Caocao Mobility Races to IPO Amidst Challenges: Navigating Regulatory Risks and Boosting Self-Sustainability

![]() 12/17 2024

12/17 2024

![]() 680

680

In what is poised to be a 'Big Year' for ride-hailing IPOs, Caocao Mobility accelerates its journey towards public listing to secure much-needed capital injection.

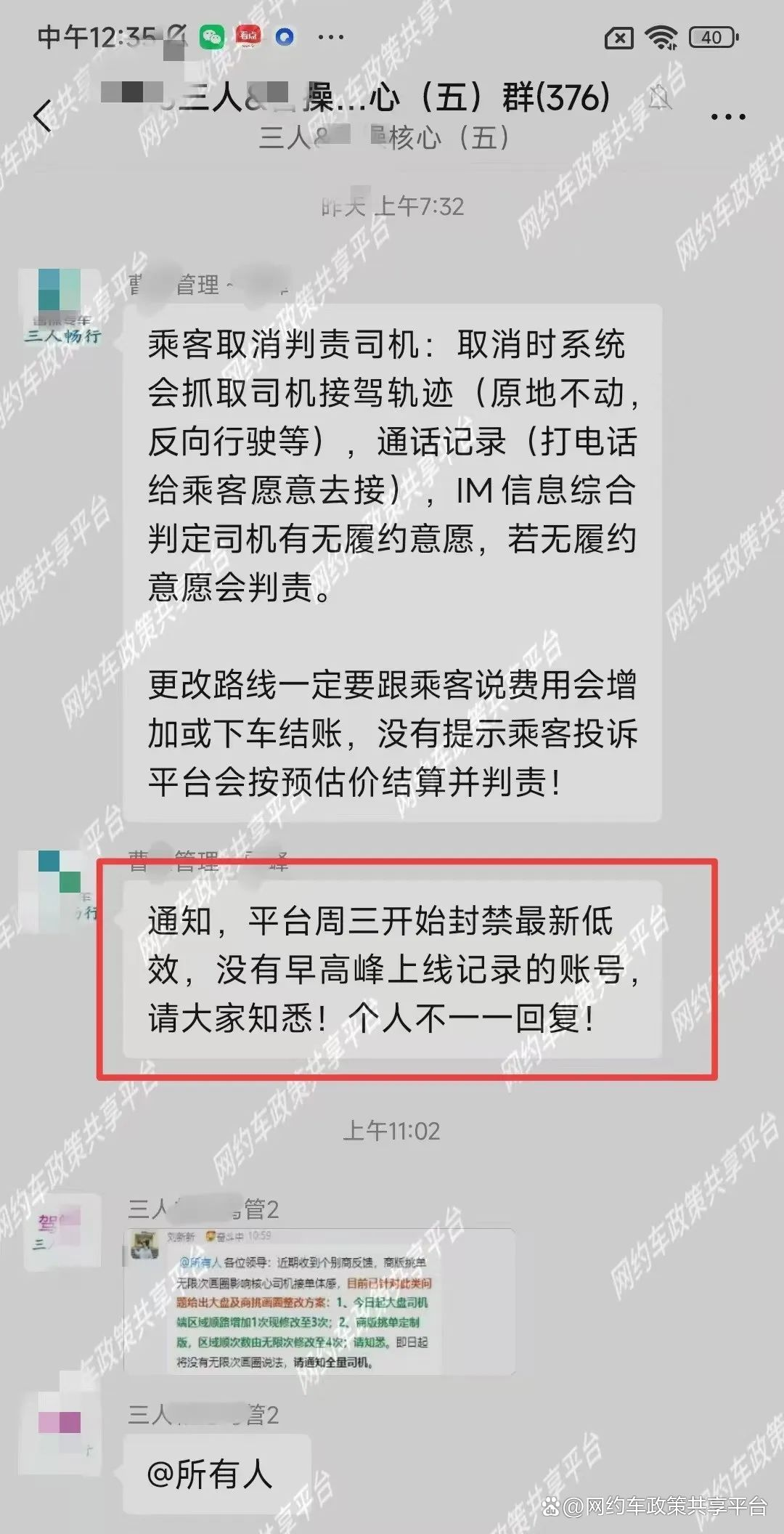

On December 13, a screenshot from a WeChat group circulated online. In a core driver group seemingly belonging to Caocao Mobility and its partner car rental companies, a fleet manager announced that accounts lacking morning peak log-in records would be banned starting Wednesday (December 11).

Xinshi Research Institute reached out to Caocao Mobility and the partner car rental company regarding this matter. While Caocao Mobility denied the authenticity of the incident, the partner car rental company 'Sanshren Changxing' stated that most of these drivers were non-compliant and that this was merely the beginning, with further clean-up efforts planned for non-compliant drivers and vehicles.

Image source: Baijiahao 'Ride-hailing Policy Sharing Platform'

Recently, Caocao Mobility submitted an updated prospectus to the Hong Kong Stock Exchange, revealing more detailed insights into its operations and financial status.

The prospectus disclosed that among Caocao Mobility's active drivers in the first half of 2024, 50,100 did not possess online taxi driver licenses, accounting for 10.7% of the total active drivers.

For Li Shufu, who has already overseen 9 successful IPOs, will Caocao Mobility deliver another perfect score?

I: Caocao Mobility Strives for 'Self-Sustainability' After Accumulating Losses of Nearly 7.8 Billion

The urgency of Caocao Mobility's situation was evident even during the initial disclosure of its prospectus earlier this year.

Data indicates that from 2021 to the first half of 2024 (reporting period), Caocao Mobility incurred net losses of 3.007 billion yuan, 2.007 billion yuan, 1.981 billion yuan, and 778 million yuan, respectively, over a period of three and a half years. The cumulative loss totaled 7.773 billion yuan. Despite the losses appearing to decrease annually, the prospect of recording positive earnings still seems distant, considering the curve's gradual decline.

The primary reason for these continuous losses lies in poor cost control.

In the prospectus, the company stated that sales and marketing expenses increased from 506 million yuan in 2021 to 836 million yuan in 2023.

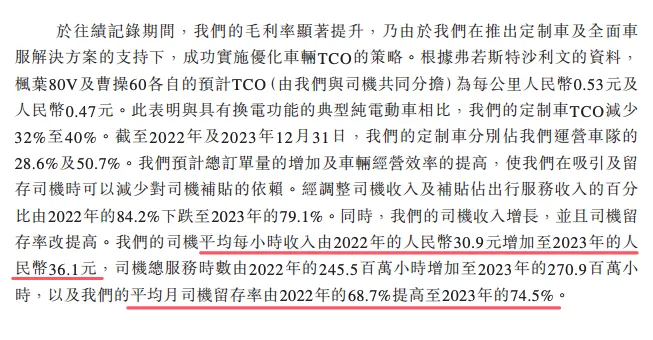

A significant portion of these expenses stems from driver subsidies. The prospectus revealed that from 2022 to 2023 and the first half of 2024, adjusted driver income and subsidies accounted for 84.2%, 79.1%, and 78.3% of mobility service revenue, respectively. Drivers' average hourly earnings were 30.9 yuan, 36.1 yuan, and 37.2 yuan, respectively. Driver subsidies increased from 1.347 billion yuan in 2021 to 2.096 billion yuan in 2023.

Image source: 'Caocao Mobility' prospectus

For Caocao Mobility, this is both a reactive measure and a proactive strategy.

In its early days, Caocao Mobility represented the self-operated model. However, market feedback following Didi's removal in 2021 provided a harsh lesson for many players.

Before Didi's regulation, the self-operated model, epitomized by Didi, was prevalent, while the aggregation model struggled to gain traction. After Didi's temporary exit, a significant market void emerged, prompting many platforms to expand their investments in the aggregation sector. On one hand, aggregation platforms such as Gaode, Baidu, and Tencent Mobility had vast traffic pools, capable of monetizing their traffic and fulfilling a substantial portion of demand. On the other hand, the asset-light model of aggregation platforms allowed for more efficient expansion and stronger long-term profitability.

In 2022, platforms like Tencent, Huawei, and Douyin successively launched aggregation mobility services. In March 2023, Meituan also formally abandoned its self-operated model and fully transitioned to an aggregation platform. Led by Gaode, aggregation platforms utilize map software as a traffic portal for the mobility sector, achieving over 100 million daily active users, allowing ride-hailing platforms to focus less on attracting traffic.

As other competitors began aggregating services, Caocao Mobility, eager to expand its aggregation portfolio, naturally leaned more towards aggregation than self-operation.

From 2021 to 2023, orders from aggregation platforms increased from 43.8% to 73.2% of total orders. Consequently, Caocao Mobility had to face higher commission expenses, with commissions charged by third-party aggregation platforms amounting to 277 million yuan, 322 million yuan, and 667 million yuan, respectively. In the first half of this year, Caocao Mobility announced its entry into 32 new cities, generating more customer referral fees, which increased sales and marketing expenses as a percentage of total revenue to 8.4%.

Moreover, under the aggregation model, the operational logic of mixing good and bad elements has led to an increase in non-compliant drivers. The number of active Caocao Mobility drivers without online taxi driver licenses has been 38,000, 48,000, and 50,000 over the years.

The most direct result is that Caocao Mobility has repeatedly set new records for the number of administrative penalties received daily. On November 1 of this year, Hangzhou Youxing Technology Co., Ltd. received 34 administrative penalties in just one day.

At this critical juncture of the IPO, such significant regulatory pressure and potential negative impacts will undoubtedly become the main focus of Caocao Mobility's efforts in the coming period.

II: The IPO: A Mutual Choice Between Caocao Mobility and Geely

Choosing to go public at this time is, of course, primarily a decision made by Geely Group, which backs Caocao Mobility.

Shen Meng of Xiangsong Capital commented that Geely Group's core business is still automobile manufacturing, especially amid increasing competition within the automotive industry. Although Caocao Mobility is already a major player in the ride-hailing business, it still requires continuous resource investment. Geely prefers that non-core businesses develop independently through IPOs.

It is well-known that the automotive industry is currently in a highly competitive era, and Geely, amidst this turmoil, has struggled with adapting to the marketing challenges of the new era.

In the past, Geely was once renowned as a 'marketing genius' in the domestic automotive circle. However, in recent years, new forces represented by NIO, Xpeng, and Li Auto have mastered the essence of internet marketing, while companies like Huawei and Xiaomi, renowned for their mobile phone brands, have become increasingly deeply involved. Caught between these players, Geely, which has always promoted technology as its core, has struggled to leave a deep impression on the public's mind.

The fiasco surrounding Geely's Jiyue brand is a typical example. In this serialized drama involving tens of thousands of participants and online spectators, many people only learned that Geely was the major investor behind Jiyue when Baidu and Geely jointly announced it.

Image source: Social media platform

From Yinhe, Lynk & Co., Zeekr, to Lotus, Geely has indeed established its own product matrix. However, with the exception of the leading Zeekr brand, it has struggled to make a deep impression on consumers. In September this year, Geely released the 'Taizhou Declaration,' aiming to enhance its reputation through integration and streamlining. Consequently, Zeekr and Lynk & Co. merged, Radar was integrated into Geely, and Geometry was merged into Yinhe.

The IPO of Caocao Mobility is naturally an important part of Geely's strategic operations.

From Caocao Mobility's perspective, it has been expanding its deployment of custom vehicles in recent years. As of the end of June 2024, Caocao Mobility had over 33,000 custom vehicles in 29 cities, the largest custom fleet in China. The proportion of custom vehicle GTV in the company's total GTV also rapidly increased from 5% in 2022 to 20% in 2023, reaching 26% in the first half of 2024.

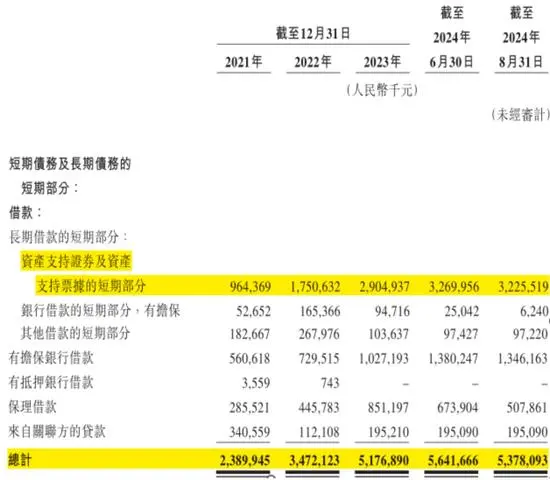

However, custom vehicles require significant upfront investment, leading to a heavy debt burden on the company. From 2021 to 2023, and as of June 30, 2024, and August 31, 2024, the company's short-term bank loan balance was 560.6 million yuan, 729.5 million yuan, 1 billion yuan, 1.4 billion yuan, and 1.3 billion yuan, respectively. During the same period, the company's debt ratio was 100.9%, 119.5%, 148.4%, and 149.5%, respectively.

Image source: Caocao Mobility prospectus

In this situation, an IPO is naturally a strategic move for Caocao Mobility. After separating from Geely, the cash cow, telling a compelling story is crucial, and custom vehicles are naturally part of that narrative. A significant aspect of this story lies in autonomous driving. In October this year, Gong Xin, CEO of Caocao Mobility, revealed at the 6th Global Intelligent Driving Conference that the company plans to launch fully customized Robotaxi models within two years.

In fact, both Dida Chuxing and Ruqi Chuxing have successfully gone public this year. Additionally, on November 13, Shengwei Times (which operates platforms like Xing365 and 365 Ride-hailing) submitted a prospectus to the Hong Kong Stock Exchange. From these perspectives, catching this wave of IPOs is also essential for Caocao Mobility's development.

Final Thoughts

Regardless of whether Caocao Mobility goes public or not, addressing compliance issues remains a top priority for the platform.

Earlier, the issue of proxy calling in the black market garnered widespread attention online. This year, regulators in various regions have repeatedly summoned ride-hailing and aggregation platforms for rectification, citing issues such as the incomplete elimination of non-compliant drivers and vehicles, order reselling, and high complaint rates on some platforms.

According to a driver's revelation on a social media platform, as a driver on the Caocao Mobility platform, their passenger entered through the Didi Chuxing mini-program and was connected to them. Not only were the platforms different, but the passenger actually paid 130 yuan, while the driver only received 76 yuan, with a commission rate far exceeding 30%. After investigation, the driver found that the passenger's actual payment displayed on their phone was 91 yuan, with the 39-yuan difference accounting for exactly 30% of the 130 yuan. In other words, platforms engage in secondary commissions through transaction orders, leaving drivers with very little.

In the first half of 2023, the Ministry of Transport and other five departments issued the 'Notice on Effectively Implementing the Standardized Management of Ride-hailing Aggregation Platforms,' stipulating that when passengers suffer damages due to safety accidents, the aggregation platform shall fulfill the responsibility of prior compensation in accordance with the 'Consumer Rights and Interests Protection Law.'

Clearly, for Caocao Mobility, addressing these non-compliance issues with a firm hand at this critical juncture of the IPO is of great significance, whether for repairing the income statement, safeguarding drivers' interests, or helping relieve the burden on Geely Group.

Editor: Zhong Xiang