e-commerce. As early as last July, Jiang Fan once again became an "active partner" of Alibaba. Previously, in April 2020, Jiang Fan was stripped of his Alibaba partnership status due to "improper handling of personal family issues, causing a severe public opinion crisis and significantly impacting the company's reputation."

Under Jiang Fan's leadership, the Alibaba International Digital Commerce Group (AIDC) has become the fastest-growing business in recent years, surpassing Alibaba Cloud to become the second-largest revenue generator.

Alibaba's recent financial report shows that in Q3 2024, Alibaba International's revenue was 31.672 billion yuan, a year-on-year increase of 29%. For comparison, Alibaba's overall revenue increased by 5% year-on-year, while Cainiao and Cloud Intelligence increased by 8% and 7%, respectively, and Taobao and Tmall only increased by 1% year-on-year, maintaining a "decent" performance.

Currently, Alibaba International's revenue is second only to Taobao and Tmall's 99 billion yuan, higher than Cloud Intelligence's 29.6 billion yuan and Cainiao's 24.6 billion yuan.

However, Alibaba's overseas e-commerce business still faces enormous pressure.

According to market analysis firm Data.ai, in 2023, Temu and Shein ranked first and second in global downloads and download growth rate among shopping apps. AliExpress ranked third and fourth in downloads and download growth rate, respectively. Meanwhile, TikTok was the world's most downloaded social app during the same period, with over 1 billion monthly active users globally.

So, how did Jiang Fan return to the power center of Alibaba through his business prowess after being 'exiled' to overseas e-commerce for the past three years, and how will he lead domestic and international e-commerce in a global competition in the future?

1. In Jiang Fan's first year in charge of overseas e-commerce, the real cross-border business war began.

The real war in cross-border e-commerce platforms began in 2022, Jiang Fan's first year in charge of Alibaba's international business.

At the end of December 2021, Alibaba announced its largest organizational restructuring since 2015, upgrading from a "middle platform strategy" to "diversified governance." Dai Shan replaced Jiang Fan to oversee the "China Digital Commerce Sector," including Taobao, Tmall, and Alimama. Jiang Fan was transferred from the "Great Taobao System," where he had worked for seven years, to oversee the "Overseas Digital Commerce Sector," encompassing AliExpress, international trade, and Lazada.

Jiang Fan once led the mobile and content-driven upgrades of Taobao, earning him the nickname of "Alibaba's Crown Prince." Due to a well-known "family issue," he was transferred from the core Taobao and Tmall business to the overseas market, which was seen by outsiders as a form of "exile."

For Jiang Fan, this was a battle he had to fight, but the overseas environment at that time was not as favorable as before, marking a turning point from a blue ocean to a red ocean.

Before 2022, Pinduoduo had not yet ventured overseas, and TikTok's overseas live streaming e-commerce was just starting. Only Shopee, Shein, and Alibaba were competing in the overseas market, but Alibaba did not seize this opportunity.

Alibaba ventured overseas early. Many people believe that Alibaba started with Taobao, but it actually started with going overseas. In 1999, Alibaba Group's first business segment was Alibaba.com, a B2B e-commerce platform.

In 2010, Alibaba established AliExpress, which once became the e-commerce platform with the highest market share in Russia by "naturally growing" on the back of overseas market dividends. However, after 12 years of development, its performance has been unsatisfactory. According to data released by Alibaba at its Investor Day at the end of 2021, AliExpress's monthly active users were lower than Lazada's, and its GMV was only slightly higher.

Founded in 2012, Lazada was once the largest e-commerce platform in Southeast Asia. In 2016, Alibaba acquired a controlling stake in Lazada for approximately $1 billion, making it Alibaba's flagship platform in Southeast Asia. Since then, Alibaba has parachuted hundreds of middle managers to Lazada and "copied and pasted" Taobao's backend to Lazada, but Lazada did not experience the expected high growth.

Starting from 2017, Lazada began to lose ground in competition with Shopee. According to data from Iprice, a Southeast Asian e-commerce aggregation platform, Shopee surpassed Lazada in the third quarter of that year to become the largest e-commerce platform in terms of traffic in Vietnam. By around 2018, Shopee began to comprehensively surpass Lazada in GMV.

In addition to Alibaba.com, AliExpress, and Lazada, Alibaba's overseas business mainly includes the South Asian e-commerce platform Daraz, the Middle Eastern e-commerce platform Trendyol, and the later-launched Spanish e-commerce platform Miravia.

Overall, when Jiang Fan took over overseas e-commerce in 2022, he faced an awkward situation internally. The two main businesses, AliExpress and Lazada, were both on a "downhill" trajectory, and external competition intensified with the entry of Temu and TikTok Shop.

In April of that year, TikTok Shop's cross-border e-commerce business was launched in Thailand, Vietnam, Malaysia, the Philippines, and other Southeast Asian countries, bringing a formidable competitor to Lazada in the Southeast Asian market.

In September, Temu was launched, targeting the North American market with its slogan "shop like a billionaire." According to Bloomberg, within six months of entering the U.S. market, Temu surpassed Shein and AliExpress in monthly active users.

Alibaba's overseas e-commerce business faced two more formidable competitors in the global competition.

2. Funding and decentralization to reorganize overseas e-commerce.

After Jiang Fan took over, Alibaba's overseas e-commerce entered a period of accelerated development.

One of the most important aspects was AliExpress. According to multiple media reports, in July 2022, Jiang Fan held an AliExpress manager's conference, analyzed various e-commerce platform models and key market opportunities, and decided to focus on the full-service model.

In December of the same year, AliExpress officially launched its full-service model. In March of the following year, the Choice business, which relies on the full-service model and emphasizes cost-effectiveness, was launched, and order volume rapidly increased.

Previously, AliExpress was a POP merchant-based platform model, placing high demands on merchants' operational and fulfillment capabilities. Under the full-service model, merchants only need to supply goods, and the platform handles price negotiation, store operations, logistics fulfillment, after-sales services, etc., reducing the burden on merchants and lowering the threshold for going overseas. In August 2023, AliExpress introduced a "semi-service" model, where merchants retain ownership of goods, pricing, and operations, while AliExpress handles logistics fulfillment services.

Subsequently, the Choice business supported by the full-service and semi-service models became the most important growth engine for Alibaba's overseas e-commerce. In April 2024, Choice accounted for approximately 70% of AliExpress's overall orders.

Under the low-price, full-service, and semi-service models, AliExpress competed directly with Temu. Under Temu's aggressive onslaught, AliExpress began to "imitate" Temu, such as launching a "billion subsidy" policy in April this year and increasing advertising investment overseas.

In March this year, AliExpress became an official partner of the 2024 UEFA European Championship; in May, it signed football superstar David Beckham as its global ambassador. This was unimaginable before. According to reports from LatePost, in 2020, AliExpress still needed to break even, with a total marketing budget of only $100 million per year for over a hundred countries outside of Russia. After Jiang Fan took office, he elevated AliExpress's strategic position and increased investment resources.

This also contributed to the expansion of losses in Alibaba's overseas e-commerce business. From Q1 to Q3 this year, the adjusted EBITA losses of the Alibaba International Digital Commerce Group increased significantly year-on-year, with losses of 4.085 billion yuan, 3.706 billion yuan, and 2.905 billion yuan, respectively. In other words, in the first three quarters of this year, Alibaba's overseas e-commerce business incurred a combined loss of nearly 10.7 billion yuan. The financial report explained that this was mainly due to increased investments in cross-border businesses such as AliExpress and Trendyol.

Jiang Fan personally led the launch of AliExpress's full-service, semi-service, and Choice businesses, even personally attending weekly and monthly meetings of AliExpress to help coordinate resources from the group side. However, in the Southeast Asian market, Jiang Fan changed his past practice of parachuting senior executives by delegating authority.

In June 2022, Jiang Fan promoted Dong Zheng to succeed as CEO of Lazada. Previously, Dong Zheng had served as CEO of Thailand and Vietnam, leading Lazada Thailand's visits to surpass those of Shopee and becoming the first e-commerce platform to achieve profitability in Thailand in 2022. He also led Lazada Vietnam's traffic to rise from fourth to second place locally.

Dong Zheng's appointment addressed cultural conflicts caused by previously parachuted executives and drove a series of localization changes. According to media reports, Lazada currently operates in six Southeast Asian countries, including Singapore, Malaysia, Thailand, Indonesia, Vietnam, and the Philippines, with local leaders in charge of five of these countries.

It was not only about "delegating authority" but also about "providing funds.""After 2018, Alibaba did not invest further in Lazada during the three years led by former Lazada executives like Peng Lei. In the nearly three years since Jiang Fan took charge of the international business, Alibaba has invested nearly $3.7 billion in Lazada, including $1.6 billion invested in 2022 alone."

These funds were used to serve localization efforts, including building a self-owned logistics network and investing in local payment enterprises. By focusing on both logistics and payments, Lazada continuously improved its e-commerce ecosystem, achieving positive EBITDA (earnings before interest, taxes, depreciation, and amortization) in July this year for the first time since its establishment in 2012.

3. There is still a tough battle to fight in overseas e-commerce.

Jiang Fan's achievements in leading Alibaba's overseas e-commerce are evident, which is why he returned to the ranks of Alibaba partners last year and is now the CEO of domestic and international e-commerce.

However, the performance pressure faced by Alibaba's overseas e-commerce business cannot be underestimated.

Temu's global user base has surpassed that of AliExpress. According to data from SimilarWeb, a data statistics website, in the first quarter of 2024, Temu had an average of 185 million monthly unique visitors globally, compared to 164 million for AliExpress and 80 million for Shein. Of course, Amazon remains the leader with 428 million monthly unique visitors globally.

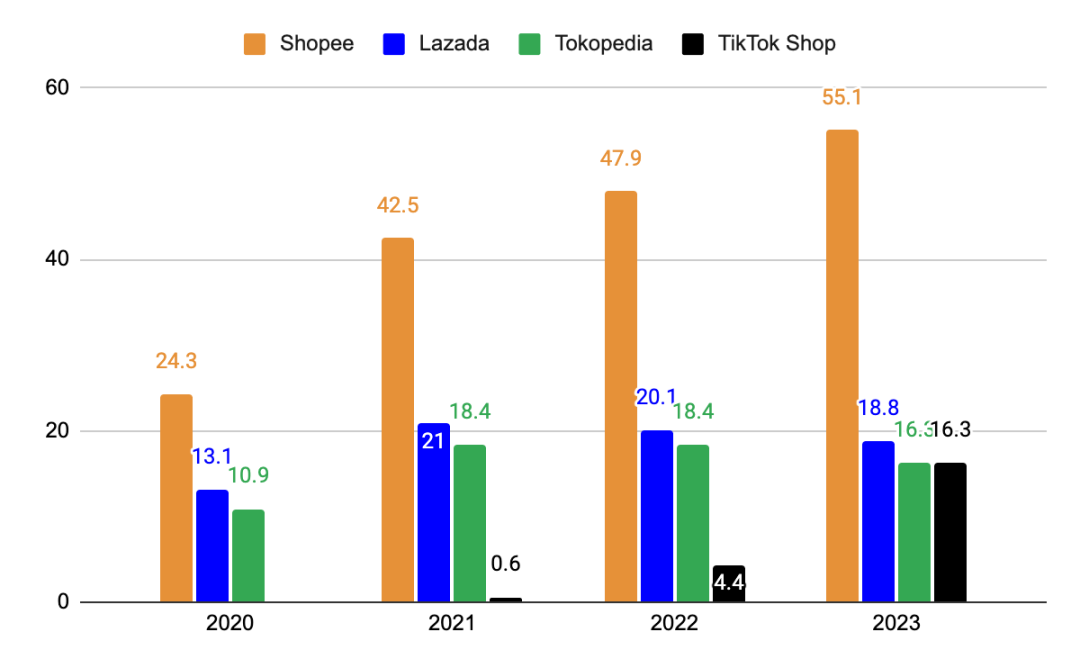

In the Southeast Asian market, after being surpassed by Shopee, Lazada was then surpassed by TikTok Shop, which had only entered the Southeast Asian market for three to four years last year. According to the Momentum Works report, in 2023, Shopee remained the largest e-commerce platform with a 48% market share and a total transaction value (GMV) of $55.1 billion. Meanwhile, Lazada's transaction volume decreased from $21 billion in 2021 to $18.8 billion in 2023.

Data source: Momentum Works, "Southeast Asia E-commerce Report 2024"; E-commerce Platform GMV (unit: billion USD)

TikTok Shop's GMV in Southeast Asia quadrupled in 2023 to reach $16.3 billion. Moreover, with the merger of TikTok Indonesia and Tokopedia, TikTok Shop became the second-largest e-commerce platform in Southeast Asia in 2024.

Data source: Momentum Works, "Southeast Asia E-commerce Report 2024"

The competition faced by Alibaba's e-commerce overseas is similar to that faced by the domestic market in previous years. On one side, Pinduoduo/Temu quickly captured users' minds with its low-price strategy and aggressive advertising investments, competing for Taobao users. On the other hand, Douyin/TikTok captured users' time with short videos and live streaming, creating a closed-loop content e-commerce ecosystem.

However, the competition in overseas e-commerce is far more intense than that in China due to the unavoidable global e-commerce giant Amazon and new cross-border e-commerce players like Shopee and Shein.

Now, whether domestic or international, this global competition has been entrusted to Jiang Fan. It is worth recalling that Wang Xing, the founder of Meituan, once commented on Jiang Fan on WeChat Moments, saying, "In the coming years, we will see how the two smart people, Huang Zheng of Pinduoduo and Jiang Fan of Taobao and Tmall, compete... If Jiang Fan can win this battle, he will undoubtedly be the successor to Alibaba's CEO. If he is interested in the job.