Fuyou Payment Races to IPO with "Clearance-Style" Dividends: Unstable Performance and Numerous Doubts Behind

![]() 11/25 2024

11/25 2024

![]() 620

620

Contributed by|Yu Yuan

Source|Beiduo Finance

Recently, Shanghai Fuyou Payment Service Co., Ltd. (hereinafter referred to as "Fuyou Payment") submitted its fifth IPO application. During the previous four preparation processes, Fuyou Payment made corresponding adjustments to its shareholding structure, business scope, and management team.

Previously, Fuyou Payment had planned to list on the A-share market, but this did not materialize. In contrast, companies like Lakala, Yika, and Lianlianpay have listed on the A-share and Hong Kong stock markets, respectively. Additionally, payment companies such as PingPong and Shouqianba have also circulated rumors of listing to varying degrees.

How solid are Fuyou Payment's prospects for this IPO?

I. Three Failed IPO Attempts in the Initial Stage, Fourth Attempt Still Underprepared

On November 8, 2024, Fuyou Payment once again submitted an IPO application to the Hong Kong Stock Exchange, with CITIC Securities and Shenwan Hongyuan Securities as co-sponsors. This was its second application to the Hong Kong Stock Exchange. Subsequently, on November 15, in the "Overseas Securities Issuance and Listing Filing Status Table" released by the China Securities Regulatory Commission (CSRC), Fuyou Payment's filing status was marked as "Supplementary Materials Required".

Screenshot from CSRC official website

On April 30, 2024, Fuyou Payment also submitted a prospectus to the Hong Kong Stock Exchange. Later, on June 7, the CSRC released the "Requirements for Supplementary Materials for Overseas Issuance and Listing Filing," requiring Fuyou Payment to provide additional information on shareholding changes, status of subsidiaries, business scope, litigation involvements, and administrative penalties.

However, until the application expired, Fuyou Payment did not provide a clear response. According to regulations, a hearing must be completed within six months after the application is submitted; otherwise, the application will be deemed invalid. However, this does not necessarily mean IPO failure. As long as the issuer submits updated financial information within three months after the prospectus expires, the listing process can continue. Therefore, this IPO application can also be seen as a continuation of Fuyou Payment's previous IPO application.

Correspondingly, in the prospectus submitted by Fuyou Payment in November 2024, it addressed some of the supplementary information required by the CSRC. However, Beiduo Finance found that the company did not provide detailed information on the actual controllers or the employee stock ownership plan.

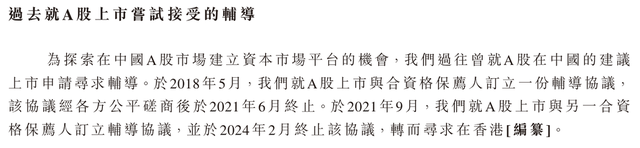

Prior to this, Fuyou Payment had already failed in three attempts to IPO on the A-share market. In December 2015, Fuyou Payment's parent company, Shanghai Fuyou Financial Services Group (hereinafter referred to as "Fuyou Financial"), signed a mentoring agreement with Industrial Securities. However, nine months later, Industrial Securities announced the termination of the mentoring due to Fuyou Financial's capital replenishment needs.

In May 2018, Fuyou Payment reached a mentoring agreement with Oriental Fortune Securities (later renamed Oriental Securities). However, in July 2021, the Shanghai Securities Regulatory Bureau's official website announced the termination of Fuyou Payment's IPO mentoring work by Oriental Securities Underwriting and Sponsorship Co., Ltd.

More than two months later, in September 2021, Fuyou Payment once again signed an IPO mentoring agreement with Guojin Securities. In April 2023, after completing the sixth phase of mentoring work for Fuyou Payment, Guojin Securities ceased further communication. Fuyou Payment stated in its latest prospectus that this cooperation was terminated in February 2024. Since then, Fuyou Payment has shifted its focus to the Hong Kong stock market.

Screenshot from Fuyou Payment's prospectus

Regardless of the number of attempts, IPO failures can have a significant negative impact on a company's development. Therefore, Fuyou Payment has made considerable efforts to successfully list, evident from the changes in its corporate information. From the start of its IPO preparations in 2015 until its second application in 2024, Fuyou Payment's business scope, management team, and shareholding structure have undergone significant changes.

According to information from the Tianyancha App, after being queried by the CSRC, Fuyou Payment made changes to its business scope and general business items in September 2024. The revised business and operating scope excluded the advertising business inquired about by the CSRC in June, moving closer to payment, data, technology, and sales-related businesses.

Screenshot from Tianyancha App

In terms of the management team, Fuyou Payment's legal representative and general manager positions were changed on the eve of the April 2024 application. Zhang Yiqun stepped down from his positions as general manager and legal representative, retaining only his positions as chairman of the board (i.e., chairman) and executive director. Fu Xiaobing took over as general manager and legal representative.

According to the prospectus, Zhang Yiqun served as the department manager and assistant president of Fuyou Network from 2009 to 2013. He joined Fuyou Payment in 2011 and later served as the assistant president from 2012 to 2014. In 2017, he joined the board of directors as an executive director and concurrently served as the general manager of Fuyou Payment until April 2024, when he also took on the role of chairman in 2019.

Fu Xiaobing joined Fuyou Payment in 2007. Prior to this, he worked at Shanghai Zhongruan Huateng Software Systems Co., Ltd., serving as assistant president of Fuyou Network from 2007 to 2011 and vice president of Fuyou Group from 2011 to 2024. Currently, in addition to his position at Fuyou Payment, he also holds positions in several other companies.

Among these companies, 18 are controlled by Shanghai Fuyou E-commerce Co., Ltd. (hereinafter referred to as "Fuyou E-commerce"), whose legal representative and director is still Fu Xiaobing, and whose controlling shareholder is Shanghai Fuyou Financial Services Group Co., Ltd. (hereinafter referred to as "Fuyou Group"). The chairman, general manager, and legal representative of Fuyou Group is Chen Jian.

Among the other companies where Fu Xiaobing serves, three have Shanghai Dayun Pingyi Investment Management Co., Ltd. as their largest shareholder. The executive director, general manager, and legal representative of this company are all Chen Jian, and the controlling shareholder is Fuyou Group; three have Chen Jian as their chairman, general manager, and legal representative.

Additionally, the other ten companies have varying degrees of connection with Chen Jian and Fuyou Group. These companies operate in industries beyond the financial sector where Fuyou Payment is located, including internet information services, organizational management services, comprehensive retail, integrated management services, other retail industries, wholesale, technology promotion services, and financial information services.

Screenshot from Tianyancha App

Although Shanghai Qingyi, Ningbo Zhefu, Jiang Weiqian, and Chen Zhaoyang decided to withdraw from Fuyou Payment on the eve of the April 2024 application, the number of shareholders remained significant, increasing from two corporate shareholders after the 2017 restructuring to the current 68 shareholders. The shareholding structure appears more decentralized and aligns more closely with the shareholding structure of listed companies.

In reality, Fuyou Payment's shareholder equity remains relatively concentrated. The prospectus shows that Fuyou Group holds 52.72% of the shares, Shanghai Qingyi holds 5.06%, Fuyouhao holds 3.66%, Shanghai Tianzi holds 1.98%, Ningbo Zhefu holds 1.45%, Jiang Weiqian holds 1.11%, Chen Zhaoyang holds 0.67%, and the remaining 65 shareholders collectively hold 33.35% of the shares.

When Shanghai Qingyi, Ningbo Zhefu, Jiang Weiqian, and Chen Zhaoyang withdrew, they transferred all their shares to Fuyou Group, resulting in Fuyou Group currently holding 61.01% of Fuyou Payment's shares. Additionally, Fuyouhao, the second-largest shareholder, and Shanghai Tianzi, the fifth-largest shareholder, both have deep ties to Fuyou Payment.

As mentioned earlier, Chen Jian, the chairman, general manager, and legal representative of Fuyou Group, is also an executive director of Fuyou Payment and currently holds director positions in other subsidiaries of Fuyou Payment. Meanwhile, Fu Xiaobing is also a member of the board of directors of Fuyou Group. Among Fuyou Group's shareholders, Shanghai Tianzi is prominently listed.

According to the Tianyancha App, Shanghai Tianzi's executive partner and ultimate beneficiary are both Fu Xiaobing, and the partners include both Fu Xiaobing and Zhang Yiqun. Although Shanghai Tianzi is named as an investment center, it only invests in Fuyou Group and Fuyou Payment.

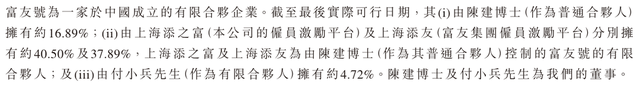

According to the prospectus, among the shareholders of the second-largest shareholder, Fuyouhao, Chen Jian holds a 16.89% stake and is the actual controller, while Fu Xiaobing holds a 4.72% stake as a limited partner.

Screenshot from Fuyou Payment's prospectus

Chen Jian worked at Shenzhen City Cooperative Commercial Bank from 1996 to 1997. From 1997 to 2002, he worked at China Merchants Bank. From 2002 to 2009, he worked at China UnionPay. He has approximately 28 years of experience in the financial and payment industries. Although he does not directly hold shares in Fuyou Payment, he has significant indirect control over the company.

Many of Fuyou Payment's interests still rest with Chen Jian and Fu Xiaobing. While concentrated interests can make corporate decision-making more efficient, they also significantly increase decision-making risks and the risk of benefit transfer. Therefore, Fuyou Payment's "clearance-style" dividends amidst unfavorable pre-IPO market value and profitability have attracted widespread attention.

It is worth noting that Fuyou Payment's profitability has fluctuated since 2021.

From 2021 to the first half of 2024, Fuyou Payment's operating revenues were 1.102 billion yuan, 1.142 billion yuan, 1.506 billion yuan, and 782 million yuan, respectively, with net profits of 147 million yuan, 71 million yuan, 93 million yuan, and 42 million yuan, respectively, showing cases of "increased revenue without increased profits."

Among them, the net profit margin dropped from 13.4% in 2021 to 5.3% by the end of the first half of 2024. Fuyou Payment explained in its prospectus that the decline in net profit margin was mainly due to the drop in gross profit margin from 30.5% in 2021 to 28.4% in 2022, as well as a decrease in net other income and expenses, and the impact of financial asset impairments.

Regarding the decrease in gross profit margin, Fuyou Payment believes it was caused by the decline in gross profit margins for domestic payment services, cross-border digital payment services, and digital business solutions.

The gross profit margin for domestic payment services dropped from 23.1% in 2022 to 21.1% in 2023, mainly due to an increase in transaction volume and an increase in commission fees for acquiring services. From 2021 to the first half of 2024, Fuyou Payment's commission fees were 753 million yuan, 789 million yuan, 1079 million yuan, and 548 million yuan, accounting for 97.0%, 96.5%, 95.9%, and 95.1% of sales costs, respectively.

The gross profit margin for cross-border digital payment services dropped from 58.0% in 2021 to 36.3% in 2023, mainly attributed to reduced service fees and increased commission fees due to market competition. The gross profit margin for digital business solutions decreased from 87.9% in 2021 to 76.5% in 2023, primarily due to the one-time recognition of higher-margin PaaS solution revenue in 2021 and higher promotion fees paid by partner banks in 2022.

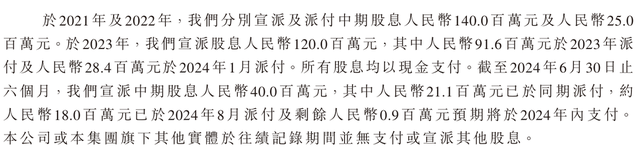

In addition to unstable profitability, Fuyou Payment's valuation has remained stagnant at 3.6 billion yuan since 2020. In contrast, the company's dividends have been quite generous.

In 2021 and 2022, Fuyou Payment distributed interim dividends of 140 million yuan and 25 million yuan, respectively, and distributed dividends of 120 million yuan in 2023, totaling 285 million yuan in dividends over three years, accounting for 91.6% of the total net profit over the three years. As of the end of the first half of 2024, Fuyou Payment announced another interim dividend of 40 million yuan.

Screenshot from Fuyou Payment's prospectus

On March 15, 2024, the CSRC issued the "Opinions on Strictly Controlling IPO Access to Improve the Quality of Listed Companies from the Source (Trial)" which pointed out the need to closely monitor whether companies planning to list engage in "clearance-style" dividends before listing, strictly preventing and investigating such behaviors, and implementing a negative list management approach.

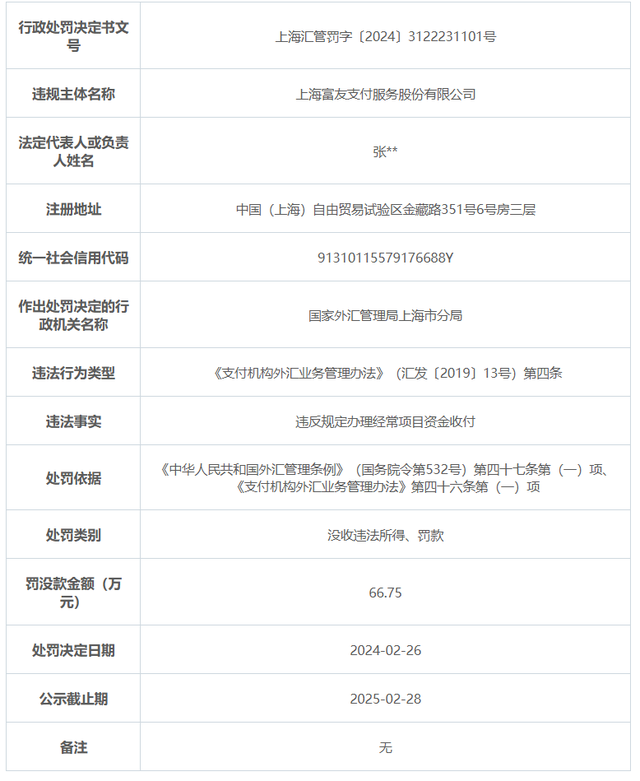

This has raised compliance concerns regarding Fuyou Payment's dividends. Beiduo Finance found that Fuyou Payment's compliance issues do not end here. In February 2024, the State Administration of Foreign Exchange's Shanghai Branch confiscated illegal income and imposed a total fine of 667,500 yuan on Fuyou Payment for violating regulations regarding the receipt and payment of current account funds.

Screenshot from the State Administration of Foreign Exchange's official website

On December 5, 2020, the Supreme People's Procuratorate named Fuyou Payment, stating that employees of Fuyou Payment and its Shenzhen branch had provided third-party fund settlement services for eight platforms, including the fraudulent stock trading platform "Hangzhou Zhongyin."

In 2021, Fuyou Payment was ordered by the People's Bank of China's Shanghai Branch to make corrections within a specified timeframe and fined 180,000 yuan for failing to handle changes as required, failing to establish and implement a special merchant information management system as required, and illegally transferring funds to non-identical bank settlement accounts.

In November 2023, administrative penalty information from the People's Bank of China's Shanghai Branch showed that Fuyou Payment was fined 4.55 million yuan for "failing to fulfill customer identification obligations as required; failing to submit large-value transaction reports or suspicious transaction reports as required; and conducting transactions with unidentified customers or opening anonymous or pseudonymous accounts for customers." Additionally, Chairman Zhang Yiqun was fined 85,000 yuan.

Given these various issues, Fuyou Payment's IPO outcome remains unoptimistic.