GoerTek Microelectronics plans to switch to the Hong Kong Stock Exchange, with continuous performance decline and a previous gambling agreement with investors

![]() 11/25 2024

11/25 2024

![]() 624

624

Produced | Entrepreneurship Frontline

Art Director | Qianqian

Auditor | Songwen

After some setbacks, GoerTek Microelectronics' listing process is back on track.

In September this year, GoerTek announced its plan to spin off its subsidiary, GoerTek Microelectronics, for a Hong Kong listing.

In early November, Bloomberg reported that GoerTek had selected CICC, CMB International, CSC Securities, and UBS for cooperation related to GoerTek Microelectronics' listing, with an expected listing as early as 2025. However, discussions are ongoing, and specific details may change. This news quickly attracted market attention.

GoerTek was listed on the Shenzhen Stock Exchange's main board in 2008, providing vertically integrated product solutions for precision components and smart device assemblies, as well as related design, research and development, and manufacturing services.

Currently, GoerTek has three major businesses: precision components, intelligent acoustic devices, and intelligent hardware. Among them, GoerTek Microelectronics is a subsidiary of the precision components business.

Publicly available information shows that GoerTek Microelectronics was established in 2017, covering key links in the industry chain such as chip design, product development, packaging and testing, and system applications. Through vertical integration, it provides customers with a one-stop product solution of "chip + device + module + system".

It should be noted that GoerTek Microelectronics' main business or assets are not the same as those when GoerTek first went public in 2008.

Currently, GoerTek Microelectronics has not officially submitted a prospectus to the Hong Kong Stock Exchange. Whether the company will successfully list in the future and whether it will be welcomed by the capital market remains uncertain.

1. Switching from the A-share market to the Hong Kong Stock Exchange

In fact, this is not the first time GoerTek has planned to spin off GoerTek Microelectronics for listing. As early as the end of 2019, GoerTek integrated microelectronics-related businesses into its subsidiary, GoerTek Microelectronics, laying the groundwork for its spin-off listing.

(Image / GoerTek's official website)

At that time, the China Securities Regulatory Commission issued the "Several Provisions on the Pilot Program for Listed Companies to Spin Off Subsidiaries for Domestic Listing," clearly supporting qualified domestic companies to spin off their subsidiaries for listing. According to Securities Daily statistics, from the end of 2019 to January 10, 2024, a total of 145 A-share companies initiated 163 spin-off plans.

GoerTek's first spin-off of GoerTek Microelectronics was also among them. In November 2020, GoerTek announced its plan to spin off GoerTek Microelectronics for listing on the ChiNext board of the Shenzhen Stock Exchange.

On December 28, 2021, GoerTek Microelectronics' listing materials were officially accepted. Starting from January 2022, GoerTek Microelectronics underwent multiple rounds of listing inquiries and successfully passed the review on October 19, 2022. At this point, GoerTek Microelectronics was very close to listing on the ChiNext board of the Shenzhen Stock Exchange.

However, for a long time afterward, GoerTek Microelectronics did not submit a registration draft for listing and instead terminated its listing process on the ChiNext board of the Shenzhen Stock Exchange on May 27, 2024.

Regarding the reason for withdrawing the A-share listing application, the parent company GoerTek responded that it was based on considerations such as market conditions.

However, GoerTek Microelectronics' own issues cannot be ignored. The prospectus submitted by GoerTek Microelectronics to the ChiNext board of the Shenzhen Stock Exchange shows that the company's revenue was 2.566 billion yuan, 3.16 billion yuan, and 3.348 billion yuan in 2019, 2020, and 2021, respectively, showing an overall growth trend with a compound annual growth rate of 14.23% in revenue.

However, according to GoerTek's spin-off plan announcement released in September this year, GoerTek Microelectronics' revenue in 2021, 2022, and 2023 was approximately 3.348 billion yuan, 3.125 billion yuan, and 3.015 billion yuan, respectively, showing an overall declining trend with a compound annual growth rate of approximately -5% in revenue.

On April 30 this year, the Shenzhen Stock Exchange responded to the issuance of nine rules, including the "Rules for the Review of Stock Issuance and Listing," clearly stating that the compound annual growth rate of operating revenue should be moderately increased. It emphasized the growth requirements of the ChiNext board and moderately increased the compound annual growth rate indicator for operating revenue in the evaluation criteria for the ChiNext board's positioning from 20% to 25%.

Obviously, GoerTek Microelectronics, with a compound annual growth rate of operating revenue of approximately -5%, does not meet the relevant requirements of the ChiNext board.

Regarding the decision to switch from the A-share market to rushing for an IPO on the Hong Kong Stock Exchange, GoerTek stated that it was a prudent decision made in response to the country's policy of supporting qualified industry leaders to list in Hong Kong, considering the mainland capital market environment and GoerTek Microelectronics' future development plan.

GoerTek also stated in the announcement that the spin-off listing of GoerTek Microelectronics is beneficial for GoerTek to highlight its main business and enhance its independence. Moreover, there is no horizontal competition between GoerTek and GoerTek Microelectronics. The two companies are independent in terms of assets, finance, and organization, and there is no cross-appointment of senior executives and financial personnel.

2. Risks in the supply chain and client side

In fact, GoerTek Microelectronics' performance has shown a continuous double-digit decline in 2021, 2022, and 2023. Not only has its revenue continued to decline, but the net profit attributable to shareholders of the parent company has also declined, amounting to approximately 329 million yuan, 326 million yuan, and 226 million yuan, respectively.

During the reporting period, GoerTek Microelectronics' gross profit margins were 22.87%, 20.84%, and 20.22%, respectively, also showing a continuous downward trend.

In terms of spin-off risks, GoerTek also disclosed some operational risks associated with GoerTek Microelectronics.

These include GoerTek Microelectronics' heavy reliance on the consumer electronics industry, a relatively low proportion of revenue from self-developed chip products, a long customer introduction cycle for self-developed chip products, risk of dependence on a single supplier, high customer concentration, and significant dependence on a single customer.

Regarding dependence on a single supplier, GoerTek Microelectronics purchases a large amount from Infineon.

According to the A-share listing draft submitted by GoerTek Microelectronics in October 2022, after penetrating GoerTek and its subsidiaries' purchases to actual suppliers in 2019, 2020, 2021, and the first half of 2022, GoerTek Microelectronics' purchases from Infineon amounted to approximately 1.408 billion yuan, 1.586 billion yuan, 1.544 billion yuan, and 684 million yuan, respectively, accounting for 64.81%, 65.40%, 58.78%, and 55.44% of total purchases, respectively, which is relatively high.

GoerTek Microelectronics explained that there are two reasons for this:

First, chips account for a relatively high proportion of the main raw materials for the company's MEMS products, resulting in larger purchase amounts.

Second, as a globally leading semiconductor company, Infineon's chip products are market leaders in multiple fields and are recognized by end customers.

The company (including its business reorganization predecessor) has established a long-term and stable cooperative relationship with Infineon since 2009 and has placed long-term orders.

It can be said that in terms of high-end chips, GoerTek Microelectronics relies heavily on Infineon's supply and has no good alternative in the short term.

(Image / GoerTek Microelectronics' official website)

Regarding risk management, GoerTek Microelectronics stated that if the company's cooperative relationship with Infineon changes in the future and the company fails to take timely and effective alternative measures, it will have a significant adverse impact on the company's operating performance.

Not only on the supply side but also on the client side, GoerTek Microelectronics faces risks.

In 2019, 2020, 2021, and the first half of 2022, the sales amount to GoerTek Microelectronics' top five customers accounted for 62.06%, 68.09%, 69.14%, and 72.63% of operating revenue, respectively. The sales amount to companies in the Apple supply chain accounted for 47.76%, 58.53%, 56.37%, and 52.04% of operating revenue, respectively.

These data indicate that GoerTek Microelectronics has a relatively high customer concentration, especially towards companies in the Apple supply chain, showing significant dependence on Apple.

In the future, if the cooperative relationship between GoerTek Microelectronics and its major customers (especially Apple) changes, it will have a significant adverse impact on the company's operating performance. Similar risks have occurred before in GoerTek, the parent company of GoerTek Microelectronics.

In 2022, GoerTek faced order reductions from Apple for its AirPods products. In December of the same year, GoerTek announced that due to these order reductions, its operating revenue for the year decreased by no more than 3.3 billion yuan, with related direct losses of approximately 900 million yuan (including direct profit reductions and production stoppage losses).

(Image / GoerTek's official website)

In its 2022 annual report, GoerTek also stated that it had fully reflected on and learned from the experience and lessons of the order reduction and actively rectified deficiencies in related work.

GoerTek Microelectronics needs to remember the lessons learned by its parent company and minimize related dependency risks.

3. Previous gambling agreement with investors

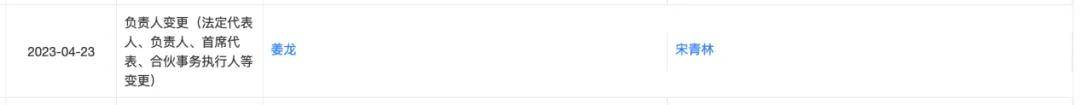

The shareholding structure disclosed by GoerTek Microelectronics in October 2022 showed that Jiang Long once held 1.85% of GoerTek Microelectronics' shares and served as the company's chairman. However, Tianyancha shows that in April 2023, Jiang Long's position as chairman was succeeded by Song Qinglin, and Jiang Long is no longer among GoerTek Microelectronics' shareholders.

The announcement in September this year shows that as of the date of issuance of the spin-off plan, GoerTek held 87.75% of GoerTek Microelectronics' shares, making it the controlling shareholder. The actual controllers are Jiang Bin and Hu Shuangmei, a couple where Jiang Bin is Jiang Long's brother.

In addition, Qingdao Microelectronics Innovation Center Co., Ltd. holds 2.66% of GoerTek Microelectronics' shares, Song Qinglin holds 1.85%, Tang Wenbo holds 1.36%, Gongqingcheng Chunlin Equity Investment Partnership (Limited Partnership) holds 1.31%, and the shareholding ratio of other shareholders is below 1%.

In March 2021, GoerTek Microelectronics introduced 15 new shareholders, including Qingdao Innovation, Gongqingcheng Chunlin, Qingdao Henghuitai, and Tang Wenbo, through capital increases. Some of these new shareholders signed a "Relevant Agreement on the Shareholders' Repurchase Right of GoerTek Microelectronics Co., Ltd." with GoerTek Group, known as a gambling agreement.

These gambling agreements were also inquired about by the Shenzhen Stock Exchange when GoerTek Microelectronics was rushing for an A-share IPO. GoerTek Microelectronics was required to explain the relevant entities involved in the gambling agreements, the specific content of the gambling agreements, and whether there were any circumstances triggering performance obligations during the validity period of the special rights clauses. If so, whether the relevant obligations had been fulfilled and whether the rights and obligations under the special rights clauses had been completely terminated.

GoerTek Microelectronics disclosed in its prospectus that in February 2021, GoerTek Group signed gambling agreements with Gongqingcheng Chunlin, Chunlin Investment, Guowei Runxin, CICC Qichen, CECIC, and CITIC Construction Investment, respectively.

(Image / Shutterstock, based on the VRF Agreement)

The content of the gambling agreement was as follows: if GoerTek Microelectronics fails to achieve a qualified listing by June 30, 2023, the aforementioned investors have the right to require GoerTek Group or its affiliates or a third party recognized by all parties to this agreement (excluding GoerTek Microelectronics and its subsidiaries) to repurchase all shares held by the investors at the agreed repurchase price.

The termination conditions of these clauses are as follows: the clauses terminate on the date when GoerTek Microelectronics' listing application passes the tutoring and acceptance inspection by the dispatched institution of the China Securities Regulatory Commission. If required by the Securities Regulatory Bureau's tutoring and acceptance inspection or GoerTek Microelectronics' sponsor's internal review, investors agree to sign relevant agreements to terminate these rights clauses in advance as required. GoerTek Microelectronics stated that there are no clauses for restoring effectiveness.

As GoerTek Microelectronics switches from a spin-off and listing on the A-share market to a listing on the Hong Kong Stock Exchange, its past gambling agreements may still attract regulatory attention.

GoerTek Microelectronics has not yet submitted a listing prospectus to the Hong Kong Stock Exchange, but the company faces the dilemma of continuous performance decline for two consecutive years and the risk of high dependence on a single supplier and a single customer, which is enough to attract the high attention of Jiang Bin and the management team.

In the future, whether GoerTek Microelectronics can successfully list will continue to be closely monitored by "Entrepreneurship Frontline".

*Note: The lead image in the article is from GoerTek Microelectronics' official website.