O-Film, Apple's Abandoned Child, Revives with Huawei's Support

![]() 11/25 2024

11/25 2024

![]() 573

573

From being abandoned by Apple's supply chain to becoming Huawei's top supplier, O-Film seems to have recovered.

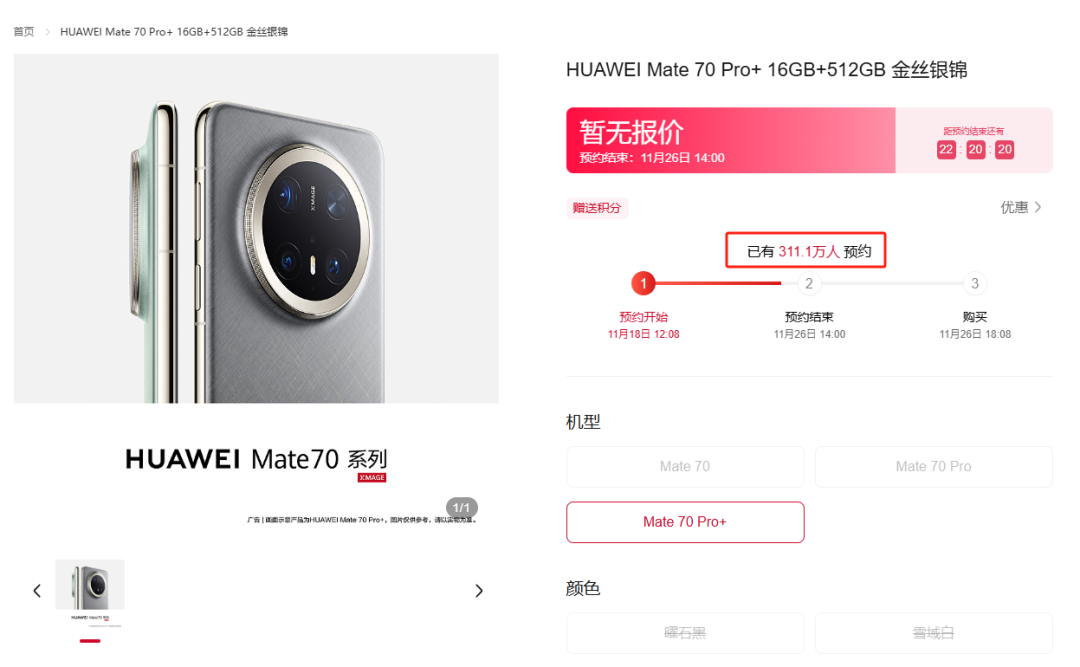

With less than 24 hours until the launch of Huawei's Mate 70 series, this year-end flagship product, hailed as the "strongest Mate ever," has attracted over 3.11 million pre-orders on Huawei's official store as of 15:40, November 25, 2024. Its popularity speaks for itself.

Image Source: Huawei Store

The popularity of the Mate 70 series has also boosted sentiment in the secondary market. Among them, O-Film, one of Huawei's concept stocks, stands out with its share price rising from a low point to a recent high of 18.84 yuan, a new three-year high. This represents a more than fourfold increase from its 2023 low.

This is not the first time O-Film has been lifted by Huawei. After the launch of the Mate 60 in 2023, O-Film's market value surged by 15 billion yuan in just six trading days.

Looking back, O-Film successfully entered Apple's supply chain in 2016, becoming the only domestic module manufacturer covering both Android and Apple supply chains at that time. Its revenue surged, peaking at over 50 billion yuan in 2019.

However, good times did not last long. In 2020, O-Film was expelled from Apple's supply chain, leading to a sharp decline in performance and a drastic drop in share price.

From 2020 to 2022, O-Film's net profit after tax totaled a loss of nearly 10 billion yuan, earning it the nickname "O-Loss" in the market.

In 2023, with Huawei's strong comeback, O-Film began to show signs of recovery. Financial reports show that in 2023 and the first three quarters of 2024, O-Film achieved revenues of 16.863 billion yuan and 14.472 billion yuan, respectively, with net profits after tax of 77 million yuan and 47 million yuan. The years of consecutive losses following its expulsion from Apple's supply chain have been halted.

By partnering with Huawei, the "light of domestic production," has O-Film truly emerged from the shadow of Apple's supply chain?

01

From the Spotlight to Dark Times in Apple's Supply Chain

O-Film rose to prominence and fell due to Apple's supply chain.

Founded in 2001, O-Film was originally a Sino-foreign joint venture on the brink of bankruptcy due to poor management. In 2002, it was acquired by brothers Cai Rongjun and Cai Gaoxiao for 4.39 million yuan.

Under the leadership of the Cai brothers, O-Film quickly overcame its difficulties, not only gaining a foothold in the infrared cut-off filter market but also securing a 30% global market share and successfully listing on the Shenzhen Stock Exchange in 2010.

After entering the capital market, O-Film continued to transform and upgrade, expanding its business from touchscreens to camera modules and into the fingerprint recognition field.

In 2016, O-Film made a significant acquisition of Guangzhou Delta, a company specializing in micro-camera modules and optical lenses, catapulting it to stardom in Apple's supply chain and driving its market value to 70 billion yuan within a year.

It is worth noting that in 2019, market reports indicated that O-Film's top three customers were Huawei (32%), Apple (20%), and Xiaomi (19%). In other words, Huawei was also a major customer of O-Film at that time.

However, this high point lasted only four years.

On the evening of July 20, 2020, Cai Rongjun, who was about to rest, was suddenly informed by an employee that the company was suspected of being on the U.S. sanctions list. That night, Cai Rongjun had a sleepless night and convened an emergency meeting, though he knew such measures were futile.

Soon after, O-Film was abandoned by Apple and expelled from its supply chain. To make matters worse, Huawei's mobile phone business also plummeted due to U.S. sanctions.

Overnight, O-Film found itself on the brink of collapse – revenue contributions from its major domestic customers dropped from 19 billion yuan to 2.8 billion yuan, and overseas customers disappeared entirely. The company's overall revenue fell from 51.9 billion yuan in 2019 to 14.8 billion yuan in 2022.

With a steep decline in performance, executive departures, and a sharp drop in employee numbers from over 40,000 to just over 10,000, O-Film fell into its darkest hour amidst internal and external challenges.

'After enduring storms, there are only bigger storms. We've been constantly pushed down,' Cai Rongjun recalled. 'Some long-time colleagues chose to leave despite my pleas. Many directors, supervisors, and senior executives departed.'

After a heavy blow, O-Film welcomed its "white knight" in 2021 – Hefei State-owned Assets Supervision and Administration Commission.

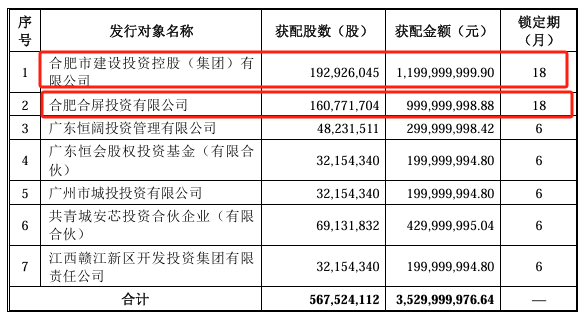

Image Source: O-Film Announcement

On September 24, 2021, O-Film announced the results of its private placement, raising 3.53 billion yuan at a price of 6.22 yuan per share. All seven subscribers participating in the private placement had state-owned backgrounds, with Hefei State-owned Assets contributing the most – Hefei Construction Investment Holding (Group) Co., Ltd. (Hefei Jiantou) received approximately 1.2 billion yuan, and Hefei Heping Investment Co., Ltd. (Hefei Heping) received approximately 1 billion yuan, accounting for 62.9% of the total fundraised amount.

The combined 2.2 billion yuan contribution from Hefei State-owned Assets enabled O-Film to survive the loss of major customer orders and share price declines.

Judging from its current performance and share price, O-Film has not disappointed Hefei State-owned Assets, even allowing them to "make a fortune."

Beyond Hefei State-owned Assets' timely assistance, O-Film also began actively rescuing itself. Building on its consumer electronics business, it embraced diversification, venturing into robotics, smart homes, smart cars, and other optical fields.

02

Revival through Huawei

O-Film's turnaround came in 2023.

Cai Rongjun revealed that in September 2023, the company's mobile phone products for a specific domestic customer officially returned to the market, generating robust sales and benefiting O-Film significantly as one of the suppliers. According to Cai, O-Film supplied rear and front cameras, fingerprint modules, and other components for this product.

In response, YuanMeiHui reviewed market news at that time and found that Huawei had announced its return with the Mate 60 series, receiving an enthusiastic market response. Additionally, media reports cited supply chain sources stating that O-Film supplied all camera modules for Huawei's Mate 60 series. Combined with multiple channels of information, including Huawei concept stocks, although O-Film has not officially responded to supplying Huawei, it is not difficult to verify its entry into Huawei's supply chain.

Huawei Mate 60 Series Promotional Image

YuanMeiHui sent an inquiry email to O-Film regarding whether it had entered Huawei's supply chain system but did not receive a response as of press time.

Benefiting from Huawei's support, O-Film's performance reversed its decline. In the fourth quarter of 2023, the company achieved quarterly revenue exceeding 6 billion yuan, with full-year revenue increasing by 13.73% year-on-year, and net profit after tax turning positive.

With Huawei's strong comeback, O-Film's performance and share price have also accelerated. However, such signs of "recovery" are still insufficient to dispel market concerns about O-Film's future stable growth.

From a market perspective, due to the continued recovery in Europe, the Caribbean and Latin America, and Southeast Asia, global smartphone shipments reached 307 million units in the third quarter of 2024, a year-on-year increase of 2%. Among them, smartphone sales in China increased by 8% year-on-year. While there has been some improvement in growth, a full recovery in the mobile phone industry will take time.

Moreover, as mobile phone cameras have undergone several upgrades, from single to multi-camera systems, the average number of cameras per phone has nearly peaked. In other words, the future growth space for camera modules, one of O-Film's main businesses, is unlikely to bring significant surprises to the market.

In terms of gross profit margin, O-Film's bargaining power is quite limited. According to Tianyancha data, O-Film's gross profit margins from 2020 to the first three quarters of 2024 were 10.91%, 8.55%, -0.1%, 10.02%, and 11.49%, respectively.

This situation is related to O-Film's pressure at both ends of the supply chain.

Upstream, O-Film's module business requires storing a large inventory, which carries the risk of impairment during industry downturns, essentially transferring the risk to itself. This was the main reason for the company's gross profit margin of -0.1% in 2022 – to dispose of inventory, the company sold products at reduced prices.

Downstream, O-Film's end customers, such as Apple and Huawei, have strong bargaining power. Besides affecting the gross profit margin, a crucial point is that even after selling products, payment may not be received in the short term.

Additionally, O-Film's debt ratio is relatively high. According to Tianyancha data, O-Film's debt ratios from 2020 to the first three quarters of 2024 were 73.71%, 60.68%, 78.19%, 79.01%, and 79.01%, respectively.

As the countdown to the launch of Huawei's Mate 70 series begins, O-Film may see a temporary uptick in performance and share price. However, in the long run, relying solely on Huawei's contributions for growth is far from sufficient for O-Film. Even if Huawei compensates for O-Film's loss in Apple's supply chain and helps it return to its peak, it may not necessarily be a good thing.

After all, the tragedy of being highly dependent on Apple has only just passed.

Some images are sourced from the internet. Please inform us for removal if there is any infringement.