Boss Zhipin: Navigating Headwinds, Not Slacking

![]() 12/12 2024

12/12 2024

![]() 693

693

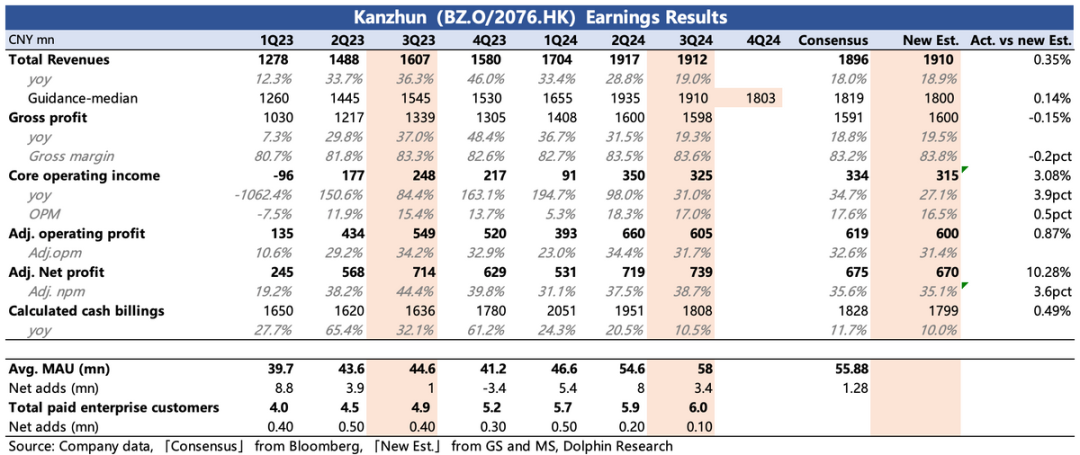

"Recruitment leader" BOSS Zhipin has finally released its long-awaited Q3 earnings report. With the company's official preview communicated earlier this month, the market has already absorbed the negative impact of the Q3 revenue pressure. As a result, the Q3 earnings report's performance has minimal impact on short-term valuation, with greater focus on management's outlook, clear quantitative guidance, or qualitative tone changes. Additionally, beyond macroeconomic factors, Dolphin will scrutinize the company's internal operations, assessing BOSS Zhipin's ability to generate alpha from a medium to long-term perspective.

Specifically:

1. Expected Growth Pressure: Q3 performance was largely anticipated, including cash flow pressure and maintaining profit margin stability through cost optimization. The company's guidance for Q4 revenue remains cautious, with year-on-year growth dipping further to low single digits, and revenue growth projections slowing accordingly.

BOSS Zhipin still expects 10%+ revenue growth in 2025, signaling a potential bottoming-out and recovery outlook compared to the second half of this year. This may implicitly incorporate the expectation that the economic cycle will accelerate towards a turning point under policy stimulus since the 924 policy. However, the company remains confident in improving profitability, anticipating a +30% increase to reach 3 billion. This stems from BOSS Zhipin's robust business model and stable competitive advantage, offering significant room for optimizing operating leverage.

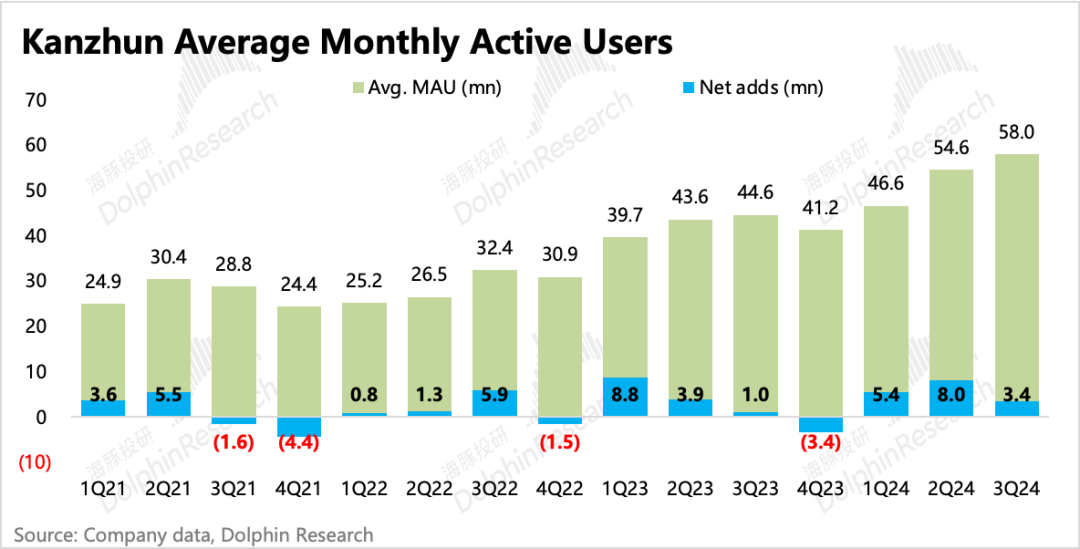

2. Traffic Peaks, CB Structure Shows Slight Warmth Post-Policy: Monthly active users continued to hit a new high of 58 million in Q3, with most new active users likely being job seekers.

The job seeker-to-employer ratio (CB ratio) in Q3 remained under pressure, with job seekers outnumbering employers among new users. However, management revealed in the preview that the CB ratio improved in late November. Currently, this marginal change hasn't translated into paid conversions, but with ongoing economic policy introductions, one can continue to monitor and anticipate a recovery in corporate payments.

At the end of 2022, the company set a goal of increasing monthly active users by 40 million over the next three years. Currently, 68% of this goal has been achieved in two years, progressing steadily as planned. The economic downturn has exacerbated the labor supply-demand imbalance, attracting a natural flow of job seekers, while BOSS Zhipin has exercised restraint in marketing investments.

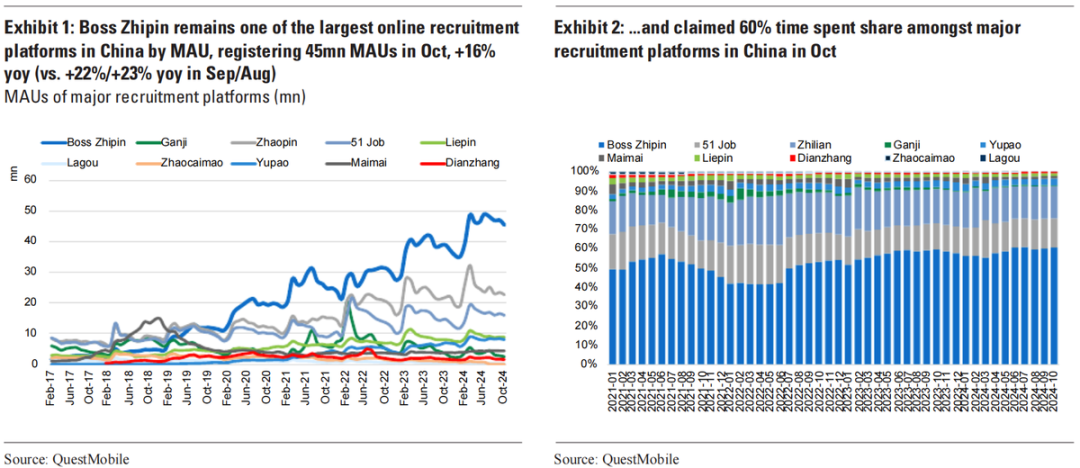

Horizontally compared with peers, BOSS Zhipin's brand awareness stands out—whether in terms of monthly active users or usage duration, its lead continues to widen.

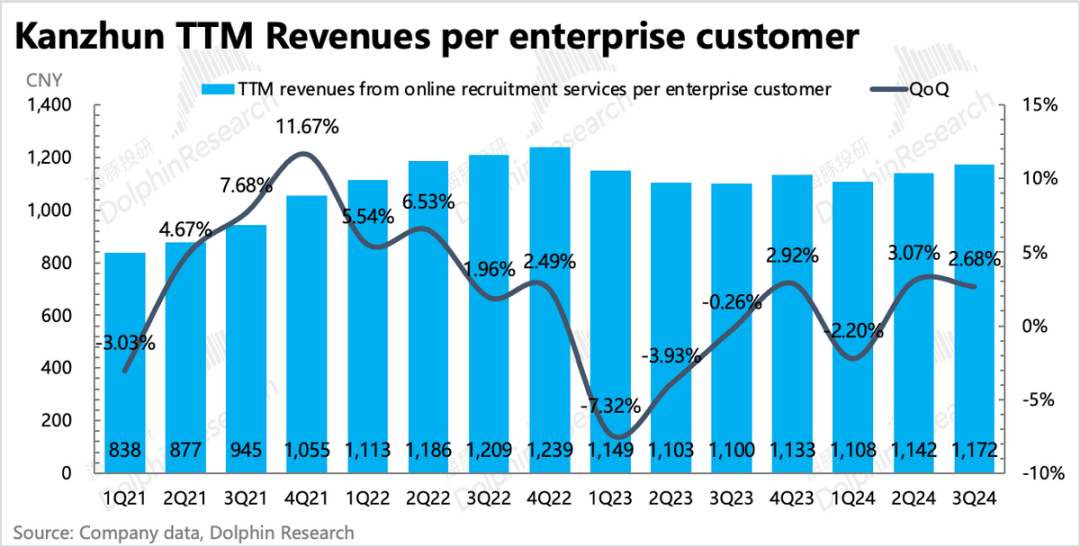

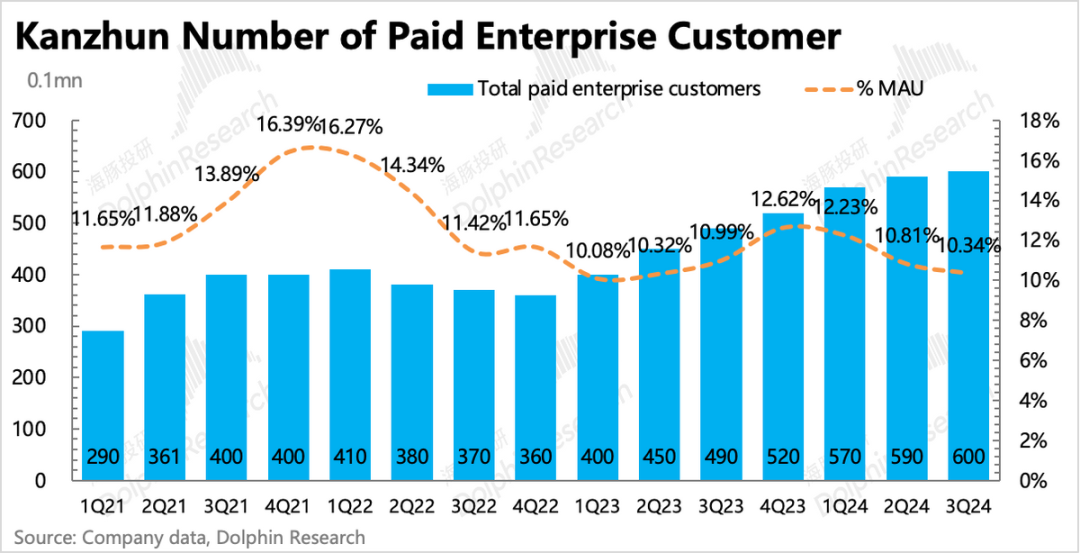

3. Rising Proportion of Large Enterprises: Corporate recruitment revenue increased by 20% in Q3, primarily driven by a 22% increase in paid corporate users from 4.9 million to 6 million. Dolphin calculates that the average payment per enterprise over the past 12 months has also increased month-on-month, indicating that in the challenging third quarter, SME recruitment demand declined faster, while the proportion of large enterprises with high ARPPU continued to grow.

For BOSS Zhipin, this mitigates some volatility during adversity. Due to business inertia, recruitment demand from large enterprises is generally more stable than that from SMEs. In the face of short-term environmental changes, large enterprises are relatively more resilient to cycles.

4. Accelerated Repurchases, New Repurchase Plan Implemented: The company announced a $200 million repurchase plan over 12 months in March, fully utilized by early December. In August, another $150 million repurchase plan over 12 months was announced. Judging from cumulative repurchases so far, implementation began in December.

Generally, BOSS Zhipin management's repurchases vary based on market capitalization fluctuations. After the 924 policy, market capitalization increased compared to September, reducing the daily repurchase amount but increasing the frequency. Since resuming repurchases post-second-quarter earnings release in late August, overall repurchases have accelerated (repurchased $120 million from September to November, compared to $90 million from March to August).

Although the new repurchase plan is for $150 million, less than the initial plan, Dolphin believes that management places relative importance on shareholder returns and revealed during the second-quarter earnings call that they were considering a dividend plan. Therefore, subsequent repurchases may continue to increase, with a third and fourth phase possible.

Optimistically, based on the accelerated repurchase pace from September to November, Dolphin expects the annualized return on shareholder returns (1.2*4=4.8 billion USD for the full year) to be 7.5%. However, a conservative estimate with $150 million repurchased within the year yields a 2.4% return rate.

Dolphin tends to believe the latter scenario is less likely. Currently, BOSS Zhipin has cash and short-term investments (no debt) of 14.6 billion Chinese yuan, approximately $2 billion. The platform's asset-light business model with prepaid contracts results in healthy cash flow. Q3 operating cash inflow was 810 million Chinese yuan, indicating ample cash flow to support increased shareholder returns.

5. Core Performance Indicators vs. Market Consensus Expectations

Dolphin's Perspective

During the preview communication earlier this month, company management remained cautious about the Q4 outlook, expecting 10%+ revenue growth in 2025. They also indicated they would no longer provide guidance on calculated cash billings.

Due to operational flexibility from cash contract signing to final revenue recognition, revenue and cash flow data don't necessarily synchronize seasonally. However, considering cash flow indicators' more forward-looking nature for business development, the market generally focuses more on cash flow indicators when trading BOSS Zhipin, paying little attention to revenue. Thus, management's cautious guidance on Q4 cash flow data and the cancellation of next year's guidance somewhat increase market concerns.

Currently, the aforementioned negatives have largely been absorbed. In the short term, policy changes significantly impact BOSS Zhipin's valuation. As policy tools continue to roll out, the market predominantly engages in short-term speculation, with expected changes continuously disturbing market capitalization.

December is typically when most clients discuss and sign contracts for the following year. It will be worth monitoring whether management provides any updates on next year's outlook based on December's current performance during the earnings call.

Beyond external factors, what the Q3 earnings report continues to verify from a medium-term perspective is that, in addition to leveraging competitive advantages to gain market share, BOSS Zhipin also focuses on "internal improvement":

On one hand, there's the release of operating leverage. BOSS Zhipin has established a strong brand presence among users. Amid the current industry's adversity (job supply far exceeds demand), the recruitment platform's natural traffic increases. While peers adopt restrained investment strategies to weather the storm, BOSS Zhipin can further optimize customer acquisition costs.

Additionally, the release of operating leverage can be seen in reduced equity incentives. Based on previous management guidance, Dolphin expects this to boost profit margins by 10 percentage points in the future. Pay attention to whether management adopts a more aggressive contraction pace.

On the other hand, there are shareholder returns. Under the asset-light business model, BOSS Zhipin's cash flow is relatively healthy, supporting more robust shareholder return plans. BOSS Zhipin has repurchased 14.5 million ADS year-to-date, using $200 million in funds. The repurchase pace has significantly accelerated since August. Although the initial plan's repurchase quota has been used up, and the new plan's quota is lower, Dolphin expects repurchases to continue. Meanwhile, during the last quarter's earnings call, management revealed they were studying a dividend plan.

Of course, from a longer-term perspective, there's BOSS Zhipin's current overseas expansion logic. However, while Dolphin recognizes BOSS Zhipin's management team's operational capabilities, it's not recommended to build expectations until effective steps are taken.

Based on the company's 2025 performance guidance and market expectations, the current market capitalization of $6.4 billion, converted at an exchange rate of 7.3, corresponds to a P/E (Non-GAAP net profit) valuation of approximately 15x for 2025 performance. Considering BOSS Zhipin's leading position and significant room for profitability improvement due to its business model advantages, much of which depends on the company itself, the original valuation premium compared to other domestic platform economies has notably diminished. From a profit growth perspective, the current valuation is slightly on the low side at around 18x, to some extent reflecting the market's heightened concerns about macroeconomic pressures. Additional risks to consider include RMB depreciation, though we assume the company's repurchases can hedge against this impact.

Of course, if more livelihood and consumption policies are subsequently introduced, accelerating the cycle's inflection point, then for SMEs, which have faced greater pressure on BOSS Zhipin in the short term, their recruitment demand will also recover faster due to operational flexibility. This could potentially lead to a Davis double play.

Detailed Interpretation:

1. No Shortage of C-end Traffic: Job Seekers Continue to Flood In

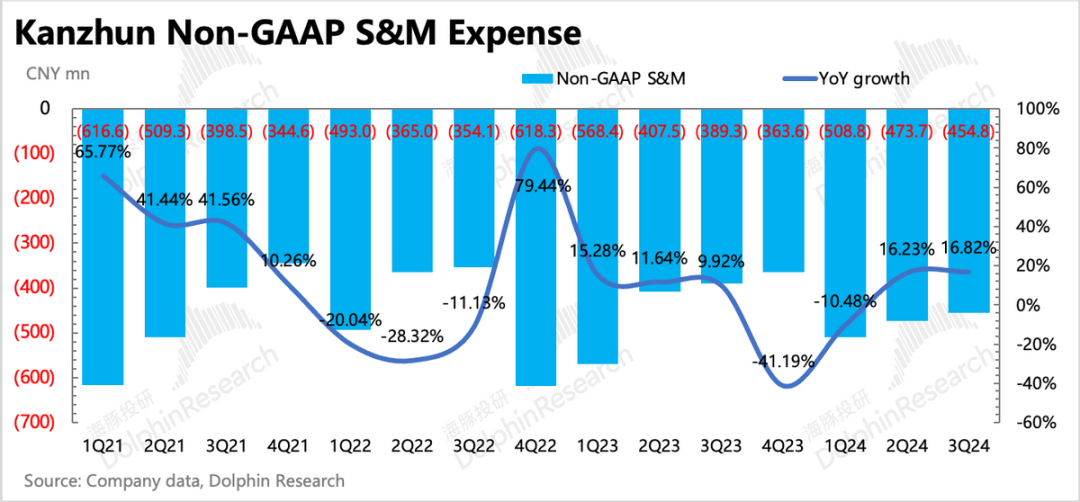

The third quarter is the peak recruitment season for fall hires. Amid the severe macroeconomic environment, recruitment platforms like BOSS Zhipin don't need extra funds to attract attention (Q3 selling expenses increased by 14.2% year-on-year and decreased quarter-on-quarter. Excluding a one-time investment of 100 million Chinese yuan for the Olympics, selling expenses for the second and third quarters were basically the same) - a surge of job seekers is active. In Q3, the platform's monthly active users increased by 3.4 million to 58 million, hitting a new high.

At the end of 2022, the company set a goal of increasing monthly active users by a net of 40 million over the next three years. Currently, 68% of this goal has been achieved in two years, progressing steadily as planned. The economic downturn has exacerbated the labor supply-demand imbalance, attracting a natural flow of job seekers, while BOSS Zhipin has also exercised more restraint in marketing investments.

During the same peak acquisition season, while BOSS Zhipin is the largest in scale, indicating the highest user penetration rate, its acquisition effect (MAU changes) and user engagement (user duration) remain higher than peers.

2. B-end Payments: Employers Tighten Their Wallets

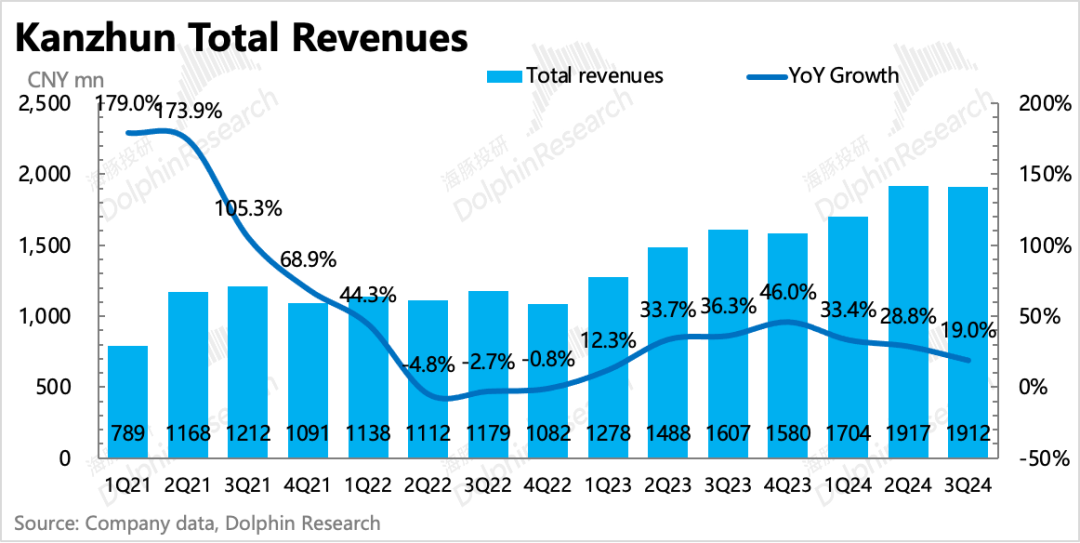

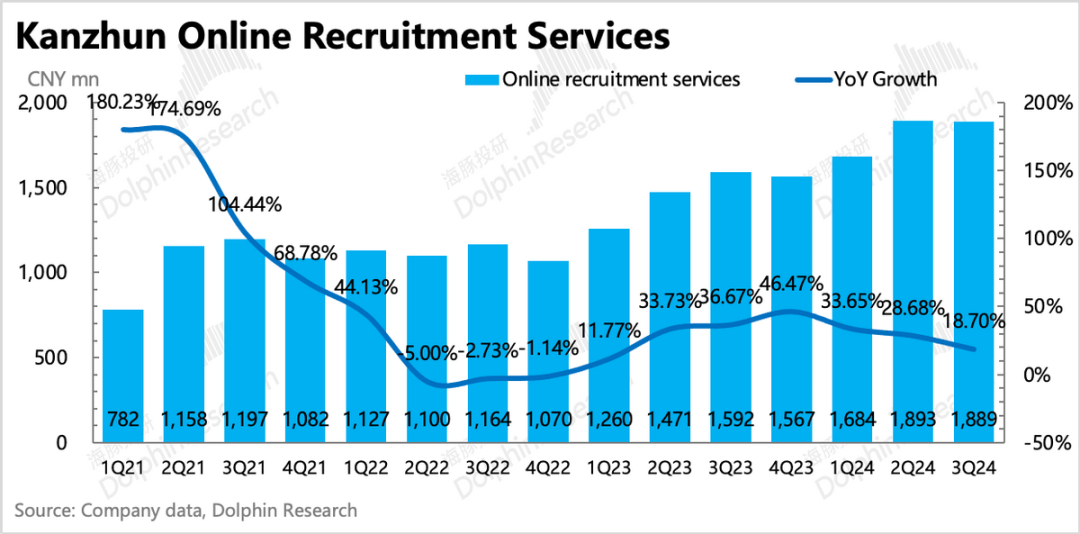

Q3 total revenue was 1.912 billion Chinese yuan, a 19% year-on-year increase, in line with guidance. ToB online recruitment service revenue was 1.89 billion Chinese yuan, a 18.7% year-on-year increase. Management's guidance for total revenue in the next quarter is 1.795-1.81 billion Chinese yuan, with a year-on-year growth rate of 13.6%-14.6%, continuing to slow quarter-on-quarter.

(1) BOSS Zhipin: SME Demand Withdraws Faster, Job Seekers 'Pay to Find a Job'

The implied average payment per enterprise in Q3 increased by 2.7% month-on-month. Besides reflecting a wave of price increases for some thriving industries at the end of last year, Dolphin believes this is mainly due to changes in the revenue contribution structure of different enterprises. As the environment marginally deteriorates, more flexible SMEs will see their recruitment demand contract faster and more significantly. In contrast, large enterprises are relatively more resilient to cycles compared to SMEs and have business operational inertia, resulting in slower responses. Thus, their recruitment demand will be relatively stable in the short term. The change in the number of paid enterprise accounts also shows that the number of paid enterprise accounts in Q3 only increased by 100,000 compared to Q1, with the single-quarter increase being another new low since COVID-19 restrictions eased.

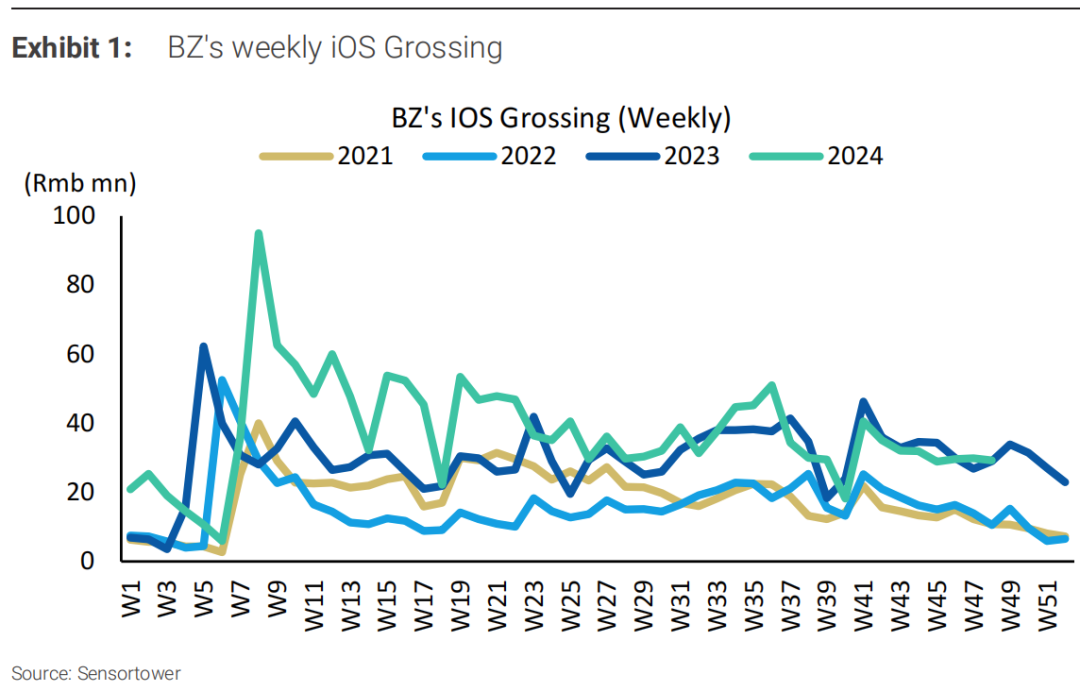

Post-924 policy, Sensor Tower data shows that BOSS Zhipin's online iOS revenue rebounded quickly but remains slightly lower than the same period last year. This indicates that the improvement in the CB ratio at the end of November hasn't yet translated into corporate paid conversions.

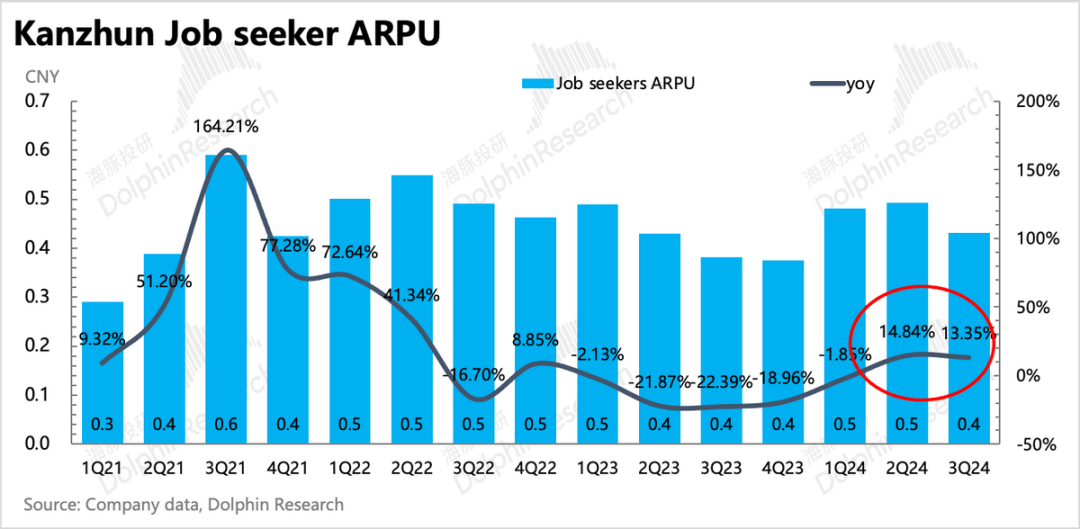

Conversely, the third quarter coincides with the graduation season, leading to a seasonal surge in labor supply in the market. However, corporate demand has not risen in tandem, making it increasingly challenging for job seekers to find employment. Consequently, some individuals even seek resume optimization and other job-seeking guidance within the platform. Over the past two quarters, Dolphin has observed a double-digit year-on-year increase in the average revenue per user (ARPU) for job seekers. Consequently, with an expanding user base, other revenue streams from services provided to job seekers increased by 48% year-on-year in Q3. Nonetheless, this revenue comprises a modest 1.2%, indicating that corporate recruiters remain the primary contributors to BOSS Zhipin's earnings.

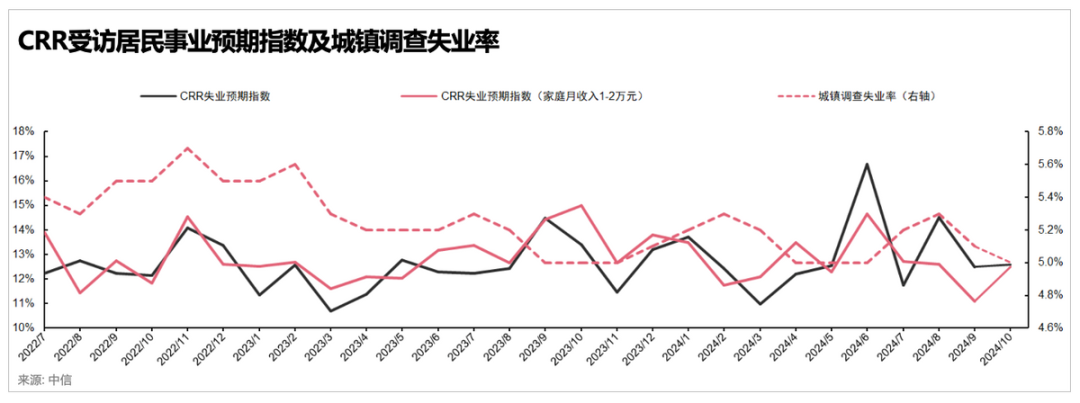

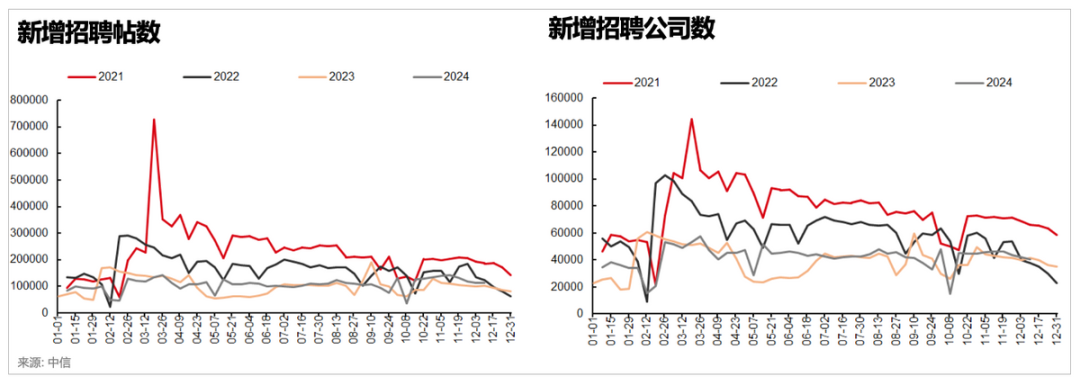

(2) Industry Insights: Short-term Policy Relief Amid Persistent Supply-Demand Imbalance

While the industry's unemployment rate dipped slightly in the third quarter compared to the second quarter, by the end of September, Datayes data revealed that corporate recruitment demand (measured by the number of recruiting companies and new job postings) outside of BOSS Zhipin hit its lowest point in three years, reflecting peak market pessimism about the future. Subsequently, the introduction of the September 24th policy brought some respite to short-term pessimism, enabling corporate recruitment demand to rebound to a level slightly above that of 2023. Nevertheless, the imbalance between labor supply and demand persisted due to the increased pool of job seekers.

3. Leveraging Profit Margins Amidst Adversity

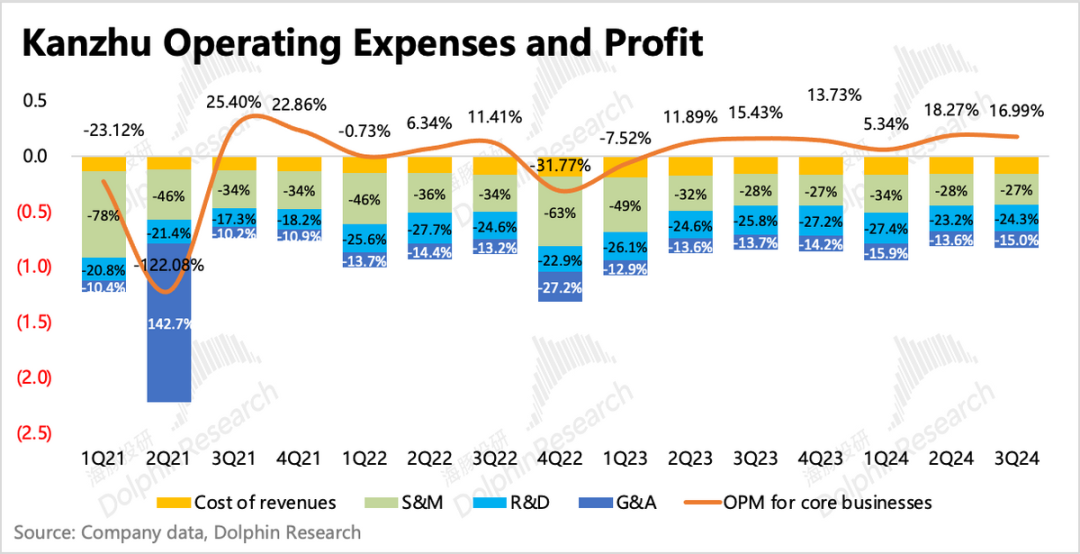

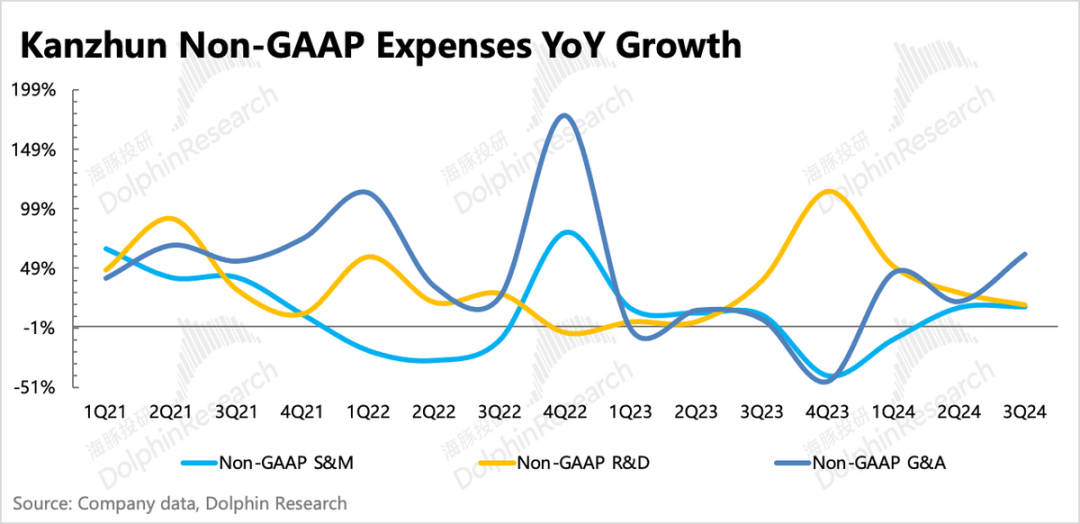

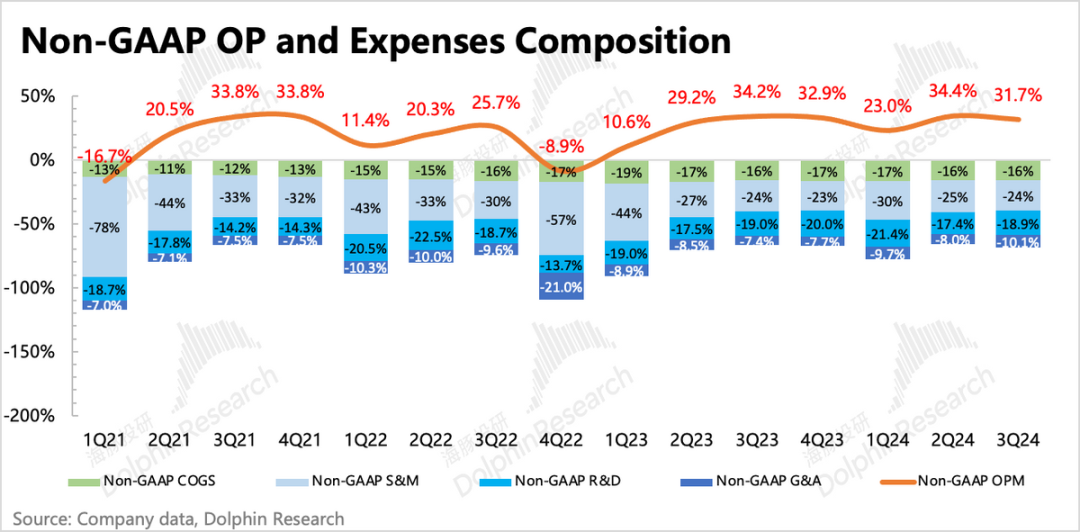

In the third quarter, BOSS Zhipin's gross margin remained stable, with its core business operating profit (revenue minus cost, selling expenses, R&D expenses, and administrative expenses) reaching 325 million yuan, representing a 17% profit margin—a mere 1.5 percentage point improvement over last year's 15.4%.

Although the profit margin improvement slowed notably in the short term, this was primarily due to one-time marketing expenses related to events like the Olympics (approximately 100 million yuan) in Q3, coupled with higher administrative expenses stemming from increased personnel compensation (as detailed in the conference call).

Excluding share-based compensation, Non-GAAP operating profit amounted to 605 million yuan, with a profit margin declining to 31.7% year-on-year and quarter-on-quarter. While the Non-GAAP net profit of 739 million yuan surpassed the latest institutional forecast (660-680 million yuan), this was primarily due to other income sources such as interest income, equity gains, and exchange gains. In Dolphin's view, this does not constitute a truly sustainable beat, and we recommend focusing primarily on changes in operating profit.

However, when viewed over a longer horizon, there is ample room for cost optimization, thereby unlocking operating leverage in the medium to long term:

(1) Customer Acquisition Cost Optimization

Dolphin believes that adversity often presents an opportunity for leading companies to further consolidate their competitive advantages. This is particularly true for job recruitment platforms, where increased job seeker demand generates more organic traffic, allowing the platform to achieve accelerated user penetration at lower customer acquisition costs.

Compared to its peers, BOSS Zhipin's advantage in customer acquisition underscores its established leading brand image, a stable industry competitive landscape, and a robust ecosystem of complementary B-end and C-end traffic. Therefore, the optimization of selling expenses is not merely a short-term measure but a long-term trend.

(2) Reduction of Share-Based Compensation (SBC) Expenses

Meanwhile, there is potential for optimization in share-based compensation (SBC), which has historically been relatively high among domestic internet platforms. Management has previously provided a 1-3-year guidance, indicating that SBC as a proportion of revenue will continue to decline in the short term, with an absolute reduction in SBC expected after 2025.

As of Q3 2024, SBC accounted for 14.4% of BOSS Zhipin's revenue. The company anticipates this percentage to decrease to low single digits in a stable state, suggesting nearly 10 percentage points of room for profit margin improvement.

The company's long-term target for Non-GAAP operating profit margin remains at 40%, still nearly 9 percentage points above the current level. The current macroeconomic pressures are primarily slowing revenue growth, thereby delaying progress toward the profit margin target.

Simultaneously, the market hopes that the company will leverage its leading position during adversity to accelerate the release of operating leverage. During an early-month preview meeting, the company projected a +30% increase in Non-GAAP operating profit margin, aiming to reach 3 billion yuan in 2025. This implies a profit margin increase from 31% this year to 36%, with potential compression primarily in marketing expenses.

// Reprint permission

This article is an original work of Dolphin Research

// Disclaimer and General Disclosure

This report is intended for general data use only, designed for general browsing and data reference by users of Dolphin Research and its affiliated institutions. It does not consider the specific investment goals, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions based on the content or information in this report must bear the risks themselves. Dolphin Research is not liable for any direct or indirect losses that may arise from the use of the data contained in this report. The information and data in this report are based on publicly available information and are provided for reference only. Dolphin Research strives to ensure the reliability, accuracy, and completeness of the information and data but cannot guarantee them.

The information or opinions expressed in this report may not be construed as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction. They do not constitute recommendations, inquiries, or suggestions regarding relevant securities or financial instruments. The information, tools, and data in this report are not intended for distribution to citizens or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, and data would violate applicable laws or regulations or subject Dolphin Research and/or its subsidiaries or affiliates to any registration or licensing requirements in such jurisdictions.

This report reflects only the personal views, opinions, and analysis methods of the relevant authors and does not represent the position of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, and its copyright belongs solely to Dolphin Research. Without the prior written consent of Dolphin Research, no organization or individual may (i) produce, copy, replicate, reprint, forward, or otherwise distribute any form of copy or reproduction in any manner, and/or (ii) directly or indirectly redistribute or transfer it to other unauthorized persons. Dolphin Research reserves all relevant rights.