Management frequently issues warnings: Pinduoduo adjusts Costco model

![]() 11/26 2024

11/26 2024

![]() 478

478

"Whether it is intentional to lower expectations" has become the main market speculation about Pinduoduo recently. During the performance meetings of the past two quarters, the management's expressions often reveal pessimism, and this abnormal behavior has instead fueled conspiracy theories.

As a representative of growth stocks in recent years, Pinduoduo has achieved remarkable results, such as breaking the original structure of the e-commerce industry by leveraging the WeChat social network and the sinking market, and then leveraging China's supply chain advantages to expand overseas. Strong human efficiency and high growth potential have become important labels for the company. Now that the management's direction has changed, the market finds it difficult to accept at first.

In this article, we mainly take Pinduoduo's main site as the research object to assess whether the management's warnings are sincere. The core viewpoints of this article are:

First, Pinduoduo's business model essentially references Costco, carefully selecting SKUs (with low price as the main criterion) to reduce consumers' decision-making costs and improve business efficiency;

Second, in the new macroeconomic cycle, the power balance between the platform and merchants is shifting, and Pinduoduo's easiest times are over;

Third, the recent warnings from management should be sincere, as the domestic main site's operating efficiency has indeed encountered challenges in recent quarters, and the platform needs to rebalance supply and demand relationships.

With the above questions in mind, we wrote this article. The core viewpoints are:

First, after 2024, JD.com focuses on profiting from the supply chain and improving procurement and sales negotiation capabilities. The aforementioned "patching" model still works;

Second, the current problem plaguing JD.com is still one of aggregate demand. How to achieve new growth has become a necessary proposition for operation, which is not only related to the income statement but also inseparable from the cash flow statement;

Third, JD.com is now in a race against time, and the performance during Singles' Day is very important. We might as well focus on the Q4 financial report.

The rise of Pinduoduo: Learning from Costco's good example

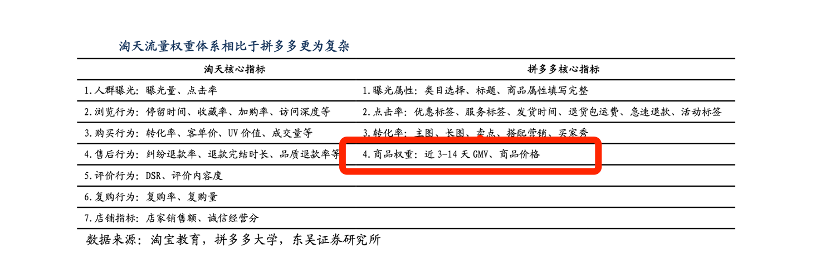

Before the establishment of Pinduoduo, shelf e-commerce was the main form in the industry, with traffic distribution scenarios mainly being "search." This was characterized by strong user initiative and high product matching, which is what we often call "people finding products." Representative enterprises mainly include Alibaba's Taobao and JD.com.

In the "people finding products" model, the platform serves as a link between supply and demand (supply being merchants and demand being users), leveraging the mobile internet's demographic dividend to rapidly expand the user base, enabling merchants to reap huge dividends and the platform to achieve success.

However, as the demographic dividend diminishes, the smoothness of this model encounters some challenges. On the one hand, user growth gradually slows down, and the marginal effect of total traffic diminishes accordingly. On the other hand, under macroeconomic conditions, the capacity of some industries begins to become excessive, increasing the supply of goods and exacerbating the difficulty of merchant operations. Additionally, strong brand merchants can increase their customer acquisition scale with strong market budgets, squeezing out medium and low-brand merchants from this model.

After the "people finding products" model encountered challenges, the "products finding people" model emerged.

In terms of business models, Pinduoduo boasts that its benchmark is Costco, with the main characteristics being:

1) The supply chain pursues quality over quantity, which is significantly different from the multitude and comprehensiveness of shelf e-commerce. The "quality" here mainly refers to "low prices," controlling the scale of SKUs to enhance the sense of gain for individual merchants' traffic;

2) The "Billion Subsidy" program ostensibly uses subsidies to strengthen the platform's low-price advantage, but deep down, it uses "subsidies" to conduct a secondary screening of products, ultimately realizing that those with lower prices gain traffic. The Billion Subsidy program further streamlines SKUs.

During the period of excess supply and overall overcapacity, Pinduoduo not only taps into massive traffic from WeChat but also simplifies supply and improves merchant accessibility, rebalancing supply and demand relationships on the platform. This is also why low-price platforms are attractive to merchants: merchants squeezed out by shelf e-commerce find a new base here to ultimately achieve the goal of "moving volume."

The transition from "people finding products" to "products finding people" is a successful model innovation by Pinduoduo. Not only Pinduoduo but also live streaming sales on short video platforms essentially follow this path: We can view influencer live streaming rooms as independent platforms for carefully selected SKUs, where the fan effect of the anchor's brand and "traffic investment" combine to form a deformed Costco model.

Any model has its unique honeymoon period, and Pinduoduo is no exception.

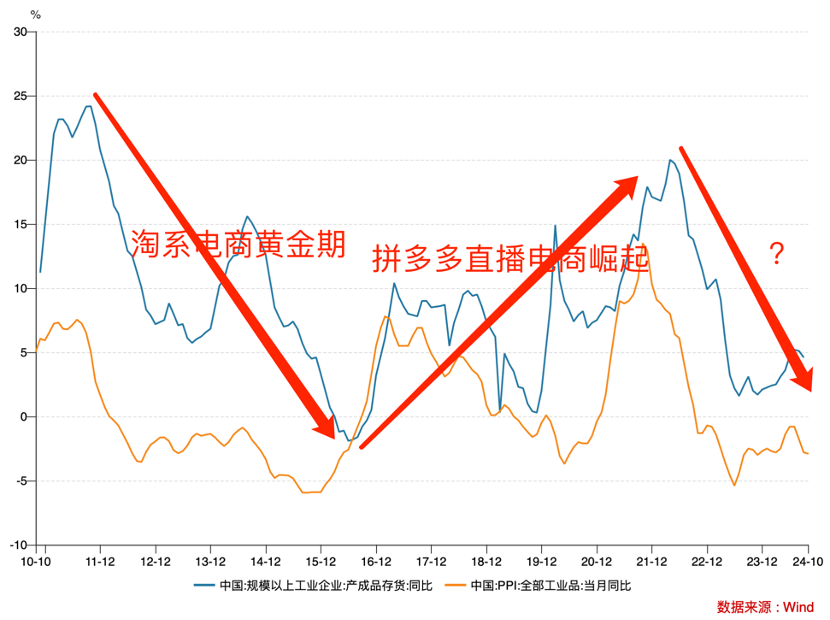

When we observe macroeconomic indicators in conjunction with industry development, we discover astonishing correlations. The most glorious period for Taobao e-commerce coincided with the previous de-stocking cycle, during which small and medium-sized sellers and brand merchants achieved sales increments through online reforms. In the subsequent new industrial cycle, Pinduoduo seized the window of opportunity for "products finding people" to rapidly rise.

After 2023, China's finished products inventory above a designated size showed a sharp downward trend, gradually stabilizing after entering late 2024. For many industries, the current inventory scale is already at a very low level.

This requires us to consider whether Pinduoduo's "products finding people" model, as mentioned earlier, has also reached a new bottleneck. At this time, the potential supply of goods is decreasing, and the increment of users has also nearly reached its ceiling. The model advantage of "products finding people" is unlikely to cut through obstacles as easily as before.

Is this really the case?

New cycle begins: Pinduoduo needs to benefit merchants

Upon continuous observation of Pinduoduo, many interesting counterintuitive phenomena can be found, such as its platform monetization rate (which can be seen as the cost for merchants to transact on the platform) being much higher than that of Taobao, or Pinduoduo remaining an important choice for small and medium-sized sellers despite low-price e-commerce being controversial in public opinion. High costs, low prices, yet inseparable.

This is inseparable from the Costco model we discussed earlier. Merchants selected to join Pinduoduo and the Billion Subsidy program are protected by low SKUs within their respective categories. The scale effect is amplified here (fewer SKUs, fewer competing merchants selected). On the other hand, small and medium-sized merchants in the industry at that time were squeezed out by shelf e-commerce, and Pinduoduo took over this part of the capacity.

More importantly, for merchants squeezed out by the original model who land on Pinduoduo, the channel's dominant position is undeniable, and pricing power is demonstrated again, with corporate profits outpacing GMV transactions.

Although similar enterprises have imitated and attacked Pinduoduo, the results have been scarce (e.g., Alibaba has Taote, and JD.com has Jingxi). Combining the previous analysis, we can easily find the reasons:

The success of Pinduoduo is not just due to low prices on the surface; more importantly, it has a strong binding relationship with upstream merchants. Similar enterprises only see low prices but cannot eliminate Pinduoduo's strong merchant relationships in the short term (Taote and Jingxi are both set outside the main site, and even if they adopt the Costco model, their total traffic is not as good as Pinduoduo's main site). This is related to both Pinduoduo's business skills and the general trend.

After entering 2024, the situation has changed.

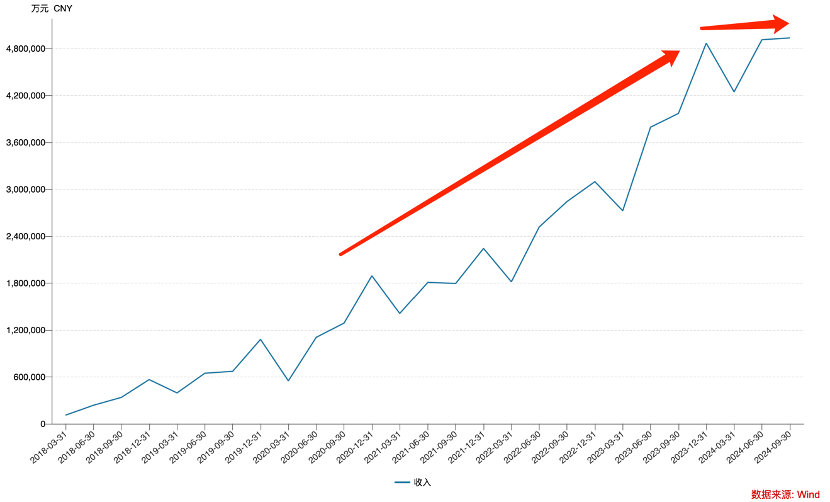

The above figure shows the changes in Pinduoduo's marketing revenue over the years, which is also the main business model of its domestic main site. It can be observed that before 2023, the line in the figure was very steep, but it became very smooth after entering 2024. In Q3 2024, this number increased by 24% year-on-year, which is obviously a relatively mediocre figure compared to the past glory. The platform's commercialization is indeed facing severe challenges, and the management's warnings are well-targeted.

After the macroeconomic cycle adjusts, Pinduoduo needs to consolidate its relationship with merchants and make concessions in commercialization, introducing measures such as reducing merchants' store deposits and withdrawal thresholds to lower their operating costs. Simply put, after the new cycle begins, the platform and merchants are changing positions, with the former no longer being dominant.

In addition, changes in competitors are also affecting Pinduoduo.

In 2023, Jack Ma repositioned Alibaba's e-commerce to "return to Taobao," implying that its traffic allocation would again focus on small and medium-sized sellers. As mentioned earlier, although Alibaba's e-commerce and Pinduoduo have been in a tug-of-war for many years, they only focused on low prices at that time and could not empathize with the small and medium-sized merchants who had been left behind. This was clearly a mismatched competition. Now that Taobao is relying on small and medium-sized merchants again (even at the expense of short-term commercialization performance), it is undoubtedly gradually approaching the essence of competition.

Moreover, after the previous round of de-stocking, some merchants have been "liquidated," and the efficiency of shelf e-commerce's "people finding products" will gradually be corrected (the supply and demand relationship will be rebalanced due to reduced supply), which will also dilute the growth potential of "people finding products" to a certain extent.

During the analyst Q&A session of the Q3 2024 financial report, Pinduoduo's management felt that "the market's business model is becoming more diverse, and competition is becoming fiercer."

Under the dual factors of the macroeconomic environment and industry competition, Pinduoduo is forced to re-examine its business model:

Its Costco business model itself does not have significant issues, but it requires fine-tuning in operations and making choices between absolute low prices and monetization rates. Simply put, if the platform wants to continue maintaining its low-price label, it needs to benefit merchants, such as reducing traffic procurement costs and loosening restrictions on merchants. This has been the focus of its operations in recent quarters.

In other words, Pinduoduo's management has indeed realized the potential pressure on operations and is actively responding, but this will inevitably affect its revenue and profit levels in the short term. For the future:

1) Pinduoduo is still an important force in domestic e-commerce and has not left the table;

2) The platform's "easy money" cycle has ended, and earning money through luck needs to shift to being ability-driven.