Pinduoduo Loses Its 'Magic'

![]() 11/22 2024

11/22 2024

![]() 584

584

By Zheng Yijiu

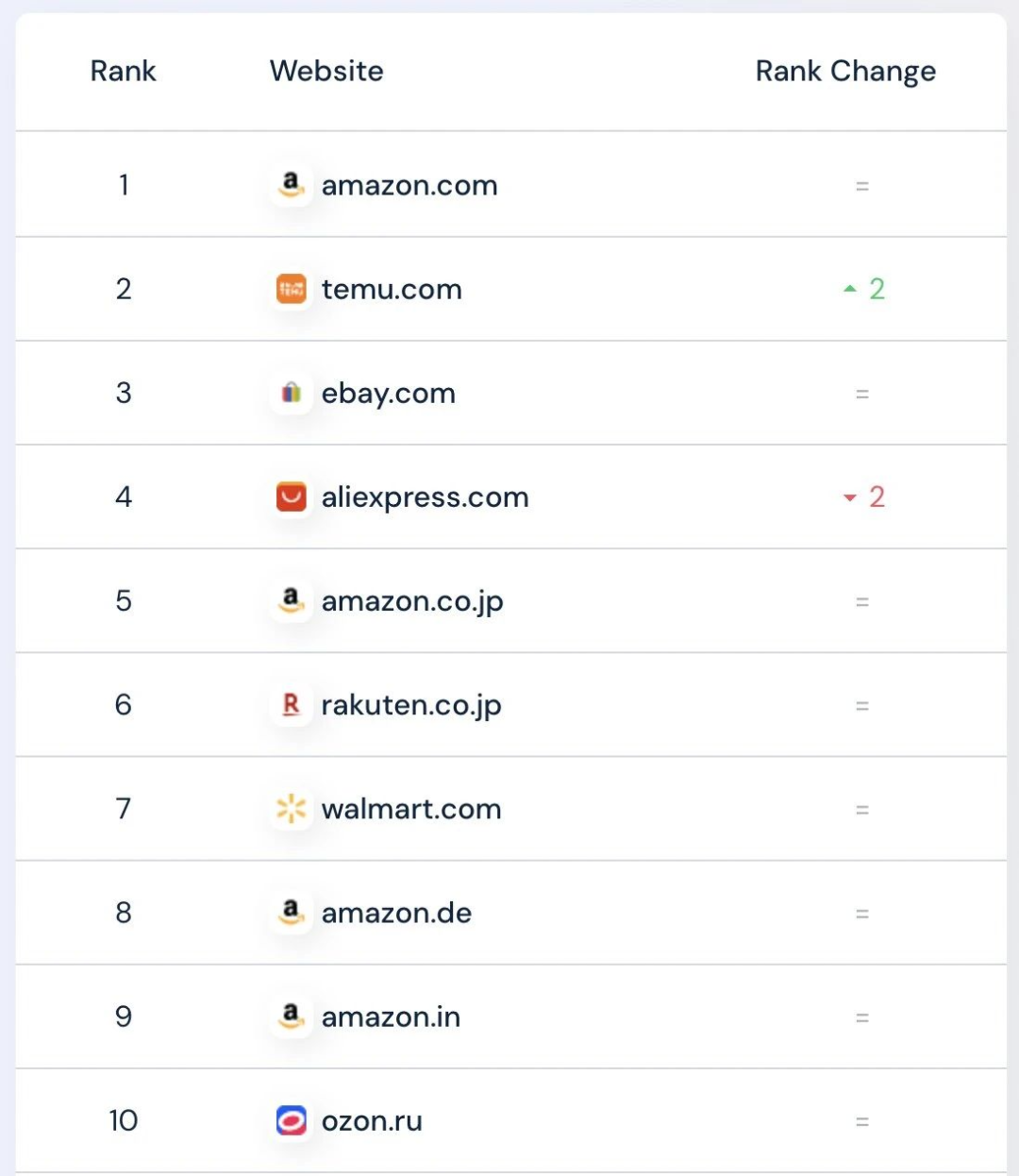

"Temu is the new Amazon"—this was an optimistic prediction widely circulated on Wall Street over the past two years. Now, it sounds ironic. As Pinduoduo's ambitious attempt to go global is falling from its "American Dream" into a "global nightmare," one can't help but ask—how did this once-seen golden key to unlocking the global market turn into a heavy shackle in just a year? For Pinduoduo and Temu, 2024 was supposed to be the most dazzling year in their globalization journey. The Chinese e-commerce giant's cross-border subsidiary, Temu, rapidly penetrated the US market and became the second-largest shopping app after Amazon.

Global e-commerce market share rankings, as of September 2024

Data Source: SimilarWeb

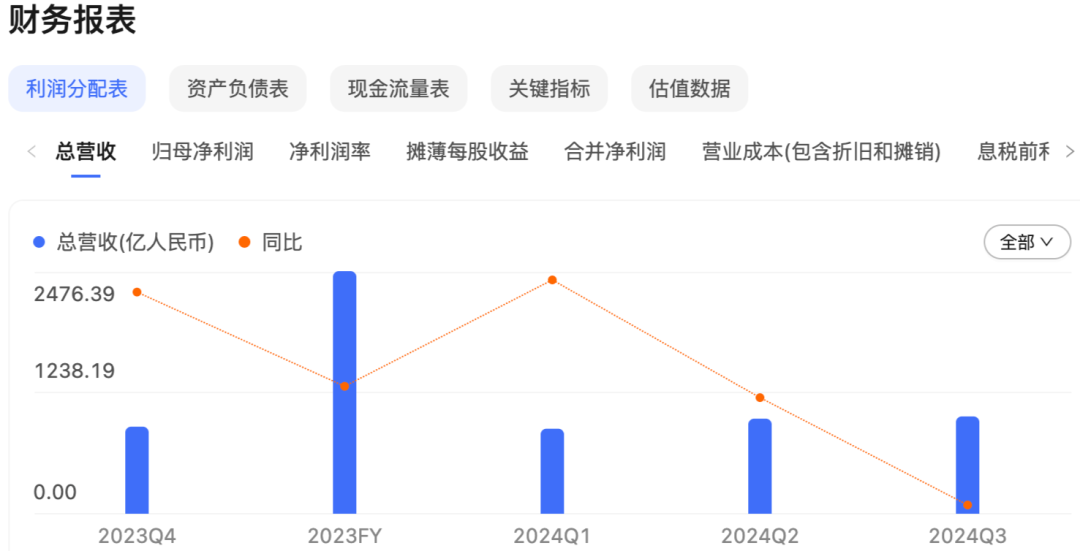

Wall Street analysts were amazed by this "growth myth": Temu gained 49 million monthly active users in less than two years, equivalent to 74% of Amazon's US user base. This rapid growth fueled a 94% year-on-year increase in Pinduoduo's third-quarter revenue last year. The dazzling numbers once led investors to see the possibility of Pinduoduo replicating itself overseas, fostering high expectations for the company's globalization prospects. However, just a year later, this once-seen tool for opening a new chapter in globalization has quietly turned into a heavy shackle on Pinduoduo's development path. The latest third-quarter financial report ruthlessly revealed how the "myth" was shattered—revenue reached 99.35 billion yuan, a year-on-year increase of 44%, which is not only the lowest growth rate since the second quarter of 2022 but more importantly, adjusted net profit fell 22% quarter-on-quarter to 27.45 billion yuan, far below market expectations.

Pinduoduo financial report Source: Baidu Stock Connect

Due to investors' concerns about growth prospects, the company's share price plummeted by nearly 11% after the financial report was released. This dramatic turn was not accidental. Pinduoduo's management admitted in the financial report conference that "competition in the globalization business is becoming increasingly fierce. With this competition combined with a complex external environment, our business is bound to experience some fluctuations and impacts." Behind this nearly frank statement lies the transformation of Temu from a highly anticipated growth engine into an unpredictable strategic burden. More worryingly, this transformation seems to have just begun. 01 Globalization Dilemma: Temu's Dual Shadow In the US market, Temu is facing an unprecedented dual test of political risks and competitive pressure. Donald Trump's campaign promise to impose a 60% tariff on Chinese goods is now becoming a reality, like a sword hanging over Temu's head. This is not just about simple arithmetic of increased costs but a severe challenge to the foundation of its low-cost cross-border e-commerce model. As Morgan Stanley's analysis points out, once the tariff exceeds the 50% threshold, Temu's price advantage, which relies on quickly capturing the market, will disappear. Temu is also changing, but the results seem equally unsatisfactory.

Source: Network

According to LatePost, over the past ten months, Temu has sent multiple first- and second-tier executives to lead teams, hoping to double the number of product offerings this year. At the same time, the semi-managed business launched in March has also set an aggressive target of achieving 20 billion USD in GMV this year, accounting for one-third of the overall target. As of October this year, in the two major markets of Europe and the US, the semi-managed model, which was originally seen as a further challenge to Amazon, failed to meet the original target in terms of the number of recruited merchants and products. To make matters worse, the competitive landscape in the US market is fundamentally changing. Amazon, keenly aware of the threat, is directly confronting Temu's low-price strategy by launching a new section in its app dedicated to selling low-priced items under 20 USD. The direct response from industry giants, coupled with rising customer acquisition costs, is forcing Temu to shift its advertising budget from the US to other regions.

Embarrassingly, this strategic shift has not only failed to alleviate pressure but has exposed deeper issues: even in markets outside the US, Temu's growth momentum is noticeably weakening, and its global app downloads have significantly declined from the peak in July 2023. 02 Paying the Tuition: Compliance Challenges and Strategic Costs If the challenges in the US market are still within sight, the undercurrents in the European market are even more concerning. The latest European Commission investigation directly points to systemic deficiencies in Temu's platform in restricting the sale of illegal products. This not only implies a potential penalty risk of up to 6% of global revenue but also highlights the deep dilemma faced by cross-border e-commerce in the globalization process—how to find a balance between rapid expansion and compliance construction?

The European Commission initiates a formal investigation procedure against Temu

To address the previously criticized controversy of exploiting merchants, Pinduoduo has paid a far higher price than expected over the past two quarters. The company invested over 10 billion yuan in a fee reduction plan, attempting to stabilize supplier confidence through service fee refunds and reduced deposits. These measures directly led to a 48% year-on-year increase in fulfillment and payment processing fees, significantly eroding profit margins. Co-CEO Zhao Jiazhen said, "To remain competitive in pricing, we have paid higher costs than our competitors." Although referring to Pinduoduo's domestic business, this also reveals the essence of Temu's dilemma: fighting in a market without pricing power often comes at a higher-than-expected cost to maintain competitiveness. Deeper concerns lie in the strategic costs that are more difficult to quantify beyond explicit costs. From supply chain compliance to platform governance, from data security to brand building, each area requires continuous investment.

Source: Network

This not only tests Pinduoduo's financial resilience but also challenges its strategic resolve. As Haitong Securities downgraded the company's rating to neutral, it pointed out that geopolitical factors' medium-term impact on Temu is far from over. For Pinduoduo, the priority may indeed not be to continue chasing the fleeting "growth myth" but to resolve this tightening "shackle." In the foreseeable future, balancing growth aspirations with compliance costs and addressing political risks and competitive pressures will be crucial tests for this focused yet controversial e-commerce giant.

And to some extent, Temu's fate will also determine the next decade of Chinese e-commerce going global.

-END-