Sevenfold app monetization business in one year

![]() 11/25 2024

11/25 2024

![]() 674

674

Who is the hottest AI stock this year? If you ask this question in the first quarter, the answer would still be SMCI. If you ask the same question two months ago, the answer would be NVIDIA. However, to answer this question today, the most suitable stock title falls to a new company, Applovin.

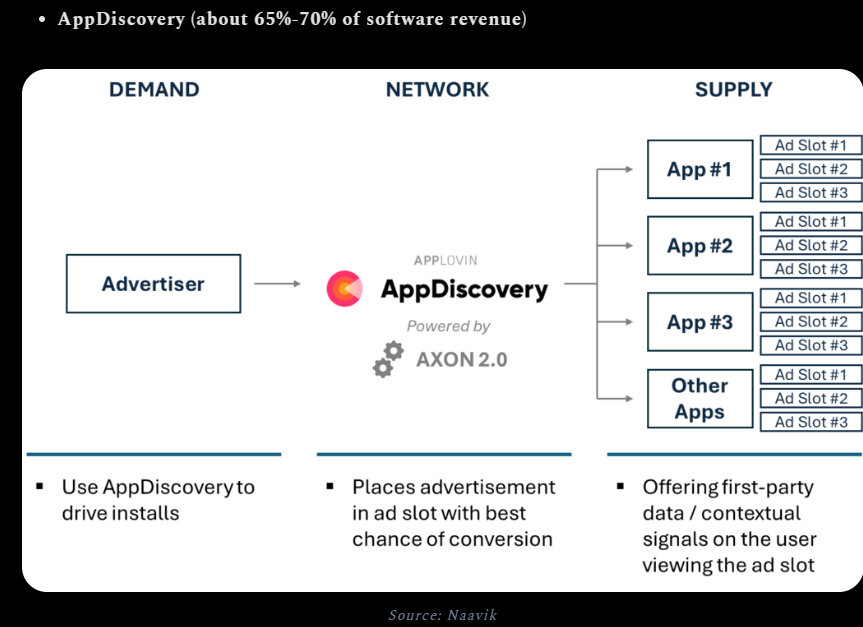

This company primarily serves as an advertising intermediary, helping a large number of low-tier internet apps monetize user traffic by placing advertising space on the Applovin platform. At the same time, Applovin tags and categorizes the user demographics behind these apps, organizing these advertising spaces and providing them to advertisers. This includes but is not limited to consumer goods companies, pharmaceutical companies, and other internet software companies.

This forms a considerable bilateral network in the market without the need for substantial physical and personnel assets, as is the case with food delivery or ride-hailing services. Everything operates online, making it an asset-light business. Since the beginning of this year, the company has successfully promoted business development using AI, gradually increasing its revenue growth rate. The entire Wall Street is looking forward to a major hit in AI application, proving the value of significant investments in AI. Applovin's success has naturally become the answer everyone wants. Stimulated by its financial report, its share price has increased sevenfold in one year.

As the overall performance expectations of hardware stocks are already high, and it is difficult to have major surprises, these application stocks are also considered the core targets for the next round of AI investments, which will continue NVIDIA's explosive market performance. Applovin, alongside Palantir, has become the hottest AI stock. In the Chinese market, the focus has also shifted from hardware computing power to AI application stocks. Currently, it is essential to understand whether Applovin can maintain its market performance for two years like NVIDIA and what future growth potential it has.

I. Flow-based business model

Firstly, the online advertising business is the largest internet business. It has always been the preserve of giants like Tencent WeChat, Meta, Google, and ByteDance. The reason their business models are highly profitable is that they have a large user base and long daily average usage time. Traffic is an asset. Based on their traffic, placing advertising space allows for accurate targeting of users worldwide. The accuracy of targeting and the breadth of dissemination are certainly superior to offline advertising.

To date, any advertiser, regardless of industry - energy, consumer goods, industrial products, software, finance - cannot avoid advertising on these internet giants when promoting a new product.

However, the internet is vast. No matter how powerful the giants are, they cannot cover all traffic. There are still many people who spend a lot of time on a large number of fringe applications, including but not limited to niche media, social media, and casual games. These app developers are small, independent companies that find it difficult to collaborate with a wide range of advertisers, which would consume a lot of energy. Therefore, traffic monetization is low, which is also where their products have a relative advantage - less advertising and a better user experience.

Advertisers also do not segment and place ads on each small app individually. However, as the monopoly position of giants strengthens, the threshold for advertising with Tencent, ByteDance, Meta, and Google becomes higher, and the return on investment increases. In contrast, combining several suitable small niche applications to advertise on can also achieve the goal of accurately targeting the desired audience at a lower cost.

These needs naturally gave rise to traffic monetization matchmaking platforms, which is Applovin's business model.

However, for this model to succeed, it is not easy. Small apps need to receive advertising fees from Applovin and earn money to cooperate. Advertisers also need to be willing to advertise here and receive good returns.

Most advertisers still prefer internet giants, which have the most precise control over internet traffic and coverage of the population. Moreover, these internet giants can also undertake the monetization services of small apps because they have extensive advertiser resources.

For example, in China, a large number of low-monetization small apps, including many mini-program games, ad-supported game apps, reading apps, and niche social media apps, do not advertise directly. Instead, their advertising monetization functions are connected to WeChat or ByteDance, which allocate advertiser demands and share revenue.

However, this approach eventually leads to contradictions. The giants themselves have huge traffic and advertising space, so they prioritize earning from good ads on their own apps. As a result, small apps that connect to the advertising alliances of internet giants often receive low-quality advertising revenue. This has given opportunities for the development of companies like Applovin.

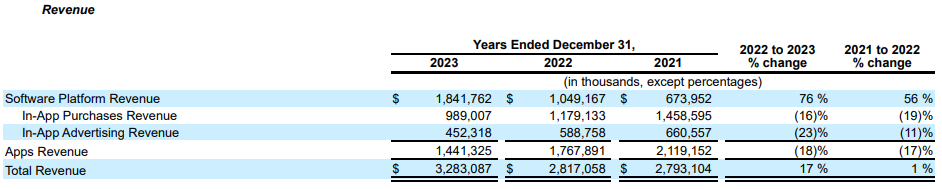

Applovin's development is also related to its strategic orientation. The company itself is a software company with a large number of apps, but in recent years, its in-app purchases and advertising revenue from its self-operated app business have been declining. In contrast, its platform revenue has increased. It can be said that the company's function as a software company is fading.

Self-operated apps should be used as a starting point to have enough advertising space to attract advertisers. Otherwise, if there are only a few third-party niche app advertising spaces at the beginning, advertisers will not consider it, and the business flywheel will not work. As a large number of small apps are connected to the company's system and the business model is established, the company begins to earn intermediary fees, shifts its focus, and starts using third-party niche apps as the core advertising space. The traffic of its own products is gradually replaced, which is reasonable.

At this point, Applovin has completed the transformation of its business model. Currently, the revenue growth of its advertising intermediary business exceeds the decline in its software business. The former model is better with higher profit margins. Therefore, we finally see an Applovin with significantly increased revenue and a surge in profit margins.

Of course, this model is not perfect. Revenue comes from advertiser investment. At the macro level, the growth rate of internet advertising is not fast. It only has a relative price competitiveness advantage over giants and can temporarily gain market share.

How much advertising revenue can be earned largely depends on advertising space. This is related to the size of internet niche traffic and the proportion of these niche apps connected to Applovin, which has a ceiling. In the end, no matter how many are connected, it will not exceed the number of ads received by Meta. It is unrealistic to expect it to grow into an internet giant.

As an intermediary, the commission is limited. The advertising fees paid by advertisers to Applovin are distributed to various niche app developers after the advertising campaign. In contrast, if it were Meta, it would earn most of the advertising fees because the advertising space of its apps also belongs to it. Therefore, Applovin's model is actually more difficult.

However, giants have their own problems, such as redundant personnel, high costs, and high R&D expenses. Currently, with a higher advertising input-output ratio, Applovin, which has a higher model operating cost, has also achieved a profit margin comparable to that of giants in the short term.

However, there is a possibility of a small loophole in this model. One day, some niche apps, which are the providers of advertising space, may grow into internet giants and receive advertisements directly. At this time, a significant amount of advertising space and advertiser demand will be lost, causing a significant impact on Applovin.

There is a real-life example of this loophole. During its development, TikTok placed a large number of ads on Meta and Google, which earned considerable advertising fees. However, they eventually found that they had nurtured TikTok.

In Applovin's client cases, advertisers are not only consumer goods or financial companies that only want to market but also a large number of internet companies that use Applovin for advertising. Their goal is, of course, to monetize traffic, either through paid in-app purchases or by selling advertising space. Some companies advertise with the intention of helping others advertise in the future.

II. Uninterrupted growth

Applovin's success is not due to its industry model advantage.

It is essentially still in the advertising industry, and other competitors have not benefited from it. For example, Unity is a game development engine company that also provides software monetization services. Many niche game apps are made using the Unity engine. After game development is completed, Unity packages and provides advertising space monetization, which naturally has strong synergistic advantages.

However, Unity has not done well. In the intermediary business, it is far behind Applovin. Unity always thinks about how to make money from niche app developers instead of aiming higher and establishing a system with everyone to connect with advertisers and do the business of Meta and Google.

In 2022, Applovin proposed to acquire Unity, which had a larger market value at that time. Unity felt that Applovin's market value was too small. Nowadays, Applovin has significantly outperformed Unity in both performance and market value and does not consider Unity anymore. Even if there is a gold mine at home, someone still needs to beg.

So, what is the key to victory? One is clearly strategic focus. As mentioned above, an intermediary's job is to optimize efficiency and provide successful advertising to advertisers to sustain the business.

Applovin itself has 200 niche apps. The question is whether to place more ads on its own apps or be selfless and place them on third-party apps. The cost is lower for the former. However, the company should be clear that having so many apps does not make it a software giant, and it cannot rely on this. Pooling efforts and absorbing the traffic of all niche apps can create efficient advertising and truly make the model work.

Another point is the optimization of costs and automation, which also involves the core theme: AI.

After various models were launched last year, the company quickly applied them. One is the tagging algorithm, which summarizes user attributes and classifies tags based on the limited usage information of niche apps to see what kind of advertising is suitable. This is actually consistent with the recommendation algorithm of most short video apps. The higher the recommendation accuracy, the better. However, there is a significant difference in difficulty between analyzing game play data and analyzing user preferences based on YouTube viewing duration or Instagram posts and pictures. This recommendation model naturally showcases Applovin's expertise. It is an AI micro-model that sets it apart from other companies. Of course, the more prominent advertising intermediaries can analyze more data and make more accurate tags. It can be said that this is a highly scalable model, and those who expand first will have the first-mover advantage.

In addition, the company is also the most efficient in advertising automation investment. The company automatically generates advertising materials through the Aigc model, significantly reducing traditional design labor and time costs, which further improves the company's efficiency in completing advertising tasks.

Therefore, it is reasonable to say that the company's business is promoted by AI, with the core being its internal algorithm micro-model and the rational application of external Aigc large models.

The company's share price has fallen significantly since 2021 but has also surged recently. This can only show the US stock market's overreaction to short-term performance.

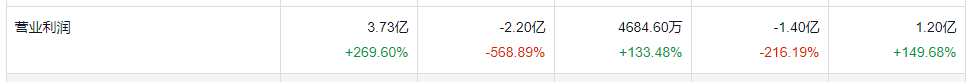

Since 2019, the company's performance has been growing without significant stagnation. In 2022, due to interest rate hikes and a downturn in the internet industry, revenue did not increase. As for profits, due to the change in business model, performance was poor from 2020 to 2022.

However, it was a bit excessive when the share price fell to one times price-to-sales.

In 2023, the company's profit margin and revenue reached new highs, and profits also surged significantly. However, despite a threefold increase last year, the share price has not yet recovered to its 2021 high, indicating that the company's valuation was restrained last year at 30 times, which is reasonable for a fast-growing internet advertising company.

Since 2024, the company's revenue has accelerated to 40%, and its profit margin has increased from 10% to 30%. Essentially, this represents the completion of the replacement of its business model.

After the market recognized the company's transformation essence as AI-driven, its valuation increased more than its performance, doubling. The valuation of advertising agencies may be 30 times PE, while the valuation of AI applications is 90 times. Last year's performance was not attributed to AI+, and there was no valuation premium. However, everything is different now.

AI+ does enhance growth, but unlike NVIDIA, the current surge in software company stock prices is still driven by valuation increases. However, NVIDIA's forward profit valuation for each quarter over the past two years has not been too high. Of course, the market may understand that selling hardware is ultimately a one-time deal with cyclicality, while software has long-term earnings potential, so the valuation increase is more optimistic. Regardless, Applovin is an example of how to effectively use AI. Assuming that future performance can continue to accelerate, with revenue growth exceeding 50%, there is still room for Applovin's valuation to continue to rise and create a bubble.

The advantages of AI are often given to companies that are good at utilizing it, especially those that transform traditional industry business models. However, the most critical point is that the target of profit seizure is truly a major giant. If it is not targeting the market of Meta or Google, it will be difficult for Applovin to achieve such significant performance growth. For many AI applications that have not yet clarified their commercial monetization direction or replaced current profit margins, it is difficult to achieve such results.

It is difficult to have the same space as Applovin if the same model is applied in China. Firstly, niche app mini-programs mostly operate through WeChat mini-programs rather than apps. Tencent has fortified its moat, making it more difficult for advertising intermediaries to emerge. In the business model, X.D. Network, which drives and distributes a large number of mini-games, may be in the closest state. However, whether it can succeed is a doubt similar to that of Unity. Utilizing AI is a capability, and it does not mean that the same ingredients will likely produce the same meal.

Conclusion

Applovin's success is partly attributed to AI, but not entirely. Without the explosion of large AI models, the company was also actively transitioning its models, which was in fact a strategic focus. AI merely accelerated this process, but in the long run, for example, using external Aigc models to produce advertising materials and reduce costs, can't other competitors imitate that? Definitely, they can. If everyone uses it, it's equivalent to not using AI at all. The decisive factor remains the proprietary tagging algorithm model, which, of course, can also be considered a small AI model.

Essentially, we can see that successful AI application stocks that thrive due to AI are not necessarily those that use externally excellent AI models exceptionally well. What everyone has does not constitute a competitive advantage. Palantir is also driven by a unique model. This also determines that true AI application stocks are extremely rare.