Behind Alibaba's Transformation, E-commerce Industry Welcomes Value Return

![]() 11/22 2024

11/22 2024

![]() 434

434

Value competition returns to the mainstream.

Only by competing valuably can sustainable development be achieved.

【Wu Yongming Rearranges the Troops Again】

Last night (evening of November 21), with Alibaba Group CEO Wu Yongming sending an email to all employees, Alibaba's e-commerce business group was officially established.

This brand-new e-commerce business group will fully integrate Taobao-Tmall Group, International Digital Business Group, as well as e-commerce businesses such as 1688 and Xianyu, forming a business cluster covering the entire domestic and international industry chain.

Jiang Fan will serve as the head of the e-commerce business group, reporting to Wu Yongming.

Some professionals in the e-commerce industry stated that this is not only Alibaba's new thinking and action towards forming a joint force from domestic and international resources but also demonstrates Alibaba's huge commitment to its core e-commerce business, namely:

Capturing global business opportunities through synergistic effects to achieve greater growth.

This 'greater' growth is built upon Alibaba's already healthy growth over the past year.

Alibaba's latest financial report released on November 15 shows:

During the 2024 Double 11, Taobao-Tmall's GMV experienced robust growth, with the number of buyers reaching a record high; Alibaba Cloud's revenue continued to accelerate; International Digital Business Group's revenue surged by 29%; and losses for Local Life Group and Digital Media and Entertainment Group narrowed significantly.

In September last year, Wu Yongming took over as CEO of Alibaba Group, clarifying that Alibaba's two strategic focuses are 'user priority' and 'AI-driven', streamlining the company's business, focusing on core e-commerce and cloud businesses, and making firm investments; at the same time, promoting the youthification of the management team and making drastic reforms to the organizational formation and business strategy.

Regarding 'user priority', Wu Yongming strongly urged Alibaba to return from 'low-quality, low-price competition' to 'value competition', respecting the essence of e-commerce and creating real value for the market and consumers.

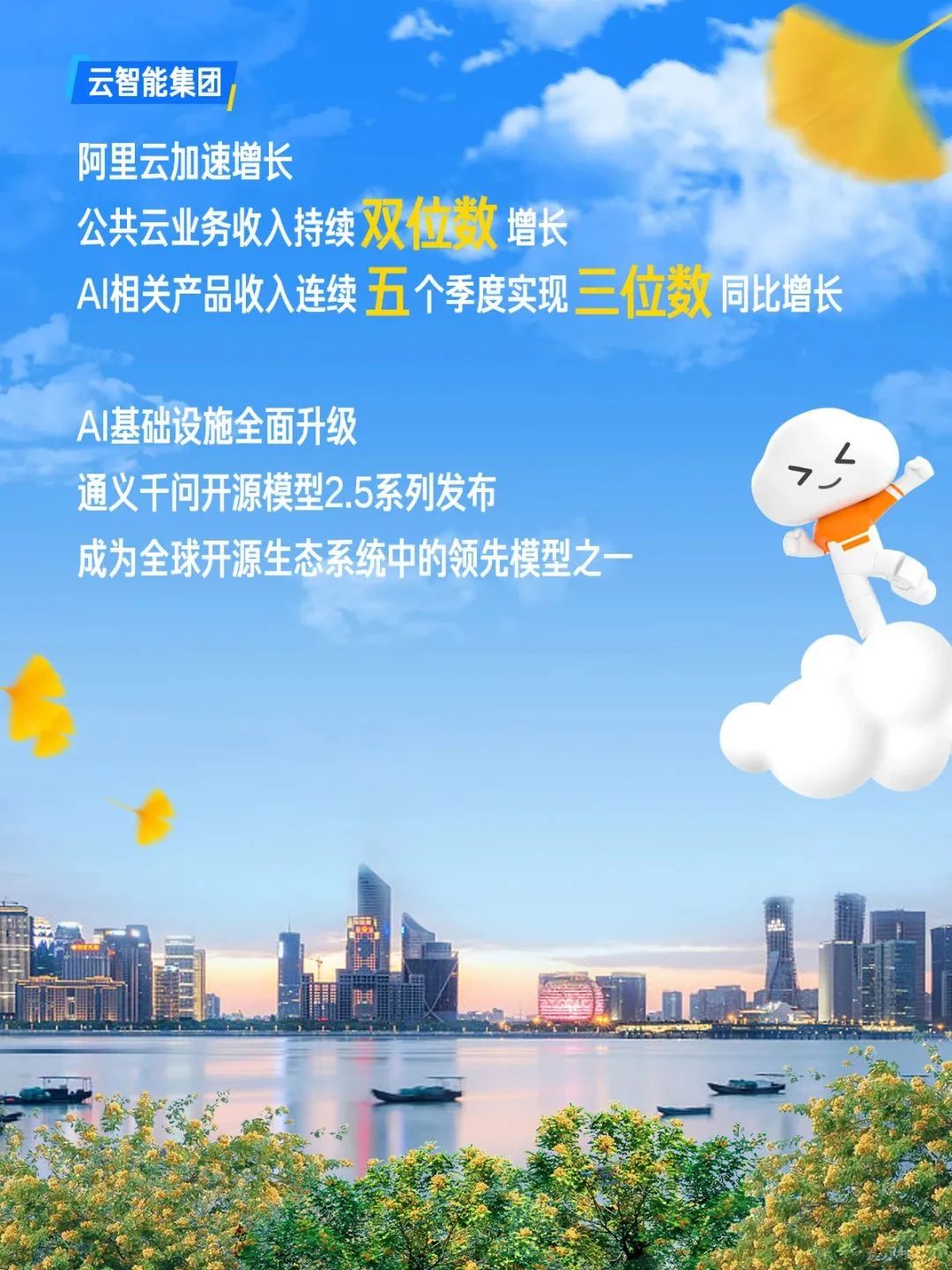

Regarding 'AI-driven', Alibaba is investing heavily in AI infrastructure cloud computing, developing leading-performance foundational large models, and transforming AI technology into the best scenario for truly empowering businesses.

Like Tongyi Qianwen, its new generation of open-source model flagship version Qwen2.5-72B performed strongly in multiple benchmark tests, becoming one of the most widely adopted open-source models globally.

This has enabled Alibaba's AI to truly benefit various industries, with AI-related product revenue achieving triple-digit year-on-year growth for five consecutive quarters.

This series of outstanding performances has made the capital market particularly favor Alibaba.

On August 28, Alibaba was listed on the Hong Kong Stock Exchange, becoming a dual-primary listed company on both the Hong Kong Stock Exchange and the New York Stock Exchange. Subsequently, Alibaba was included in the Stock Connect program, with cumulative southbound inflow exceeding HK$46 billion in less than a month, ranking among the top three publicly offered Hong Kong stocks with heavy positions.

For consumers, Alibaba's efforts to lead the industry out of 'low-price competition' and return to 'value competition' are clearly more noteworthy and were more vividly demonstrated during this year's Double 11.

【The Time for E-commerce's Value Return】

'Make it easy to do business anywhere' is not only Alibaba's founding mission but also the driving force behind its business development since its inception in e-commerce, with creating more incremental value as its core.

In recent years, as e-commerce competition has intensified, Alibaba is strengthening its competitive edge through further 'value competition'.

Double 11 serves as a mirror, witnessing the booming rise of China's e-commerce while also reflecting the ups and downs of the broader business environment.

Some believe that China's e-commerce has clearly bid farewell to the golden age of high-speed growth and is entering a new phase of low growth and low profits.

According to National Bureau of Statistics data, from January to October 2024, China's online retail sales amounted to RMB 12.3 trillion, representing an 8.8% year-on-year increase; compared to last year's 11.2% growth rate, a slowdown in growth has become a trend.

It was amidst this backdrop that Alibaba's Double 11 was a resounding success.

The origins of this success can be traced back to a closed-door meeting during this year's 618 shopping festival, after which Taobao and Tmall began to downplay their absolute low-price strategy, returning from the 'Five-Star Price Power' distribution system to a GMV (Gross Merchandise Volume)-based weight distribution.

This was seen as a crucial step in returning from 'low-price competition' to 'value competition'.

This iconic move by Taobao holds significant advocacy and leading value in the e-commerce industry.

During this year's Double 11, Alibaba addressed the 'three persistent issues' of low-price competition, high return shipping costs, and malicious refunds through a series of Heavy weight measures, providing 'cures'.

To address low-price competition, Taobao introduced an 'Experience Score', making quality service a new dividend for merchants. The 'Experience Score' covers multiple dimensions such as product quality, store service, and after-sales logistics. Merchants with high scores will receive more traffic support from the platform.

This has gradually instilled confidence in merchants, enabling them to move away from low-price competition and return to a value-oriented approach focused on enhancing consumer experience.

To address high return shipping costs, Taobao launched 'Return Treasure', further reducing return costs.

As a result, nearly one million merchants eagerly subscribed to 'Return Treasure' within a month of its launch; during Double 11, 'Return Treasure' further reduced fees, benefiting small and medium-sized merchants with return shipping cost reductions of up to 58%.

To address malicious refunds, Taobao continuously optimized its 'Refund Only' strategy, reducing platform intervention in merchants' affairs while upgrading the abnormal refund identification model.

As a result, two months after the new measures were implemented, Taobao daily intercepted an average of 400,000 abnormal refund-only orders, significantly reducing the number of unreasonable 'Refund Only' cases, with over 95% of merchant appeals resolved within seven days.

This series of measures to optimize the business environment has greatly inspired brand merchants. Data shows that 300,000 Tmall brand merchants actively participated in Double 11, with over 1.5 million top-quality products and over 20,000 super items.

At the same time, Taobao's improvements to the external environment have also achieved tremendous results.

In logistics, free shipping was implemented in six regions - Xinjiang, Inner Mongolia, Tibet, Ningxia, Qinghai, and Gansu - significantly optimizing the user experience, reducing merchant fulfillment costs, and enhancing operational efficiency.

In payments, Taobao took the lead in enabling interconnection, allowing multiple payment methods such as Alipay, WeChat Pay, and UnionPay to be integrated.

According to a Questmobile report, this new measure, which breaks away from the mindset of stock competition, is expected to help Taobao surpass 1 billion monthly active users by 2025.

In commercialization, the 'Omnichannel Promotion' feature for merchants to place ads has connected Taobao's free and paid traffic pools, significantly increasing transaction volumes.

In terms of results, Alibaba's strategic measures for 'value competition' were a complete success during Double 11 - not only did the number of 88VIP members reach 46 million within a few years, making it the largest paid membership system for e-commerce in China, but Double 11 also saw a record number of purchasers, with 589 brands generating over RMB 100 million in transactions, a year-on-year increase of 46.5%.

According to Analysys data, Taobao-Tmall's Double 11 GMV increased by 10.2% year-on-year, accounting for over 60% of the market share among comprehensive e-commerce platforms.

As investor Jesse Livermore said, 'As long as the pursued goal is appropriate, everything will come to you, rewarding your correctness.'

【Major Integration, New Globalization】

This transformation by Alibaba, integrating domestic and overseas e-commerce into a two-way endeavor, may seem sudden but actually had early signs.

This is because over the past year, Alibaba has successfully completed numerous integration attempts between domestic and overseas e-commerce.

For instance, in September this year, Taobao announced an investment of RMB 1 billion to turn Hong Kong into a 'free shipping zone': Hong Kong users can enjoy free shipping on Taobao purchases over RMB 99.

In the same month, Taobao launched an English-language app in Singapore and Malaysia, significantly lowering the shopping threshold for English-speaking users and enabling convenient currency conversion.

Furthermore, the 'Global Free Shipping Plan for Apparel' launched by Taobao in collaboration with Alibaba's overseas e-commerce platform offers '0 returns, 0 refunds, 0 shipping insurance', with the platform providing shipping subsidies and marketing expenses, connecting users in Singapore, Malaysia, South Korea, Hong Kong, Macao, and Taiwan. Free shipping is available for orders over RMB 99-199.

As a result, within three days of its August 2 launch, overseas transaction volumes in Taobao's apparel industry surged by nearly 40%, with participating merchants experiencing a nearly 90% year-on-year increase, and shoe, bag, and accessory merchants seeing a staggering 114% year-on-year increase.

Due to the great success of apparel exports, in September, Taobao expanded its overseas projects from apparel to merchants across all industries, adding new overseas markets such as Japan, Cambodia, Thailand, Vietnam, and Australia.

The ultimate results were impressive - during this year's Double 11, Taobao experienced a 40% growth rate in Thailand, nearly 30% in Australia, and a 600% increase in sales of free shipping items in Hong Kong; Taobao's overseas user base surged by 100%.

This series of heavyweight collaborations between Alibaba's overseas business and Taobao has showcased the supply advantages of Taobao-Tmall and the platform connectivity advantages of Alibaba's overseas e-commerce in full.

Some analysts believe that this may be due to the recent decline in inflation expectations and improvement in weak consumption trends in European and American markets.

However, most importantly, a brand-new incremental market and business model have suddenly emerged before Alibaba, namely:

Taobao handles domestic merchant recruitment, while Alibaba's overseas business handles logistics and consumer operations, instantly realizing 'inventory integration' for domestic and overseas e-commerce.

Moreover, it's not just about attracting overseas users, primarily ethnic Chinese, through the overseas version of Taobao. Alibaba's overseas e-commerce platforms like AliExpress and Lazada can also directly reach more overseas users and a larger global market.

Alibaba's comprehensive integration of domestic and overseas e-commerce has become a natural progression.

Obviously, this will create a new round of convenient and direct business opportunities for domestic SMEs to go global.

Once the business perspective is broadened to a global scale, one can immediately understand why Alibaba must return to the fundamentals of 'value competition'.

Over the past 20+ years of China's e-commerce, it has been proven that intensive low-price competition is a dead-end.

The true value of e-commerce lies in three points: good products, good prices, and good service.

Just as a new model capable of integrating domestic e-commerce for convenient overseas expansion is striding towards Alibaba, how large is the market opportunity and scale?

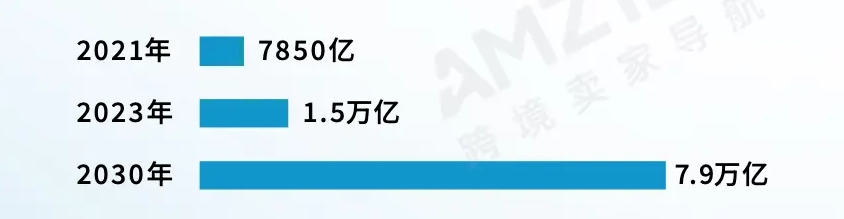

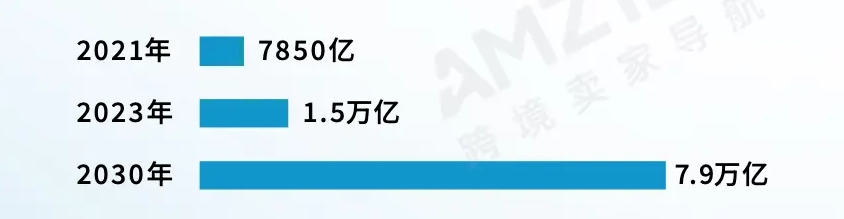

▲Source: AMZ123's 2023 Cross-border E-commerce Industry Annual Report

According to Statista data, the global cross-border e-commerce market was valued at USD 1.5 trillion in 2023 and is expected to reach USD 7.9 trillion by 2030, with a compound annual growth rate of 26.79%.

Faced with such a vast market, it is imperative to quickly return to value competition to create new models and win new spaces and opportunities in the new development cycle.

This is a new turning point in the development of China's e-commerce and also marks a new era and beginning led by Alibaba.

In this sense, this future drama of 'value competition' will not only have a profound impact on China's e-commerce but will also benefit the high-quality development of China's real economy.

——END——

Welcome to follow [Huashang Taolue] to recognize influential figures and read tales of strategy and wisdom.

All rights reserved. No unauthorized reproduction allowed.

Some images are sourced from the internet.

In case of infringement, please contact us for deletion.