Embrace Opportunities! Amazon Business Drives New Momentum for Global Expansion

![]() 12/17 2024

12/17 2024

![]() 674

674

At the recently concluded 2024 Amazon Global Selling Cross-border Summit, during the "New Momentum for Overseas Expansion" sub-forum, Amazon Business provided in-depth insights into global cross-border B2B market trends, encompassing industrial empowerment, regional opportunities, and exclusive tools.

Amid the global shift towards online business procurement, Amazon Business has emerged as one of Amazon's fastest-growing businesses globally, with Chinese sellers embracing both B-end and C-end opportunities as a key development strategy. Over the past three years, the number of sellers on Amazon simultaneously engaging in both B2B and B2C has doubled, and sales generated by Chinese sellers through Amazon Business have surged by over 400%.

According to third-party data, the global B2B e-commerce industry is projected to exceed $37 trillion by 2027, with 96% of business customers planning to increase their share of online procurement.

Song Xiaojun, Vice President of Amazon China and Head of Amazon Global Selling's New Seller Expansion, Emerging Markets, and Amazon Business in China, remarked, "Cross-border B2B represents the next wave of significant growth." Crafting a customer-centric digital "innovation chain" is crucial to ride this wave. Amazon Business remains committed to empowering Chinese enterprises, enhancing their core competitiveness, and fostering high-quality overseas expansion.

In April 2024, Amazon Business expanded into Mexico, offering Chinese sellers direct access to nearly 5 million local business and institutional buyers. Mexico became the 10th market Amazon Business has entered in nine years. At the summit, Amazon Business held a ceremony to mark the official launch of its Mexico site.

Mexico's B2B Market: Enormous Potential

Firstly, the United States-Mexico-Canada Agreement (USMCA) has bolstered Mexico's trade, fostering steady industrial growth. According to People's Daily data, Mexico's industrial production index rose by 3.9% year-on-year in the first ten months of 2023.

Secondly, the surge in Mexican enterprises has sparked a demand explosion in B2B transactions. Statista predicts an 11% compound annual growth rate for Mexico's B2B e-commerce market.

Quick Overview of Mexican B2B Buyer Characteristics

Mexico boasts nearly 5 million potential business customers, predominantly small and medium-sized enterprises. These enterprises favor bulk purchasing and have low return rates, highly beneficial for sellers. Mexican business customers primarily purchase items such as computers, home appliances, kitchenware, and office supplies.

Amazon operates 11 fulfillment centers, 3 sorting centers, and 27 delivery stations in Mexico. For Chinese sellers, entering the Mexican market not only captures local opportunities but also paves the way for expansion into the broader Latin American market.

Additionally, the Canadian site stands out as another emerging market opportunity that Amazon Business has emphasized in recent years. Canada's B2B market thrives, with Chinese sellers contributing over 50% of third-party sales. By 2025, sales on the Amazon Business Canada site are projected to reach CAD $1 billion, representing a vast untapped potential.

Beyond emerging markets, Amazon Business's established sites—the United States, Europe, and Japan—remain cornerstone markets. Reach core categories and top brands in these markets!

The "Home Improvement" category thrives in all three regions. Europe and the US prefer small lighting products like LED bulbs, while Japan favors larger items such as high-pressure washers. The US, Europe, and Japan host numerous international enterprises, allowing sellers to connect with companies like Intel, 3M, Citibank, Honeywell, and Mitsubishi, fostering industry reputations and expanding clientele.

In 2023, Amazon Business launched the "Industry Belt Accelerator Program," aiming to cover 100 industrial belts in China within three years, supporting tens of thousands of manufacturers, and accelerating Chinese sellers' transition from traditional manufacturing to digitization. Through the Direct To Buyer (DTB) model, sellers can directly engage with end-buyers and build global brands.

As of July this year, in line with the industrial belt development plan, Amazon Business has expanded into over 60 industrial belts, encompassing over a thousand manufacturing enterprises and several hundred leading firms. In the past two years, Amazon Global Selling signed MOUs with the Fujian and Shandong Provincial Departments of Commerce to foster cross-border e-commerce and industrial belt integration.

Furthermore, Amazon Business has established seller communities in over 40 industrial belts nationwide, hosting hundreds of events and roundtables, offering one-on-one solutions to enterprises' overseas expansion challenges, and initiating the "Industry Belt Benchmark Factory" project, achieving remarkable results.

Currently, industrial belt development has yielded initial results. In the first half of 2024, the number of newly listed factory-type sellers in Amazon Business-covered industrial belts was five times higher than the same period last year, with total order sales surging over tenfold.

For sellers considering market entry, consider Amazon Business's three key product selection trends:

New Reach: Focus on MRO industrial product solutions. The MRO market is worth trillions of dollars, with procurement models gradually shifting towards digitization and online platforms. Amazon Business has established a dedicated industrial product team in China to support sellers' global endeavors.

New Applications: Embrace advanced manufacturing, service robots, and new energy sources (the "new trio"). These areas represent China's manufacturing future and significant global opportunities. Leading market trends include 3D printing materials, VR/MR devices, service robots, and photovoltaic energy storage products.

New Scenarios: Concentrate on large items and bulk packaging products. Bulk sales offer advantages like larger orders, operational convenience, and cost efficiency, reducing logistics costs by up to 50%.

Notably, many factory-type sellers have capitalized on the B2B market's rapid growth phase, leveraging their strengths and Amazon Business's empowerment. This trillion-dollar blue ocean awaits more sellers.

Amazon Business is dedicated to crafting an exceptional seller experience, securing large business procurement orders through continuous online tool optimization and comprehensive B-end business growth empowerment.

Discussing tool empowerment, Zhou Xirong, Senior Project Manager of Amazon Business Seller Experience, shared at the summit, "A great seller experience is about helping sellers succeed." The core lies in providing convenient, user-friendly tools tailored to B-end procurement scenarios, empowering sellers to efficiently serve business customers.

Amazon's Flywheel Theory's three customer-centric points form the backbone of the B-end seller experience: product selection and convenience, price competitiveness, and traffic and conversion. Revolving around these pillars, Amazon Business has launched over 20 B2B-specific services and tools, significantly driving seller growth. Recently, Amazon Business introduced exclusive display advertising and sponsored product ads for sellers, enabling precise targeting of B2B audiences and expanding reach through exclusive bidding adjustments, allowing advertisers to increase bids for Amazon Business website advertising space by up to 900%.

By effectively utilizing B-end tools, one company became a leading player in the audio-visual equipment category within a year!

In early 2024, Washeng Technology focused on Amazon Business, achieving remarkable results with 20-30% of orders and 50% of sales stemming from B-end customers.

RFQ Quoter: New Momentum for Factory-type Sellers

Since going global, Luoyang Shuangbin Office Furniture Co., Ltd. has leveraged Amazon Business tools and services across various sites. In 2024, Shuangbin Furniture's B-end sales multiplied, accounting for up to 30% of its brand sales.

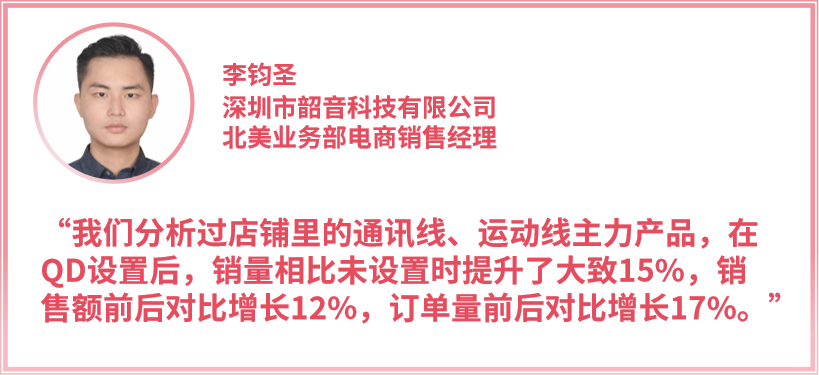

With the help of BPQD, this company's order volume surged by 17%.

Moreover, AfterShokz Technology actively utilizes other tools and services, including Amazon Business's compliance, invoicing functions across sites, and exclusive advertising features.

Amazon Business is committed to delivering a premium seller experience, attracting more sellers, enriching product lines, enhancing price advantages, and improving consumer satisfaction.

Looking ahead, Amazon Business aims to collaborate with sellers to foster platform growth, achieve business flywheel effects, and establish a more efficient, convenient trading platform for global buyers and sellers.

Reference Materials: