Meituan: The "Heaviest" Chinese Concept Stock, Did It Finally Prevail?

![]() 12/02 2024

12/02 2024

![]() 478

478

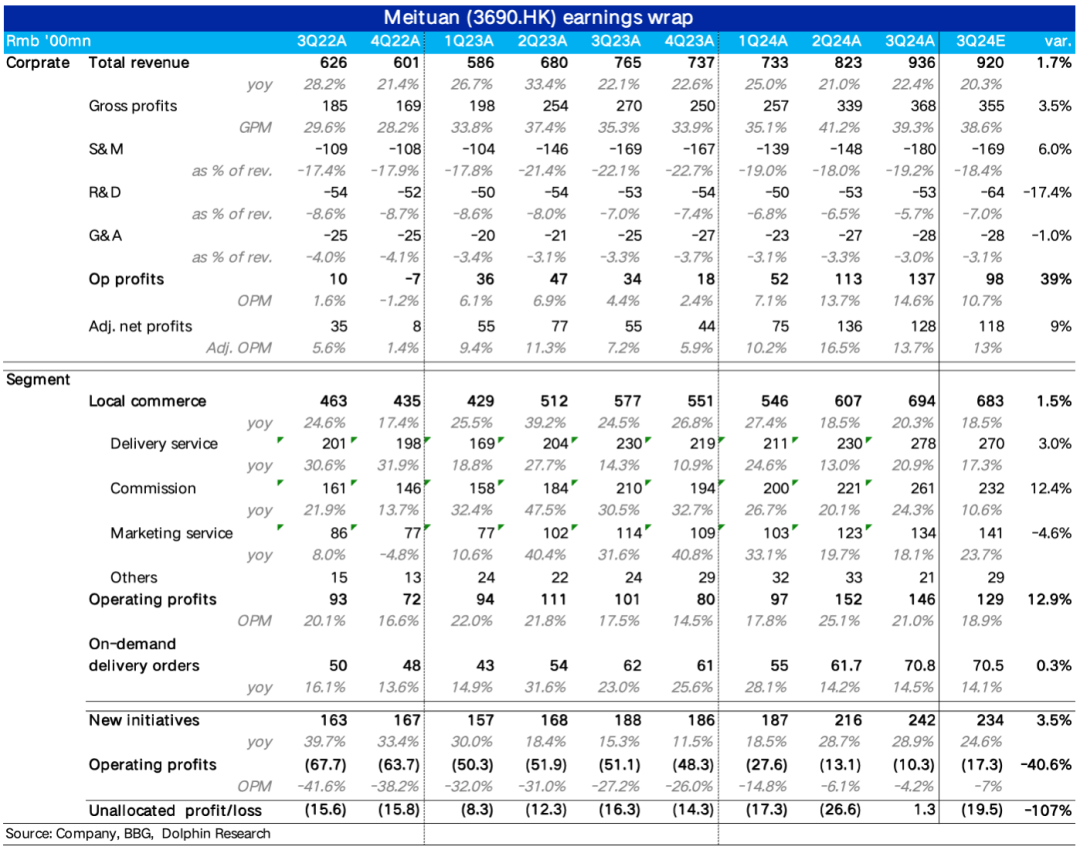

After the Hong Kong stock market closed on November 29, Meituan released its third-quarter 2024 financial report. Amidst the ongoing "thunderous" performance of many consumer peers, Meituan's significant growth in both revenue and profit in this quarter still stands out. Specifically:

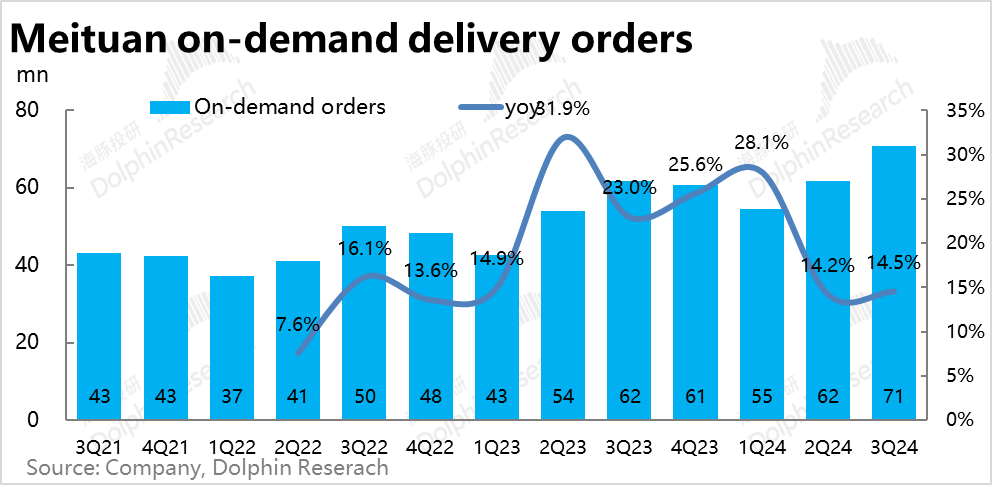

1. The core indicator of the home delivery business—the total number of instant delivery orders—reached approximately 7.1 billion this quarter, up 14.5% year-on-year. The growth rate was roughly the same as the previous quarter, in line with the company's previous guidance, although not exceptionally impressive. Considering the recent ratio of about 3:1 between the growth rates of flash sales and takeout orders, the volume of takeout orders should still exceed 10%. After the low base period in the first half of 2023, the growth rate of Meituan's takeout business has generally stabilized at its medium-term central growth rate.

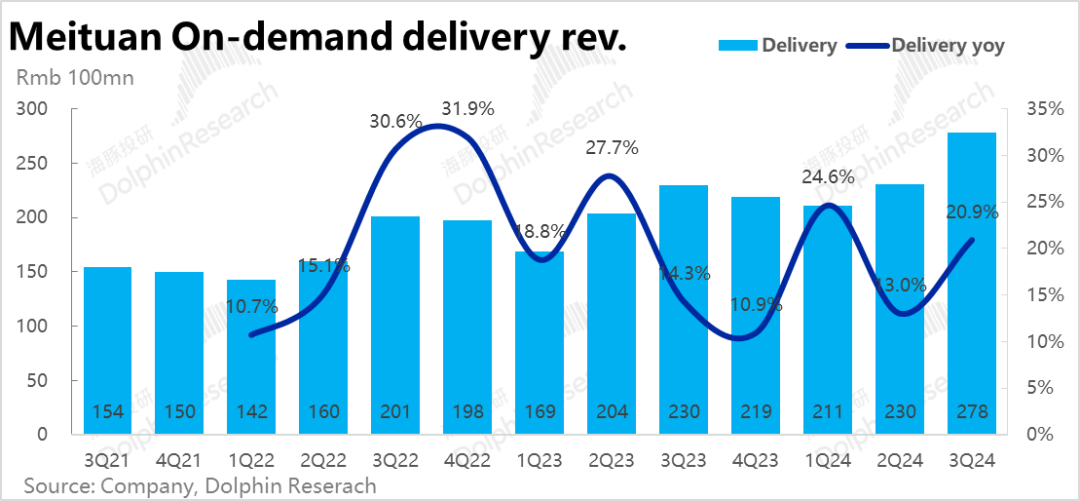

The growth rate of order volume remained basically flat, but the year-on-year growth rate of logistics revenue surged significantly from 13% in the previous quarter to 20.9%. Rough calculations show that the average delivery revenue per order has increased by 6% year-on-year. We believe that the significant increase in average delivery revenue and the subsequent improvement in delivery unit economics (UE) profit are the main contributors to the better-than-expected performance of the local lifestyle segment. The reasons for the improvement in average delivery revenue are discussed in more detail in the main text.

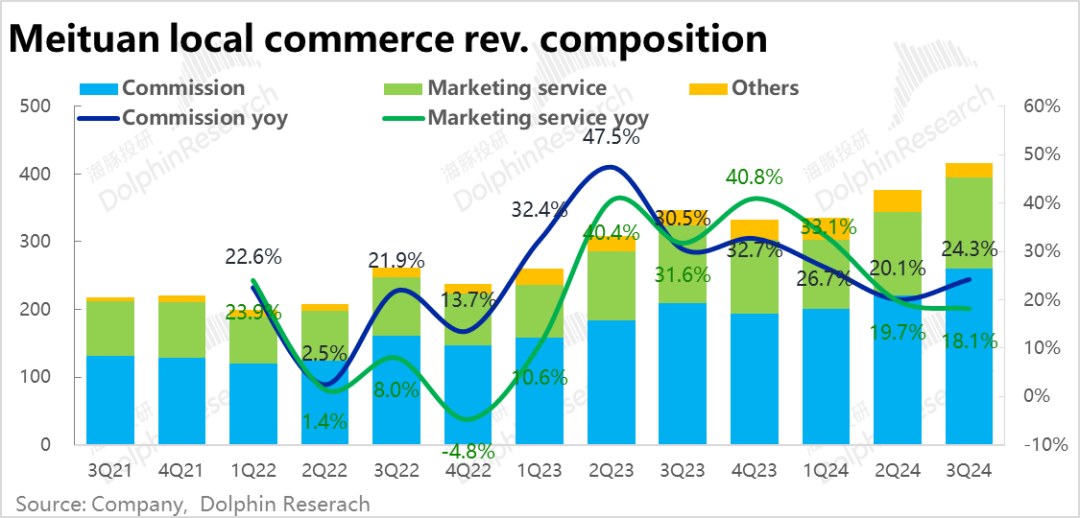

2. Commission and advertising revenue, which combine both store visits and home delivery business, grew at 24.3% and 18.1% year-on-year, respectively, in this quarter. The former is accelerating, while the latter is slowing down. Based on the company's previous guidance, the gross transaction value (GTV) growth rate of the store visit business should be roughly the same as the previous quarter. The slight acceleration in commission revenue reflects Meituan's focus on monetization rather than market share expansion, along with Douyin, as it increases its monetization rate (or reduces commission reductions and subsidies).

However, the growth rate of advertising revenue declined by about 1.6 percentage points (pct) from the previous quarter, widening the gap between the growth rates of commission and advertising business to 6 pct, reminiscent of the fierce competition between Douyin and Meituan from 2022 to early 2023. However, a single quarter's performance is not enough to indicate a significant resurgence in competition for merchant advertising investment between Meituan and Douyin; further observation is needed. It is also possible that the slowdown in advertising revenue growth is due to a decline in overall advertising budgets for merchants under macroeconomic factors, as these budgets do not directly lead to conversions.

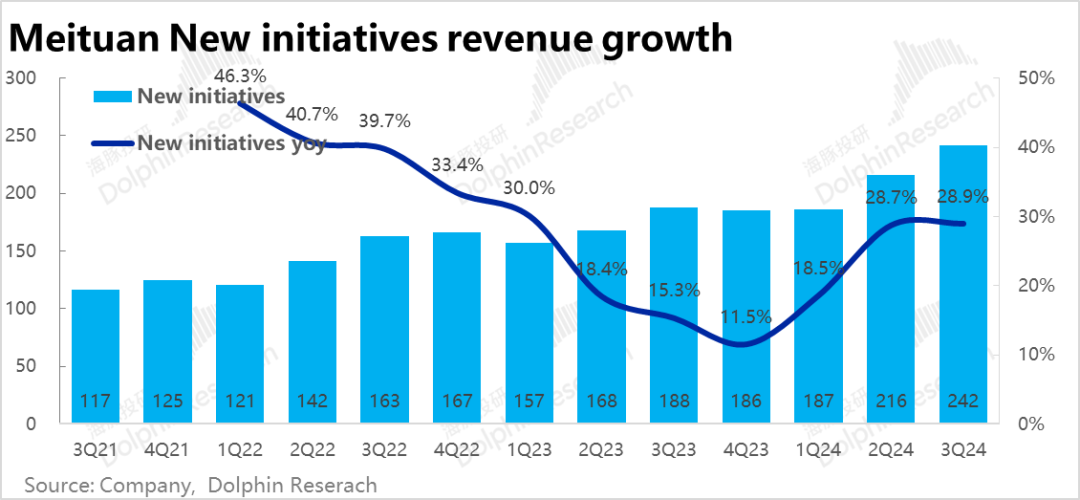

3. Innovative business revenue for this quarter was 24.2 billion, up 28.9% year-on-year, a slight acceleration from the previous quarter and about 800 million more than market expectations. According to the company's own explanation, this growth was mainly driven by the strong performance of retail businesses such as Xiaoxiang and Youxuan, with possible contributions from overseas markets as well.

In addition, the loss reduction in innovative businesses this quarter was also better than expected, with an actual operating loss of 1.03 billion, significantly better than the 1.7 billion loss expected by Bloomberg. However, the market's actual expectations for losses were probably not that high, and a more accurate comparison would be the continued loss reduction of 300 million from the previous quarter. The main contribution to loss reduction was from efficiency improvements in community retail businesses such as Youxuan and Xiaoxiang Supermarket (e.g., improved fulfillment UE).

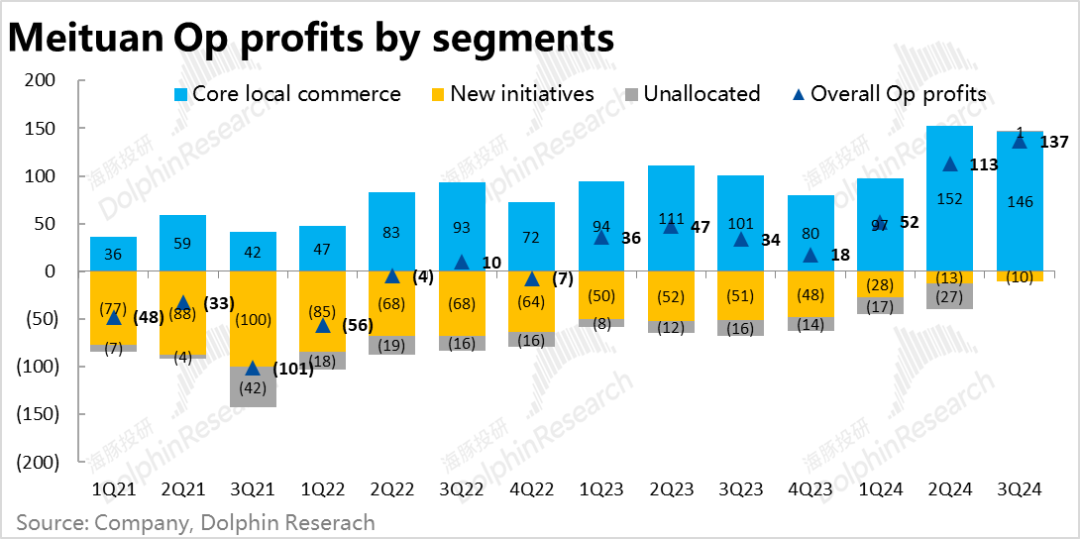

4. At the profit level, Meituan Group's overall operating profit reached 13.7 billion this quarter, setting a new high compared to the previous quarter and exceeding Bloomberg's consensus estimate by nearly 4 billion. The magnitude of this beat is quite remarkable. So, where did this excess profit come from?

Firstly, the loss reduction in innovative businesses nominally contributed about 700 million in unexpected profit, but the actual magnitude of this surprise was not that large.

The operating profit of the core local lifestyle segment was 14.6 billion, showing a slight decline compared to the previous quarter, but in line with the company's guidance regarding the seasonal increase in delivery costs during the summer. Therefore, the actual profit was 1.7 billion more than Bloomberg sellers' expectations. Combining the previous information, the main sources of unexpected profit should be the improvement in delivery UE and the increase in commission rates for store visit businesses.

Additionally, the group level achieved a turnaround from loss to profit this quarter, generating a positive operating profit of 130 million, contributing about 2 billion in unexpected profit alone. However, this was mainly due to Meituan recognizing exchange gains of 1.55 billion and investment income of 570 million this quarter. The unexpected profit from these one-time positive factors should be ignored.

Therefore, the actual operating profit of Meituan this quarter exceeded expectations by about 2 billion. (We cannot rule out the possibility that buyers had even higher profit expectations.)

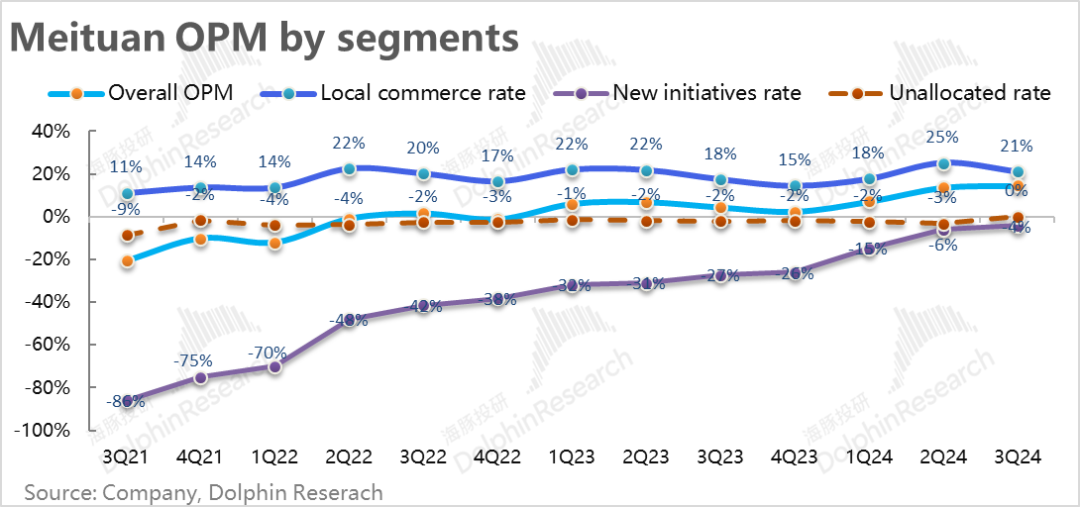

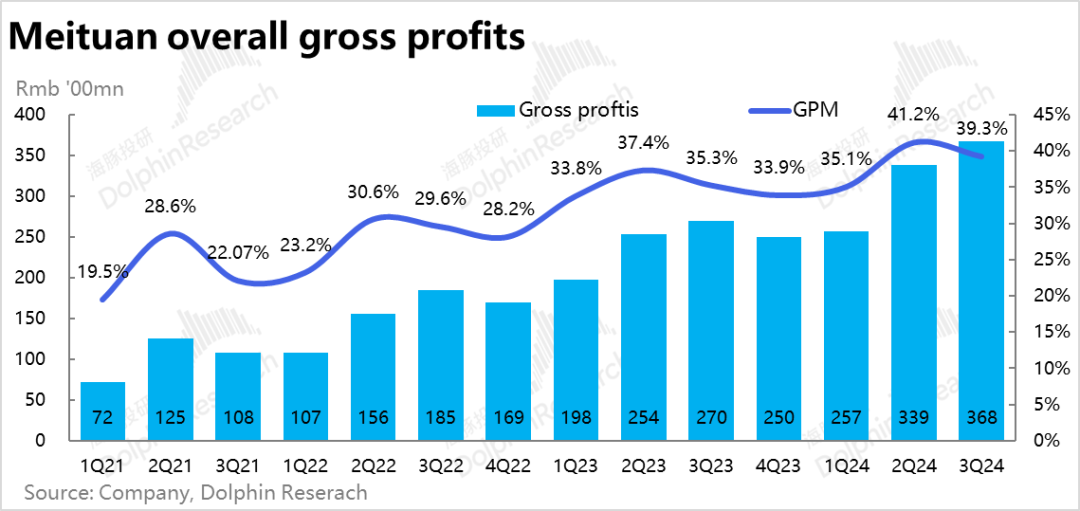

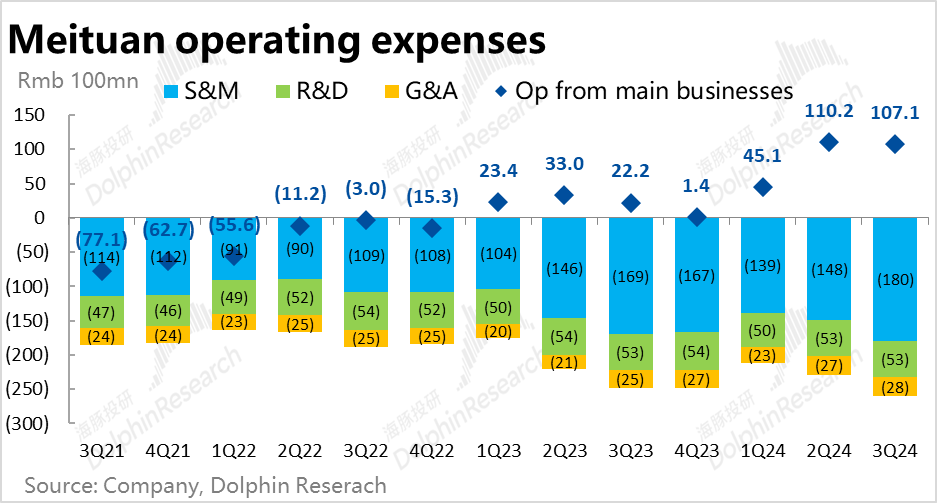

5. From a cost and expense perspective, Meituan's gross profit for this quarter reached 36.8 billion yuan, with a gross margin of 39.3%, a significant increase of 4 percentage points compared to the same period last year and an even larger increase of 3.8 percentage points compared to the previous quarter. Marketing expenses increased slightly by 6% year-on-year, gradually returning to growth but still diluted compared to the 22% revenue growth rate. Compared to slow-growing e-commerce industries with high-speed expense investment, Meituan's competitive landscape appears significantly better. Administrative expenses increased by 10%, possibly due to the impact of expanding overseas business, while R&D expenses declined year-on-year. Overall, the total of the three operating expenses increased by 5% year-on-year, indicating that the expense ratio was still being diluted and declining.

Dolphin Investment Research Viewpoint:

Obviously, whether from the perspective of expectations gap or the trend of performance itself, Meituan's financial report for this quarter can still be considered excellent. Although the home delivery business (especially takeout) has matured in terms of penetration, making it difficult to re-accelerate order volume growth, as a platform, Meituan undoubtedly has considerable pricing power in logistics, commissions, and advertising to unlock growth or profits. While this pricing power cannot last forever and "excess leads to counteraction," it is not surprising for Dolphin Investment Research to see Meituan deliver unexpected revenue or profit in the medium term.

In the store visit business, Meituan and Douyin currently appear to be in a relative truce, working together on monetization and profit. Although the slowdown in advertising growth is not a good sign, it is not yet enough to significantly worry the market about intensifying competition.

Innovative businesses continue to exceed expectations in loss reduction and revenue growth, also in a good cycle. However, the "easy" space for loss reduction may be gradually ending. As overseas business enters an expansion phase, it is premature to expect the overall innovative business to achieve stable profitability and for the market to seriously value this part of the business.

The above are all commendable aspects of Meituan, but Dolphin Investment Research must also point out that since the previous quarter's financial report, Meituan has undoubtedly been one of the most favored Chinese concept stocks in the market, with one of the best stock price performances. The market has also priced Meituan above HK$200 at one point, a rather optimistic valuation. Fortunately, after recent weeks of correction, we believe the current valuation has returned to a more optimistic level.

Regarding whether Meituan can continue to deliver impressive performance in the future, Dolphin Investment Research believes that the probability is not small for at least 1-2 quarters. However, as for whether the current price offers good value for money, we believe it is difficult to say. In other words, while there may still be opportunities to profit from performance beats, there may also be some distance between your position and the safety cushion.

Below is a detailed review of the financial report:

I. Average Delivery Revenue Turns Around, Double Contributor to Revenue and Profit

The core indicator reflecting the performance of the home delivery business (catering takeout and flash sales)—the total number of instant delivery orders—was approximately 7.1 billion this quarter, up 14.5% year-on-year. The growth rate was roughly the same as the previous quarter and in line with the company's guidance. Considering the recent ratio of about 3:1 between the growth rates of flash sales and takeout orders, the volume of takeout orders should still exceed 10%. It can be seen that after the low base period in the first half of 2023, the growth rate of Meituan's takeout business has returned and stabilized at its medium-term central growth rate.

From a revenue perspective, compared to the roughly flat order volume growth on a quarter-on-quarter basis, the year-on-year growth rate of logistics revenue surged significantly from 13% in the previous quarter to 20.9% this quarter. Simply calculated by dividing instant delivery revenue by order volume, the average delivery revenue per order increased by 6% year-on-year. We believe this should be the main contributor (or one of the main contributors) to the better-than-expected performance of the local lifestyle segment this quarter.

The reasons for the turnaround in average delivery revenue per order, in our view, include: 1) Meituan has explicitly stated that more merchants are switching to using Meituan delivery (rather than self-delivery or other third-party delivery), leading to an increase in average delivery revenue due to the higher proportion of Meituan's self-operated delivery; 2) The same period last year saw the most significant decline in average delivery revenue, providing a low base for comparison; 3) The proportion of high-value and high-weight flash sales orders has increased.

The significant rebound in average delivery revenue per order, however, is unlikely to be accompanied by a similar increase in average delivery cost per order, resulting in unexpected improvements and incremental profits in Meituan's average delivery UE.

II. Widening Gap in Growth Rates Between Commissions and Advertising, Is the 'Nightmare' Returning?

In terms of commission and advertising revenue, which combine both home delivery and store visit businesses, the year-on-year growth rates for commissions and advertising revenue were 24.3% and 18.1%, respectively, in this quarter.

Based on the company's previous guidance, the GTV growth of the store visit business should be roughly the same as the previous quarter, and the growth rate of takeout orders was also roughly the same. Therefore, the slight acceleration in commission revenue should reflect Meituan and Douyin's joint focus on monetization rather than market share expansion, resulting in an increased monetization rate (or reduced commission reductions and subsidies).

However, the "complementary" advertising revenue growth rate declined by about 1.6 percentage points from the previous quarter, widening the gap between the growth rates of commission and advertising business to 6 percentage points, reminiscent of the fierce competition between Douyin and Meituan in the store visit business from 2022 to early 2023. We believe that a single quarter's performance is not enough to indicate a significant resurgence in competition for merchant advertising investment between Meituan and Douyin; further observation is needed. It is also possible that the slowdown in advertising revenue growth is due to a decline in the overall proportion of advertising budgets for merchants that do not directly lead to conversions under macroeconomic factors.

III. Innovative Business Revenue and Loss Reduction Both Exceed Expectations

Apart from the core home delivery and store visit businesses, innovative businesses, centered on Meituan Youxuan (community group buying) and Xiaoxiang Supermarket (self-operated front-end warehouse), as well as bike-sharing and overseas businesses, generated revenue of 24.2 billion this quarter, up 28.9% year-on-year, a slight acceleration from the previous quarter and about 800 million more than market expectations, also performing well. According to the company's announcement, this growth was mainly driven by the strong performance of retail businesses such as Xiaoxiang and Youxuan, with possible contributions from overseas markets as well.

In addition to exceeding revenue expectations, the loss reduction in innovative businesses this quarter was also better than expected, with an actual operating loss of 1.03 billion, significantly better than the 1.7 billion loss expected by Bloomberg. However, the market's actual expectations for innovative business losses were probably not that high, and a more reasonable comparison would be the continued loss reduction of 300 million from the previous quarter. Similarly, the main contribution to loss reduction came from efficiency improvements in community retail businesses such as Youxuan and Xiaoxiang Supermarket (e.g., improved fulfillment UE).

IV. Who Contributed to the 'Explosive' Profit?

At the profit level, Meituan Group's overall operating profit reached 13.7 billion this quarter, setting a new high compared to the previous quarter and exceeding Bloomberg's consensus estimate by nearly 4 billion, demonstrating strong performance. Specifically, who were the contributors to this unexpected profit?

Firstly, as mentioned earlier, the loss reduction in innovative businesses (nominally) contributed about 700 million in unexpected profit, but the actual magnitude of this surprise was not that large.

The operating profit of the core local lifestyle segment was 14.6 billion. Although it showed a slight decline compared to the previous quarter, this was in line with the company's guidance regarding the seasonal increase in delivery costs during the summer. It was still 1.7 billion more than Bloomberg sellers' expectations. Combined with the above-mentioned unexpected strength in delivery revenue and the quarter-on-quarter increase in commission revenue, we believe that the main reasons for the unexpected profit in the local lifestyle segment should be the improvement in delivery UE, supplemented by the increase in commission rates for store visit businesses.

In addition, the group level achieved a turnaround from loss to profit this quarter, generating a positive operating profit of 130 million, contributing about 2 billion in unexpected profit alone compared to Bloomberg expectations. However, this was mainly due to Meituan recognizing exchange gains of 1.55 billion and investment income of 570 million this quarter. The unexpected profit from these one-time positive factors should be ignored.

Therefore, the actual operating profit of Meituan this quarter exceeded expectations by about 2 billion. (We cannot rule out the possibility that buyers had even higher profit expectations, resulting in a smaller magnitude of the surprise).

From a cost and expense perspective, Meituan's gross profit reached 36.8 billion yuan this quarter, with a gross margin of 39.3%, a significant increase of 4 percentage points compared to the same period last year and an even larger increase of 3.8 percentage points compared to the previous quarter.

At the expense level, marketing expenses increased slightly by 6% year-on-year, gradually returning to growth but still diluted compared to the 22% revenue growth rate. Compared to slow-growing e-commerce industries with high-speed expense investment, Meituan's competitive landscape appears significantly better. Administrative expenses increased by 10%, possibly due to the impact of expanding overseas business, while R&D expenses declined year-on-year. Overall, the total of the three operating expenses increased by 5% year-on-year, significantly lower than the revenue growth rate.

The significant improvement in gross margin and the dilution of expense expenditure by revenue scale are the reasons for the unexpected profit.

- END -

// Reprint Authorization

This article is originally created by Dolphin Investment Research. Please obtain authorization before reprinting.