BOSS Zhipin's Q3 Report: Market Expectations Improve, Blue-Collar Income Share Rises

![]() 12/16 2024

12/16 2024

![]() 504

504

Since the end of September, signs of improvement in the labor supply and demand relationship have emerged alongside a series of supportive macroeconomic policies.

When BOSS Zhipin released its Q3 report a few days ago, management mentioned during the conference call that despite the traditional lull in recruitment towards the end of the year, the number of new corporate users on the platform improved year-on-year after October, a trend that persisted into November and early December. Currently, the ratio of job seekers to employers on the platform is declining, now lower than last year and reaching a relatively low level for the year. This signifies an improvement in supply and demand issues in the job market.

Reflecting in the financial report, there is a marginal increase in the number of new corporate users on the platform, and the labor supply-to-demand ratio is improving. Perhaps recognizing these positive operational signals, renowned brokerages such as Credit Suisse, Citibank, HSBC, and Macquarie all raised their target prices for BOSS Zhipin following the release of the Q3 financial report.

In the long run, as the human resources service industry accelerates its adoption of online recruitment and the online rate continues to rise, BOSS Zhipin, as a leading player in China's online recruitment market, still holds significant growth potential.

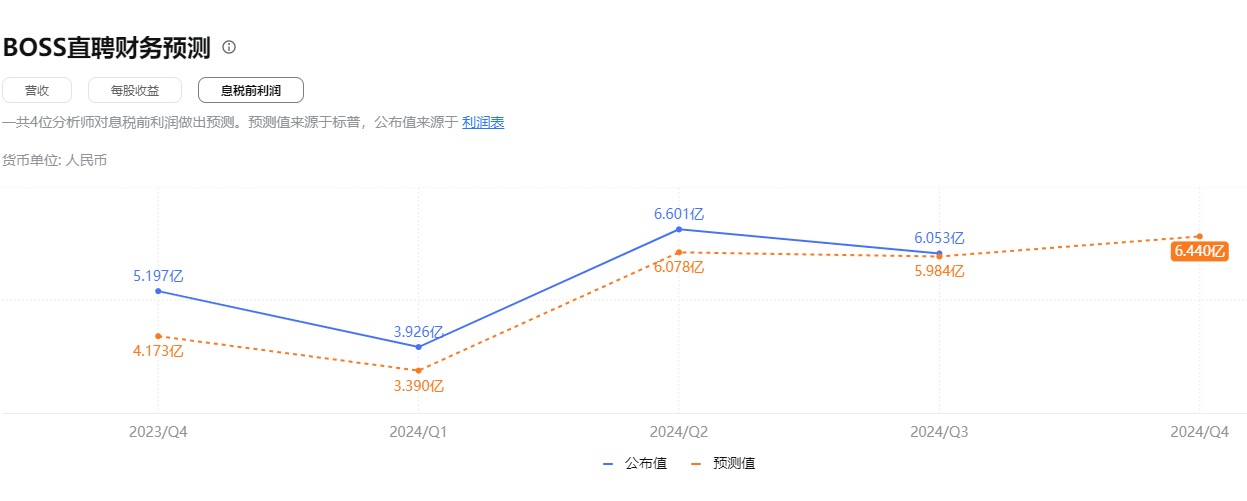

The financial report indicates that the company generated revenue of 1.912 billion yuan in the third quarter, a 19% year-on-year increase; net profit was 464 million yuan, and adjusted operating profit reached 605 million yuan.

Judging from the current results, this report highlights a key aspect of the company's steady development: serving users. Regarding business growth, Zhao Peng, Chairman and CEO of BOSS Zhipin, noted, "Essentially, it means a company's products and services have won over more users or gained greater user recognition."

How to better serve users is the core proposition for the online recruitment industry to take root and thrive in a challenging environment.

Revelations from the Three Efficiency Revolutions in the Online Recruitment Industry

The online recruitment industry, with a history of 30 years, has maintained high growth potential largely due to three significant mode innovations.

In the 1990s, recruitment companies like Monster and 51job moved offline recruitment information online through job advertisement boards, leveraging the internet to improve the dissemination efficiency of recruitment information. In the early 21st century, second-generation players like Indeed and LinkedIn introduced search and social networking models, making job matching more convenient.

Over the past decade or so, BOSS Zhipin pioneered a new recruitment model using recommendation algorithms, further enhancing job matching efficiency and optimizing the experience for both employers and employees, thus achieving rapid growth.

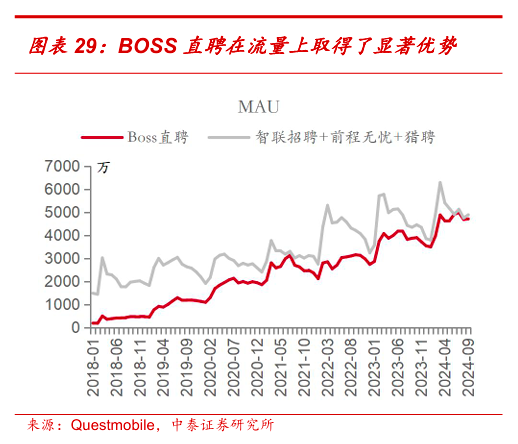

According to Questmobile data, the average monthly active users (MAU) of BOSS Zhipin, 51job, Zhaopin, and Liepin in Q3 2024 were 47.95 million, 16.50 million, 23.85 million, and 8.89 million, respectively.

As of 2024, BOSS Zhipin's recommendation technology remains prominent: on the one hand, it makes the recruitment platform's business model more scalable; on the other hand, it allows the platform to maintain good profitability while ensuring user experience.

Behind BOSS Zhipin's 19% year-on-year revenue growth in the third quarter, further penetration into the blue-collar industry, second- and third-tier cities, and small business markets was a significant factor. Additionally, the company is cautiously exploring overseas markets. These demonstrate that there are still many scalable directions for BOSS Zhipin to explore based on its efficient service model utilizing recommendation technology.

Meanwhile, compared to traditional offline recruitment, online recruitment inherently has high-margin characteristics. With the help of recommendation technology, BOSS Zhipin further enhances job matching efficiency, driving profitability. In this quarter, with the paid rate stabilizing at 20% to 30%, BOSS Zhipin's adjusted EBIT margin expanded by 520 basis points to 34.4%, maintaining stability during adverse times.

In summary, observing the three mode innovations that have sparked iterative changes in the Chinese and American online recruitment industries, we can see the transformation brought about by the efficiency revolution in the human resources service industry. As the third-generation innovation in the industry, more precise and intelligent matching technology continues to drive BOSS Zhipin to navigate various environmental changes and achieve business growth.

Capturing Structural Opportunities in the Recruitment Market to Drive Steady User Growth

The rigid demand for human resources services ensures that the industry as a whole can maintain a stable upward trend, which is a constant. However, within the industry, structural changes have been occurring continuously.

Specifically for platforms, players who capture these structural changes can continuously drive the growth of user scale, continuously strengthen bilateral network effects, drive revenue and profit growth, and build important moats.

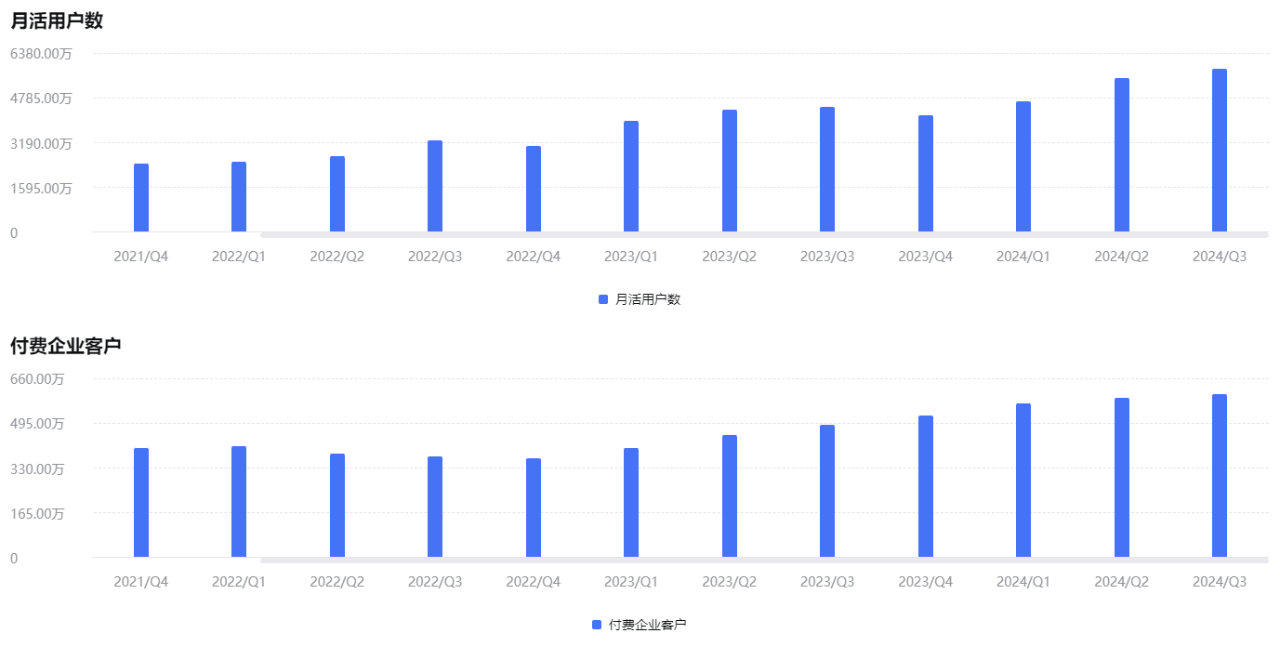

In the third quarter, BOSS Zhipin maintained bilateral growth in monthly active users and paying corporate clients. The company's average monthly active user (MAU) on the app was 58 million, a year-on-year increase of 30%; the number of corporate clients paying the company reached 6 million within the 12 months ended September 30, 2024, up 22.4% year-on-year.

The reason behind this is that BOSS Zhipin has focused on two key areas.

First, BOSS Zhipin continues to deepen its presence in the blue-collar recruitment market and enhance user service levels in this sector.

Since the beginning of this year, the growth rate of industrial production has remained high, serving as an anchor for macroeconomic operations. Incremental policies have increasingly boosted corporate confidence, and demand for labor in the industrial sector has continued to improve. Taking the manufacturing sector as an example, many positions, despite having a substantial base, still maintained a relatively fast year-on-year growth rate in the third quarter.

Therefore, in the third quarter, BOSS Zhipin continued to meet the relatively robust recruitment demands in blue-collar sectors such as supply chains/logistics and manufacturing.

As BOSS Zhipin improves user service levels in the blue-collar sector with the help of "Conch Preferred," a significant amount of natural traffic flows into the platform, attracting more companies to recruit workers. Zhao Peng introduced during the financial report conference that in the third quarter, the cumulative number of companies joining Conch-led projects increased by 45% month-on-month, driving the contribution of the overall blue-collar business to total revenue to rise above 38%.

From white-collar to gold-collar and blue-collar workers, the platform's user structure has become more diversified. With the economic vitality of the sinking market emerging and the increasing demand for labor, user growth will further drive the company's business growth.

On the other hand, BOSS Zhipin continues to focus on campus recruitment, part-time work, and employment for vulnerable groups, meticulously meeting the job-seeking needs of different users in various scenarios.

High-quality and full employment for college students is a concern of the entire society. BOSS Zhipin's "mobile + direct chat + intelligent matching" model demonstrates the platform's more precise and personalized advantages in employment services in this area. In 2024, the number of job positions suitable for fresh graduates to apply for/chat with and the average number of successful matches per student user on the platform increased compared to the previous year.

Additionally, the flexible employment market presents opportunities. In the third quarter, the company made corresponding product and algorithm optimizations based on the "part-time" scenario, adding 21 job theme modules such as "Short-term Labor," "Easy to Learn," and "Physical Labor."

As local governments improve flexible employment service systems, coupled with this new employment model optimizing the employment structure, the platform added millions of part-time job positions in the third quarter, which is expected to continue benefiting from growth in this area.

Overall, BOSS Zhipin has captured the growth trends of more segmented demands in the new supply-demand relationship and explored broader business boundaries. Previously, analysts from Dongxing Securities stated in their report that they are optimistic about the flexible employment track in human resources outsourcing and the online recruitment track in talent acquisition, which have structural opportunities, from the perspectives of scale, growth rate, and landscape.

This means that the engine for platform user growth can still maintain a good "rotation speed," and BOSS Zhipin can rely on bilateral network effects to deploy more strategies, meeting the challenges and opportunities of the fourth wave of innovation in online recruitment.

People-Oriented, Technology-Empowered, and the Underlying Logic of Long-Term Operation

In 2024, online recruitment is accumulating new momentum for technological innovation and efficiency reform, and the technological attributes of human resources in the industry continue to strengthen.

For example, in response to the aforementioned structural opportunities, BOSS Zhipin has adopted a series of technical measures, including AI interview services for large-scale corporate campus recruitment needs and corresponding product and algorithm optimizations based on the "part-time" scenario.

Changes in the cost structure also show that BOSS Zhipin still attaches great importance to technological innovation while accelerating the release of operating leverage.

On the one hand, BOSS Zhipin has increased its R&D investment, with R&D expenses in the third quarter amounting to 464 million yuan, a year-on-year increase of 12%. This figure signals innovation and efficiency improvements by the leading online recruitment platform.

During the financial report conference, the company introduced that artificial intelligence technology has improved overall review efficiency in protecting user safety. Therefore, despite millions of new users and stable platform operation, there has been no increase in the number of safety team members.

On the other hand, the company's marketing expenses in the third quarter were 522 million yuan, accounting for a narrowed ratio of 27% of revenue, reflecting optimized customer acquisition costs. Although the short-term profit margin increase slowed significantly, this was mainly due to marketing investments for events like the Olympics in Q3 (approximately 100 million yuan), which was a one-time expense.

The increase in monthly active users against the backdrop of reduced marketing expenditures demonstrates that bilateral network effects have brought more natural traffic and benign growth to the platform. In this regard, brokerages such as CICC and Huatai Securities have pointed out that they have good expectations for BOSS Zhipin's cost control and stable profitability.

In the future, the relatively high equity incentive expenses as a proportion of revenue will also gradually decrease as expected. Management has provided a 1-3 year guideline, maintaining the long-term Non-GAAP operating profit margin target at 40%, which is nearly 9 percentage points higher than the current level.

Therefore, while maintaining a business growth model driven by technological innovation and user growth, BOSS Zhipin will gradually improve its profitability.

With the introduction of a series of domestic measures to stabilize employment and promote the economy, domestic recruitment market expectations have gradually recovered from a low level. BOSS Zhipin's continuous share repurchases also convey management's long-term confidence in business development. In March and August 2024, the BOSS Zhipin board of directors approved two share repurchase plans worth $200 million and $150 million, respectively, with the company having repurchased nearly $220 million in total within the year.

This has been reflected in the capital market, with many institutional investors taking an optimistic view. Some optimists believe that even at a target price of $16.60, BOSS Zhipin's fair value is underestimated by 18%.

In research reports, brokerages such as Goldman Sachs, Morgan Stanley, J.P. Morgan, and Citibank have a buy/overweight rating on the company. Meanwhile, renowned long-term institutions such as Schroder Investment Management, Thornburg Investment, and WCM have increased their holdings in BOSS Zhipin, and the number of institutional investors in the company has increased compared to the second quarter.

A series of reports and position changes indicate that the market had fully digested the negative factors before the release of the Q3 financial report, and expectations for the company's valuation repair have increased.

Source: US Stock Research Society