Ele.me's First Step in the "New Three Years": Achieving Steady Growth with Rhythm

![]() 11/25 2024

11/25 2024

![]() 546

546

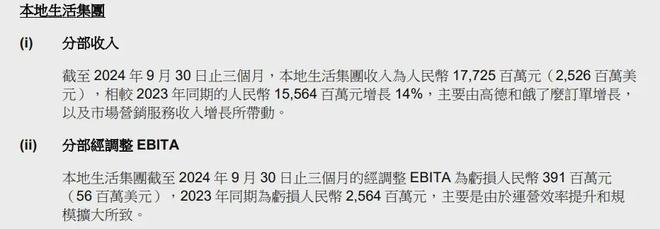

On the evening of November 15, Alibaba announced its second-quarter results for fiscal year 2025.

The financial report shows that Alibaba's Local Life Group saw a 14% year-on-year increase in revenue to 17.725 billion yuan; adjusted EBITA losses narrowed from 2.564 billion yuan in the same period last year to 391 million yuan, exceeding market expectations.

Such achievements are closely related to the steady growth of Ele.me, the home delivery business of the Local Life Group, in this quarter.

'First take a step forward with the right foot for efficiency improvement, then take a step forward with the left foot for scale growth, and then alternate between the two.' This is how Ele.me internally describes its development plan.

Obviously, after smoothly transitioning through the leadership change, Ele.me is striving to gradually develop the rhythm of its "left and right feet" for the "new three years."

01 Further Good News

In March this year, Ele.me completed a generational change in management, with Yu Yongfu handing over the top position to the "youngest management team in history": Chairman Wu Zeming, born in 1982, and CEO Han Liu, born in 1988, both post-80s managers.

In modern management theory, organizational development often occurs in three-year cycles. Over the past three years, under Yu Yongfu's leadership, Ele.me has achieved its phased goal of reducing losses and is on a path of healthy development.

In a vertical comparison, from fiscal years 2022 to 2024, Alibaba's Local Life Group's revenue increased from 44.616 billion yuan to 50.249 billion yuan to 59.802 billion yuan, continuously climbing; net losses narrowed from 22.092 billion yuan to 13.148 billion yuan to 9.812 billion yuan, primarily due to "improved unit economic efficiency and increased transaction scale at Ele.me."

If the past three years were mainly about the "right foot" of overall operational efficiency improvement, in the new three years, the younger leadership team has begun to take a bigger step with the "left foot."

The financial report data provides evidence—

Following revenue exceeding the 16 billion yuan mark in the first quarter of fiscal year 2025, Alibaba's Local Life Group's revenue in the second quarter approached 18 billion yuan, again achieving double-digit steady growth.

At the same time, losses narrowed to 391 million yuan, reaching a level of "minimal losses."

In the financial report, Alibaba repeatedly mentioned that this was mainly driven by the rapid growth of orders on Ele.me and Gaode Maps, as well as the increase in marketing service revenue.

Aiming for the "new three years," what should Ele.me do?

At the 2024 Instant E-commerce Future Business Summit held in Shanghai at the end of October this year, Ele.me CEO Han Liu publicly announced to the market for the first time that in the "new three years," Ele.me will continue to adhere to its long-term strategic track of "1+2."

The '1' represents Ele.me's commitment to being a healthy-growing, consumer-centric home delivery dining platform. The '2' represents two newly identified growth tracks for Ele.me: instant retail that aligns with Ele.me's characteristics and an instant logistics service network that extends market value.

02 Firmly Grasping the Growing Trend of Instant E-commerce

As everyone knows, takeout is Ele.me's core business, but the categories of home delivery services have long exceeded dining and have great development potential, which we are familiar with as instant retail.

According to the "2024 Annual Online Shopper Trends Research Report" released by Nielsen, more and more online shoppers are beginning to use and rely on instant retail platforms. This year, the penetration rate of third-party home delivery service platforms among online shoppers increased from 49% last year to 59%.

The growing instant demand is driving the market size upwards. The latest report from the Market Research Institute of the Ministry of Commerce shows that as of 2023, the order volume of the domestic instant delivery industry was approximately 40.9 billion, with a year-on-year increase of 22.8%, and the market size of instant delivery was 341 billion yuan, with a year-on-year increase of 24.8%.

Currently, the instant e-commerce industry continues to maintain high compound growth, with an average annual growth rate exceeding 30%. It is expected that by 2027, the market size of instant e-commerce will exceed 5 trillion yuan.

From the recent summer season, it can be seen that while aligning with the growing trend of instant e-commerce, Ele.me also strives to more accurately meet user needs.

Summer is inherently a peak season for instant consumer demand due to the heat, making people more inclined to order takeout. This summer, the European Championship and Paris Olympics, two major global events, further stimulated the local consumption trend of "staying at home to watch matches."

Data shows that during the Olympics, Ele.me engaged over 250 million people in interactive activities through fun game mechanics and rich interactive designs, transforming the "overwhelming traffic" of the Olympics into "retained business traffic," leading to breakthrough growth of over 100% for many merchant brands on the platform.

Taking advantage of this opportunity, Ele.me achieved peak business key indicators this summer. According to its disclosure, under the combined influence of the match-watching economy and traditional festivals like the Beginning of Autumn and Qixi Festival, Ele.me set new all-time highs in orders and transaction volumes for both dining and retail on its platform this summer. On the day of the Beginning of Autumn, Ele.me's order volume surpassed its historical peak; during the Qixi Festival, Ele.me's retail order volume, transaction volume, monthly active users, and other indicators surpassed the platform's historical peaks.

03 Ele.me's "Differentiated" Determination

With various players entering the instant retail market in recent years and competing fiercely, winning in this chaotic environment undoubtedly tests the comprehensive abilities and differentiated advantages of participants.

At the 2024 Instant E-commerce Future Business Summit, Ele.me sent a strong signal that it is firmly committed to an "ecological" approach in the new three years.

At the conference, Lei Yanqun, President of Ele.me's Merchant Ecosystem, said that for the next three years, Ele.me will use data accumulation from intelligent CRM to help merchants accelerate the development of their membership systems, enhance consumer operations and management, and support merchants in digital and intelligent applications. To this end, Ele.me has launched the "Pentium Plan," investing 1.5 billion yuan of special funds to help dining brand merchants enhance their digital and intelligent capabilities, thereby driving business growth.

At the same time, Hu Qiugen, Senior Vice President of Ele.me, also stated that Ele.me will continue to invest in instant retail and collaborate with multiple platforms within the Alibaba ecosystem, including Taobao, Alipay, and Gaode Maps, to break through time and space fulfillment constraints in instant retail and better serve consumers. "Ele.me does not compete with merchants in the supply chain and insists on a win-win ecological approach," Hu Qiugen emphasized at the conference.

Hu Qiugen introduces Ele.me's instant retail development strategy

Unlike some industry platforms that operate their own businesses, it is clear from this conference that Ele.me is determined to focus on an "ecological" approach. This means that Ele.me does not intend to operate directly or be satisfied with being a direct procurement channel for a certain brand. Ele.me's differentiated "ambition" lies in providing a platform and building various tools and capabilities around this platform to enable brands to deeply participate in instant retail business, thereby enhancing the controllability, growth, and sustainability of the business process.

It is not difficult to see that Ele.me has become increasingly committed to the development path of "promoting technological innovation and advancing with the ecosystem." With an increasingly clear differentiated strategic layout, Ele.me is also laying the groundwork for growth in the "new three years."

•END•