Performance soaring Pinduoduo sees market value evaporate by over 120 billion yuan

![]() 11/26 2024

11/26 2024

![]() 566

566

Click 'Short, Plain, and Fast Interpretation' to follow us. For tips, please @editor

Overnight, Pinduoduo's market value shrank by over 120 billion yuan.

Although the company recorded revenue and net profit growth in the third quarter, both fell short of institutional expectations, performing far worse than in previous quarters. Gross and net profit margins also saw significant declines.

Prior to the disclosure of this quarterly report, Nongfu Spring founder Zhong Shanshan criticized Pinduoduo's pricing system, drawing more attention to the company. Pinduoduo did not respond to this. For Pinduoduo, it is now more important to ensure merchants operate in compliance and protect consumer rights.

Share price fell by over 10%

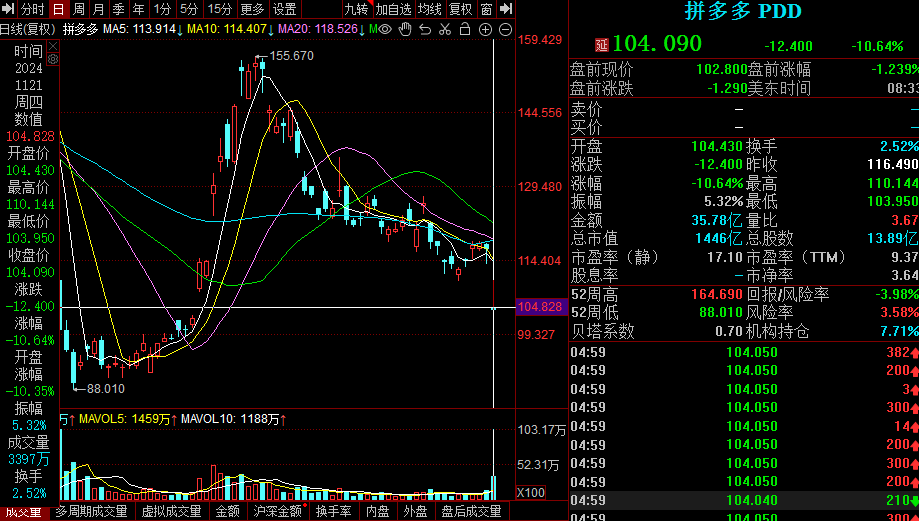

On November 21, Pinduoduo's US stock price plummeted at the open and closed down 10.64% at $104.09 per share, with a total market value of $144.6 billion and a trailing twelve-month (TTM) P/E ratio of 9.37.

Overnight, Pinduoduo's market value shrank by $17.2 billion, equivalent to approximately 124.7 billion yuan.

On the same day, Alibaba's US stock price was $85.58 per share, with a total market value of $204.7 billion and a TTM P/E ratio of 16.73. The market value gap between the two e-commerce platforms widened further.

Thinking back to last year, when Pinduoduo's market value surpassed Alibaba's, Jack Ma even personally came out to boost his employees' morale. Times have changed, and the market values of the two e-commerce platforms have reversed again.

In terms of news, Pinduoduo disclosed its Q3 quarterly report yesterday.

In the third quarter, Pinduoduo achieved revenue of 99.354 billion yuan, a year-on-year increase of 44%, and net profit attributable to shareholders of 24.98 billion yuan, a year-on-year increase of 61%.

Pinduoduo's Chairman and CEO Chen Lei said that in the past quarter, our focus remained on promoting high-quality development of the platform. We are committed to continuously and patiently investing in our platform ecosystem to achieve long-term impact.

Although Pinduoduo's revenue and net profit both increased significantly, they fell short of market expectations. Previously, Bloomberg had expected Pinduoduo's Q3 revenue and net profit to be 102.83 billion yuan and 29.21 billion yuan, respectively, representing year-on-year increases of 49% and 72%.

This is one of the important reasons why the company faced a vote of no confidence from investors.

Compared to Alibaba and JD.com, Pinduoduo's revenue growth rate is undoubtedly ahead. Alibaba and JD.com's revenue growth rates for the quarter were 5.21% and 5.12%, respectively. However, the gap in net profit growth rates among the three e-commerce platforms is not as significant as that in revenue growth rates. Alibaba and JD.com's net profit growth rates were 58.12% and 47.82%, respectively.

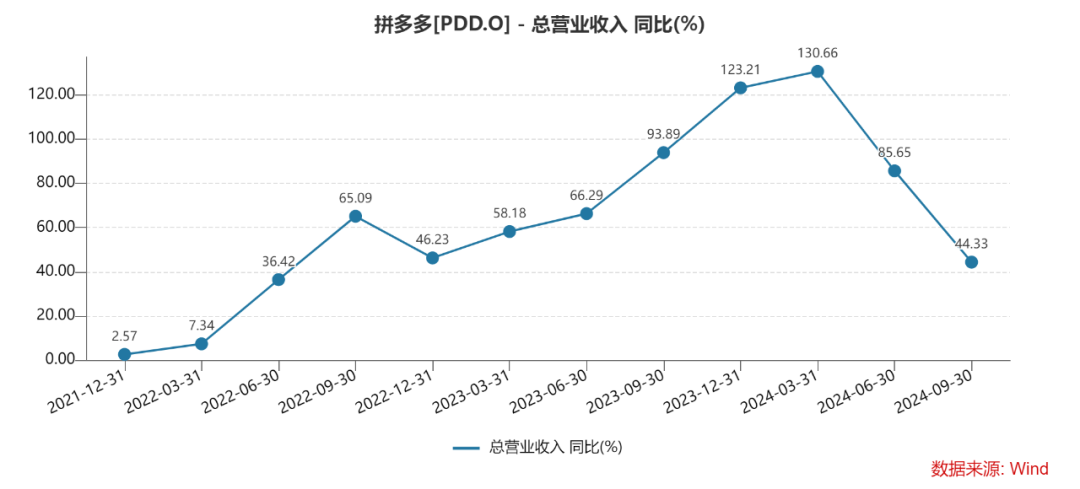

Compared to itself, Pinduoduo's revenue and net profit growth rates slowed down significantly this quarter. In the first half of the year, the quarterly revenue growth rates were 130.66% and 85.65%, respectively. Additionally, the Q3 growth rate was the slowest since Q3 2022.

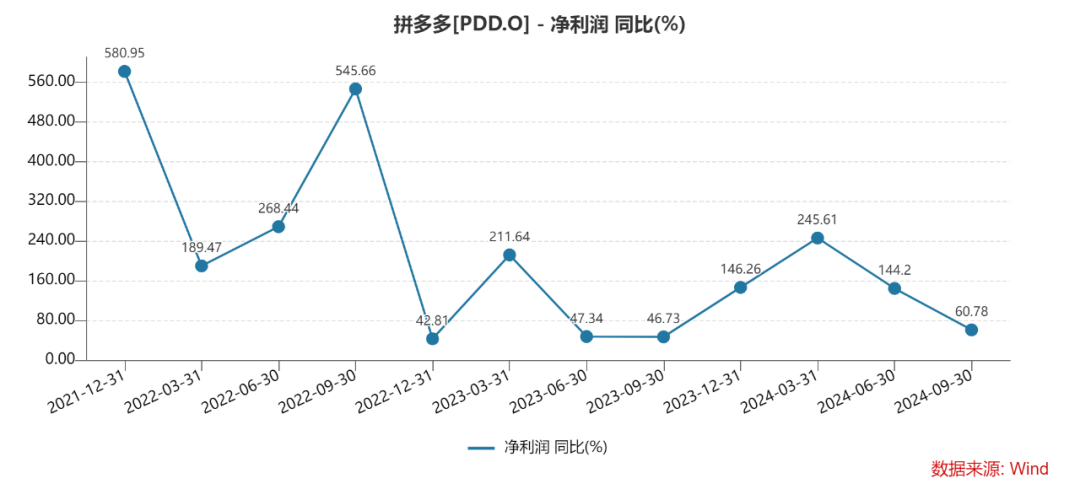

The net profit growth rates for the two quarters in the first half of the year were 245.61% and 144.2%, respectively. This means that the net profit growth rate in Q3 had already halved compared to Q2. Additionally, Q3 net profit also declined quarter-on-quarter, with a decrease of 21.96%.

In terms of business segments, online marketing services and other revenue amounted to 49.351 billion yuan, a year-on-year increase of 24%. This growth rate was the lowest since Q1 2022. Transaction services revenue was 50.003 billion yuan, a year-on-year increase of 72%. This growth rate was the lowest since Q1 2021.

Pinduoduo, which has been surging ahead, has also encountered a growth bottleneck.

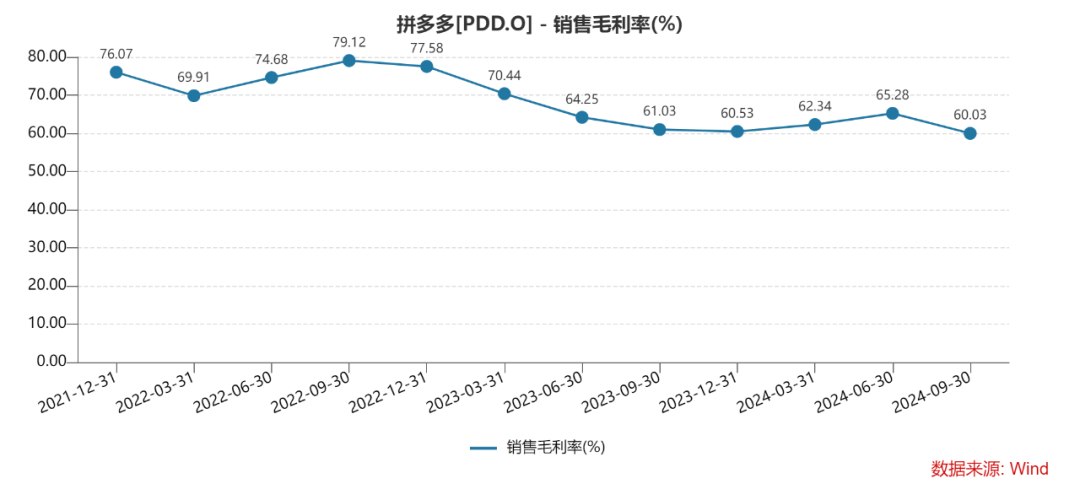

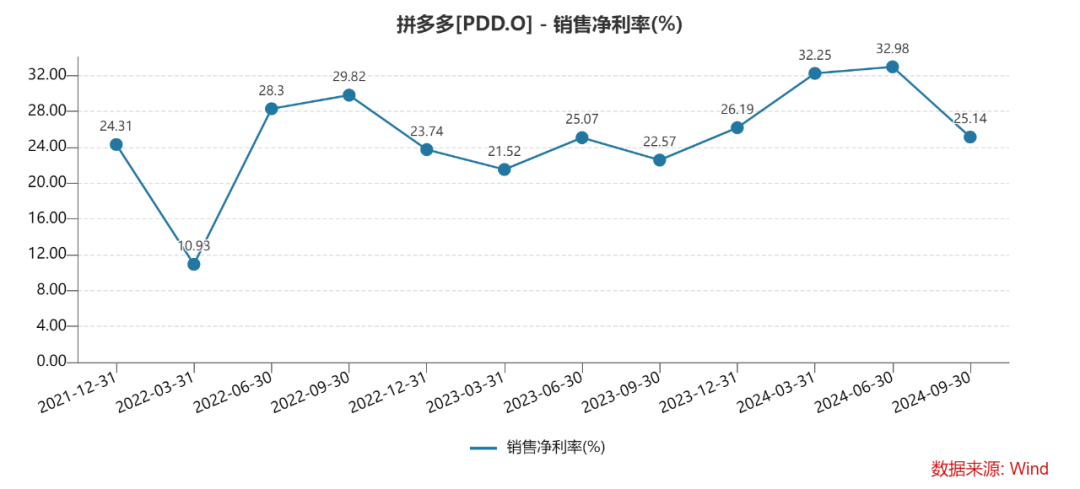

In addition, the company is also facing a decline in profitability indicators. This year, the gross profit margins for each quarter were 62.34%, 65.28%, and 60.03%, respectively, with the Q3 margin declining by 5.25 percentage points quarter-on-quarter.

The net profit margins for the same period were 32.25%, 32.98%, and 25.14%, respectively, with the Q3 margin declining by 7.76 percentage points quarter-on-quarter. Such a decline is relatively rare for a giant like Pinduoduo.

From the expense perspective, sales, research and development, and administrative expenses in Q3 were 30.484 billion yuan, 3.063 billion yuan, and 1.806 billion yuan, respectively, representing year-on-year increases of 40%, 8%, and 138%. The significant increase in sales expenses was mainly due to increased expenditures on promotions and advertising activities.

In the third quarter, Pinduoduo launched a "10 billion yuan reduction" plan, successively implementing a series of new measures such as service fee refunds, deposit reductions, waiving logistics transfer fees, and upgrading merchant after-sales services. These measures reduced merchants' operating costs but increased the company's operating costs, which is the key to the decline in profitability indicators.

In fact, during the previous quarter's earnings call, Pinduoduo admitted that revenue had slowed compared to previous quarters and indicated that further slowdowns were inevitable due to competition and global uncertainties.

The company also stated that our business is currently facing fierce competition and changing external factors, which will inevitably bring fluctuations to our business and slow down our top-line growth.

In other words, the company had already anticipated a slowdown in performance in the previous quarter, which also caused a significant drop in the company's share price at that time. Now, it seems that the impact of the slowdown was greater than anticipated by company management.

Regarding the decline in Q3 profits and profit margins, Pinduoduo stated that as revenue growth slows and we remain committed to investing in building a healthy and sustainable platform ecosystem, our profitability may fluctuate slightly or even decline in the long run.

In other words, there is still potential for profit margins to decline further.

Why the backlash

Prior to the disclosure of this quarterly report, Pinduoduo faced backlash from Nongfu Spring founder Zhong Shanshan.

Zhong criticized e-commerce price wars, stating that internet platforms, especially Pinduoduo's pricing system, are a huge detriment to Chinese brands and industries.

As everyone knows, Pinduoduo quickly captured the lower-tier market with its low-price strategy and off-peak competition. Later, to shed the "cheap" label, it introduced the "10 billion subsidy" policy. At that time, Tmall and JD.com did not have the same determination as Pinduoduo, allowing the company to further expand its scale.

As Pinduoduo grew stronger, Tmall and JD.com could no longer sit idly by and introduced their own "10 billion subsidy" policies, attempting to compete for market share with low prices. This led to an e-commerce price war, but Pinduoduo had already established a strong presence in consumers' minds, limiting the effectiveness of other platforms' subsidies.

Pinduoduo's original intention was to shed the "cheap" label, but to this day, the label persists. Additionally, the platform still hosts a mix of good and bad merchants, with an endless stream of counterfeit products, causing many brands harm but leaving them helpless.

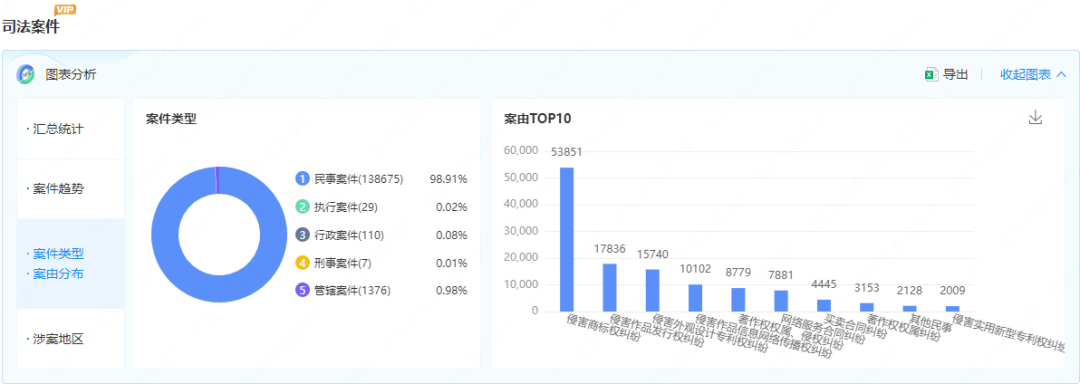

QCC shows that Pinduoduo's operating entity, Shanghai Xunmeng Information Technology Co., Ltd., has up to 140,000 legal cases. The top cause of action is trademark infringement disputes, totaling nearly 54,000 cases, with the company mostly serving as the defendant.

Consumers also encounter issues from time to time. According to Heimao Complaints, as of November 22, Pinduoduo had received 37,478 complaints in the past 30 days, with only 1,710 resolved, resulting in a complaint resolution rate of less than 5%. Most complaints involved product quality issues and unresponsive merchants.

However, Pinduoduo's "refund only" policy somewhat protects consumer rights but also creates new problems, attracting many freeloaders, making merchants miserable and even causing some to leave the platform.

Since the official number of merchants is not disclosed, the number of merchants leaving the Pinduoduo platform is unknown to the outside world. However, analyzing the company's series of policies to support merchants, it can be estimated that the number is not insignificant.

On August 13, Pinduoduo reduced the service fee for pay-after-use from 1% to 0.6%, with the basic service fee also refundable.

On September 6, the platform lowered the threshold for the basic deposit for stores. For eligible merchants, the threshold was reduced to 500 yuan, and already-enrolled merchants who meet the relevant conditions can also enjoy the same treatment. This policy covers nearly 70 categories of merchants.

Whether this basket of support policies can retain merchants will be answered by future performance.

Judging from the complaints on the Heimao Complaints platform, how to ensure merchants operate in compliance is also something that Pinduoduo's management should seriously consider. After all, after wild growth, compliance is crucial for stable and long-term development.

During the earnings call, Pinduoduo stated that the company's business development and regulatory trends in various markets have placed higher demands on our compliance capabilities. We have always believed that providing a safe and reassuring consumer environment is the duty of an e-commerce platform.

In summary, Pinduoduo continues to invest heavily in building a professional compliance team, preparing detailed compliance education materials for merchants to enhance their compliance capabilities, and optimizing the norms and processes for merchant enrollment and product listing through technological means.

(Short, Plain, and Fast Interpretation - Original work, please do not reprint without permission! PS: If the manuscript infringes upon copyright or contains erroneous data, please contact us promptly for correction)