Ke Holdings: A Poor Third Quarter, but Will Tomorrow Be Better?

![]() 11/25 2024

11/25 2024

![]() 596

596

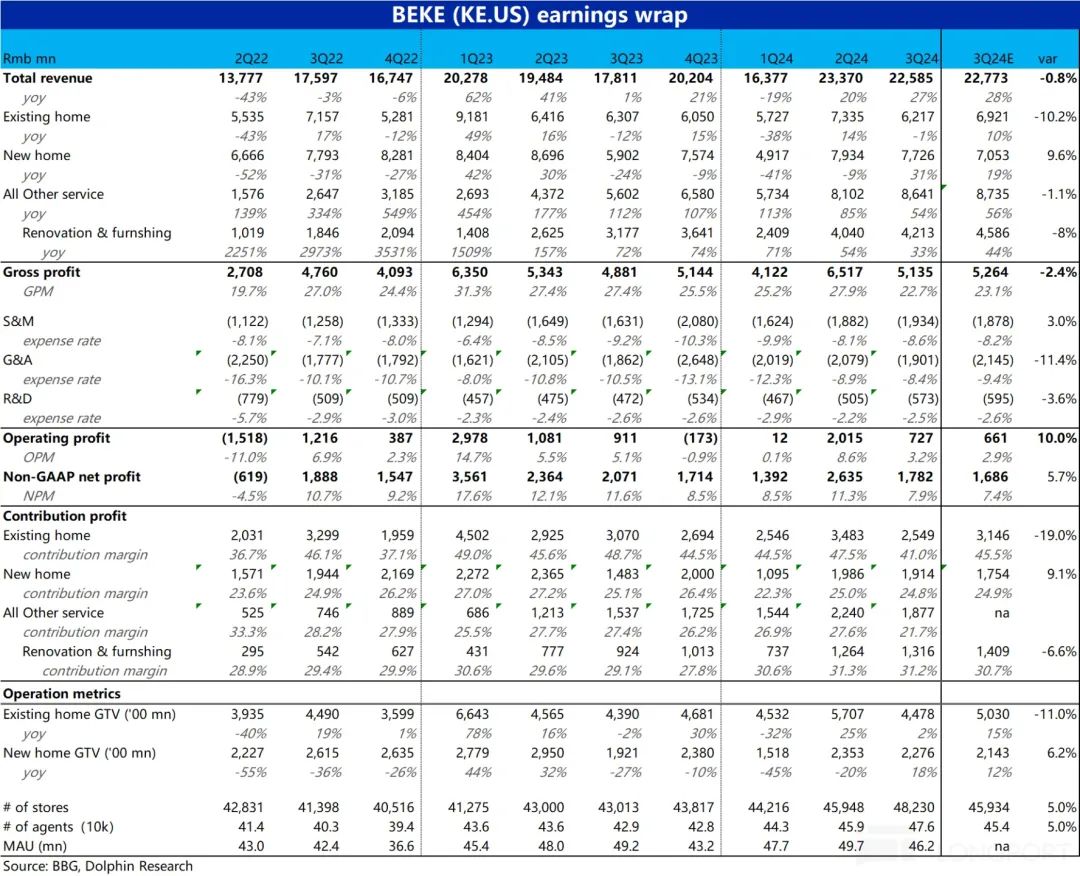

On the evening of November 21, Beijing time, before the U.S. stock market opened, Ke Holdings released its third-quarter financial report for 2024. The revenue and profit performance of this quarter alone are not good, but as the main target of market gaming in real estate policies, the fourth quarter and subsequent housing transactions are the key factors affecting the company's trend. The specific points are as follows:

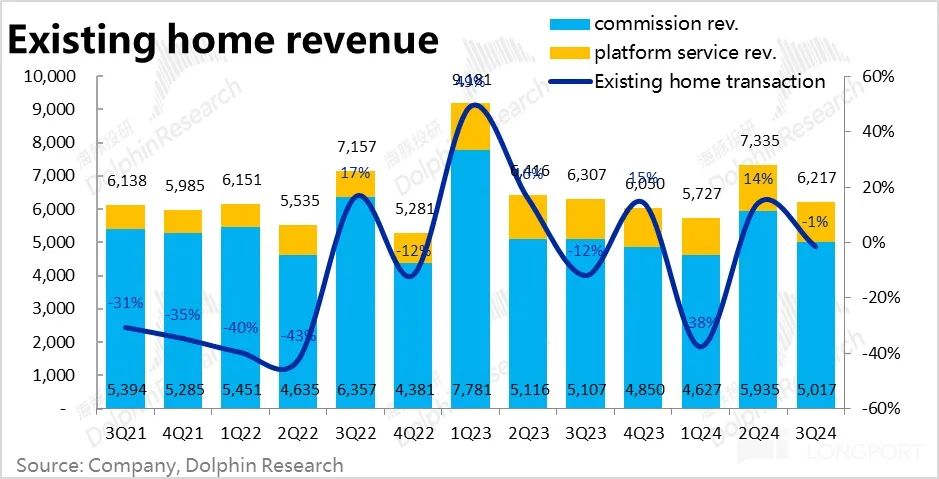

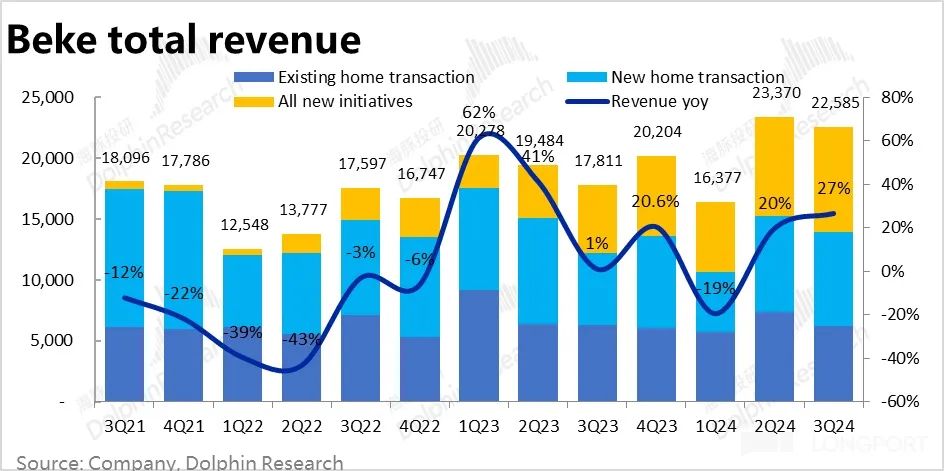

1. The core stock housing business had a GTV of 447.8 billion this quarter, with a year-on-year growth of only 2%, significantly lower than the market expectation of 15% growth (the company's previous guidance was around 10% growth), and a decrease of about 21.5% compared to the previous quarter. According to the company's explanation, due to the supportive policies starting from May 17, housing transactions were concentrated between the end of May and June. Subsequently, with the diminishing effect of policy stimulus, the actual transactions in the third quarter were not as good as expected.

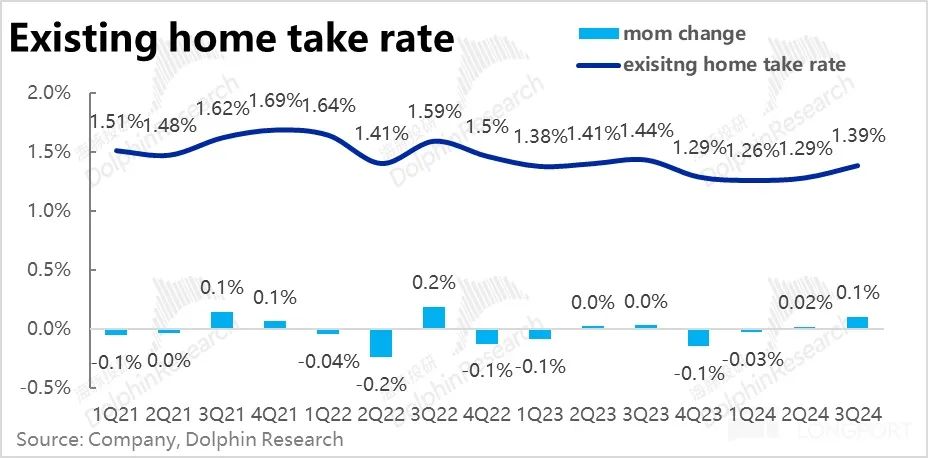

Revenue from stock housing fell by 1% year-on-year, also significantly below expectations. In addition to the near-zero growth in GTV, the monetization rate of Ke Holdings' stock housing business was 1.39% this quarter, a decrease of about 5bps compared to the same period last year. In the general trend of the property market exchanging price for volume, the company may also have offered discounts on commissions to promote transactions.

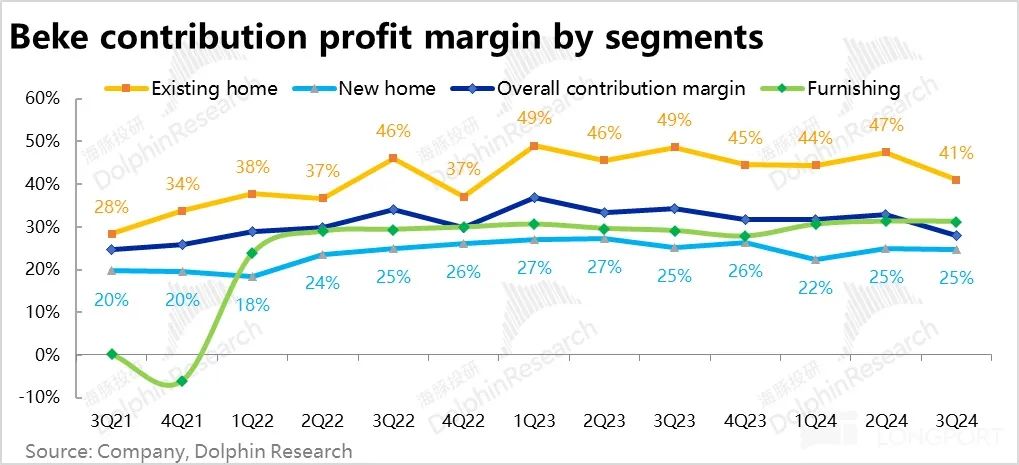

Due to the lower-than-expected transaction volume recovery and a slight year-on-year decline in the monetization rate, the profit contribution of the stock housing business was 2.54 billion this quarter, nearly 19% lower than expectations. The profit contribution margin of the stock housing business was only 41% this quarter, a significant decrease of 6.5pct quarter-on-quarter and also significantly lower than the expected 45.5%, indicating a notable decline in profit margins.

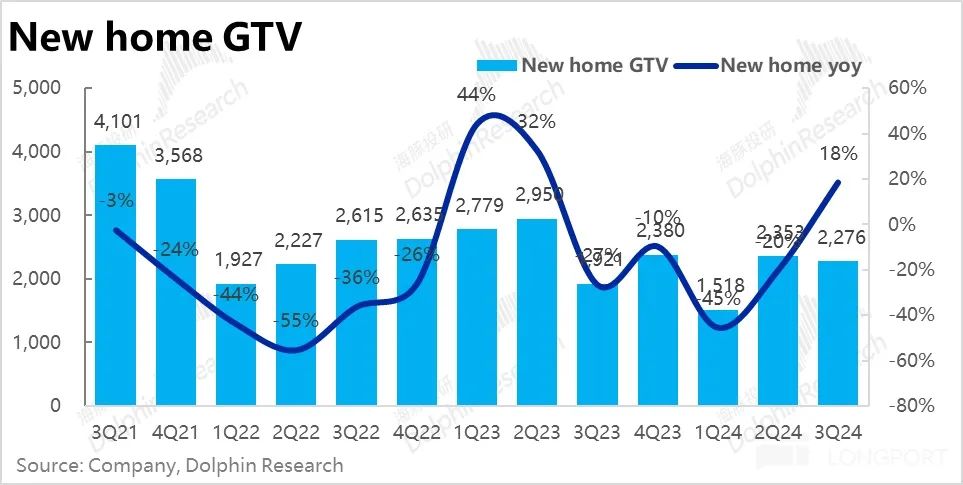

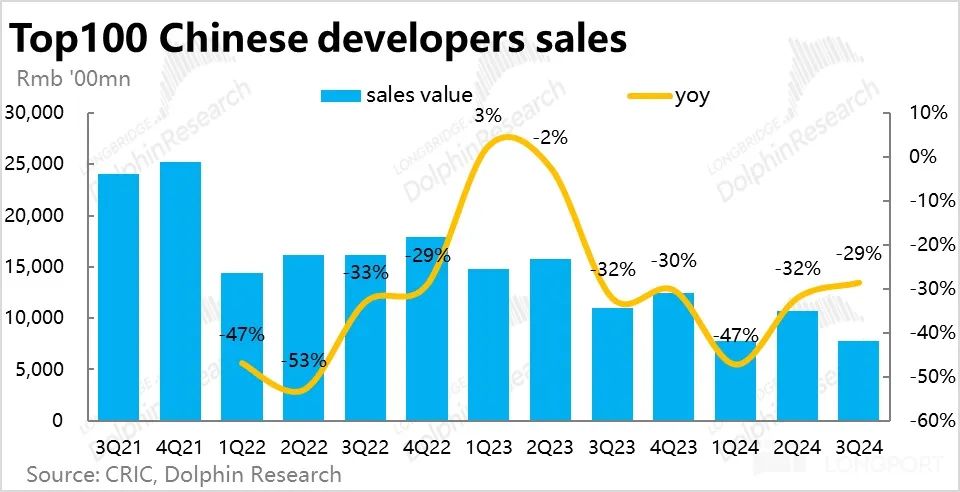

2. In contrast, Ke Holdings' new home business performed strongly this quarter. The transaction volume of new homes increased by 18%, a significant improvement from the previous quarter and also significantly higher than the market expectation of 12% growth. In comparison, the sales of the top 100 real estate enterprises in China still fell by 29% year-on-year in the third quarter, indicating that Ke Holdings performed exceptionally well against the trend. This is still mainly attributed to the fact that nearly 60% of its partner real estate enterprises are leading state-owned enterprises, which are relatively resilient. Moreover, as a leading channel, Ke Holdings is significantly important for real estate enterprises to acquire customers.

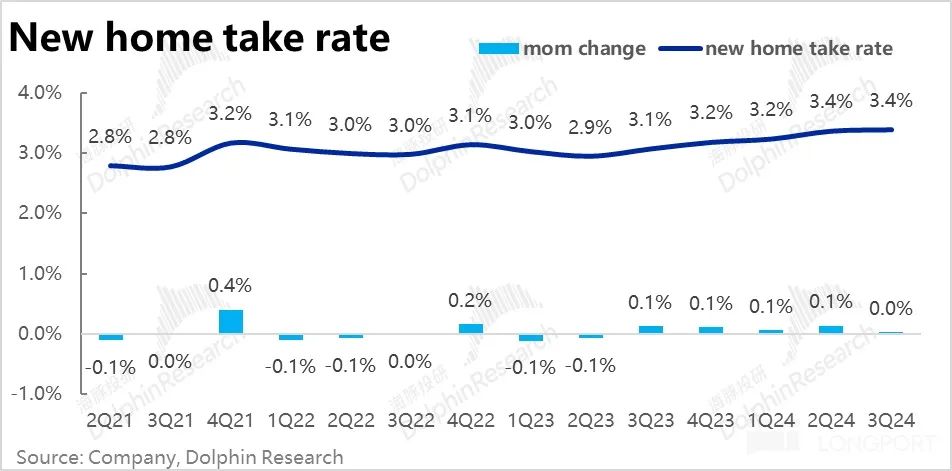

Revenue from the new home business increased by 31% year-on-year, significantly outperforming the market expectation of 19% growth. The monetization rate of the new home business remained flat at the historical high of 3.4% quarter-on-quarter (an increase of about 0.3pct year-on-year), also verifying the increasing importance of Ke Holdings as a channel.

Due to the remarkable growth and the maintained high monetization rate of the new home business, the profit contribution rate remained largely stable at 24.8% this quarter, with an actual profit contribution of 1.91 billion, significantly better than the expected 1.75 billion.

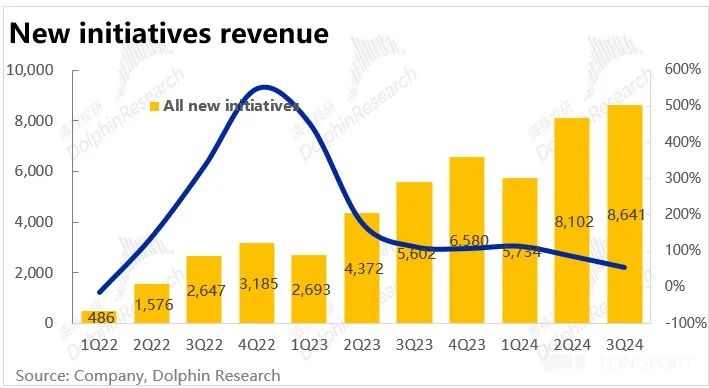

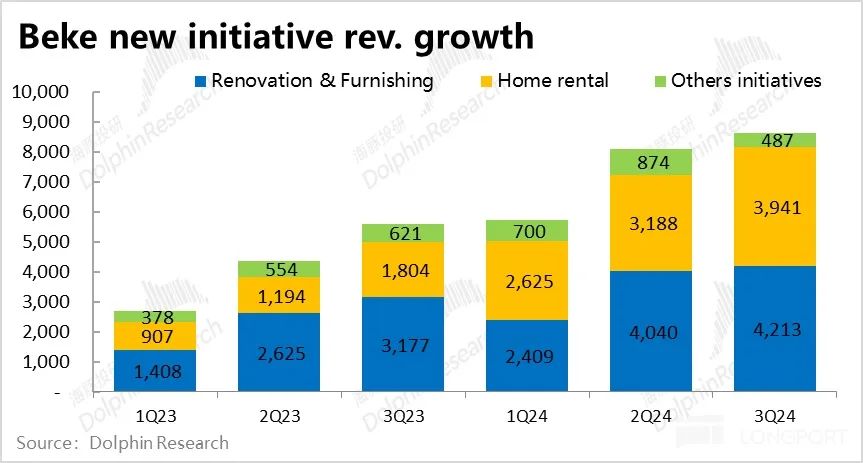

3. The total revenue of the second channel, which mainly includes home decoration, leasing, home furnishing services, and financial services, reached 8.64 billion this quarter. In this quarter, the second channel accounted for 38% of Ke Holdings' total revenue, with a year-on-year increase of 54%, undoubtedly becoming a new major growth driver for the company.

The home decoration business, which accounts for nearly half of the revenue contribution in the second channel, generated 4.24 billion in revenue this quarter. As the base increased, the year-on-year growth rate continued to slow down to 33%, with a quarter-on-quarter increase of 4%. After the early rapid growth stage, the medium- and long-term growth potential of the home decoration business still needs to be verified.

The leasing business, which is slightly smaller in size, contributed 3.94 billion in revenue, with a quarter-on-quarter growth rate of 24%, still in the growth stage, mainly benefiting from the growth of Ke Holdings' "Easy Rent" service. However, the profit contribution margin of the leasing business fell significantly by 1.4pct quarter-on-quarter to 4.4%, indicating a less favorable profit performance, which may be due to the decline in rental prices in some cities.

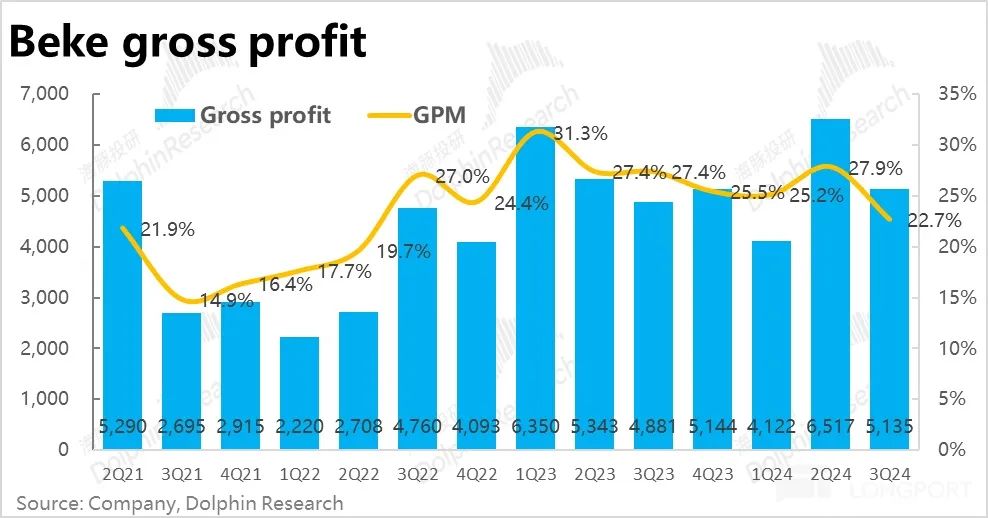

4. From the perspective of expenses and profits, ① In terms of overall gross profit, the gross profit margin for this quarter was 22.7%, a significant drop of more than 5pct quarter-on-quarter and lower than the market expectation of 23%. As mentioned above, this was mainly due to the decline in profit margins of the stock housing business and leasing business this quarter.

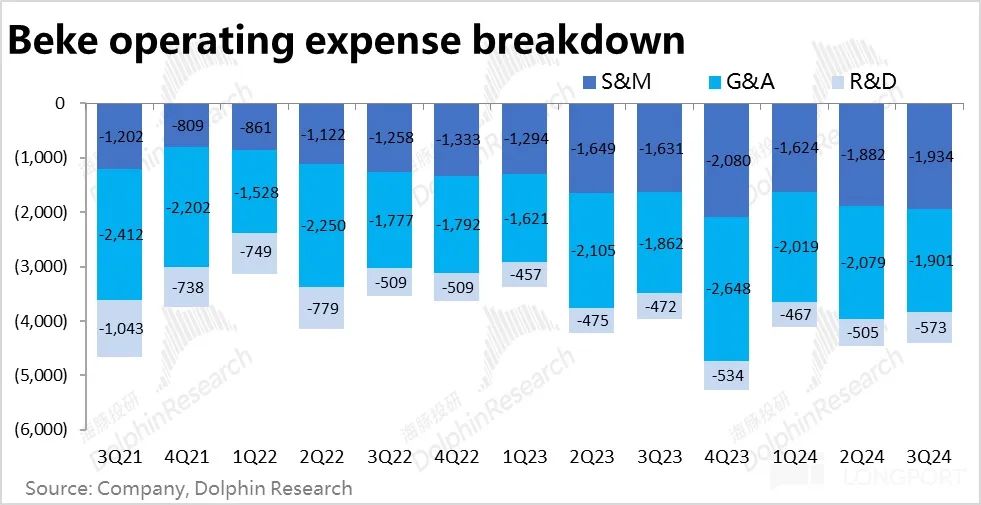

On the expense side, although Ke Holdings' growth rate recovered somewhat this quarter, the overall scale still shrank quarter-on-quarter. Marketing expenses increased by about 3% quarter-on-quarter, with expenditures slightly higher than expected. Research and development expenses also increased significantly quarter-on-quarter. The increases in these two external expenses reflect Ke Holdings' renewed confidence in the market after seeing numerous policy expenditures. Fortunately, the largest internal management expenses decreased slightly quarter-on-quarter, so the overall expense expenditures still decreased by about 5 million yuan quarter-on-quarter.

The number of stores and agents on the Ke Holdings platform also increased by 12% and 11% year-on-year, respectively, returning to store expansion and recruitment, which also reflects the improvement in the company's confidence. However, attention should also be paid to the potential issue of expense expansion.

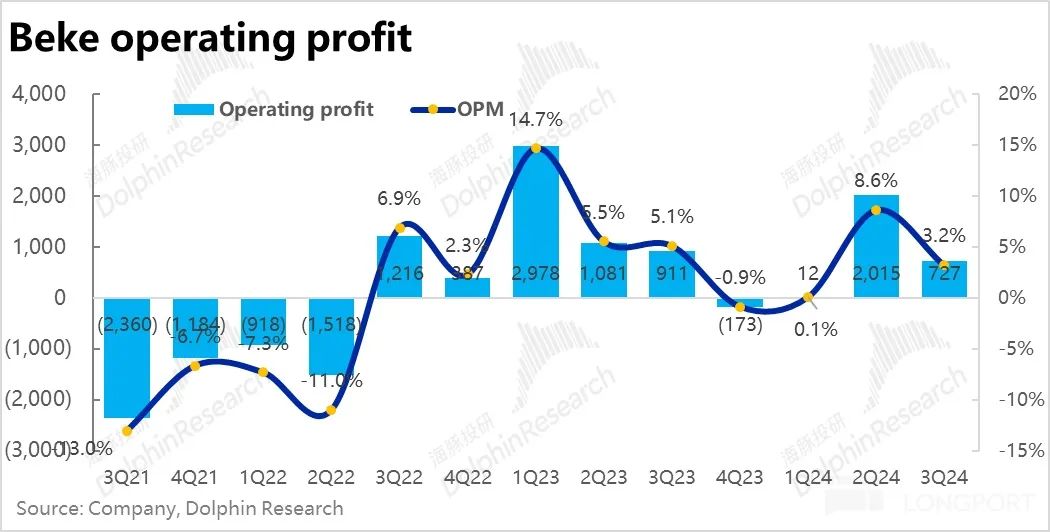

Overall, the proportion of expense expenditures to revenue remained largely stable with a slight increase of 0.3pct. However, due to the diving decrease in gross profit margin, Ke Holdings' operating profit margin was 3.2% this quarter, a significant decrease both year-on-year and quarter-on-quarter, with an operating profit of 730 million yuan, a year-on-year decrease of 20%. Although better than expected, the shrinking profit performance year-on-year is obviously not good.

Dolphin Investment Research Viewpoint:

Overall, Ke Holdings' performance in the third quarter alone was not good. The growth of the core stock housing business was lower than expected, leading to weak overall revenue and gross profit for the group. Although expenses remained largely flat quarter-on-quarter, they still led to an overall operating profit of less than 1 billion yuan this quarter, actually at 730 million yuan, showing a decline both year-on-year and quarter-on-quarter.

However, since September, under the stimulus of a new round of supportive policies, Ke Holdings' current share price trend has basically had nothing to do with its performance in the past three quarters. As the target that Dolphin Investment Research believes will benefit most directly from the recovery of the property market, Ke Holdings' share price has increased by over 40% since the end of September, with relatively few corrections from highs. It can be seen that the market has already factored in a significant portion of the effects of the new policies in the company's valuation.

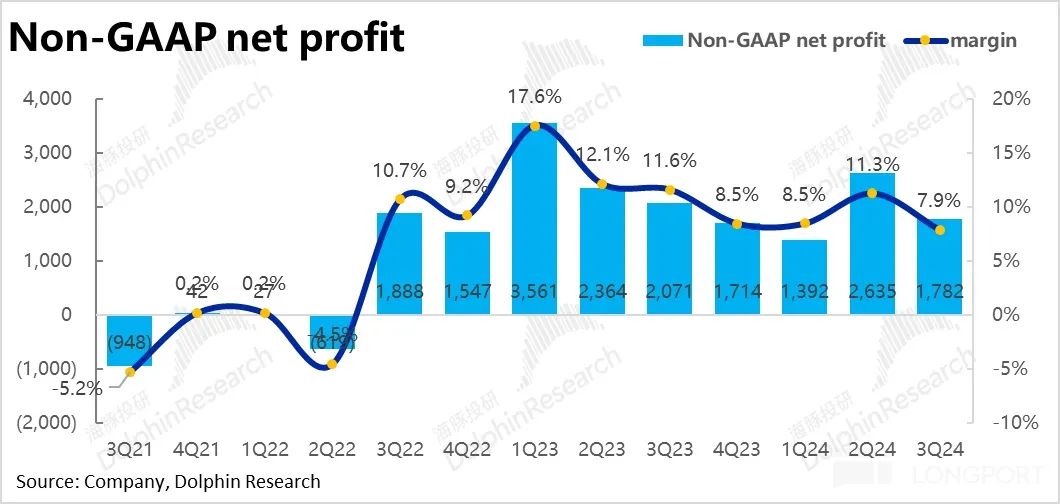

So, how high of expectations are reflected in the current price? Due to the great volatility in the current domestic property market, there is also great uncertainty regarding the medium- and long-term profits expected of Ke Holdings. Therefore, we use the logic of reverse deduction. The company's current market capitalization is approximately RMB 170 billion. Dolphin Investment Research believes that even under optimistic expectations, a valuation of 20x PE is already the upper limit. This implies a profit demand of 8.5 billion. We note that although the property market recovered strongly in the fourth quarter, due to the corresponding increase in expenditures by Ke Holdings, sellers' expectations for Ke Holdings' adjusted net profit in the fourth quarter are slightly higher than 2 billion, lower than the 2.7 billion in the second quarter. Based on the annualized fourth-quarter profit, it can barely meet the profit demand of 8.5 billion implied by the market capitalization.

Therefore, the market has already fully reflected the currently foreseeable market recovery in the valuation. For the share price to continue to rise, the company's actual profit delivery needs to exceed current expectations, or the positive impact of policies needs to last longer. In this regard, Dolphin Investment Research believes that more new policies may be announced to further stimulate the recovery of the property market. However, the current point is not very safe or cost-effective.

Detailed Interpretation of This Quarter's Financial Report

1. Stock Housing: A Weak Period After Strong Stimulus, Growth Below Expectations

The core stock housing business had a GTV of 447.8 billion this quarter, with a year-on-year growth of only 2%, significantly lower than the market expectation of 15% growth (the company's previous guidance was also around 10% growth). The transaction volume also decreased by about 21.5% compared to the previous quarter.

According to the company's explanation, due to multiple major national property market policies starting from May 17, housing transactions were concentrated between the end of May and June. Subsequently, with the rapid diminishment of the effect of policy stimulus, actual transactions in the third quarter were not as good as expected. Specifically, the GTV dominated by Lianjia and the GTV dominated by 3P stores both grew at around 2% year-on-year, performing poorly.

From a revenue perspective, revenue from stock housing fell by 1% year-on-year this quarter, also significantly below expectations. In addition to the GTV growing by only 2%, the monetization rate of Ke Holdings' stock housing business was 1.39% this quarter, a decrease of about 5bps compared to the same period last year. Moreover, the growth rates of the self-operated chain and platform 3P intermediary businesses were roughly the same this quarter, and structural changes had little impact on the comprehensive take rate. Therefore, the decline in the monetization rate may be more a result of the company actively offering discounts on commissions, which is also in line with the general trend of exchanging price for volume.

2. New Homes: Growing Against the Trend, Increasing Importance of Channels

Compared to the underperforming stock housing business, Ke Holdings' new home business performed strongly this quarter. The transaction volume of new homes increased by 18%, a significant improvement from the previous quarter and also significantly higher than the market expectation of 12% growth. In contrast, the sales of the top 100 real estate enterprises in China still fell by 29% year-on-year in the third quarter, indicating that Ke Holdings performed exceptionally well against the market trend. As before, Ke Holdings' ability to significantly outperform the industry is mainly attributed to the fact that nearly 60% of its partner real estate enterprises are leading state-owned enterprises, which are relatively resilient. Additionally, as a leading channel, Ke Holdings' importance in new home sales is becoming increasingly apparent.

On the revenue side, revenue from the new home business increased by 31% year-on-year, significantly outperforming the market expectation of 19% growth. Consistent with the previous quarter, the revenue growth rate of the new home business continued to significantly outperform the GTV growth rate. According to calculations, the monetization rate of the new home business remained flat at the historical high of 3.4% quarter-on-quarter (an increase of about 0.3pct year-on-year), verifying the increasing importance of Ke Holdings as a channel for real estate enterprises to acquire customers.

Dolphin Investment Research believes that as land in key urban centers becomes increasingly scarce, and with suburban projects lacking natural customer flow and difficult to sell, the bargaining power of channel providers over developers will show an upward trend in the medium term.

3. New Business Growth Remains Impressive, Long-Term Growth Potential Still Needs Verification

In addition to the primary housing transaction business, the second channel of Ke Holdings, which mainly includes home decoration, leasing, home furnishing services, and financial services, generated a total revenue of 8.64 billion this quarter. By this quarter, the second channel accounted for 38% of Ke Holdings' total revenue, with a year-on-year increase of 54%, undoubtedly becoming the main growth driver for the company.

Specifically, the home decoration business, which accounts for nearly half of the revenue contribution in the second channel, generated 4.24 billion in revenue this quarter. As the year-on-year base increased, the year-on-year growth rate continued to slow down to 33%, with a quarter-on-quarter increase of 4%. After the early rapid growth stage, the medium- and long-term growth potential of the home decoration business still needs to be verified.

The smaller leasing business contributed 3.94 billion in revenue, with a quarter-on-quarter growth rate of 24%, still in the rapid growth stage. According to the company's disclosure, this was mainly due to the growth of Ke Holdings' "Easy Rent" service.

After summing up all businesses, Ke Holdings' total revenue for this quarter was 22.59 billion, mainly driven by the new home business, with the overall year-on-year growth rate increasing to 28%. However, due to the significantly lower-than-expected recovery of the stock housing business, total revenue was slightly lower than expectations by about 0.8%.

4. Stock Housing Drags Down the Overall Contribution Margin

From a growth perspective, the recovery of the stock housing business in the third quarter was below expectations, while the new home business performed strongly. The initial explosive growth stage of innovative businesses is nearing an end. Corresponding to the above trends, in terms of the profit contribution margin of each segment (excluding labor costs such as commissions, which is close to the gross margin):

1) The profit contribution of the stock housing business was 2.54 billion this quarter, nearly 19% lower than expectations. Due to the lower-than-expected transaction volume recovery and a slight year-on-year decline in the monetization rate, the profit contribution margin of the stock housing business was only 41% this quarter, a significant decrease of 6.5pct quarter-on-quarter and also significantly lower than the expected 45.5%. Under the dual pressure of declining scale, operational deleveraging, and commission concessions, profit margins declined significantly.

2) Due to the significantly better-than-expected scale growth and the maintained high monetization rate of the new home business this quarter, the profit contribution rate remained largely stable at 24.8%, with an actual profit contribution of 1.91 billion, significantly better than the expected 1.75 billion.

3) The total contribution profit of all new businesses in the second channel has also reached 1.88 billion this quarter, accounting for 30% of the total, with a contribution ratio 1 percentage point higher than that of the previous quarter. In detail, the contribution profit rate of home decoration business has reached 31.2%, basically flat quarter-on-quarter.

However, the contribution profit rate of leasing business has declined significantly by 1.4 percentage points quarter-on-quarter to 4.4%, which may be dragged down by the decline in rental prices in some cities.

V. Gross profit plunges, dragging down profit instead of increasing

The above is the revenue and profit situation of various sectors, as well as the overall expense expenditure and profit perspective:

1) In terms of overall gross profit, the gross profit margin for this quarter is 22.7%, a significant plunge of more than 5 percentage points quarter-on-quarter, lower than the market expectation of 23%. As mentioned above, this is mainly due to the drag of declining profit margins in the existing home business and rental business this quarter.

On the expense side, although Ke Holdings' revenue growth rebounded in the third quarter, its marketing expenses increased by about 3% quarter-on-quarter when the revenue scale was lower than that of the previous quarter, with expenditures slightly higher than expected. R&D expenses also increased significantly quarter-on-quarter. Both of these external-oriented expenses increased, reflecting Ke Holdings' renewed confidence in the future market after seeing numerous policy expenditures.

Fortunately, the largest internal management expenses decreased slightly quarter-on-quarter, so the overall expense expenditure still decreased slightly by about 5 million yuan quarter-on-quarter.

However, diluted by stronger revenue growth, all expense ratios still declined significantly. The combined three expense ratios decreased by 6 percentage points quarter-on-quarter. Coupled with a gross profit margin that increased by about 2 percentage points quarter-on-quarter, compared to the nearly zero profit in the previous quarter, the operating profit margin for this quarter rebounded directly to 8.6%. Ultimately, the operating profit for this quarter was 2.02 billion yuan, far exceeding the expected 0.95 billion yuan.

Even after adding back share-based compensation, impairment of credit, amortization, etc., the adjusted net profit for this quarter was 2.64 billion yuan, also exceeding expectations by nearly 0.8 billion yuan.

In addition, the number of stores and agents on Ke Holdings' platform also increased by 12% and 11% year-on-year, respectively, returning to store expansion and recruitment, which also reflects the improvement of the company's confidence. However, attention should also be paid to the potential cost expansion issues.

However, diluted by stronger revenue growth, all expense ratios still declined significantly. The combined three expense ratios decreased by 6 percentage points quarter-on-quarter. Coupled with a gross profit margin that increased by about 2 percentage points quarter-on-quarter, compared to the nearly zero profit in the previous quarter, the operating profit margin for this quarter rebounded directly to 8.6%. Ultimately, the operating profit for this quarter was 730 million yuan, a year-on-year decrease of 20%. This is obviously a poor performance. The adjusted net profit for this quarter was 1.78 billion yuan, also a year-on-year decrease of about 14%.

- END -

// Reprint Authorization

This article is an original article by Dolphin Investment Research. For reprint, please obtain authorization.