Zhou Hongyi's new venture: targeting Baidu

![]() 11/29 2024

11/29 2024

![]() 639

639

Zhou Hongyi's new product, promoted through a short film he specially produced, has finally launched.

On the evening of November 27, 360 officially released the multimodal content creation engine, 'Nano Search'.

As one of the hottest tracks in current AI applications, AI search already has players like Tencent, Mita, SenseTime, and Douyin. Baidu, the traditional search giant, is also stepping up efforts. Competition does not hinder 360, with its search experience, from embarking on this new venture again. The more players enter the market, the clearer it becomes what users' needs really are.

The short film acted by Zhou Hongyi, titled 'Rekindling Life: The Reclusive Hacker Amazes the World', fully introduces Nano Search's four core functions of 'searching, reading, writing, and creating', as well as how ordinary people can transform from searching to creating with the help of AI tools.

According to the 'Red Robe Pope', this short film was purely made at the urging of the marketing department. But for Zhou Hongyi, who has been exceptionally active in the past two years, finding a new track to embrace the changing times is an attractive prospect.

With multiple players engaged in fierce competition, 360 has entered the AI search field.

Looking back at the development of AI applications, this year can be considered the inaugural year for the explosion of AI search.

In just these two months, well-known internet technology companies such as Zhihu, Sogou, and 360 have successively announced new search products. Zhihu's AI search product, Zhihu Direct Answer, has launched a new professional search function, Sogou Input Method has introduced an AI search function based on the Hunyuan large model, and 360 has launched the multimodal content creation engine, 'Nano Search'.

Prior to this, ByteDance has deployed its search business within the platform for the fourth time, launching the independent search app 'Douyin Search', and Baidu has also officially announced the upgrade of its Wenxin Yiyan app to Wenxiaoyan. Tencent's intelligent agent application ima also includes advanced search functionality, covering content from WeChat Official Accounts.

In addition to these vertical search enterprises and traditional search enterprises, AI large model startups such as Mita AI, Dark Side of the Moon, and Zhipu AI are also making breakthroughs with full force. Technology companies view AI search as a strategic high ground in the new era, attempting to find opportunities to become the next Baidu.

This is based partly on the consideration of the vast market potential of AI search in the future and partly on the threat and encroachment of a more efficient search model on the market position of traditional search methods. According to QYResearch data, the global search engine market size exceeded USD 200 billion in 2023.

From the perspective of market structure, the rise of generative AI search is reshaping the market landscape that has been monopolized by traditional search products.

As of May this year, in the domestic mobile search market, Baidu's market share dropped from over 66% in 2020 to 53.31%, while AI-dominated Bing increased to 26.26%. The absolute difference is still significant, but it shows that the introduction of new technology has indeed changed some users' perceptions of search engines, a change that deserves the most attention.

In the global market, according to GS Statcounter data, as of April this year, Google's search engine market share hit its lowest point since 2009, dropping to 86.99%, down from over 90% previously.

In terms of product landscape, Gartner predicts that traditional search engine traffic may decrease by up to a quarter by 2026, with this outflow most likely being absorbed by AI chatbots and intelligent agents. The IDC report also predicts that the annual revenue of the AI search market will grow at an average annual rate of 27.2% from 2023 to 2028, expanding to USD 21.5 billion.

Therefore, 360 has frequently updated and iterated new AI products this year.

In June, 360 released '360 AI Search' and '360 AI Browser'.

In September, 360 began to focus on shaping the 'AI ecosystem', fully opening up the four major AI application scenarios of Security Guard, Security Browser, Search, and Smart Hardware, and collaborating with 15 large model manufacturers to integrate their mainstream models into 360's newly released 'AI Assistant'. At the same time, it announced the full introduction of the 360 Brain large model into the 360 ecosystem.

In October, 360 AI Search's traffic surged to 287 million visits, more than triple that of Perplexity AI, a well-known global search startup during the same period, catapulting 360 AI Search into the top three in the global AI search field and making it the AI-native search engine with the highest global user traffic.

Perhaps based on this series of remarkable achievements, 360 chose to strike while the iron is hot and continue to increase its efforts by launching a new independent AI search and creation app, the 'Nano Search' app. This new product is currently available on the Apple App Store and Android app stores like Yingyongbao, directly competing with high-profile AI search products such as Aliyun's Kuake, Baidu's Wenxiaoyan, and Mita AI.

AI is the key to 360's performance turnaround

Of course, there is another important consideration for 360 in fully launching its new AI search product.

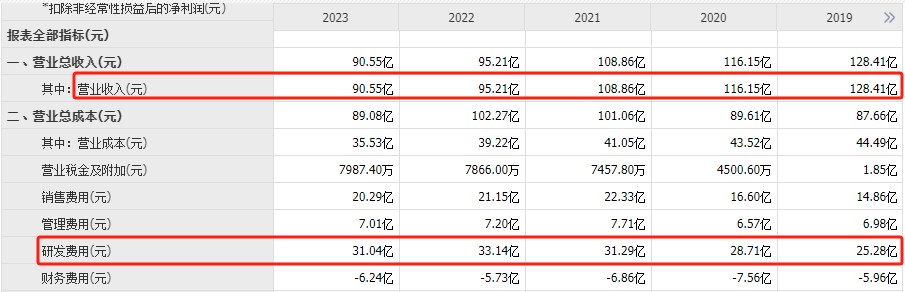

Since 2022, 360 has suffered consecutive annual losses for three years. Its annual revenue has been shrinking since 2018, when it hit a record high of RMB 13.129 billion. In 2023, 360 achieved annual revenue of RMB 9.055 billion, with a net profit attributable to shareholders of the listed company of -RMB 492 million for the same period, a narrowing of the loss by 77.65% compared to the same period last year.

As of the third quarter of this year, 360's revenue continued to decline by 14.21% year-on-year to RMB 1.917 billion, with a net profit attributable to shareholders of listed companies of approximately -RMB 238 million.

The growth issue in the fundamental performance has made creating incremental points the core business task for 360.

A piece of reference information is that 360 has been investing heavily in research and development in recent years. Financial reports show that since 2022, 360 has consistently maintained annual R&D investments of over RMB 3 billion. As of the first three quarters of this year, its R&D expenses for the year amounted to RMB 2.373 billion.

Regarding this, 360 stated in its financial report that it will adhere to the dual-track strategy of 'AI + Security', continuing to reshape its internet business and digital security business with AI based on nearly RMB 30 billion in high R&D investments over the past decade.

Obviously, well-funded AI will become a new growth engine for 360.

Currently, on the B-end, 360 has collaborated with CNOOC Engineering to create the Offshore Engineering Brain large model, empowering smart factory construction. During the reporting period, the number of customers increased by 31% year-on-year, and the number of trial users of the Security Cloud grew to over 3,000.

It is reported that in the third quarter, 360 won the bid for the third project exceeding RMB 100 million this year, following Linfen and Suzhou, with the Ningbo Industrial Base project worth RMB 170 million.

On the C-end, based on 360's pioneering CoE technology platform, AI products and services such as AI Search, AI Office, and AI Browser have developed rapidly, becoming new sources of revenue.

Especially the search business, as a natural scenario with a large user base, is currently one of the most commercially valuable models for AI on the C-end, having nurtured oligopolies such as Baidu and Google in the past. The impact of the new AI search ecosystem has given more possibilities to second- and third-tier participants and newcomers.

In fact, markets such as office software and browsers have also entered a relatively stable phase, but the addition of AI has similarly activated the growth vitality of the entire market. Based on these considerations, Zhou Hongyi and 360 have become increasingly active in searching for innovation opportunities.

Product is the ultimate foundation

Before the launch event, while promoting what is claimed to be the largest domestic native AI application new product, Zhou Hongyi solicited names online for the new product, limiting the name to start with 'N'. According to his own disclosure, just securing the domain name alone cost a 'small fortune'.

Ultimately, the new product was named 'Nano Search'. According to Zhou Hongyi, this is to create a brand-new search brand, and the word 'nano' represents the height of technological development, making it highly recognizable;

'Nano' is an extremely small unit of measurement. Nano Search hopes to solve demand issues from a micro perspective, reshaping search through the four functions of 'searching, learning, writing, and creating', pushing search into the 3.0 era.

A beautiful wish does not mean there are no concerns about the future. Judging from the timing of the product launch, 360 is still in the leading group but is slightly behind other players.

In terms of reshaping the functional boundaries of traditional search engines, Baidu has already launched the Wenxiaoyan app; in terms of vertical content ecosystems, Douyin has launched in-app search products four times in a row; in terms of powerful 'answering' large models with strong generative capabilities, Dark Side of the Moon and Zhipu AI have repeatedly broken records.

Although 360 itself is also an internet software product with national fame, the AI new products released in the past have not made a big splash in the C-end field.

Therefore, the debut of this 'Nano Search' must generate more heat to make 360's efforts and achievements visible.

This may explain why we are seeing Zhou Hongyi becoming increasingly active and 'memorable'. From Xiaomi to Huawei, their grassroots marketing tactics have greatly benefited their corporate strategies. Zhou Hongyi has seen the essence and has repeatedly emphasized that 'entrepreneurs today must not only build an IP but must vigorously promote it'. Over the years, Zhou Hongyi has been steadfastly advancing on the trial-and-error path of building an entrepreneur IP.

However, when it comes to specific performance, perhaps for a product with a strong technological aura, it may be a bit demanding to achieve mass communication through this method. Currently, the viewing volume of Zhou Hongyi's Weibo videos titled 'Rekindling Life: The Reclusive Hacker Amazes the World', which have millions of followers, is only tens of thousands per episode, and the data on other short video platforms is not particularly outstanding.

Upon reflection, figures like Yu Chengdong and Lei Jun have indeed become spokespersons and voices for new corporate products in recent years, even becoming pop icons at one point. But essentially, what ultimately allows these companies to handle surges in traffic is the mass appeal of the products themselves.

However, AI is different. Word-of-mouth propagation within circles is the current mainstream, creating the illusion of high heat. In reality, in the mass market, most AI products are still relatively unknown.

For 360, this unique launch ceremony may be enough to leave a name for Nano Search amidst the AI search frenzy. But for 360's AI ecosystem to flourish and become a new hit like 360 Security Guard, Zhou Hongyi still needs to ponder where the leverage lies beyond the IP.

Source: Pinecone Finance