Pinduoduo enters a stage of high uncertainty

![]() 11/25 2024

11/25 2024

![]() 599

599

By Guo Jiayi

Edited by Zhang Xiao

In the third quarter, Pinduoduo remained the fastest-growing e-commerce platform among major players. However, after the quarterly report was released, Pinduoduo's share price declined significantly, far exceeding the declines seen in JD.com and Alibaba, which also released their third-quarter financial reports earlier.

After releasing its third-quarter 2024 financial results on November 21, Pinduoduo's share price fell sharply in pre-market trading, with a maximum decline of 15.87%.

Unlike the previous quarter, when the share price decline was mainly due to pessimistic guidance from management, this quarter's decline was mainly driven by the dual slowdown in revenue and profit growth.

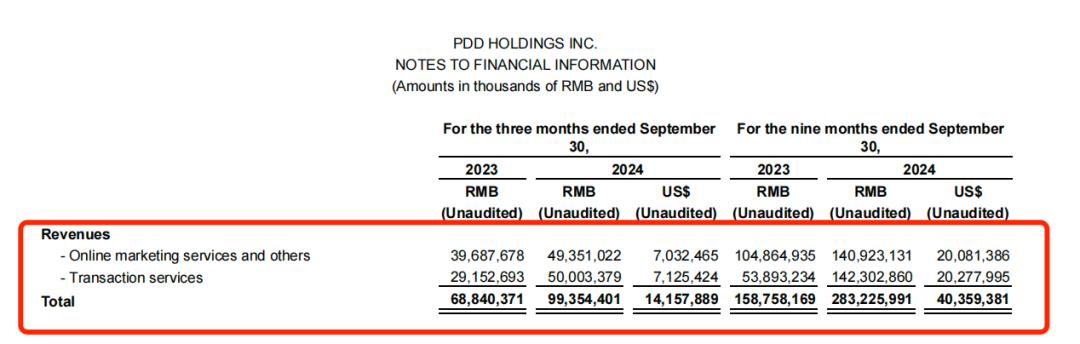

In the third quarter, Pinduoduo reported revenue of 99.354 billion yuan, lower than market expectations of 102.834 billion yuan, with a growth rate of 44%, which continued to slow down. In the first two quarters of this year, Pinduoduo's revenue growth rates were 131% and 85.65%, respectively.

Graph/Pinduoduo's Third Quarter Financial Report

On the profit side, Pinduoduo's net profit attributable to ordinary shareholders was 24.981 billion yuan, a year-on-year increase of 61%, but this growth rate also slowed down. The previous two quarters' year-on-year growth rates were 246% and 144%, respectively. Under Non-GAAP, Pinduoduo's net profit attributable to ordinary shareholders for the quarter was 27.459 billion yuan, also up 61% year-on-year. This profit growth rate also slowed down, with the previous two quarters' year-on-year growth rates being 202% and 125%, respectively.

During the earnings call, Pinduoduo's management expressed views similar to those in the previous quarter:

Zhao Jiazhen, Executive Director and Co-CEO of Pinduoduo, mentioned that Pinduoduo believes that "the slowdown in revenue growth is inevitable." Liu Jun, Pinduoduo's Vice President of Finance, also said that in the long run, Pinduoduo's profitability may fluctuate slightly or even decline.

Connecting the decline in Pinduoduo's growth rate in the second and third quarters with the statements from management, it is not difficult to see that Pinduoduo has accepted the fact that it may not be able to sustain high growth rates indefinitely and has begun to proactively slow down its growth rate—it is now more cautious in exploring the balance of interests with merchants and addressing its own shortcomings.

A clear signal is that Pinduoduo has entered a stage of high uncertainty in its development.

This uncertainty stems from obstacles in Temu's model exploration, intensified market competition, controversies surrounding Pinduoduo, and the industry's re-examination and rethinking of low prices.

01

Temu Slowdown: Slowing Growth and Increased Regulatory Uncertainty

Temu officially entered the US market in September 2022 and has been a key driver of Pinduoduo's performance for the past two years.

Pinduoduo does not disclose Temu's performance in detail in its financial reports, but Temu's contribution to Pinduoduo's transaction service revenue is significant. In 2023, Pinduoduo's transaction service revenue increased by 241% year-on-year.

However, Temu's growth rate may have also slowed down this year.

According to estimates by Dolphin Investment Research, Temu's revenue growth rate in the second quarter of this year was around 10% quarter-on-quarter, and the growth rate in the third quarter may not have exceeded 10% either.

Combined with previous estimates from Huatai Securities in a research report, Temu's quarter-on-quarter revenue growth rates were 47.11% and 18.42% in the fourth quarter of last year and the first quarter of this year, respectively.

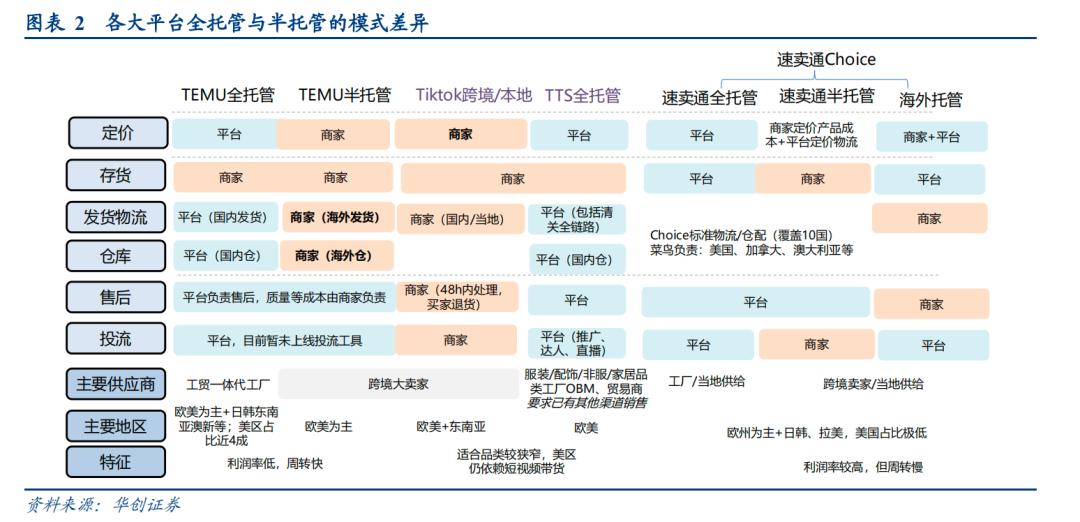

Graph/Huatai Securities

Judging from the statements made by Pinduoduo's management during the earnings calls in the past two quarters, the decline in Temu's revenue growth rate should have been within Pinduoduo's expectations.

As early as the previous quarter, Chen Lei, Chairman and Co-CEO of Pinduoduo, mentioned that as the business grows, Pinduoduo is feeling an accelerating change in the external environment, and that Temu's business operations are being increasingly interfered with by abnormal commercial factors, significantly increasing uncertainty, which "will inevitably bring fluctuations to future business development."

The 'interference from abnormal commercial factors' mentioned by Pinduoduo mainly refers to the more complex regulatory policies that cross-border e-commerce players, including Temu, may face in different regions.

The semi-managed business that China's cross-border e-commerce platforms have been vigorously promoting since the first half of this year is also a preemptive response to potential regulatory risks to some extent, as the previously fully-managed small package airfreight model was already facing high regulatory risks.

Moreover, in the US market, after Donald Trump was elected, restrictions on cross-border e-commerce are also likely to be further strengthened. According to estimates in a research report from Huachuang Securities, the US market will account for 35% and 32% of Temu's global GMV in 2024 and 2025, respectively.

Temu is also facing increased uncertainty in more markets.

For example, Temu launched in the Vietnamese market in October with aggressive marketing strategies, including free shipping and discounts of up to 90% during the initial launch, as well as commissions as high as 30%. However, earlier this month, Vietnamese authorities required Chinese cross-border e-commerce platforms Shein and Temu to register with the government by the end of November, or all their services, business, and advertising activities would be suspended.

Another example is that in October, Indonesia ordered Google and Apple to remove Temu from their app stores to protect the country's own retailers. Previously, Temu had attempted to apply for trademark registration with Indonesia's Ministry of Law and Human Rights three times but was rejected each time.

Also in October, the European Commission launched a formal investigation into Temu due to allegations that it was not complying with the EU's Digital Services Act (DSA) and product safety standards.

All of the above indicates that Temu is facing increasing potential regulatory risks, both in markets where it is already present and in new markets yet to be explored.

02

Long-term Challenges for Temu: Model, Competition, and Platform Ecosystem

In addition to regulatory uncertainties, Temu faces even more practical challenges.

The first is the model challenge.

According to a recent report by LatePost, Temu is considering launching a third-party platform model, similar to Taobao, where merchants can independently select products, set prices, and operate their own stores, with the platform charging transaction commissions for shipments overseas.

Behind Temu's move is the semi-managed model launched in March this year, which Pinduoduo had high hopes for. However, half a year has passed, and the progress of Temu's semi-managed business has fallen short of expectations.

According to a LatePost report, a Temu insider said that the internal expectation for the semi-managed business was "success is the only option, and it must be achieved."

To this end, Temu has sent multiple first- and second-level executives to lead teams and has assembled a recruitment team of nearly 1,000 people, hoping to double the number of product offerings this year and drive the semi-managed business to contribute one-third of Temu's 2024 GMV.

However, the progress of Temu's semi-managed business has not been smooth. As of October this year, the number of merchants and products recruited through Temu's semi-managed model in the two major markets of Europe and the US has failed to meet the original targets.

Second, the uncertainty and complexity of market competition are also increasing.

According to estimates from Huachuang Securities, the US and European markets will contribute more than 70% of Temu's GMV in 2024-2025.

Specifically, in 2024, the US and European regions will contribute 35% and 42% of GMV, respectively, totaling 77% of GMV. In 2025, these contributions will be 32% and 38%, respectively, totaling 70% of GMV.

Graph/Huachuang Securities

However, in these two markets, the potential market competition faced by Temu is becoming increasingly fierce.

In the US market, SHEIN may no longer be the primary competitor that Temu needs to beware of. As reported by The Information, facing Temu's challenge, SHEIN ultimately decided to return to its core business and focus more on branded goods and fashion products.

The new competitor is Amazon. Recently, Amazon officially launched a low-priced store called "Amazon Haul," which was opened to some customers in the US on November 13. This plan was first mentioned by Amazon in June this year.

According to reports from Ebrun.com, "Amazon Haul" is similar to the fully-managed model, adopting an invitation-only recruitment method. Orders are fulfilled and delivered by warehouses operated by Amazon in China, and sellers only need to be responsible for sending products to Amazon's domestic warehouses.

In addition, "Amazon Haul" mainly provides white-label low-priced fashion, home, and lifestyle products, with the first batch of products covering nine categories: clothing, home, beauty, electronics, accessories, office supplies, kitchenware, sports equipment, and gardening supplies.

The launch of "Amazon Haul" is Amazon's counterattack against Temu and SHEIN. The Wall Street Journal reported earlier this year that, according to insiders, Amazon already considers SHEIN and Temu as bigger threats than retailers like Walmart and Target.

In the European market, the competitive landscape faced by Temu is also becoming increasingly complex.

According to a report on the European e-commerce market released by ChannelX, Amazon and eBay account for approximately 17% and 14% of European traffic, respectively, followed by e-commerce platforms such as AliExpress, Allegro, and Etsy, each with single-digit traffic shares.

Earlier, CBCommerce.eu also released a ranking of the top ten cross-border e-commerce platforms in Europe, with Temu and SHEIN listed at fifth and eighth, respectively.

However, given the uncertain regulatory risks and more competitors, it will not be easy for Temu to gain more market share in the European market.

Thirdly and most importantly, Temu faces long-term challenges in platform ecosystem construction.

Since the fourth quarter of 2023, conflicts between Temu and cross-border merchants on the platform have persisted.

During this period, on July 30, the hashtag "Pinduoduo's platform Temu angers sellers" trended on social media. At that time, hundreds of Temu merchants went to Temu's Guangzhou headquarters to demand their rights, claiming that they had been fined and had their "after-sales reserves" deducted by the platform due to after-sales issues, with amounts ranging from tens of thousands to millions of yuan.

At that time, Pinduoduo responded to China Securities Journal: "The platform will not earn money from fines imposed on merchants for violations, and any fines collected will be compensated to consumers."

Many merchants disagree. A previous report by ECNS pointed out that multiple Temu merchants stated that their products need to pass the platform's quality inspection or spot checks when entering Temu's warehouses, but these products that have passed Temu's quality control may still lead to fines.

They also mentioned that Temu's after-sales fines do not specify the quality issues and lack evidence such as customer service and customer conversation records or problem product photos.

To some extent, Temu's "heavy fines" on cross-border merchants are just the fuse, and behind it are more intricate factors—conflicts between Temu's pursuit of extreme low prices and merchants' interests, contradictions between the rights and interests of cross-border merchants based on the "only refund" service and consumer rights and interests, and so on.

To illustrate with a simple example, from the fully-managed model to the semi-managed model, objectively speaking, cross-border e-commerce platforms have indeed achieved diversification in platform services and product categories, and to a certain extent, improved logistics efficiency.

Graph/Huachuang Securities

However, with the coexistence of these two models, for fully-managed merchants, on the one hand, the platform holds high bargaining power, and on the other hand, platform traffic is tilt towards semi-managed merchants, both of which are squeezing their survival space.

For semi-managed merchants, the platform's "only refund" policy, return rate, etc., are also increasing operating costs and eroding profit margins.

In other words, regardless of the model, the interest game between the platform and merchants will persist in the long run. How to explore a win-win approach for the platform and merchants so that merchants can also earn more money is an issue that Temu needs to continuously consider.

03

Pinduoduo Faces Dual Declines in Main Station Revenue and Profit, and Addresses Its Shortcomings

Pinduoduo's revenue consists of two parts: online marketing services and other income, and transaction service revenue.

In the third quarter, the slowdown in Pinduoduo's revenue growth was mainly driven by a more significant decline in transaction service revenue growth.

Although the revenue growth rate of Pinduoduo's advertising business also declined this quarter, the decline was not significant, from 29.48% year-on-year in the previous quarter to 24.35% this quarter. However, transaction service revenue fell sharply from a year-on-year growth rate of 234.15% in the previous quarter to 71.52% this quarter.

Regarding the significant decline in transaction service revenue growth, Dolphin Investment Research analyzed that the problem is more likely to lie in the commission revenue of the main station.

It believes that a series of subsidies provided by Pinduoduo to merchants in the third quarter may have led the market to underestimate the impact of these subsidy policies on reducing commission revenue.

Behind this, an important move made by Pinduoduo since the third quarter has been to intensify efforts to improve the merchant ecosystem.

Specifically, Pinduoduo first launched the "10 billion yuan reduction" plan, introducing policies such as "service fee refunds" and "margin reductions." Later, it initiated the "New Quality Merchant Support Program," officially stating that it will invest 10 billion yuan to select new quality brands with product and technological innovation capabilities, providing full-chain support from product to marketing, operations, and supply chain. In addition, Pinduoduo has also launched initiatives such as "E-commerce Goes West."

In the long run, Pinduoduo's expenditures related to the supply side may become the norm going forward. Judging from Pinduoduo's third-quarter report and the statements made by management during the earnings call, management's determination for long-term investment is also firm.

"In the future, we will continue to make more long-term and meaningful investments in this direction," said Zhao Jiazhen.

Pinduoduo's initiatives are not difficult to understand. To some extent, Pinduoduo is now proactively slowing down and looking back to address the issues and shortcomings exposed during its rapid expansion. For example, Pinduoduo has also made significant efforts in platform compliance and governance systems in the third quarter.

However, a challenge facing Pinduoduo is that its heavy investment and construction of the merchant ecosystem may only just be beginning—it should certainly do this, and in fact, doing it later would have made the task even more difficult.

In the past two years, under the pressure of Pinduoduo's "low prices," from Alibaba to JD.com to Douyin E-commerce, all have had to intensify price competition, both as a defensive measure and an offensive strategy.

But after experiencing this vigorous low-price experiment, actions of various companies have begun to diverge. They realize that Pinduoduo's growth method may not be suitable for all platforms.

Behind this lies the fact that Pinduoduo started in the lower-tier market. For a long time, low prices have been synonymous with it. To some extent, under the platform-led "low-price" orientation, Pinduoduo's merchant ecosystem will also be more fragile in comparison—because the platform is forcing merchants to improve quality and service while lowering prices. At the same time, the platform is intangibly more biased towards consumers between merchants and consumers.

This is also why, until today, on social media, from merchants to consumers, the controversy surrounding Pinduoduo has never stopped.

For example, a well-known online influencer recently publicly posted an article accusing Pinduoduo of allowing pirated merchants on its platform. Then a few days ago, Zhong Shanshan, the founder of Nongfu Spring, also expressed his criticism of the e-commerce price war. He believes that internet platforms like Pinduoduo are constantly driving down prices, which is not only a case of bad money driving out good but also an industrial orientation that causes tremendous harm to Chinese brands and industries.

Judging from Pinduoduo's third-quarter report, finding new drivers beyond low prices is becoming increasingly urgent.

In this quarter, against the backdrop of a weak market environment, in order to better cope with market competition, Pinduoduo's marketing expenses increased by 40% year-on-year, maintaining almost the same year-on-year growth rate as the previous two quarters. However, as we mentioned above, Pinduoduo's revenue growth rate has dropped significantly.

Judging from the management's statements, the fierce competition in China's e-commerce market is putting increasing pressure on Pinduoduo.

Zhao Jiazhen mentioned that as the business models in the market become more diverse and competition intensifies, the gradual aging of the Pinduoduo team and its lack of capabilities may also cause the company to miss some macro opportunities when responding to certain changes.

"For example, since the beginning of this year, there have been macroeconomic policies that have a significant positive impact on certain industries and consumption. Our team is limited by the historical capabilities of third-party platform operations and has not fully grasped these macroeconomic policy dividends. As a result, in order to maintain the same product competitiveness, the platform needs to incur huge costs that are far higher than those of other peers. This will inevitably affect the profitability of the Pinduoduo platform now and in the future," he said.

In summary, for the current Pinduoduo, from the main site to Temu, from market competition to market uncertainty, the deceleration of Pinduoduo has both passive and active factors.

Objectively speaking, the fact that Pinduoduo's current speed is slightly slower than before is not necessarily a bad thing. After all, even if its growth rate slows down now, it is still the best-performing Chinese e-commerce company.

However, after entering a stage of high uncertainty, how to provide a healthier platform ecosystem in both domestic and overseas markets, and thereby establish long-term competitiveness, will be a long-term challenge for Pinduoduo.