E-commerce goes overseas to Latin America: Seize the next wave in this young and fertile land

![]() 11/22 2024

11/22 2024

![]() 683

683

Editor | Li Xiaotian

Before important festivals or season changes, Claudia, a citizen of Chile, usually has to drive for an hour to get to the mall in Santiago, the capital.

Claudia lives in a town about 100km away from Santiago. "I'm still relatively close to the center of Chile. Some people live 600km away from the capital, making offline shopping quite inconvenient," Claudia told Xiaguangshe.

But after the pandemic, Claudia found that offline shopping was no longer a necessity. The "lockdowns" during the pandemic accelerated the expansion and growth of online economic models in Latin America. "People don't need to travel long distances anymore. E-commerce platforms allow people to shop online without leaving home, and those living outside major urban centers can also access a wider variety of goods," Claudia said.

Claudia's experience is a microcosm of the rapid growth of Latin American e-commerce platforms in recent years. According to Statista's "Digital Market Outlook," e-commerce sales in Latin America exceeded $117 billion in 2023 and are expected to reach $205 billion by 2028. The growth rate of e-commerce in countries with high per capita income, such as Brazil, Mexico, Colombia, and Chile, is leading the entire Latin American region.

Chinese cross-border sellers on the other side of the globe seem to have not fully grasped the business opportunities brought about by the transformation of Latin American e-commerce. In the cross-border industry, North America, Europe, and Southeast Asia have always been hot topics, while Latin America appears distant and unfamiliar to sellers, much like its geographical location.

However, some people always seize the opportunity and arrive early at "the last blue ocean."

They have chosen MercadoLibre, the largest e-commerce platform in Latin America, with top traffic and popularity:

In 2020, the fashion apparel brand MyWinni entered the Latin American market, successively opening MercadoLibre stores in Mexico and Chile, with annual GMV growth stabilizing at around 100% over four years; in 2022, Qingdao Thunderobot Technology Co., Ltd. ("Thunderobot"), the "first gaming equipment stock," entered the Mexican store and became the top cross-border laptop brand seller on MercadoLibre; in 2023, Shenzhen Huafurui Technology Co., Ltd. ("CUBOT") brought its smartphone brand CUBOT to Latin America and became the category sales champion in Mexico just one month after launching.

In this young and fertile land, they have seized the first wave. And from their perspective, this huge door of opportunity has just opened and is far from closing.

Almost everyone who pays attention to Latin America will mention the distinct trait of this land - its youthfulness.

According to an ICBC Securities report, Latin America had a population of about 650 million in 2022, with about 23.55% of the population aged 0-14 and 67.46% aged 15-64. This population structure dominated by the working-age population (15-64 years old) is often referred to as the "golden population structure" or "demographic dividend," which means the region will have a higher labor participation rate and productivity, as well as greater purchasing power and consumption potential.

Having many young people does not entirely equate to high average order value and profit. Companies that have tried the waters in Southeast Asia have already learned this lesson. Currently, people are still accustomed to comparing Latin America with Southeast Asia, another emerging market, but in reality, their business experiences are vastly different."

In the observation of Guo Wei, the founder of Thunderobot, although Southeast Asia has a large population base and a younger population structure, "purchasing power in Southeast Asia is relatively low, while Latin America's purchasing power falls between Southeast Asia and mainland China." Currently, the average order value of Thunderobot's core products sold on MercadoLibre exceeds $1,000, with the highest-priced gaming laptop selling for up to $2,600.

The reason for the high purchasing power is related to the shopping habits of Latin American consumers. Shi Yuwen, the business head of MyWinni, found during her research that "Latin American consumers don't like to save money very much. Some Latin American countries use a weekly pay system, so people tend to spend their wages immediately after receiving them." At the same time, most Latin American countries have been plagued by inflation, and to stimulate consumption during inflationary periods, governments have encouraged consumers to pay in installments since the last century. After decades of development, installment payments have gradually become popular in Latin America. This kind of "carpe diem" consumption habit is obviously beneficial to sellers.

The demographic dividend and good purchasing power have already provided Latin America with the foundation most needed by the consumer industry. But for sellers, what is most attractive is a transformation called the "e-commerce economy."

With the rapid development of local internet and digital technology, the Latin American e-commerce market is experiencing unprecedented growth. According to Statista's "Number of E-commerce Users in Latin America, 2017-2029" report, by 2026, there will be 340 million e-commerce consumers in Latin America, surpassing the total population of the United States. Among them, the Brazilian market alone has 100 million e-commerce consumers; from 2019 to 2023, the compound annual growth rate of retail e-commerce in Latin America was as high as 29%, and it will continue to maintain double-digit growth in the next three years. Specifically, Brazil and Mexico will continue to lead the growth of the e-commerce market in Latin America.

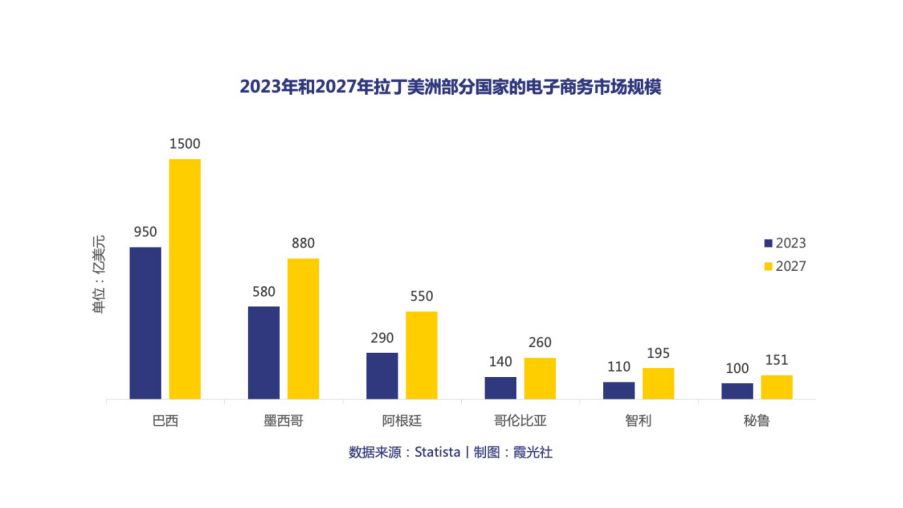

E-commerce market size in selected Latin American countries in 2023 and 2027. Sellers' research also verifies the credibility of the data. During a visit to Mexico, Guo Wei found that "there are many large malls there, with dedicated areas for selling electronic products like computers, but there are no computer malls like Huaqiangbei or Zhongguancun. I was thinking, if there isn't enough offline display space, then the potential must be online."

As a veteran cross-border player from the "LightInTheBox" independent station era, Sun Zhaowu, CEO of CUBOT, found that "there is great potential for growth in Latin American e-commerce penetration, which was only around 10% before and has cultivated many users' online shopping habits during the pandemic, and this trend is continuing." Currently, CUBOT has decided to focus on Latin America as a key market in recent years.

Before entering the Latin American market, Sun Zhaowu had long been cultivating the European and American markets. After comparing the two, he discovered the effectiveness of the "time machine" theory. "The smartphone market in Latin America is still in its early stages of development, which can be understood as being three to five years behind Europe and the United States."

In fact, not only the electronics manufacturing industry but the entire manufacturing and industrial sectors in Latin America are still in the developmental stage. Since the beginning of the last century, when Latin American countries began to emulate the high-welfare systems of Europe and the United States, they have underinvested in their domestic manufacturing and industrial sectors, leading to challenges in industrial development and a gap in the market's demand for product diversity.

CUBOT's rugged phone, featuring drop, water, and dust resistance. Source: CUBOT.For Chinese sellers with well-established supply chains and decades of e-commerce experience, this is a huge opportunity. The key is to find long-standing but unsatisfied market demands.

"Big smartphone brands are always pursuing thinness and lightness, but in Latin America, I've observed that many groups have high demands for phone durability, like renovation workers. Dropping their phones is quite normal for them, so phone screens sell very well there," said Sun Zhaowu. Based on this, CUBOT's positioning in the Latin American market is as a "rugged phone," featuring drop, water, and dust resistance.

Guo Wei is focusing on the gaming laptop and accessory sector. According to the 2023 Global Games Market Report by market research firm Newzoo, the total revenue of the gaming market in Latin America was $8.7 billion in 2023, an increase of 3.8% year-on-year. Amidst the slowing growth of the global gaming market, Latin America is one of the few regions with a growth rate exceeding 3%, and its market revenue will continue to grow due to improvements in mobile internet infrastructure.

"Although there are computer display areas in offline malls in Latin America, accessories such as keyboards, mice, and controllers are scarce. Products priced between $30 and $50 have great potential, and consumers are willing to try new things." Currently, Thunderobot's positioning in Latin America is mainly as an "e-sports ecosystem computer brand." "Gaming enthusiasts certainly want a complete product portfolio, not a mishmash of products," Guo Wei said.

Drawing on previous experience in the women's fashion industry and research on the Latin American market, Shi Yuwen targeted "evening gowns."

Latin Americans are renowned for their love of parties and gatherings, and their entertainment activities are endless. In Gabriel García Márquez's renowned novel "One Hundred Years of Solitude," there are numerous descriptions of the Boendia family's carnival feasts and revelry in Macondo. Latin American consumers have a high passion for fashion, and during the four years of operation in the Mexican market on MercadoLibre, Shi Yuwen often received "buyer shows" that were even better than the model photos. "These were all voluntarily provided by buyers. They would imitate the shoots or outfits of internet celebrities, with a very ceremonial feel."

Source: MyWinni.Currently, MyWinni still focuses on evening gowns and party wear, tapping into a niche segment in the fiercely competitive fashion category that has doubled its GMV data.

The untapped potential in the Latin American market is like a treasure trove waiting to be explored. As long as sellers explore with care and gain a deep understanding of local consumer needs and preferences, they may open up a commercially viable track with unlimited potential.

In addition, according to Xiaguang Intelligence's "2023 Latin American E-commerce Market Research Report," Chinese products are also quite popular among Latin American consumers. JPMorgan Chase data shows that currently, cross-border goods in Latin America mainly come from China, the United States, and Japan, with Chinese products accounting for up to 62%, about 2.6 times that of the United States.

After operating in the Mexican store for some time, Sun Zhaowu changed the phone packaging to colorful designs.

"We thought phone brand packaging would either be high-end black or pure white, but in the offline Latin American market, I rarely see these colors. They prefer colorful designs like bright yellow because consumers believe it must be eye-catching. We've also launched many colorful phones," Sun Zhaowu said when discussing localization strategies. "Dual speakers are a must. Latin American consumers have high demands for daily music. They might start dancing to the music while chatting, and a group of people start dancing. They're quite happy all day long."

Photo: Unsplash.This is a localization challenge that cross-border e-commerce often faces. Before a product is officially tested by the market, you cannot make complete localization preparations based on research alone. Almost every seller needs to receive a certain amount of feedback before specifically adjusting the product design to better suit local consumers.""We need to test the domestic product first and optimize it in the process," Guo Wei said. Taking keyboards as an example, the keyboard layout used in China is the same as that in the United States, but keyboards in Latin America need adjustments - the keyboard needs to use phonetic symbols for Spanish-speaking regions, and the Enter key needs to be changed from the "straight version" used in China to the "curved version." "Although they can use the domestic keyboard layout, the consumer experience will definitely not be good enough."

Challenges also focus on the logistics aspect. Latin America is the continent farthest from China. For cross-border sellers to deliver goods to consumers in a timely manner, they must prepare goods in advance.

The strategy for stock preparation is crucial. "If you prepare too little, you won't have enough to sell; if you prepare too much, you'll have excess inventory," Guo Wei recalled. When Thunderobot first entered the Latin American market three months ago and participated in its first MercadoLibre promotion, it prepared goods based on triple the daily sales of the past three months in the store. "But we sold out the next day, and the inventory was insufficient, resulting in missed sales opportunities. We felt quite sorry at the time.""The risk of lost goods in Latin America cannot be ignored. "Every seller may encounter lost goods. On the one hand, we need to constantly change the packaging, from tape wrapping to plastic bagging, and then upgrading to iron mesh or even wooden boxes. When problems arise, we can only find solutions and constantly adjust based on actual conditions," Sun Zhaowu told Xiaguangshe."

At this point, sellers may be most concerned about whether the platform's support and solutions for sellers can address their current troubles.

When discussing lost goods, Sun Zhaowu said that based on his experience with MercadoLibre over the past year, he believes the platform provides sufficient support for sellers. "MercadoLibre's warehouses are the safest. I haven't heard of any issues with overseas warehouses, like robberies or heists. There have been no problems with the platform's last-mile delivery, but when using third-party small packages, lost packages and rejections often occur."

Regarding warehouse capacity issues, MercadoLibre has also proposed better solutions. Starting from June this year, the overseas warehouse capacity quotas for MercadoLibre's Mexican and Chilean sites officially took effect. The platform will intelligently allocate based on the Inventory Performance Index (IPI) and historical sales data, and reward merchants with consistently high IPI with additional warehouse capacity. This approach is more intelligent and flexible for merchants, reducing the risk of capital occupation and inventory stagnation.

It is worth mentioning that MercadoLibre is also increasing its investment in the four major Latin American sites to better serve sellers and consumers.

In March this year, MercadoLibre announced investments in the Mexican and Colombian markets for 2024. It will invest $2.45 billion in the Mexican market, an increase of 48% over 2023, and $380 million in Colombia to advance the company's technology and strengthen its logistics operations and other key areas.

MercadoLibre's significant investments are based on its optimistic performance and confidence in the future growth potential of the Latin American market. According to MercadoLibre's first-quarter financial report for this year, the company achieved revenue of $4.3 billion, a 36% increase over the same period last year; quarterly GMV reached $11.4 billion, a 21% year-on-year increase; and net profit was $344 million, a 71% year-on-year surge.

For sellers, the data speaks for itself. Challenges always come with opportunities. However, if we compare, the current opportunities in the Latin American market outweigh the challenges.

From their future plans, we can glimpse their expectations for the Latin American market:

Thunderobot Technology will combine online and offline channels in the future to provide consumers with more experiences, further building an "esports full-ecosystem computer brand"; the share of the Latin American market in CUBOT's total revenue has risen to 30% within a year, and this year, the Latin American market is CUBOT's absolute operational focus; MyWinni continues to focus on the Latin American market, strengthening brand building through social media marketing and other methods.

Now, let's rewind to 2019.

MercadoLibre, the largest e-commerce platform in Latin America, launched the CBT (Cross Border Trade) project, opening up four major traffic sites in Brazil, Mexico, Colombia, and Chile to Chinese sellers and simultaneously inviting investment within China. MyWinni became the first batch of Chinese sellers to join MercadoLibre, followed by Thunderobot Technology and CUBOT.

They may not have foreseen that this step not only marked an important milestone in their business development history but also positioned them at the forefront of the globalization of e-commerce.

In Latin America, the era of e-commerce transformation has only just begun.