Fuyou Payment's 'Five Battles' for IPO: Annual Revenue of 1.5 Billion, but Net Profit Less Than 100 Million

![]() 11/28 2024

11/28 2024

![]() 623

623

Produced by | Bullet Finance

Designed by | Qianqian

Reviewed by | Songwen

In a game of Stock game , third-party payment institutions have witnessed a wave of IPOs this year.

Following Lianlian Digital's listing on the Hong Kong Stock Exchange in March as the 'first cross-border payment stock,' Shanghai Fuyou Payment Service Co., Ltd. (hereinafter referred to as Fuyou Payment) also formally submitted its IPO application to the Hong Kong Stock Exchange in April this year.

However, Fuyou Payment failed to complete its listing hearing or go public within six months, rendering its prospectus invalid. On November 8, Fuyou Payment resubmitted its IPO application to the Hong Kong Stock Exchange's main board. CITIC Securities and Shenwan Hongyuan Hong Kong remained as joint sponsors.

According to the prospectus, Fuyou Payment still faces challenges on its path to listing, with the issue of increasing revenue but not profit remaining unresolved. As regulation tightens and industry compliance requirements increase, Fuyou Payment has repeatedly been punished by regulators.

1. A tortuous path to listing, with up to 72 shareholders

According to its official website, Fuyou Payment was established in 2011 and is headquartered in Shanghai. It is a technology-driven payment company. Since its inception, Fuyou Payment has obtained multiple payment business licenses issued by the People's Bank of China, forming its own industry advantages.

Fuyou Payment is one of the few companies in the industry that simultaneously holds five payment business licenses for prepaid cards, internet payments, bank card acquiring, fund payments, and cross-border payments. The other four companies are Alipay, UnionPay Business, One Wallet, and Allinpay.

Additionally, Fuyou Payment also holds payment licenses in Hong Kong and the United States.

According to Bullet Finance, most of Fuyou Payment's founding team and middle-to-senior management have senior backgrounds in China UnionPay, commercial banks, and well-known internet companies.

Founder Chen Jian was one of the earliest practitioners in China's digital payment industry, serving as Deputy Director of the General Office of China Merchants Bank, General Manager of UnionPay's Risk Management Department, General Manager of the Business Management Department, and General Manager of the Strategic Development Department. He worked at China UnionPay from March 2002 to February 2009 and participated in the establishment of China UnionPay.

In 2008, Chen Jian founded the Fuyou Group and served as its Chairman and CEO. In 2011, Fuyou Payment was established in Shanghai, with Chen Jian serving as Executive Director.

Leveraging its digital payment gene and license advantages, Fuyou Payment embarked on its journey to an A-share listing.

(Image / Shutu, based on VRF agreement)

At the end of 2015, Fuyou Payment's parent company, Fuyou Group, began planning for an IPO, initially signing a coaching agreement with Industrial Securities. However, in October 2016, Industrial Securities terminated the coaching work.

In May 2018, Fuyou Payment, as the listing entity, signed a listing coaching agreement with CEB International Securities, the predecessor of Orient Securities. However, three years later (July 2021), Orient Securities announced the termination of the Coaching Agreement and ceased its coaching work for Fuyou Payment's IPO.

In September of the same year, a report on the coaching record of Fuyou Payment issued by Guojin Securities revealed that Guojin Securities began undertaking the coaching work for Fuyou Payment's IPO. In February 2024, Guojin Securities terminated the coaching.

After three unsuccessful attempts at an A-share listing, Fuyou Payment turned its gaze to the relatively relaxed IPO environment of the Hong Kong Stock Exchange.

However, Fuyou Payment's journey to an IPO on the Hong Kong Stock Exchange has also been fraught with difficulties. On April 30, 2024, Fuyou Payment officially submitted its IPO application to the Hong Kong Stock Exchange, with CITIC Securities and Shenwan Hongyuan Hong Kong as joint sponsors, planning to list on the main board.

However, in June this year, the China Securities Regulatory Commission issued supplementary materials for overseas listing registration, requiring Fuyou Payment to provide additional information on the basis and rationality of the company having no actual controller, as well as information security protection and data collection and usage. On October 30, the prospectus became invalid because Fuyou Payment failed to complete the listing hearing or go public within six months.

According to the rules of the Hong Kong Stock Exchange, Fuyou Payment still has the opportunity to submit the latest financial information within the next three months to continue its listing process. On November 8, the third-party payment institution resubmitted its IPO application to the Hong Kong Stock Exchange's main board.

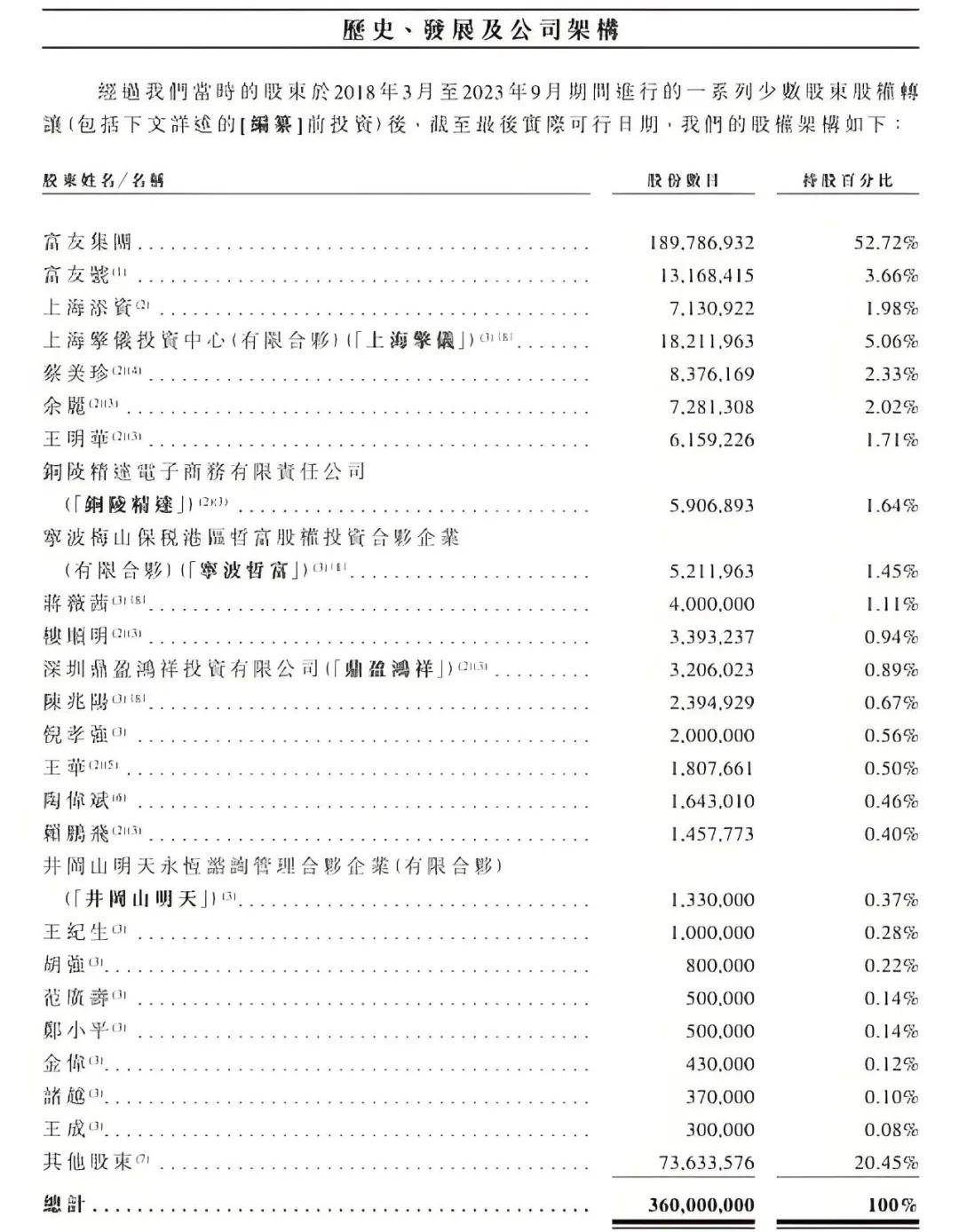

Judging from the prospectus, Fuyou Payment's shareholder structure is highly complex, a phenomenon that has attracted considerable external attention. Bullet Finance reviewed the latest version of the prospectus and found that Fuyou Payment's total share capital is 360 million, with a total of 72 shareholders.

There are 8 corporate shareholders, with Fuyou Group as the controlling shareholder holding 52.72%, Shanghai Qingyi holding 5.06%, and Fuyouhao holding 3.66%.

There are 64 natural person shareholders who collectively hold over 40% of the equity. These natural persons include senior executives of Fuyou Payment and their family members. For example, the prospectus reveals that Chen Jian's spouse, Cai Meizhen, holds 2.33% of the shares, while Wang Hua, the sister of Cai Meizhen's mother, holds 0.5%.

(Image / Fuyou Payment Prospectus)

The equity structure behind some corporate shareholders is equally complex.

The prospectus reveals that the controlling shareholder, Fuyou Group, has up to 60 shareholders, with Chen Jian indirectly holding 9.49% of Fuyou Group's shares as the largest shareholder, and Cai Meizhen holding 7.11% of Fuyou Group's shares.

Fuyouhao is a limited partnership enterprise established in China, with Chen Jian holding 16.89% of the shares. Shanghai Tianzhifu and Shanghai Tianyou hold 40.50% and 37.89% of Fuyouhao's shares, respectively. Both companies are limited partners of Fuyouhao controlled by Chen Jian. Fu Youzhi's director, Fu Xiaobing, holds 4.72% of the shares.

In companies planning an IPO, the presence of a large number of shareholders and the "family group" of founders may raise concerns in the capital market about the company's management and decision-making efficiency, as well as the potential for conflicts among shareholders' rights and interests.

2. Annual revenue of 1.5 billion, but net profit of less than 100 million

According to the Fuyou Payment prospectus, for this IPO, Fuyou Payment plans to use 35% of the raised funds for differentiated innovative solutions to expand its product portfolio; 30% for investment in technology platforms and infrastructure; 15% for further expansion of the payment network and deepening relationships with ecological partners; 10% for overseas business, with the remainder for general corporate purposes.

Fuyou Payment's main customers include small and medium-sized merchants, enterprises, and financial institutions from various industries. It primarily provides two major businesses: integrated digital payment services and digital business solutions.

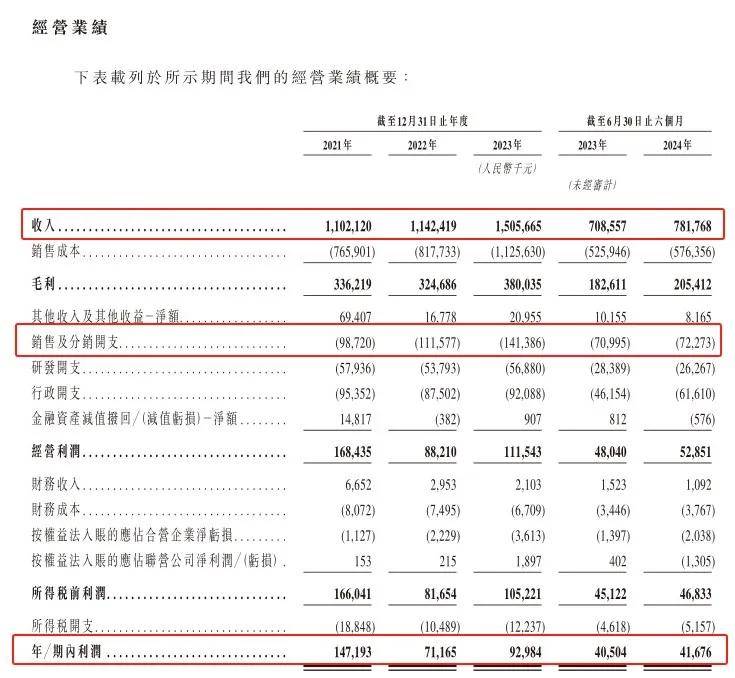

It is important to note that in recent years, Fuyou Payment has faced the challenge of increasing revenue without a corresponding increase in profit.

From 2021 to 2023, Fuyou Payment achieved operating revenues of approximately 1.102 billion yuan, 1.142 billion yuan, and 1.506 billion yuan, respectively. However, net profit performance lagged far behind revenue, with net profits of 147 million yuan, 71 million yuan, and 93 million yuan for 2021, 2022, and 2023, respectively.

(Image / Fuyou Payment Prospectus)

Gross profit margins have also declined year by year. From 2021 to 2023, Fuyou Payment's gross profit margins were 30.5%, 28.4%, and 25.2%, respectively.

Regarding the reason for the year-on-year decline in gross profit margins, Fuyou Payment explained that both domestic payment services and cross-border digital service businesses currently face significant market competition pressure, leading to reduced service fees and increased commissions.

Specifically, the gross profit margin for domestic payment services has declined from 23.1% in 2022 to 21.1% in 2023. In terms of cross-border digital payment services, the gross profit margin also dropped from 48.9% in 2022 to 36.3% in 2023.

In the first half of 2024, Fuyou Payment's operating revenue reached 782 million yuan, a year-on-year increase of 10.3%. Net profit was 42 million yuan, a year-on-year increase of 3%, with a gross profit margin of 26.3%, a slight rebound from the end of last year.

In its prospectus, Fuyou Payment stated that it plans to adjust its business strategy in the future to mitigate the impact of high commission rates on gross profit margins and develop high-margin businesses, especially digital business solutions.

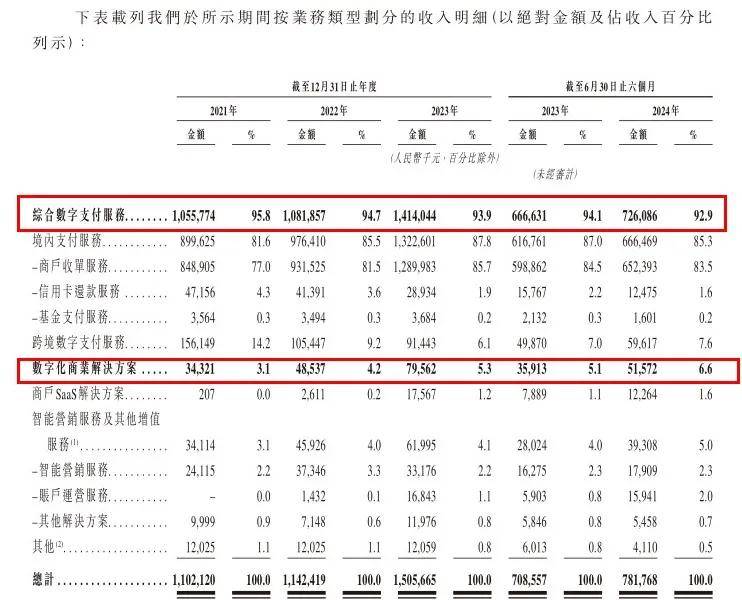

However, judging from the prospectus, integrated digital payment services account for over 90% of Fuyou Payment's revenue among its two major businesses. From 2021 to 2023, integrated digital payment services accounted for 95.8%, 94.7%, and 93.9% of the company's revenue, respectively.

Digital business solutions accounted for 3.1%, 4.2%, and 5.3% of the company's revenue during the same period, showing a year-on-year increase but with a significant gap in business volume compared to integrated digital payment services.

(Image / Fuyou Payment Prospectus)

From the above data, although Fuyou Payment intends to vigorously develop high-margin digital business solutions in the future, it will likely take a long time for this business to support the company's overall revenue.

3. Tightening regulation and increasingly prominent compliance issues

In recent years, China's payment industry has shown tremendous development potential.

According to the Fuyou Payment prospectus, the total payment volume (TPV) of third-party payment service providers in China's payment market increased from 249.9 trillion yuan in 2019 to 340.3 trillion yuan in 2023, with a compound annual growth rate of 8.0%. It is expected to reach 547.1 trillion yuan by 2028, with a compound annual growth rate of 11.0% from 2024 to 2028.

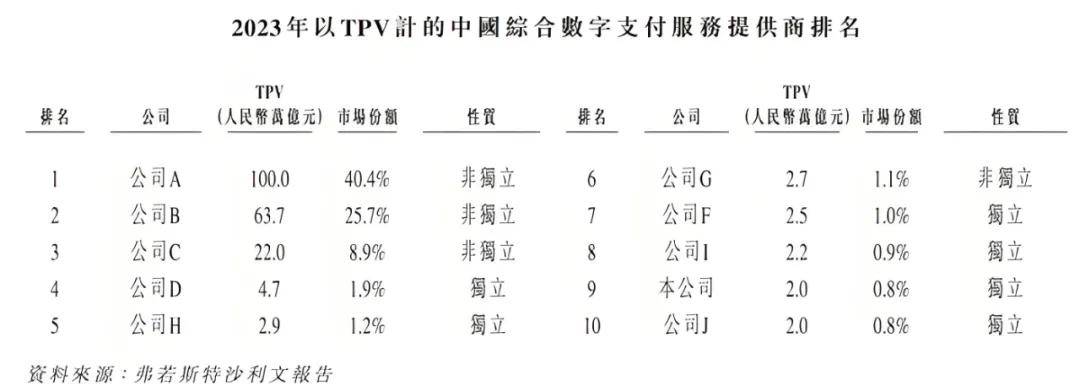

Despite the vast size of the payment market, the "Matthew Effect" is evident in the payment industry from a market share perspective. Alipay and Tenpay remain the "duopoly" in the third-party mobile payment market.

The prospectus shows that in China's integrated digital payment services market, Alipay and Tenpay together occupy 66.2% of the market share, while UnionPay International accounts for 8.9%. The remaining market players each have less than 2% share. Fuyou Payment ranks ninth with only 0.8% market share.

(Image / Fuyou Payment Prospectus)

With the promulgation of policies such as the "Regulations on the Supervision and Management of Non-Bank Payment Institutions," China's third-party payment licenses are accelerating their shuffle and integration. Data disclosed by the People's Bank of China shows that there are fewer than 200 licensed payment institutions, and the industry has entered a battle for the existing market.

Against the backdrop of tightening regulation, institutions are receiving an increasing number of fines. According to Wind data statistics, in the first half of this year alone, the People's Bank of China issued a total of 24 fines in the third-party payment sector, totaling over 118 million yuan in fines and forfeitures.

The Fuyou Payment prospectus reveals that the company failed to fully comply with applicable laws and regulations in certain aspects of its payment services from 2021 to 2023, resulting in administrative penalties totaling approximately 6.9 million yuan.

Additionally, Fuyou Payment was involved in up to 46 P2P-related lawsuits due to its provision of payment services to P2P platforms on a point-to-point basis, primarily involving transactions that occurred before Fuyou Payment massively terminated its cooperation with P2P platforms at the end of 2019.

From 2018 to 2024, Fuyou Payment received a total of 89 P2P-related complaints forwarded by regulatory agencies, but none of these complaints led to regulatory action against the company.

(Image / Shutu, based on VRF agreement)

'As we operate in an emerging and evolving market, applicable laws, rules, and regulations are constantly developing and evolving. If we fail to continuously comply with applicable laws, rules, and regulations, we may face increased compliance costs, fines, restrictions on business activities, legal proceedings and prosecutions, and may even have some or all of our licenses to conduct business activities suspended or revoked,' Fuyou Payment candidly admitted in its prospectus.

Overall, the third-party payment industry holds broad prospects but faces fierce market competition and high industry concentration.

Against this backdrop, can Fuyou Payment, on its fifth attempt at an IPO, successfully list as hoped? How will Fuyou Payment enhance its profitability while ensuring operational compliance in the future? Bullet Finance will continue to keep a close watch.

*The lead image in this article is from the ECNS photo library.