Written after Alibaba's stock price hit a new low: How much room for growth does Alibaba Cloud have?

![]() 12/02 2024

12/02 2024

![]() 505

505

Text and Image | Tangjie

Since reaching an intra-year high of $117.8 on October 7, Alibaba's market capitalization has fallen by a quarter; the market had expected a "stellar" third-quarter report to turn the tide, but the results were somewhat disappointing, failing to exceed expectations significantly. As a result, the company's stock price did not surge after the third-quarter report, unlike other Chinese stocks with significant expectations gaps.

Alibaba's current stock price of less than $87 is still below the $90 mark seen on September 23, indicating that despite the recent policy-driven expectations reversal, Alibaba's stock price has actually fallen. Of course, if you believe that this expectations reversal will take time, then based on the company's fundamentals alone, Alibaba's forward P/E ratio of less than 10 times (9.8 times) combined with its strong buyback intentions suggest it is undervalued.

Therefore, from a safety perspective, Alibaba below $90 is highly certain. The only controversial viewpoint is: in the current environment, does Alibaba still have growth potential and investment value?

Recently, news of Alibaba's strategic readjustment has been widespread. E-commerce businesses such as Taobao, Tmall, 1688, and Xianyu have merged to form the Alibaba E-commerce Business Group, with Jiang Fan, the former head of the International Digital Commerce Group, appointed as CEO. In a nutshell, the integration and reorganization of the company's e-commerce business can reduce internal friction and leverage synergies between platforms.

Both internally and externally, Jiang Fan is deeply trusted, and the gradual recovery of the e-commerce business can be left to time. However, we want to emphasize that beyond the spotlight, Alibaba Cloud Intelligence Group has undergone a transformation over the past year. When combined with external environmental changes over the past year, you may draw the same revolutionary conclusion as us:

The Cloud Intelligence Group has become one of Alibaba's most important growth drivers, especially in terms of profit contribution, which will continue to amplify in the coming quarters.

01 Expectations Reversal

When it comes to cloud services, few people consider it a priority for Alibaba. On the one hand, its share is indeed not large, and it is not a toC business like e-commerce, which has a certain understanding threshold. On the other hand, SaaS has some compatibility issues in China. The market is not dismissive of Alibaba Cloud but rather believes that all cloud services are not worth overestimating.

In simple terms, doubts arise from two aspects: product strategy and business model. From an investor's perspective, the business model may take precedence over the product, as it is straightforward: within the secondary market system, technologies and products that cannot be monetized have no valuation space.

Regarding the business model of cloud services, there is a very typical argument: The rental and sale of computing resources (computing power, storage, etc.), which are the foundation of cloud services, constitute a business model with network effects. The more users utilize these products, the higher their value becomes for individual users (similar to C-end products like WeChat). Similarly, this service model also has economies of scale, where marginal benefits increase as investments expand.

Network effects and economies of scale complement each other, collectively constituting the main characteristic of the cloud services market—the Matthew Effect. A handful of enterprises that started earlier, invested more, and gained more customers occupy the vast majority of the market share.

According to Canalys data, in Q2 2024, Alibaba Cloud's domestic market share reached 36%, maintaining its lead year-round; Huawei Cloud (19%) and Tencent Cloud (16%) ranked second and third, respectively, while other cloud vendors had market shares in the mid-single digits. In the global cloud services market, Amazon Web Services (AWS) has long dominated with over 30% share, followed by Microsoft Azure and Google Cloud, with the top three combined accounting for over 65% of the market.

It can be seen that regardless of the stage of market development, both the Chinese and international cloud services markets exhibit similar structures. The market share rankings of the top three remain relatively stable, with little significant fluctuation between them. Not to mention other vendors, who have come in waves over the years, some claiming revolutionary technologies and products, yet none have effectively challenged the top three.

This illustrates that, from a business model perspective, scale and network effects are inherently competitive barriers, and they are the hardest and highest barriers in this industry. While the industry leader cannot be said to have an eternal hold, as long as it maintains a certain investment intensity, it can easily face competition. Even if a global-scale outage like Microsoft's occurs, as long as it is handled properly, it will not affect market share.

The combination of the Matthew Effect, network effects, and economies of scale means that as cloud services grow to a certain stage, their profitability will accelerate, potentially even surpassing platform-based businesses like e-commerce.

Source: Amazon Financial Report

Taking Amazon as an example, the above chart shows the sources of the company's operating profit over the past decade. Excluding the international business, which has been largely unprofitable, cloud services have been growing rapidly since surpassing the North American business segment in 2018 and have since become the main contributor to Amazon's operating profit. With only 17% of revenue, AWS contributes over 60% of Amazon's operating profit.

This is the best aspect of the cloud services business from a commercial perspective: Initially, investments are huge, and results are slow to materialize; later, growth is rapid, and profits are abundant. Comparing the global leader to the Chinese leader, it can be seen that Alibaba Cloud's business is on the eve of an explosion.

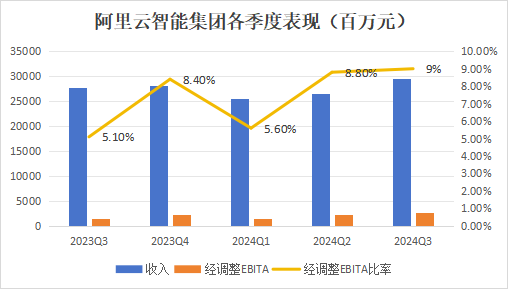

Source: Alibaba Quarterly Financial Reports, Tangping Index

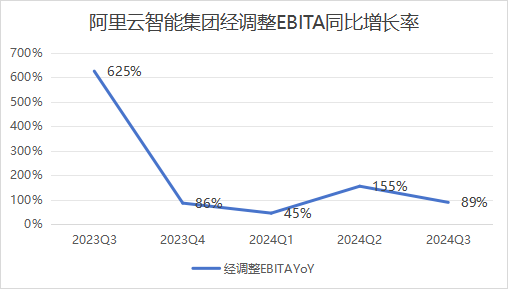

Since Wu Yongming took office as CEO of the current Cloud Intelligence Group in the third quarter of last year, the group's adjusted EBITA and adjusted EBITA ratio have accelerated, with very high-speed growth in five quarters. At the same time, the overall revenue growth rate of this business segment is also gradually increasing, expanding from low to mid-single digits to mid to high single digits, with a growing curve maintained.

As the industry leader with an annual revenue of over 100 billion yuan, the Cloud Intelligence Group can still achieve a rebound in revenue growth by adjusting business focus and optimizing the business model. Meanwhile, according to the development status of the cloud services business itself, the company has entered a stage of accelerated profit recovery. It is highly probable that fundamentals will continue to improve in the future, which will also become an important source of expectations gap for the entire Alibaba Group.

02 Model or Product Dilemma?

Over the past year, Alibaba Cloud has undergone significant changes.

Nine months ago, Liu Weiguang, who had been in charge of the Public Cloud Business Unit for three months, announced the largest price reduction in Alibaba Cloud's history, covering almost all core products with an average reduction of 20%. In the first half of 2023, Alibaba Cloud also initiated a round of significant price reductions, prompting other vendors to follow suit; however, the February price reduction this year did not seem to attract many followers.

Source: Alibaba Quarterly Financial Reports, Tangping Index

Ultimately, the cost advantage brought by economies of scale is difficult for other companies to match, as detailed earlier. However, it is crucial to note that despite significant price reductions over two consecutive years, adjusted EBITA has maintained ultra-high growth rates, with a slight decline in growth speed but still in the high double digits. This is driven by their product logic.

It is well-known that SaaS businesses like cloud services in China are difficult to monetize. Many believe this is due to an unsuitable business model, but in reality, it is a product mindset issue: failing to develop suitable products tailored to specific needs of Chinese customers indicates insufficient expertise rather than a flawed business model.

The reason SaaS is highly sought after globally is that it contributes annual recurring revenue (ARR) each year. Put bluntly, companies with high ARR can still maintain next year's performance even if they cut all existing sales staff and expenses. This is the charm of SaaS—sustained income leads to higher revenue quality and profitability. However, it also places higher demands on a company's reputation and product strength.

This is what Alibaba Cloud has been doing under Wu Yongming's leadership over the past year:

'The Cloud Intelligence Group will firmly implement an AI-driven, public cloud-priority strategy and increase investment in AI-related hardware and software. ... We will prioritize all products and business models, reduce project-based sales orders, increase investment in public cloud core products, and continuously improve the revenue quality of the cloud business. We believe that adhering to a public cloud-priority strategy will enable us to continuously reap the benefits of economies of scale and technological dividends in the future.'"

It's important to note that Alibaba Cloud already has advantages in high renewal rates, scalable public cloud computing infrastructure resources, and cloud application service products. Relying on individual projects alone could not have led to years of sustained market share leadership. Meanwhile, a public cloud-priority strategy implies that they should and must pursue a cost-effective approach, leveraging scale to achieve efficiency.

From a product perspective, a public cloud is like building an apartment building and renting ready-made apartments to users based on their needs. In contrast, a hybrid or private cloud is akin to building a customized villa from scratch for a specific client. For users, public clouds offer lower access costs, more flexible resource demands, and higher stability with easy access at any time.

However, compared to hybrid or pure private clouds, public clouds have obvious drawbacks: Data is stored in a relatively shared environment, and some sensitive industries with high information privacy requirements may still worry about the risk of data leakage. Additionally, products tend to be more standardized, lacking the flexibility required by large, independent enterprises that need highly customized services.

Therefore, choosing a public cloud-priority product strategy means targeting small and medium-sized enterprises and specific low-risk needs of large or data-sensitive enterprises. Its advantage lies in consistent customer payments and leveraging economies of scale for profit. However, in Alibaba Cloud's view, this does not mean abandoning the hybrid or dedicated cloud and project-based government and enterprise markets.

At the September Cloud Town Conference, Alibaba Cloud unveiled dedicated cloud products for government and enterprise customers. First, it released Flying Apsara Enterprise Edition V3.18, an enterprise-grade dedicated cloud platform specifically designed for government and enterprise customers. Sharing the same roots as Alibaba Cloud's public cloud, the new version upgrades intelligent computing capabilities to achieve 'one cloud, multiple computing.' Second, it introduced the Bailing Exclusive Edition 2.0, which is compatible with both public cloud VPC and dedicated cloud environments, assisting government and enterprise customers in developing large models.

It is evident that this leverages public cloud technology accumulation to customize dedicated cloud products. This is another significant benefit of economies of scale and network effects: creating customized products that satisfy customers using a low-cost, highly completed standardized approach. This reverses the past commercial reality of high unit prices but low margins in the government and enterprise market through mature technology.

03 Conclusion

A stable competitive landscape does not guarantee eternal dominance. Alibaba Cloud is currently on the right path, but that does not mean competitors will not catch up. Internationally, this year has seen rapid growth in cloud revenue for Google and Microsoft, narrowing the market share gap with AWS.

The variable here is AI. Fortunately, the domestic cloud services customer base is generally more cautious and pragmatic about AI, giving these large cloud service providers more time. By integrating an open large model ecosystem, allowing more third-party large models to connect to Alibaba Cloud, it can not only serve enterprises of different sizes but also observe future market trends in the process.

Currently, the accelerating effect of AI on the cloud services market overseas may not be fully replicated in the domestic market. However, as AI applications emerge, the growth potential will only manifest more rapidly. For Alibaba today, the future growth of Alibaba Cloud is promising.

Disclaimer: This article is for learning and exchange purposes only and does not constitute investment advice. Likes, views, and shares are welcome; your support is our motivation to update!