Kuaishou faces penalties again, needing to 'cure its wounds by scraping the bone'

![]() 11/26 2024

11/26 2024

![]() 572

572

Kuaishou's 'mental illness'.

According to the 'National Network Security Bulletin Center', recently, in response to issues such as illegal information in Kuaishou's short videos, public security organs imposed a warning penalty on Kuaishou in accordance with the 'Cybersecurity Law'.

Image source: screenshot from the official account

Although the public security organs did not disclose the specific illegal information content, and Kuaishou did not publicly respond to this, the notification indicated that 'Kuaishou failed to promptly dispose of information prohibited from being published or transmitted by law and administrative regulations, and did not fully implement the youth mode, leading to the spread of illegal information, harming the physical and mental health of minors, and violating relevant provisions of the Cybersecurity Law.'

The public security organs imposed administrative penalties on Kuaishou in accordance with the law, ordering it to fully implement the youth mode, comprehensively investigate and clean up illegal information, and handle illegal accounts in accordance with laws and regulations.

In fact, prior to this, Kuaishou had been penalized multiple times due to violations in short video content.

As Kuaishou's user base expanded, a series of vulgar and borderline content was frequently exposed, plunging Kuaishou into a whirlpool of public opinion multiple times.

Kuaishou is also attempting to shed the label of 'low-brow, vulgar, messy, and poor quality' and hopes to expand its user base to seek more value and recognition in the capital market; however, Kuaishou, which is 'rooted' in the sinking market, seems to struggle to truly escape the 'vulgar' label.

In 2018, Kuaishou and Huoshan Xiaoshipin platforms were summoned by the State Internet Information Office for spreading vulgar and inappropriate information involving minors, and were ordered to conduct comprehensive rectification and suspend relevant algorithm recommendation functions; subsequently, both platforms responded by banning live streaming for minor users and establishing a minor protection system for strict management.

That year, Kuaishou CEO Su Hua published an article titled 'Accepting Criticism, Moving Forward with Renewed Determination' to apologize and pledged to establish a dedicated youth protection system, resolutely resisting and eliminating illegal, Violation of regulations , and pornographic content.

He also mentioned in the article, 'If community development cannot follow its original intentions, everything will become meaningless. The algorithms used in community operations have values because people are behind the algorithms, and the values of the algorithms are the values of people, with flaws in the algorithms reflecting flaws in values.'

Image source: screenshot from Weibo

Su Hua's reflection also prompted Kuaishou to make a swift turn.

Over the years, Kuaishou has taken a series of rectification measures, including a full-site inspection, deletion and blocking of illegal videos and accounts, upgrading the artificial intelligence recognition system, conducting special governance, and achieving certain results.

According to Kuaishou's '2023 Kuaishou Community Governance Report', Kuaishou continues to conduct special governance on illegal live streaming behaviors, focusing on vulgar and borderline content, outdoor live streaming, live streaming PKs, vulgar hype, and other key violations, and severely cracking down on unhealthy live streaming practices; in 2023, over 40,000 accounts were penalized by the platform for illegal live streaming.

It is worth mentioning that this report also specifically mentioned youth protection, stating that 'since the launch of Kuaishou's youth mode version 1.0 in 2019, it has been upgraded to version 5.0 by the end of 2023, further improving the content review mechanism, enriching the youth mode content pool, introducing age-specific recommendation strategies, and gradually forming a closed loop for the digital platform's minor protection system with the youth mode product as the core carrier.'

However, in practice, Kuaishou's 'youth mode' still has shortcomings in functional design. Previously, media reports claimed that the 'youth mode' on multiple short video, live streaming, and social media platforms, including Kuaishou, had issues such as low-age-appropriate content and bypassing real-name authentication, causing many to question its effectiveness.

Image source: screenshot from Weibo

For example, the 'Xiaoshijie' section of the Tencent QQ platform was summoned by the State Internet Information Office and subject to administrative penalties for containing a large amount of pornographic and other illegal information, harming the physical and mental health of minors; live streaming platforms such as Douyu, Huya, Douyin, Bilibili, Huajiao, and Kugou Live were also criticized and penalized.

However, on Kuaishou, in addition to inadequate implementation of the 'youth mode', there are still many chaotic phenomena such as vulgar content and deviated value orientation, like 'cancerous tumors', still lurking in the corners of the platform's content ecosystem, repeatedly plunging Kuaishou into a whirlpool of public opinion.

This penalty also reveals that the Kuaishou platform still has deficiencies in its regulatory mechanism and a lack of responsibility awareness, with loopholes and blind spots in content review, allowing some vulgar content to escape supervision.

The traffic and user stickiness brought by vulgar content are both Kuaishou's 'mental illness' and its 'trump card'.

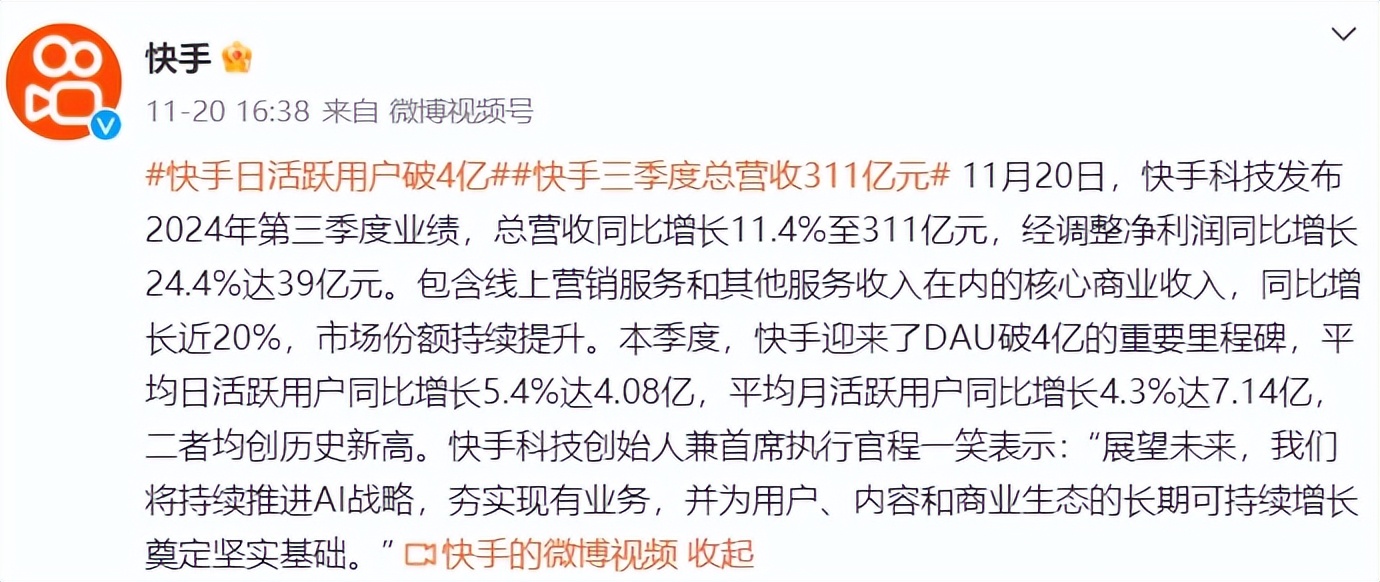

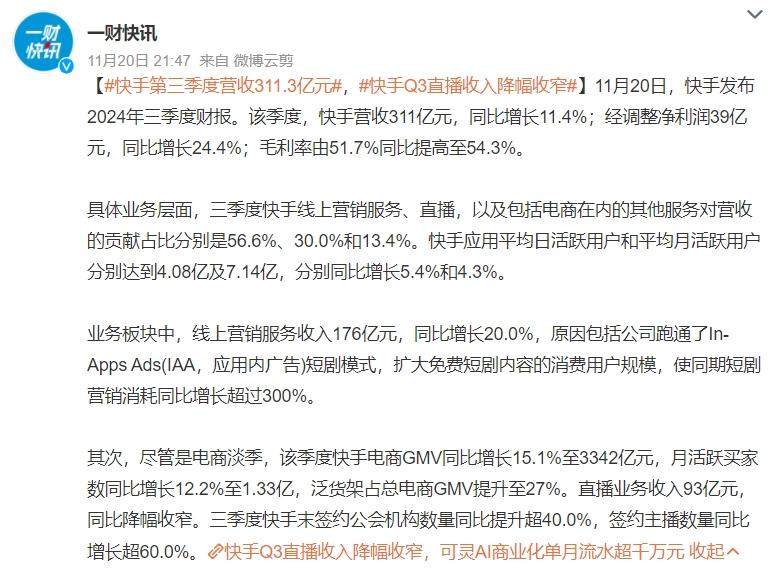

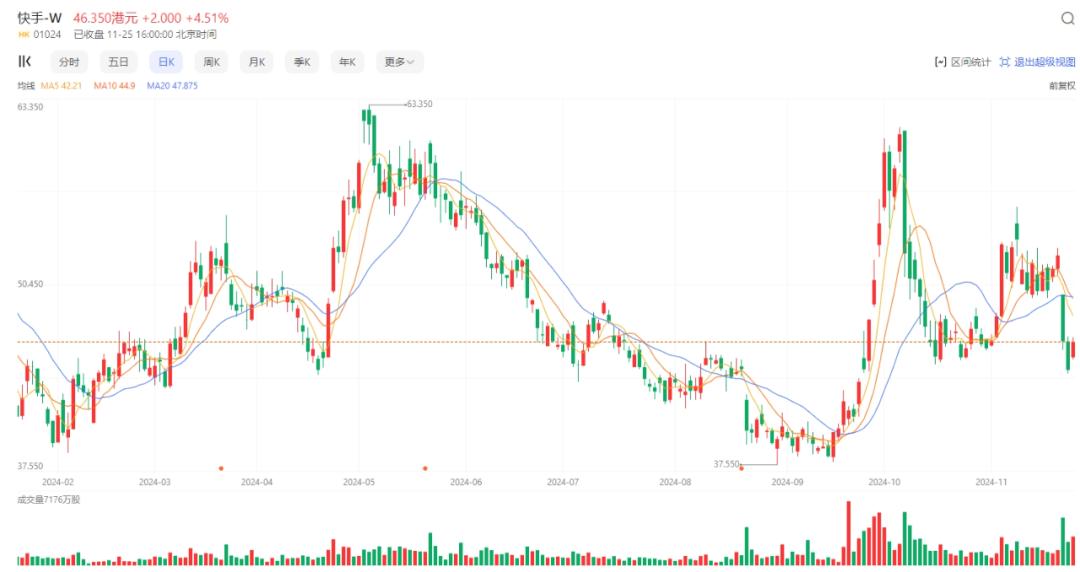

On November 20, Kuaishou (1024.HK) released its third-quarter 2024 financial report. The financial report data shows that in Q3 this year, Kuaishou's revenue reached 31.1 billion yuan, a year-on-year increase of 11.4%; the adjusted net profit was 3.9 billion yuan, a year-on-year increase of 24.4%; both growth rates slowed compared to the past four quarters.

In terms of user scale, Kuaishou achieved an important milestone with an average daily active user count exceeding 400 million; the average daily active user count increased by 5.4% year-on-year to 408 million, and the average monthly active user count increased by 4.3% year-on-year to 714 million, both setting new records and making Kuaishou China's third-largest application (based on quarterly average daily active users).

Image source: screenshot from Weibo

Although Kuaishou has a huge user base, during its early rise, to compete for traffic, the platform's algorithms and operating mechanisms tended to recommend content that could attract users' attention and garner more interaction, and vulgar and sensational content often quickly attracted users' attention, leading Kuaishou to develop its unique content characteristics and user base.

However, once vulgar content forms a certain 'label' on the platform, content producers chasing traffic are more inclined to produce this type of content, and user groups who prefer this type of content are more inclined to pay for it, thereby hindering Kuaishou's in-depth exploration and optimization in the content field.

In recent years, Kuaishou's live streaming business revenue has continued to decline, with its proportion constantly decreasing. The financial report shows that in the third quarter of 2024, Kuaishou's live streaming business revenue was 9.3 billion yuan, a year-on-year decrease of 3.9%, contributing 30.0% to revenue; in the third quarter of 2023, Kuaishou's live streaming business revenue accounted for 34.8% of total revenue.

Image source: screenshot from Weibo

In response, Kuaishou continued the statement from its first-quarter report, stating that they are committed to building a long-term sustainable live streaming ecosystem. According to 'QuJieShangYe's' understanding, Kuaishou has been strengthening live streaming content governance in recent years and expanding live streaming content and categories, introducing high-quality unions and anchors.

The e-commerce business is an important development direction for Kuaishou in recent years. The rapid growth of the live streaming e-commerce business is one of the main reasons for Kuaishou's turnaround from loss to profit, but the growth rate of Kuaishou's e-commerce is also slowing down. In the third quarter of 2024, Kuaishou's e-commerce business GMV was 334.2 billion yuan, a year-on-year increase of 15.1%; this growth rate was almost the same as Q2 and was significantly lower than the growth rates of over 20% or even 30% in previous quarters.

There are various reasons for the slowdown in Kuaishou's e-commerce growth rate, but more importantly, Kuaishou faces fierce market competition and has not yet found new growth points to build a traffic advantage.

Overall, the slowdown in revenue growth and the underperformance of GMV have raised concerns in the capital market about Kuaishou's current stage. Reflected in stock price performance, the day after Kuaishou released its financial report, its stock price fell by over 12% at one point; as of November 25, Kuaishou closed at 46.35 Hong Kong dollars per share, with a cumulative decline of about 16% for the year; it has fallen by nearly 90% from its post-IPO high, with a market value erosion of approximately 1.55 trillion Hong Kong dollars.

Image source: screenshot from Baidu Gushitong

Bloomberg Industry Research analysts such as Robert Lea commented that Kuaishou's third-quarter profit margin fell short of expectations, and under increasing profit margin pressure, the company's general earnings forecasts for the fourth quarter and 2025 face downward revision risks.

However, for now, Kuaishou already has a response plan. On November 25, during Kuaishou's third-quarter 2024 investor conference call, Kuaishou CEO Cheng Yixiao believed that as the penetration rate of short videos among internet users gradually increases and it becomes more difficult to acquire new users, the company will achieve traffic growth through three specific strategies:

First, in terms of traffic distribution, continue to promote the upgrading of the brand mechanism and promote community development by tilt supporting high-quality content; second, in terms of product optimization, the company will continuously consolidate its moat in social and private domains, increase interactive gameplay, and enhance the user experience; third, in terms of content operation, create high-quality group content centered around users and achieve user breakout through influential events.

On one side is continuous 'money-burning' marketing and promotion, and on the other side is investment in emerging businesses such as e-commerce, AI, and short dramas; under increasingly fierce industry competition, Kuaishou can only achieve 'healthy and high-quality growth through good content, good products, and a reasonable traffic mechanism' and realize sustainable and healthy platform development by focusing on users, balancing content and commerce, and finding a balance between traffic algorithm mechanisms and social responsibility.