NVIDIA Q3 Earnings Report: Dominating the AI Wave

![]() 11/26 2024

11/26 2024

![]() 554

554

Produced by Zhineng Zhixin

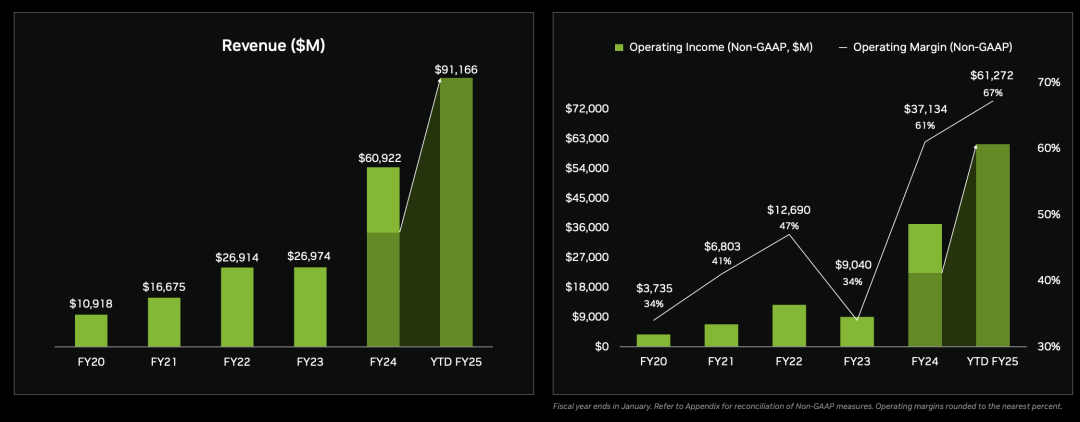

NVIDIA's fiscal third-quarter 2025 earnings report revealed that the world's most valuable company continues to expand steadily amid the AI wave.

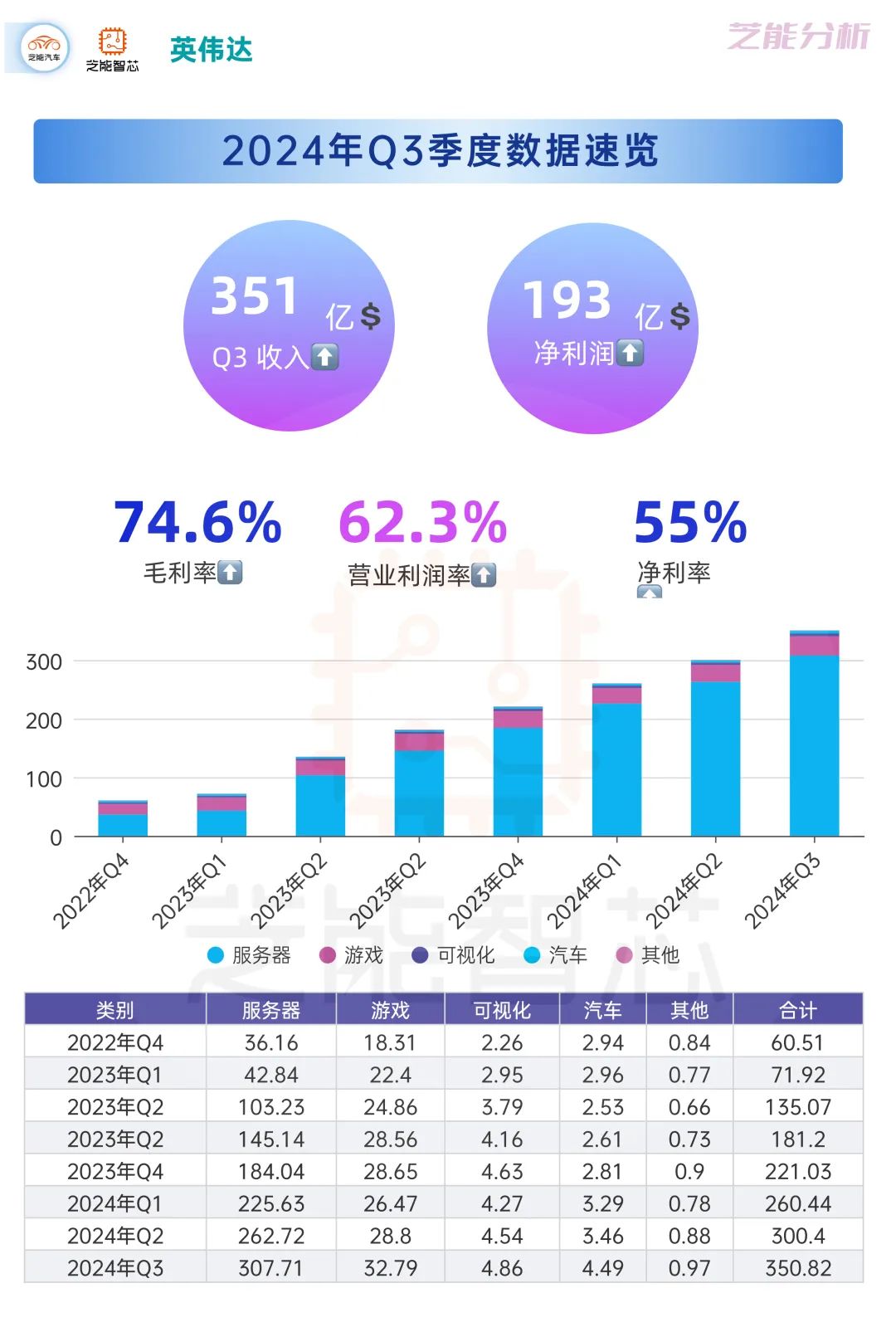

Revenue increased by 93.6% year-on-year to $35.08 billion, exceeding market expectations. The data center business accounted for nearly 90% of total revenue, becoming the core driver of growth, while the gaming business also showed signs of recovery.

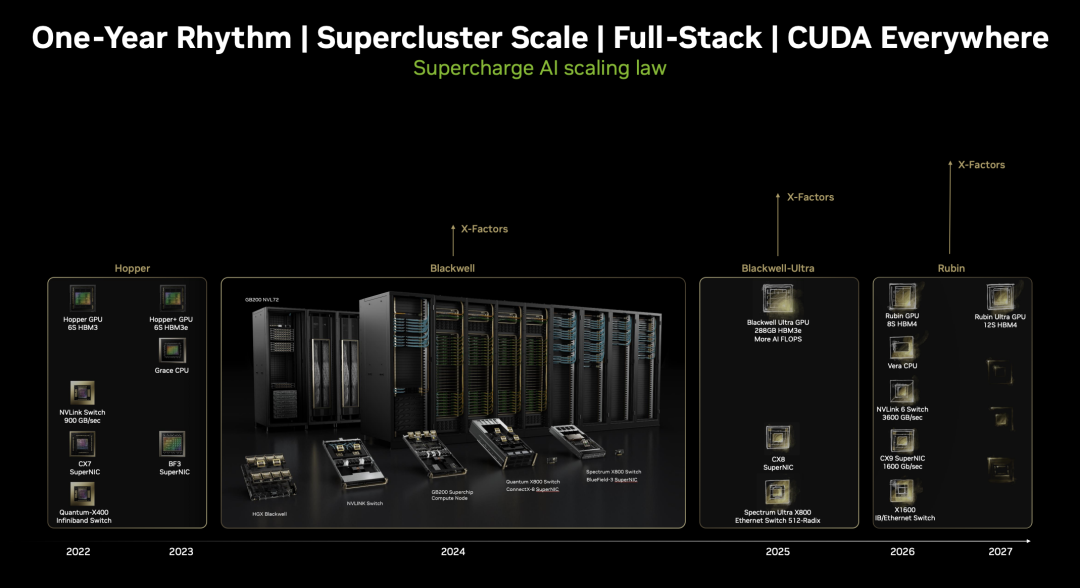

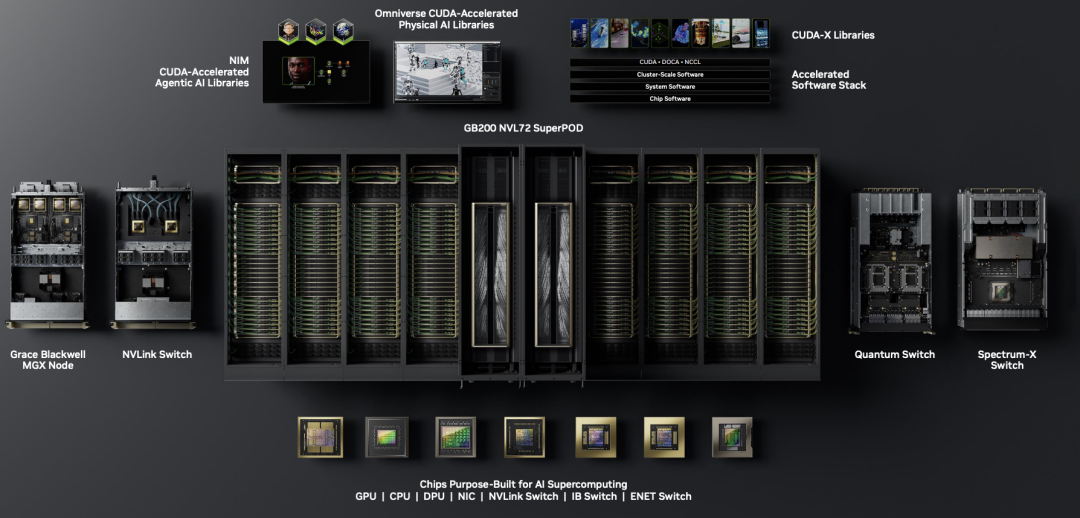

With the mass production of the next-generation Blackwell GPU, NVIDIA will further consolidate its dominant position in the AI chip market in the coming quarters. However, short-term pressure on gross margins and high market expectations for growth rates still pose challenges to its valuation and share price performance.

We will analyze the value of this earnings report from two aspects: core financial data and future outlook.

Part 1

Core Financial Data and Business Analysis

● NVIDIA achieved revenue of $35.08 billion in Q3, a year-on-year increase of 93.6%, far exceeding market expectations.

● Net profit reached $19.3 billion, a year-on-year increase of 109%, setting a new record high.

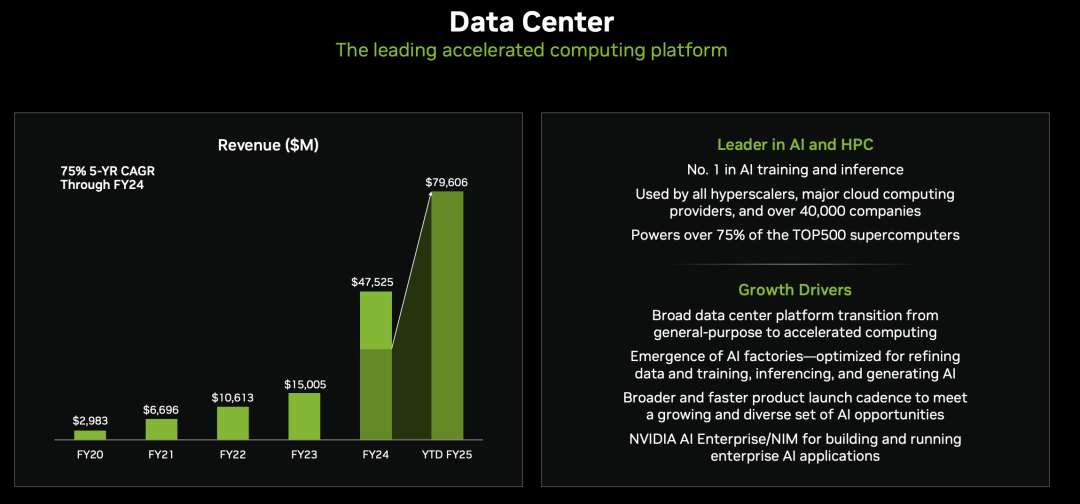

● The data center business contributed $30.77 billion, a year-on-year increase of 112%, accounting for 87.7% of total revenue.

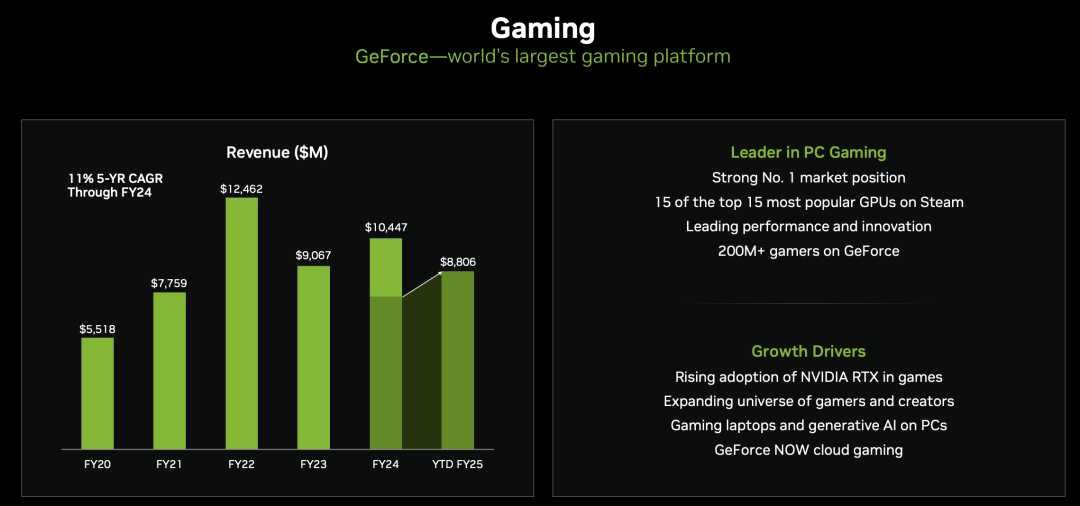

● The gaming business generated revenue of $3.28 billion, a year-on-year increase of 14.8%, indicating an expansion of the graphics card market share.

For the fourth quarter, NVIDIA expects revenue of $37.5 billion (±2%), a year-on-year increase of 69.7%, mainly driven by Blackwell GPU shipments. The market generally believes that the company's actual revenue may approach $40 billion.

● NVIDIA's gross margin (GAAP) for this quarter was 74.6%. Due to stockpiling and initial production ramp-up of Blackwell, the gross margin experienced a temporary decline. The gross margin for Q4 is expected to be 73% (±0.5%). In the future, with the large-scale mass production of Blackwell, the gross margin will rebound to around 75%.

● Data Center Business: Revenue increased by 112% year-on-year to $30.77 billion. Driven by Hopper GPU and AI training demand, computing revenue accounted for 80.8%, continuing to far exceed AMD and Intel. The annual rhythm is indeed excellent.

● Gaming Business: Revenue was $3.28 billion, a year-on-year increase of 14.8%, benefiting from the strong sales of RTX 40 series graphics cards and increasing demand for gaming console SoCs.

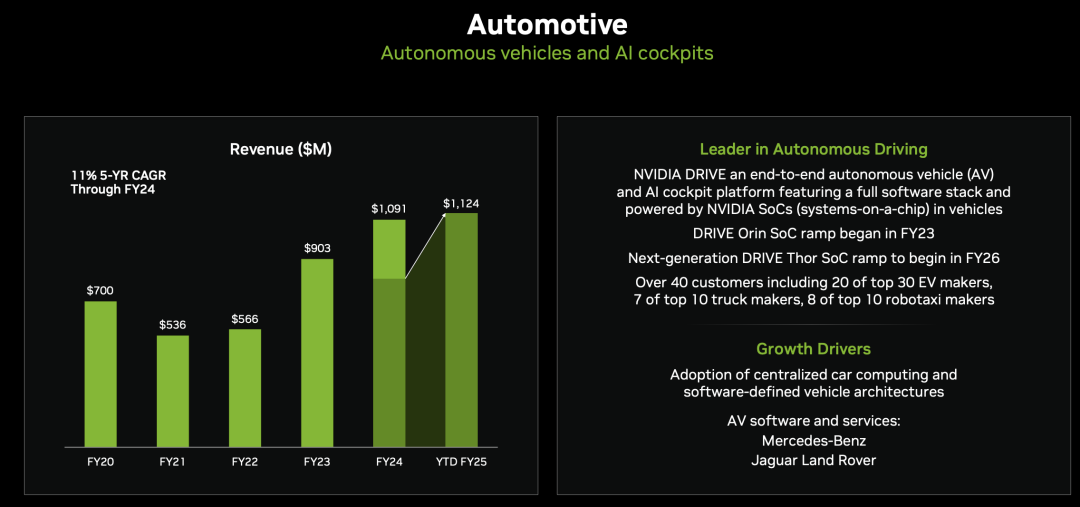

● The automotive business has underperformed, but currently, no one cares.

Driven by the dual engines of the data center and gaming businesses, NVIDIA's overall performance surpassed its competitors. AMD's gaming business revenue declined by 69.3% year-on-year this quarter, further highlighting NVIDIA's dominant position in the graphics card market.

Part 2

Future Outlook: Technological Iteration and Market Competition

The next-generation Blackwell GPU is seen as a key growth engine for NVIDIA in the coming quarters. Management has raised its expectations for Blackwell revenue in the fourth quarter, increasing it from "billions of dollars" to a higher level.

It is revealed that servers equipped with Blackwell from Foxconn, Quanta, and Dell will begin mass production shipments by the end of 2024, aligning with the peak capital expenditure periods of Meta, Google, Microsoft, and Amazon, the four major cloud vendors.

● Initial demand for Blackwell products has significantly exceeded supply, and it is expected that there will be a "shortage" situation in the next fiscal year.

● NVIDIA's share of the AI chip market is expected to further expand from the current 80.8%, consolidating its dominant position in the industry.

Cloud vendors' capital expenditures are the main driver of the data center business. The combined capital expenditures of the four major cloud vendors totaled $64.9 billion this quarter, a year-on-year increase of 73.8%. This figure is expected to reach $69.6 billion next quarter, a quarter-on-quarter increase of 7.2%. With leading product capabilities and a stable supply chain, NVIDIA has become the preferred partner for cloud vendors' expansion.

With the continued explosion of demand for generative AI, Hopper and Blackwell GPUs will provide underlying computing power support for large model training and inference. It is expected that AI chip demand will maintain high growth rates in the coming years.

● Although the gaming business's share of the company's revenue has decreased, the strong performance of RTX graphics cards shows that NVIDIA still has room for growth in this area. Thanks to the strong sales of GeForce RTX 40 series GPUs, NVIDIA's discrete graphics card market share has further increased to an all-time high, while AMD and Intel graphics cards continue to underperform.

According to IDC data, global PC market shipments increased by 0.9% year-on-year in Q3 2024. This trend will support the demand for gaming graphics cards.

● In the consumer market, NVIDIA is expected to launch PC products based on the Blackwell architecture in 2025, which will further expand its influence in the consumer market.

● In the automotive field, no one cares anymore.

NVIDIA delivered an impressive earnings report in the third quarter. With the rapid growth of its data center business and the increase in market share of its gaming business, the company has demonstrated strong profitability and growth potential.

The mass production shipments of the Blackwell GPU will be the core driver of Q4 revenue growth. In the long run, the company's technological leadership and stable market demand in the AI chip field will continue to support its high valuation.

However, as market expectations for its growth continue to rise, the company must maintain stable performance in revenue growth and gross margins to avoid valuation pressure.

Summary

NVIDIA undoubtedly leads the AI wave, and the market performance of the Blackwell GPU will be a key observation point in the future. Against the backdrop of increasing capital expenditures by major companies, NVIDIA is expected to continue consolidating its dominant position in the AI chip market, which is undeniable.