Baidu's revenue declines for two consecutive quarters: AI transformation pressure emerges, advertising business under pressure

![]() 11/22 2024

11/22 2024

![]() 677

677

Li Yanhong pointed out that performance was affected by macroeconomic challenges, AI search transformation, and changes in the internet content ecosystem.

@TechNewKnow Original

Whether it's the 2024 Baidu World Conference or the recently released Q3 financial report, the eye-catching data of "1.5 billion daily calls to the Wenxin large model" has become a new topic of conversation for Baidu.

Indeed, as a company with a strong AI gene, Baidu is undoubtedly a beneficiary of this wave of AI, but the market does not seem to be buying it.

After the Hong Kong stock market closed on November 21, Baidu released its third-quarter earnings. Subsequently, U.S. stocks opened with a gap down and closed with a 5.9% decline; the next day, Hong Kong stocks opened with a roughly 9% decline throughout the day until closing.

In fact, Baidu's financial report is not outstanding on a fundamental level.

01

iQIYI drags down performance

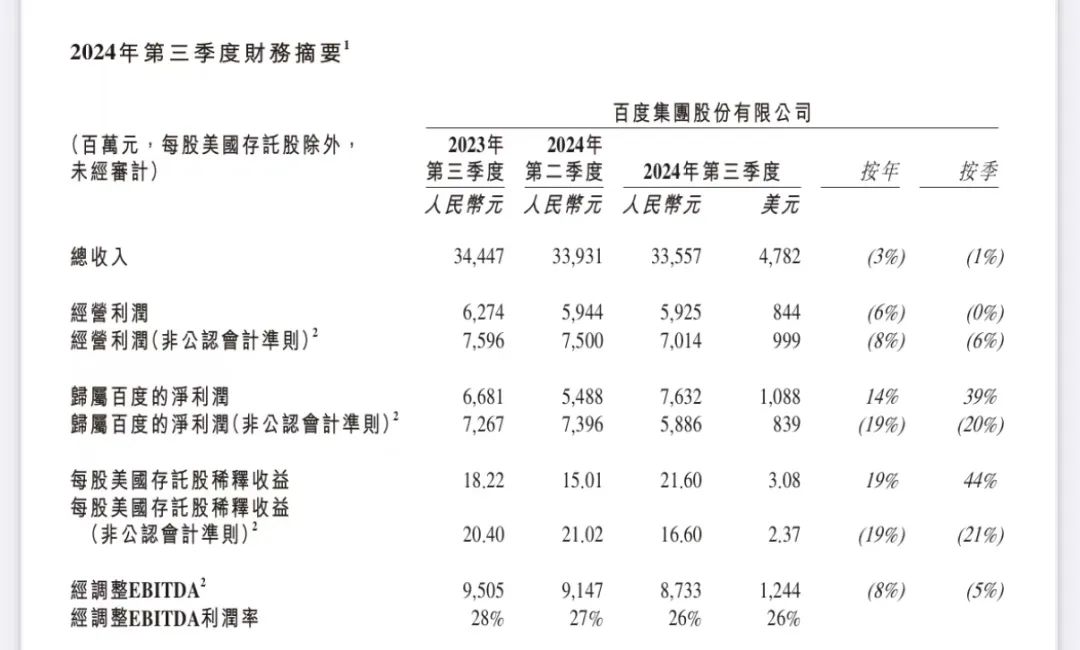

The financial report shows that Baidu achieved revenue of 33.6 billion yuan in Q3, a year-on-year decline of 3 percentage points, recording the largest drop in more than two years. Previously, analysts expected 33.43 billion yuan. In fact, this is the second consecutive quarter of revenue decline for Baidu, and the decline is continuously expanding.

In terms of net profit, Baidu's net profit attributable to shareholders was 7.63 billion yuan, a year-on-year increase of 14%; however, under Non-GAAP, net profit fell 19% year-on-year to 5.89 billion yuan.

From a business perspective, iQIYI dragged down Baidu's performance to some extent, with this segment's revenue decreasing by 10% year-on-year to 7.2 billion yuan. However, Baidu's "core" revenue in the third quarter reached 26.5 billion yuan, roughly the same as the previous year. Among them, online marketing business remains Baidu's primary source of revenue. This quarter's online marketing revenue was 18.8 billion yuan, a year-on-year decrease of 4%; non-online marketing revenue was 7.7 billion yuan, a year-on-year increase of 12%, mainly driven by the intelligent cloud business.

During the earnings call, Baidu's co-founder and CEO Li Yanhong attributed this to: "macroeconomic challenges, our ongoing AI-driven search transformation, and the ever-changing internet content ecosystem."

A clearer perspective is that Baidu's advertising business is highly correlated with the macro environment. However, vertical sectors such as real estate, franchising, and healthcare continued to weaken in the third quarter. Nevertheless, Luo Rong, head of the Mobile Ecosystem Group (MEG), also stated that a significant improvement in advertiser spending patterns was observed in the fourth quarter, despite continued low consumer spending.

He pointed out that recently introduced economic stimulus policies would take some time to reach small and medium-sized enterprises and boost their confidence in advertising expenditures. Baidu remains cautiously optimistic about future recovery trends.

02

AI strategy impacts the advertising business

Baidu has been actively promoting the transformation of traditional search functions through AI technology. However, for traditional search giants like Baidu and Google, developing AI search also means a direct impact on their core advertising business, as it bypasses advertiser content to provide users with AI-generated answers directly, reducing ad exposure and clicks.

It is worth mentioning that, similar to traditional search engines, advertising may become one of the primary revenue sources for AI search in the future. According to U.S. media disclosures, the currently popular AI search engine Perplexity has planned to introduce an advertising model on its search platform and is in talks with brands such as Nike and Marriott to launch a "sponsored" question model (brand-related search answers), with ads sold for over $50 per thousand impressions.

However, under this model, it remains unknown whether AI will compromise the quality of generated answers, achieve the desired effects for advertisers, or be accepted by users. Before long-term commercial monetization can be achieved, Baidu indeed needs to withstand some pressure.

In fact, since the previous quarters, Baidu's management has repeatedly emphasized during calls that although the AI-centric strategy will cause short-term pressure on the advertising business, it should be viewed with a long-term perspective. Luo Rong, head of the Mobile Ecosystem Group (MEG), also stated that Baidu is still in the early stages of exploring commercial monetization opportunities for AI search and will prioritize enhancing user experience in the short term rather than rushing to capture market share.

In addition to regular business and AI, the intelligent driving service Apollo Go has also been highly anticipated, but its growth rate has also significantly slowed down this quarter.

Data shows that as of October 28, Baidu's autonomous driving service has provided over 8 million rides nationwide; 988,000 rides were provided in the third quarter, a year-on-year increase of 20%. The slowdown in Apollo Go's order growth rate is relatively easy to understand as its business is only conducted in specific areas of a few cities, limiting order volume growth.

Although the expansion of Apollo Go in cities like Wuhan represents a significant step forward for Baidu in mobility services, it still faces long-term challenges amid public opinion pressure and competition from other platforms.

From a secondary market valuation perspective, Baidu has become an "undervalued stock" in the U.S. market, with a PE-TTM of just over 10 times in Hong Kong. This to some extent indicates that investors have developed irreversible pessimism towards the company. Standing at a critical juncture of comprehensive AI transformation, it may be that the market has yet to see Baidu's value, or perhaps it is difficult for Baidu to realize its value.

- The end -