Alibaba Finally Acknowledges: Transitioning Away from New Retail

![]() 12/20 2024

12/20 2024

![]() 595

595

Alibaba has decided to shed its physical retail operations and refocus on its core e-commerce business! Over the past decade, the company has incurred losses totaling nearly 57.4 billion yuan in its new retail endeavors.

Original: Xinshang

Author: Jiang Li | Editor: Long Kui

As expected!

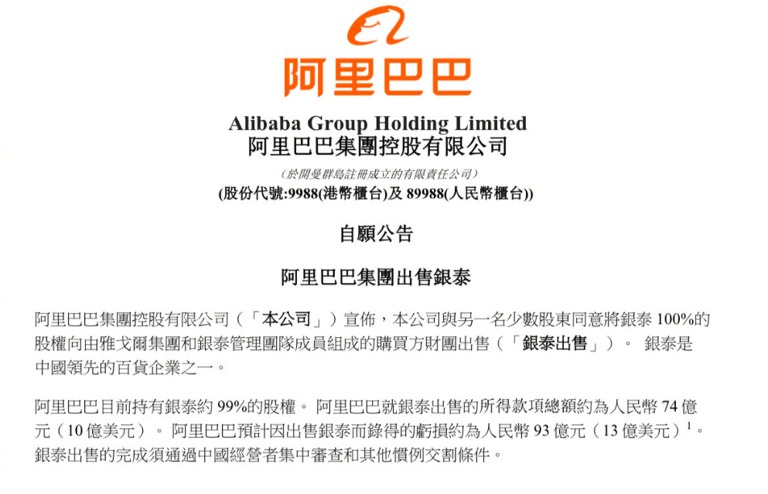

After nearly two years of rumors surrounding the sale of its new retail business, Alibaba has finally sold Intime.

Since its strategic investment of HK$5.37 billion in Intime in 2014, culminating in full ownership by 2018, Alibaba invested a total of approximately 20 billion yuan in Intime.

Now, Alibaba is willing to sell Intime at a loss of 9.3 billion yuan. Its goals are clear: one is to divest non-core assets, and the other is to return to its main e-commerce business.

The market has speculated about the reasons behind Alibaba's decision to part ways with Intime, but considering the losses incurred over the past decade in new retail, it's easy to understand Alibaba's rationale.

For Alibaba, both its strategic investment in Intime ten years ago and its current sale are driven by the evolving retail landscape.

A decade ago, when Alibaba entered Intime, it aimed to integrate traditional retail with digitization, transforming Intime into an online-offline integrated department store. In 2016, the concept of new retail emerged, and traditional retail officially embraced the internet. Nowadays, the rise of instant retail has propelled domestic retail into its 3.0 stage.

Against this backdrop, Alibaba's split with the asset-heavy Intime is well-timed.

Alibaba's new retail journey began with its strategic investment in Intime in 2014.

At that time, Alipay, still part of Alibaba, was in its user expansion phase and required numerous transactions to boost user numbers. Offline stores with abundant customer flow were naturally Alibaba's go-to choice.

Apart from multiple investments increasing its stake until full ownership, Alibaba established the new retail "benchmark" Hema in 2015 and invested 28.3 billion yuan in Suning Commerce Group, the predecessor of Suning.com, that same year. In 2016, Alibaba acquired up to 32% of shares in Sanjiang Shopping Club, a Chinese-funded supermarket operator, becoming its second-largest shareholder.

In 2017, Alibaba entered into a strategic partnership with Bailian Group, a large retail enterprise. Jack Ma, who attended the meeting, declared that 2017 marked the first year of Alibaba's new retail initiative.

That same year, Alibaba invested approximately HK$22.4 billion to acquire a 36.16% stake in RT-Mart. In 2020, it increased its stake for HK$28 billion, becoming RT-Mart's controlling shareholder. At that time, RT-Mart, which owned the RT-Mart and Auchan brands, was a leading physical comprehensive hypermarket in China.

Through a series of strategic investments, Alibaba extended its reach to multiple physical retail brands. The integration of online and offline fostered a period of rapid growth and prosperity for the internet ecosystem's new retail format.

However, the pandemic accelerated the shift in consumer behavior towards online shopping. The rise of instant retail further squeezed the living space of offline supermarkets. In this context, Alibaba's timely decision to "let go" of its physical retail business is undeniably correct.

In addition to this reason, Alibaba's decision to exit its physical retail business also stems from its focus on returning to its core business.

When it comes to Alibaba's core business, the e-commerce sector undoubtedly takes precedence. Among Alibaba's current major revenue sources, the e-commerce business of Taobao and Tmall Group ranks first with a revenue share of 44.27%.

Although still the leading e-commerce player, Taobao and Tmall Group face stiff competition from domestic platforms like Pinduoduo, JD.com, Douyin, and Kuaishou. Alibaba's fiscal second-quarter report for 2025 shows that Tmall Group's revenue increased by only 1% year-on-year for the three months ended September 30th.

To reverse the slowdown in its e-commerce growth, Alibaba has adopted two main strategies: reassigning its "formidable general" Jiang Fan from the overseas digital commerce sector to lead the Alibaba e-commerce business group once again, and implementing a "burden reduction" plan to gradually sell off non-core assets.

During the earnings call in February this year, Joe Tsai, when asked about "selling non-core assets," mentioned that Alibaba's balance sheet still included some traditional physical retail businesses that were not core-focused, making it reasonable for Alibaba to exit.

He also noted that given the current market situation, the exit might take time to achieve.

Selling Intime is just one step in Alibaba's exit from the physical retail business.

In fact, selling Intime at a loss is just a fraction of the losses Alibaba has incurred in new retail over the past decade.

Alibaba spent a total of HK$50.4 billion to acquire RT-Mart. Based on RT-Mart's total market value of HK$25 billion on December 18th, Alibaba suffered a loss of approximately HK$25.4 billion, or approximately RMB 23.86 billion, on its investment in RT-Mart.

Suning's share price has plummeted from 15.2 yuan per share when Alibaba invested in 2015 to a closing price of 2.2 yuan per share on December 18th. With 1.861 billion shares of Suning, Alibaba has accumulated losses of approximately 24.2 billion yuan. Coupled with the 9.3 billion yuan loss from the sale of Intime, Alibaba's losses in its new retail layout, including investments in these three physical retail entities, totaled nearly 57.4 billion yuan over the past decade.

The impact of online consumption on physical retail is profound.

In recent years, with the rise of online consumption and instant retail, e-commerce platforms have thrived. Under the division of traditional shelf e-commerce platforms like Taobao, JD.com, and Pinduoduo, as well as content e-commerce platforms such as Douyin and Kuaishou, the customer base for clothing, jewelry, and general merchandise in offline stores has continued to decline.

Although Intime, Suning.com, and others have increased their online presence by leveraging Alibaba's internet resources, their costly asset-heavy model is clearly at a disadvantage compared to the asset-light model of e-commerce platforms.

Simultaneously, the rise of instant retail has complemented the timeliness shortcomings of traditional e-commerce platforms, further drawing more users online.

New players in instant retail, such as Meituan Flash Stores, JD Daojia, and Ele.me's nearby brand flagship stores, are further compressing the living space of physical stores.

Wang Puzhong, CEO of Meituan's core local business, revealed at the 2024 Meituan Instant Retail Industry Conference that over 30,000 Meituan Flash Stores currently cover categories such as digital appliances, maternal and child toys, daily necessities, clothing, beauty and personal care, pet supplies, convenience stores, fruits, ingredients, alcoholic beverages, flowers, and medical devices.

When e-commerce platforms and instant retail platforms offer the advantages of a comprehensive product range, immediacy, and low cost, what can offline stores compete with?

In fact, in the new retail era, physical stores have not been absent from online-offline integration efforts.

With Alibaba's support, Intime has achieved omnichannel sales through the Mall Street app, the "Intime Department Store" WeChat mini-program, and the "Intime Department Store" Alipay mini-program, amassing over 40 million digital members. RT-Mart has also integrated with Taobao Fresh Go, Ele.me, and Tmall Supermarket.

However, analyzing the performance of Intime and RT-Mart in recent years reveals that despite establishing an online-offline link, its impact on performance is not significant.

The high operating costs inherent in the asset-heavy model are clearly detrimental.

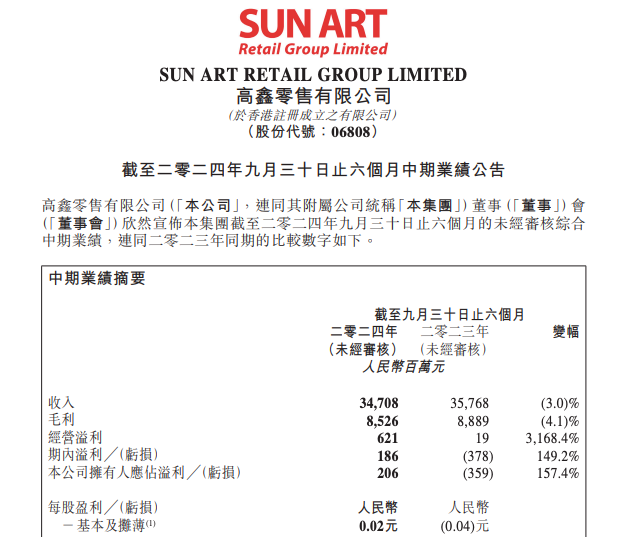

Taking RT-Mart as an example, the company's interim financial results report for fiscal year 2025 shows that for the six months ended September 30th, employee welfare expenses amounted to 4.106 billion yuan, and sales costs were 26.14 billion yuan, together accounting for approximately 87% of the total operating revenue of 34.708 billion yuan.

In addition to selling Intime, RT-Mart was briefly suspended from trading on September 27th this year. The company mentioned in its announcement that RT-Mart had received a contact letter from an interested bidder.

It's reasonable to speculate that RT-Mart might be the next physical retail business Alibaba will sell.

After "burden reduction" by abandoning the asset-heavy model, Alibaba has placed more hope in the "asset-light" instant retail for its new retail ambitions.

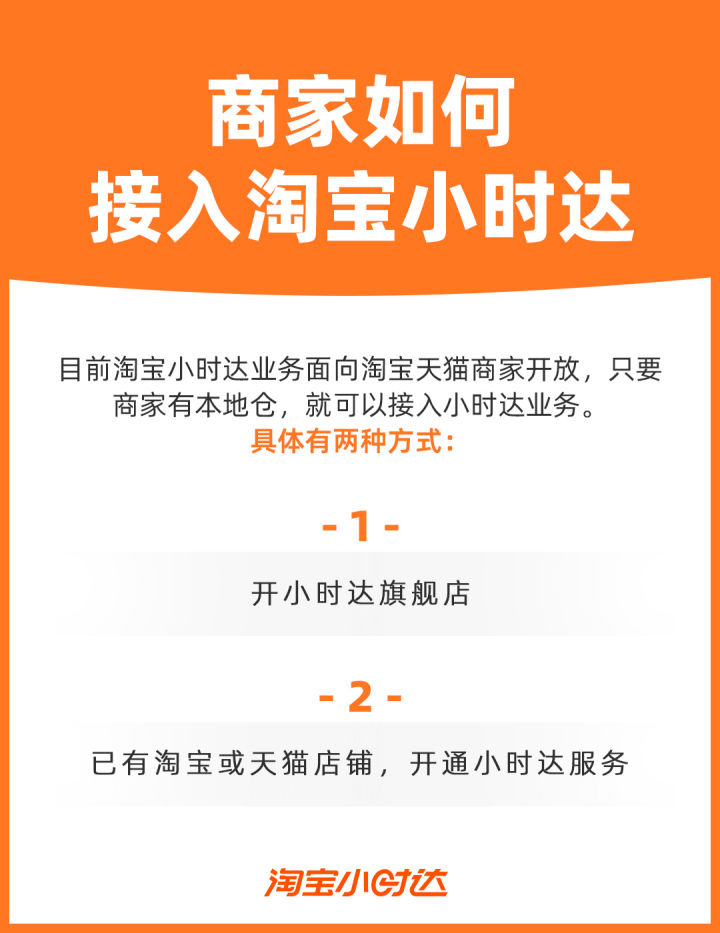

On one hand, it is strengthening its nearby official flagship stores through Ele.me, aiming to overcome the limitations of time and space in instant commerce. On the other hand, it is competing with Meituan, JD.com, Douyin, and others through Taobao's one-hour delivery service.

In July this year, Taobao once again prioritized its one-hour delivery service, giving it a prominent position on the app's homepage. Simultaneously, it collaborated with Ele.me to open up access for Taobao and Tmall merchants with local warehouses capable of meeting instant delivery demands.

Compared to asset-heavy physical retailers like Intime and RT-Mart, the dark store model significantly reduces offline operating costs. Moreover, intense competition in the instant retail sector has already expanded dark stores from single categories to full categories.

Admittedly, offline retail stores have application scenarios that cannot be replaced by online sales, such as music festivals, amusement parks, and meet-and-greets. For instance, Youngor, which has taken over Intime, aims to "strengthen and supplement the supply chain" and improve the fashion ecosystem in its future cooperation with Intime.

However, for Alibaba, whose primary business is e-commerce, divesting from physical retail at least aligns with the company's current development path.

Does Alibaba's move prove that it has completely abandoned new retail? Perhaps not. Maybe Alibaba is merely exploring and laying the groundwork for the next stage of new retail.