Old Iron can't support Kuaishou's next round of development

![]() 11/25 2024

11/25 2024

![]() 517

517

The "longest Double 11 in history" came to a successful conclusion in 2024. With the financial support of Kuaishou's loyal users, the number of products with transaction amounts exceeding 100 million yuan increased by 200% year-on-year, and the GMV of high-priced products priced above 1,000 yuan also achieved a year-on-year increase of 110%.

In the current economic downturn, the income levels of loyal users may not have changed significantly, but their spending power has been effectively driven by Kuaishou.

The contradiction here lies in the fact that, according to the market's previous perception of Kuaishou's e-commerce attributes, it is one of the few e-commerce platforms in China driven by a semi-acquaintance community trust mechanism.

'A family call is greater than heaven, anchors should quickly provide links,' but no one's family can grow exponentially every year.

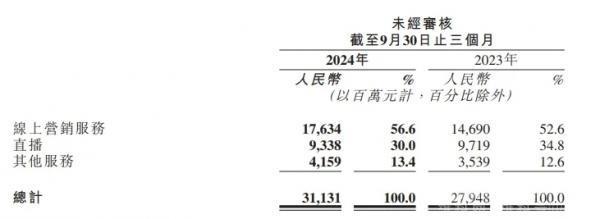

The secret to this growth stems from Kuaishou's traffic strategy transformation implemented since 2022: the platform gradually regained control of traffic allocation from anchors as part of a 'big family,' strengthening central traffic control to achieve a more efficient and commercially valuable allocation of traffic resources. This strategy has had a significant direct impact, with the platform's live streaming revenue accounting for a significantly reduced proportion of total revenue, dropping from 80.4% in 2019 to 30% in the most recent quarter.

According to Yuanchuan Research Institute, taking Xinba, the largest local powerhouse anchor on Kuaishou, as an example, his personal GMV contribution rate has sharply declined from one-quarter in the early stages to less than 5% in 2022.

The new business logic has effectively driven Kuaishou's development but also made long-time users feel alienated.

01

Kuaishou is on the fast track to growth

On November 20, Kuaishou released its third-quarter 2024 financial report, with total revenue reaching 31.1 billion yuan, a year-on-year increase of 11.4%, and adjusted net profit increasing to 3.9 billion yuan, a year-on-year increase of 24.4%.

In this quarter, Kuaishou's core business revenue, including online marketing services and other services (including e-commerce), achieved a year-on-year increase of nearly 20%, marking a significant step forward on Kuaishou's path to profitability.

Since the largest-ever organizational and management adjustments at the end of 2021, Kuaishou's strategic focus has shifted from user growth to profit improvement, transitioning from a 'subsidy expansion' model to a 'cost reduction and efficiency enhancement' strategy.

For an ordinary Kuaishou user, the only perceivtible change from this listed company's grand strategy is that previously, watching short videos could earn gold coins, with 10,000 gold coins redeemable for 1 yuan in cash.

But now, Kuaishou tells them: Old Iron, come and spend money here too.

In January 2022, Kuaishou launched the 'Chuan Liu Plan' to support white-label factories in upgrading to 'Kuaishou Brands,' accelerating Kuaishou's growth momentum. By 2023, Kuaishou had successfully achieved overall profitability and continued to maintain a high-growth trend according to the financial report for the first three quarters of 2024.

The primary driver of Kuaishou's growth comes from its online advertising business. This quarter, online marketing service revenue reached 17.6 billion yuan, accounting for 56.6% of total revenue, making it Kuaishou's largest source of revenue. Notably, Kuaishou's online advertising business relies more on advertising placements by its own e-commerce merchants rather than external advertising placement services. The company's financial reports from 2022 to 2023 clearly state that the growth in advertising revenue is 'primarily due to placements by e-commerce merchants.'

This makes its advertising revenue relatively stable, largely unaffected by industry cycles and macroeconomic fluctuations.

The market generally views Kuaishou's approach of 'left hand on advertising, right hand on e-commerce' as a closed-loop model. Like Pinduoduo, after securing a sufficient number of users, it precisely allocates traffic, wielding both a carrot and a stick to achieve its goals wherever directed.

However, obviously, one cannot take off from the ground by stepping on one's own foot. Even Pinduoduo rapidly expanded its user base through a 'burn money' strategy in its early stages, achieving significant short-term results but consuming vast amounts of capital; subsequently, its 'low price' and 'refund only' policies, while attracting users, also put pressure on merchant resources.

As a short video platform, Kuaishou's content appeal often obscures the issue of its customer acquisition costs.

According to the latest quarterly data, Kuaishou's e-commerce monetization model has had a negative impact on its existing user base to a certain extent, which remains significant even with the investment of significant sales costs. In the first quarter of 2024, Kuaishou's monthly active users (MAU) decreased by more than 3 million from the previous quarter, and continued to decline to 692 million in the second quarter, lower than market expectations of 699 million. Simultaneously, sales expenses in the second quarter reached 10 billion yuan, exceeding market expectations by 200 million yuan.

Kuaishou's high marketing expense ratio is particularly prominent, reaching 32%, far higher than the average level of 10% to 20% for mature social platforms. The market originally expected Kuaishou to gradually reduce customer acquisition costs or improve customer acquisition efficiency by leveraging its high user stickiness, but until the third quarter, Kuaishou had to further increase sales expenses to barely achieve the goal of 400 million daily active users (DAU).

The attributes of a short video platform have not helped Kuaishou offset losses in the process of profitability through natural growth but have, instead, made Kuaishou's growth more challenging in the current market environment.

02

User churn: no new iron coming, old iron leaving

On August 16, 2023, Er Lv, a well-known anchor with 48 million followers and one of the original 'Six Great Families' on the Kuaishou platform, was penalized by local public security authorities for fabricating a script during an outdoor live stream in Qingdao. Kuaishou promptly responded by announcing an indefinite ban on his account.

This incident coincided with a crucial moment for Kuaishou, just before the release of its financial report. Kuaishou delivered its best financial report since personnel changes, achieving profitability at the group level for the first time with revenue reaching 27.74 billion yuan, a year-on-year increase of 27.9%, marking the company's official entry into the stage of overall profitability.

This ban and profitability are like a microcosm of changing times.

Before this, the 'Six Great Families' were synonymous with Kuaishou's content and e-commerce ecosystems. The Xinba Family, Sanda Family, Er Lv Family, Fangzhang Family, Zhang Ersao Family, and Paipaiqi Family each rose to fame in different ways but shared a commonality: they all scolded Kuaishou during their live streams.

This logic of 'eating from the platform while scolding it' is simple and brutal because, in the past, they played a crucial role in driving traffic and commercial monetization on Kuaishou.

Under this relationship model, a complex dependency forms between family anchors and the platform, also displaying elements of creators and content service teams. As content creators, family anchors need the platform to provide traffic and support; the platform, in turn, relies on these anchors to attract users and achieve commercial monetization. This relationship requires the platform to play a one-on-one service role, closely catering to the needs of anchors to drive traffic growth and commercial monetization.

Taking Xinba as an example, he once attempted to establish his own supply brand and APP, intending to dominate the supply chain. As a marketplace platform, Kuaishou formed a certain cooperative and competitive relationship with Xinba's supply chain business. Xinba's move, to some extent, reflected his view of himself as an equal partner to the Kuaishou platform.

However, as Kuaishou introduced factory-operated brands, adjusted traffic rules, and took a series of measures to weaken the influence of major anchors, the constraining power of major anchors gradually weakened.

From an industrial perspective, this change in the Kuaishou platform helps drive the entire ecosystem toward a more benign and healthy development. However, the historical impact is difficult to eliminate entirely. The fall of major anchors has not changed the attributes of the user groups they attracted, leading Kuaishou into a painful period of label tearing.

On the one hand, there is a significant lag in the market's perception of changes in Kuaishou's brand identity.

A typical example of this phenomenon is the recently emerging internet meme of 'Slow Foot Culture.' Originating from public ridicule and observation of certain quirky and sensational content on Kuaishou, collectively referred to as 'Slow Foot Culture,' it has gradually become a new label for Kuaishou's content ecosystem in the public eye. Under this label, impulsive behavior and borderline pornographic content among minors have replaced extreme acts like eating raw dead pork and chewing on glass by older generations as the new focus of discussion.

For platforms with distinctive labels, such as the lifestyle sharing platform Xiaohongshu or the anime-centric Bilibili, expanding their user base often faces greater resistance. However, this labeling also brings a positive aspect, with internal users showing higher retention rates due to the strong label atmosphere.

On the other hand, Kuaishou has initiated internal ecological changes, making it difficult for some old users immersed in family-style stories to quickly adapt to the platform's commercialization pace, while also eroding the positive impact of its originally high retention rate.

Kuaishou's drastic adjustments to its e-commerce ecosystem have left old users in third- and fourth-tier cities feeling at a loss. They were accustomed to logging on to watch anchors chatting and competing for rankings, but now they frequently receive advertising pushes and shopping guidance.

Industry observers point out that ordering behavior in Kuaishou live streams is often based on 'human connection and loyalty,' representing emotional consumption by family fans to support anchors.

These internal and external changes represent a crisis within Kuaishou. Additionally, Kuaishou also faces challenges from the external environment.

On the one hand, Kuaishou's high sales expense ratio (around 30%) is relatively high compared to other platforms in the industry (10% to 20%). This has raised questions in the market about Kuaishou's advantages such as 'high private domain stickiness' and concerns about its long-term profit growth potential.

On the other hand, Douyin has achieved a significant lead in user data, with most internet celebrities emerging from Douyin. The upper limit of its platform growth further influences content creators' choices of creative focus.

Emerging competitors like Xiaohongshu are also actively deploying live streaming e-commerce. Meanwhile, Kuaishou's largest institutional shareholder, Tencent, has also entered the short video and e-commerce sectors through video numbers, relying on the powerful tool of social networking, with its subsequent growth potential far surpassing that of Kuaishou.

A short video platform is a pool of limited traffic but the core of all business operations.

For Kuaishou, regardless of how its internal revenue business adjusts, if it loses its user base in the traffic competition, all efforts will be in vain. Although Kuaishou has transitioned from 'burning money for growth' to 'turning losses into profits' and achieved steady growth in performance, the market still has high expectations and doubts about its future growth path.

Looking back to 2021, Kuaishou invested up to 44.2 billion yuan in sales costs but failed to significantly narrow the gap with Douyin in monthly active users. Nowadays, in an increasingly competitive and volatile market environment, it is undoubtedly more difficult for Kuaishou to exchange money for growth.

Faced with the continuous loss of loyal users, Kuaishou's next choice is crucial.