E-commerce sellers face soaring traffic cost, how to solve this problem?

![]() 11/29 2024

11/29 2024

![]() 621

621

The Double 11 shopping festival has ended this year, but discussions around "traffic cost" have heated up once again.

Traffic cost refers to the advertising and promotion fees paid by merchants to acquire traffic. Specifically, traffic cost can be understood as the price paid to acquire each customer.

According to data from market research institutions, the cost of acquiring traffic on e-commerce platforms has generally increased by 30% to 50% over the past year.

Moreover, the founder of a leading women's wear brand that announced the closure of its stores in June complained that "traffic cost has increased tenfold" over the years.

"Under this situation, many merchants may not survive more than three years," one e-commerce observer even asserted.

The survival difficulties of merchants are also detrimental to platform development. This Double 11, many platforms promptly adjusted their direction, shifting from favoring consumers to pleasing merchants, and introducing various support policies.

For merchants, are they providing the right solution?

01

Merchants have been struggling with traffic for a long time

In the early days of internet e-commerce, traffic seemed "inexhaustible." Many merchants who entered the market at that time could quickly rise by simply investing money in traffic.

In 2012, Zhang Liao, the founder of Three Squirrels, said, "A new era has come, and e-commerce has five years of opportunity. Within five years, an internet e-commerce brand can be established." This became the motto of many entrepreneurs.

Based on this judgment, Zhang Liao decisively adopted a strategy of large-scale advertising at the beginning of his entrepreneurship. It is revealed that in the first two months after Three Squirrels was launched, about one to two million yuan was invested in search advertising spaces and Juhuasuan activities each month.

The results were also very significant—

On Double 11 in 2012, Three Squirrels achieved sales of 7.66 million yuan, ranking first in the nut industry. The following year, annual sales exceeded 300 million yuan, with Double 11 sales alone reaching 35.62 million. By 2019, Three Squirrels was at its peak, with revenue exceeding 10 billion yuan, leading the industry and occupying the top spot in snack sales for many years, and it even went public as the first e-commerce snack stock.

There are many similar examples.

In 2016, Zhang Dayi's online store "My Favorite Wardrobe" became the first women's wear store to exceed 100 million in sales on Double 11. At her peak, Zhang Dayi revealed that she earned 300 million yuan in one year.

When talking about her success, she simply said that she did "the right thing at the right time, was quite charming, and sold decent clothes."

However, after years of rapid growth, the bonanza period of internet e-commerce has long passed, and e-commerce competition has become homogenized and Stockization .

Against this background, traffic cost, rather than operating cost, can determine a merchant's revenue and profitability. This has also led to persistently high traffic costs and chaos in the entire e-commerce industry. Merchants relying on traffic investment to drive growth have become unsustainable.

In the year of its IPO, starting from 2019, Three Squirrels' net profit continued to decline, while its peers were almost all growing. In response, Zhang Liaoyuan helplessly stated, "Three Squirrels must forget the era of traffic and get used to slower growth.""

Similarly, on September 19 this year, Zhang Dayi announced on Weibo that new product launches would be indefinitely delayed, "Well, it's like closing the store." As of September 21, "My Favorite Wardrobe" had 12.41 million followers and sold over 90,000 items per month.

Even top merchants can't withstand the pressure, let alone small and medium-sized merchants with limited profits. A factory-type merchant once told the media that its promotion costs have accounted for 60-70% of its profits.

The survival difficulties of merchants, coupled with the current complex economic situation, have made "low growth rate" a keyword for the entire e-commerce industry. According to data from the National Bureau of Statistics, online retail sales nationwide increased by 12.5% year-on-year from January to July 2023, compared to only a 9.5% increase this year over the same period.

How platforms can optimize traffic allocation and reduce merchant costs to achieve a win-win situation for platforms, merchants, and consumers has become a core proposition facing the industry.

02

How to solve the problem?

How should this core proposition be addressed? At the start of this year's Double 11, relevant departments have already set the tone at the policy level.

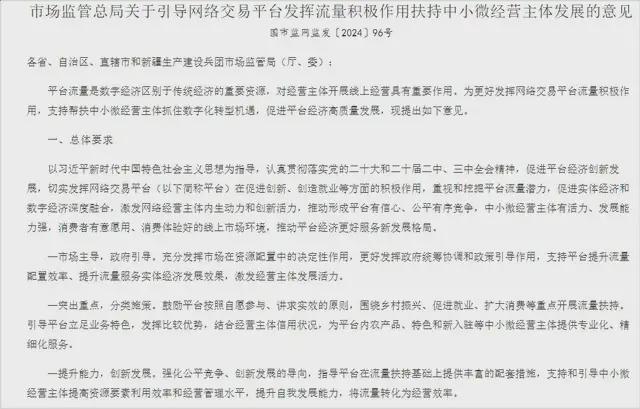

On October 18, the State Administration for Market Regulation issued the "Opinions on Guiding Online Trading Platforms to Play a Positive Role in Traffic and Support the Development of Micro, Small, and Medium-sized Business Entities."

The "Opinions" not only require platforms to strengthen traffic support for newly-joined business entities and provide exposure opportunities but also require comprehensive service measures such as product research and development, supply chain optimization, and data analysis to help business entities improve their operational capabilities.

The Economic Daily pointed out that encouraging platforms to tilt traffic is equivalent to asking platforms to make a difficult decision, which requires a high sense of social responsibility to drive.

After all, for the same amount of traffic, helping a top live streamer sell a bottle of high-priced face cream versus helping an agricultural product merchant sell 5 jins of potatoes can reflect a hundreds-fold difference in platform revenue. For platforms, it not only means a direct reduction in revenue generated through traffic monetization but may also affect the overall gross merchandise volume.

However, platforms are also aware that only by achieving a balance of interests among merchants, consumers, and platforms in the long term can a healthy business ecosystem be built, which is the cornerstone of ensuring stable growth.

Since the beginning of this year, various platforms have introduced various tools and sought more policy and ecological solutions to alleviate merchants' difficulties in acquiring customers by finding increments and tapping into existing resources.

A more direct strategy is to adjust the traffic allocation mechanism.

For example, platforms will encourage merchants to attract consumers by improving cost-effectiveness, service quality, and product quality. Once merchants excel in these areas, the platform will provide them with sufficient traffic and exposure opportunities, bringing more cost-effective products to consumers.

The significance of this strategy is that the platform returns part of the traffic control to merchants, allowing them to focus on product quality and price without having to spend time and energy studying complex traffic acquisition strategies.

At the same time, it returns the logic of e-commerce competition to the products themselves, allowing market forces to determine which products can stand out, bringing more choices and a better shopping experience to consumers.

This also promotes the development of the entire e-commerce industry towards a healthier, more orderly, and dynamic direction.

03

The optimal solution for small and medium-sized merchants

In fact, compared to other e-commerce platforms, Pinduoduo's traffic mechanism has always been unique and more friendly to small and medium-sized merchants.

Generally speaking, to make traffic cost expenditure more cost-effective, many merchants choose two strategies. One is to choose the cheapest paid traffic with the greatest return on investment, and the other is to explore high-quality organic traffic as much as possible.

On the paid traffic side, to maximize the return on investment, merchants need to closely follow platform policies and promptly grasp traffic "discount packages."

A merchant once introduced, "In recent years, it's not just us merchants who have been worried about traffic; platforms have also been worried about merchant loss, so they will try their best to help merchants grow, launching various 'traffic discount packages' and marketing tools."

However, as the internet e-commerce bonanza fades and paid traffic strategies become well-known, it is expected that the cost of purchasing traffic will continue to rise in the future. Most traffic will still flow to well-funded top merchants, making it even more difficult for factory-type merchants and small and medium-sized merchants.

This also leads factory-type merchants and small and medium-sized merchants to pay more attention to stability when investing in traffic. After all, if the traffic investment performs poorly, it may erode their already low profits, leading to losses.

A small and medium-sized merchant who has operated an online store for 9 years but has never participated in any shopping festival activities once bluntly stated, "As a small merchant, the input-output ratio of investing in traffic to participate in activities is quite low.""When I first started operating the store, I tried investing in traffic but soon found that for white-label merchants, investing in traffic does not solve the traffic problem: "The conversion rate of traffic investment is extremely low. You might invest 1,000 yuan in traffic and get zero output. After trying multiple times, I gave up on traffic investment, and my store relies solely on organic traffic.""

For such merchants, Pinduoduo, which still has a simple mechanism, cost-free, and huge organic traffic, is undoubtedly the best choice.

It is understood that some small and medium-sized merchants have told the media that 70%-80% of their traffic on Pinduoduo comes from recommendations rather than active user searches.

According to a 2023 analysis by TechNode, the average customer acquisition cost of several mainstream e-commerce platforms is 800 yuan. According to Tianfeng Securities data, Alibaba's customer acquisition cost was 1,397 yuan in 2023, JD.com's was 3,569 yuan, and Pinduoduo's was the lowest at 506 yuan.

Since its inception, Pinduoduo's recommendation mechanism has been price-centric: as long as the product price is competitive, it can obtain a certain amount of organic traffic. Merchants can launch popular products at a reasonable cost by overlaying traffic investment on this basis.

This traffic allocation model is naturally suitable for new merchants and merchants that frequently launch new products or hit big single products—most of which are white-label or industrial belt merchants.

When recalling 2019, when a securities firm published a research report titled "Pinduoduo May Not Survive More Than Three Years" and questioned, "Products on Pinduoduo can be bought elsewhere; Pinduoduo's functions are available on other platforms. Why would users and merchants choose Pinduoduo?""Today, the answer is obvious: whoever paves a smoother path for merchants will be their firm choice.

•END•