Freight Insurance: Stirring Up the E-commerce Landscape

![]() 12/20 2024

12/20 2024

![]() 631

631

Edited by | Jiran

"Since I received this return, I'll never open (freight insurance) again." An e-commerce merchant shared a photo of a shipping waybill on social media, highlighting in red the number 475/812, indicating one of over 800 returns received simultaneously.

This startling figure prompted some netizens to point out the underlying issue: a case of people specifically targeting freight insurance for fraudulent purposes.

There are various reasons for choosing to discontinue freight insurance. One merchant shared, "I stopped when freight insurance reached 1.5 yuan."

This comment resonated with many, eliciting responses such as, "I've gone up to 3.5 yuan," "Mine is 5 yuan," "The most expensive store I have is just over 6 yuan now"...

The numbers mentioned by these merchants refer to freight insurance premiums, which directly correlate with the return rate. Typically, insurance companies calculate premiums based on the merchant's return rate over the previous three months, with higher rates leading to increased premiums.

Today, it's evident that more and more merchants, particularly clothing merchants, have discontinued their freight insurance services on e-commerce platforms. While some large brands and international labels can still sustain the cost, many small and medium-sized merchants cannot. This phenomenon spans mainstream platforms like Taobao, Pinduoduo, and Douyin.

The plight of freight insurance hangs like a sword over merchants' heads, serving as a microcosm of the conflicts between consumers, merchants, and platforms within the current e-commerce ecosystem. If an e-commerce platform is a seesaw, with merchants and consumers on either end, favoring one side inevitably disadvantages the other. The platform continuously seeks a balance between the two.

The Frenzy of Profit Seekers

A policy originally intended to optimize the business environment and enhance user experience has unexpectedly become a target for the 'grey industry,' fostering an underground industrial chain.

A courier station owner openly advertised on their WeChat Moments:

"Recruiting 'downlines,' 'brushing returns to earn freight insurance, earning 2-3 yuan per order, taking only 10-20 minutes a day, and earning 500-600 yuan a month from home.'"

E-commerce self-media Paidai reported that to increase the success rate of profit seeking, some 'grey industry' practitioners have discovered a pattern: choose products priced under 10 yuan and opt for self-shipping.

Choosing products priced under 10 yuan reduces costs. Most single-digit priced products are small items with a first-weight limit of no more than one kilogram, allowing for inexpensive shipping. Opting for 'self-shipping' allows the courier station to earn money, with each order earning 0.3-0.5 yuan, and the courier station earning twice from one return or exchange.

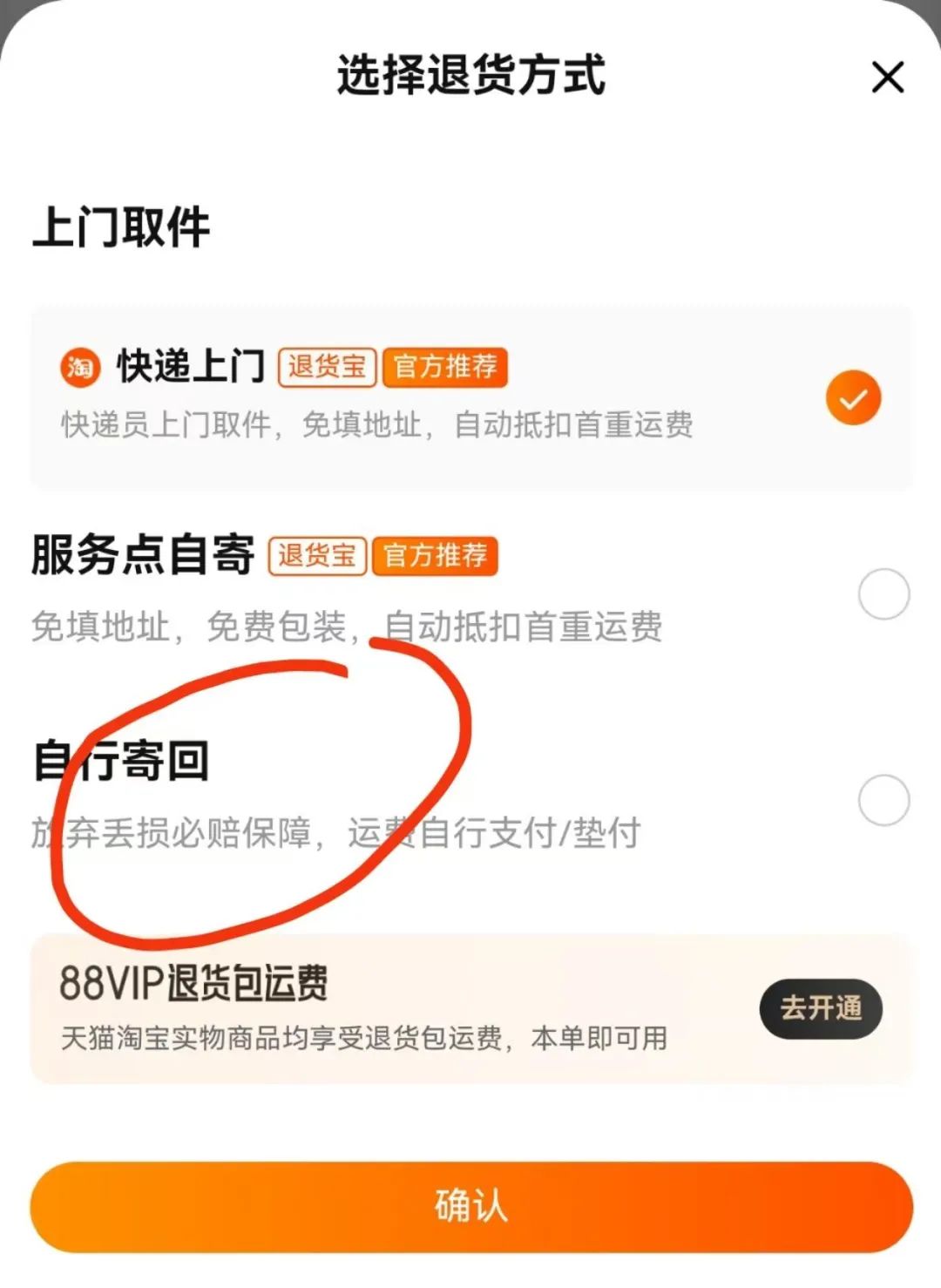

The stories of courier stations earning from freight insurance exposed by the media are actually just the tip of the iceberg. This venture is highly profitable, with a simple 'business model': earn the difference between low-cost shipping and freight insurance. Typically, products with freight insurance have a shipping subsidy of 10-13 yuan upon return. Normally, consumers opt for door-to-door delivery, with shipping costs directly deducted online. However, the option to 'return by self-shipping' exists, leaving room for exploitation. 'Profit seekers' utilize this option to find cheaper shipping channels through bulk shipping, reducing the return shipping cost to 3-4 yuan per order, thus creating a price difference.

This business relies entirely on volume and is highly profitable. Processing 100 orders a day can bring in 300-400 yuan.

Previously, media reported that searching keywords like 'freight insurance' on platforms like Xianyu could yield a wealth of information on profit seeking. "Grabbing freight insurance is simple and easy to get started, earning over 200 yuan a day initially, and stabilizing at over 1000 yuan later." However, these keywords have recently been blocked. It seems the platform has dealt with a batch of related grey industry links starting from keywords. But there are always ways around the rules; changing keywords can still yield similar information, such as 'Taobao return shipping' and 'freight insurance profit seeking'.

The entire industry has formed an invisible industrial chain. Sometimes shipping costs aren't that cheap? Search for 'dropshipping' on second-hand trading platforms, and an order can be sent for around three yuan. Want to earn more? Then ship further. The freight insurance cost for shipping from Beijing to Beijing is 6 yuan, but the compensation for freight insurance for shipping from Beijing to Xinjiang is around 15 yuan. Similarly, find a 'dropshipping' service on a second-hand platform, and the 'profit' directly doubles.

In a case uncovered by public security organs this year, professional profit seekers defrauded millions of yuan in freight insurance over eight months.

Merchants Have Long Suffered from Freight Insurance

The malicious disruption of the market by profit seekers has exacerbated the plight of e-commerce merchants.

The e-commerce industry is becoming increasingly competitive, and media reports show merchants frequently venting their frustrations. Doing business ultimately pursues higher returns with lower costs. However, the chaos behind 'freight insurance,' combined with ongoing practical challenges in the business process, significantly burdens merchants.

What is most crucial for merchants is controllable costs. Costs often play a pivotal role in the business chain, affecting the entire operation.

As early as June this year, Fang Jianhua, founder of Guangzhou Huimei Fashion Group, the parent company of the women's wear brand Inman, published an article calling on merchants to boycott freight insurance. He lamented its drawbacks, pointing out that it generates a large number of invalid orders. For a returned clothing order, the cost without revenue is about 15 yuan, including advertising fees, packaging materials, and shipping costs. "If we conservatively calculate a 40% return rate for sales of 10 million yuan with an average order value of 200 yuan, the loss cost exceeds 300,000 yuan, with a monthly loss of over a million yuan due to associated costs."

Some merchants calculate even more meticulously. A women's wear merchant explained in an interview that the average freight insurance for their store is 4.8 yuan. With a 60% return rate, it takes three shipments to complete one sale. The cost of three shipping bags is three yuan, post-return manual inspection and processing cost six yuan, the freight insurance premium for three shipments is 15 yuan, and shipping costs for three national average shipments are 12 yuan. The normal shipping cost for one piece of clothing is seven yuan, but now it costs 30 yuan to complete a sale.

The cost to complete a sale for one product has nearly tripled.

The problem is that this calculation method is not static and will increase with higher return rates.

A Taobao clothing merchant with over a decade of experience complained that previously, the freight insurance premium for each order in their store was only 0.3 yuan. At that time, they directly provided freight insurance services to consumers, putting little pressure on merchants and even boosting sales. However, as they were targeted by profit seekers and the return rate surged, their premiums shot up to 2 yuan per order. This merchant told Beijing News, "If 100 orders are shipped in a day, an additional 5100 yuan must be paid just for insurance premiums."

From his description, it's evident that this merchant's order volume isn't large, but the additional cost of over a thousand yuan per day is critical for small and medium-sized merchants. Larger brands are even more affected. With larger order volumes come more probable return orders and higher insurance premiums. This is a vicious snowball effect.

According to reports, due to increased returns, the insurance premium for White T-shirts rose from 1.5 yuan to 3 yuan per order, nearly matching the cost of shipping. With each sale not earning a penny and even subsidizing two shipping fees, the company's production compared to the first half of 2023 increased, but revenue decreased.

This phenomenon becomes even more critical during promotional periods. Promotions are crucial times for brands, with normally higher return rates than daily sales nodes. To win during promotions, merchants often enable freight insurance services. While it's common to use profits to exchange for sales and GMV during promotions, merchants previously invested the deducted profits in advertising and marketing, at least ensuring a return on investment. However, investing in freight insurance only leads to thankless efforts.

Third-party insurance companies also suffer. An insurance practitioner said, "As far as I know, this type of insurance barely makes any money. There are two reasons: first, the frequency of returns is high, meaning insurance companies must frequently compensate. Second, there is a risk of moral hazard, such as exploiting insurance companies for profit."

Moreover, the additional burden on merchants from freight insurance will ultimately be passed on to consumers. Fang Jianhua wrote in his article that when the return rate reaches 50%, one successful transaction user must bear the return cost of another user. When the return rate reaches 70%, one successful transaction user must bear the return costs of two users, creating a vicious cycle where inferior products drive out superior ones over time, making it increasingly difficult for consumers to purchase good products.

To delve deeper into this issue, beyond the malicious phenomenon of illegal 'profit seeking,' we should further consider a long-standing problem in the e-commerce sector that has been difficult to solve: why is the e-commerce return rate so high, especially in the clothing industry?

When the return rate soars to over 50% or even nears 80%, even excluding around 25% of return orders due to illegal activities, the burden on merchants remains unbearable.

Hence, more and more merchants are discontinuing their freight insurance services.

The Platform Strives for Balance between Consumers and Merchants

This is the 'bitter fruit' of industry competition. Some well-intentioned initiatives ultimately lose their meaning due to distorted actions. After all, consumption is an ecosystem requiring interaction between merchants, platforms, and consumers. If one party falters, the system will struggle to function effectively.

Theoretically, unless it is clearly the merchant's fault, the returning party should bear the shipping costs. However, due to competition, things have spiraled out of control. Once a platform sets a precedent, and once a merchant secures sufficient orders through freight insurance in the early stages, fierce competition rolls like a wheel, crushing everyone in its path.

Some are unwilling to compromise. Recently, Pangdonglai opened a shopping channel on its mini-program and chose not to offer free shipping for returns and exchanges, requiring consumers to bear the costs. However, we cannot impose Pangdonglai's approach on all e-commerce merchants. Pangdonglai is unique, with a special position in the current consumer market and nearly monopolistic status in Xuchang, supporting such decisions. Even if it loses online channels, its annual offline revenue exceeding 10 billion yuan won't cause significant losses.

To improve the e-commerce ecosystem, platforms may need to step in for balance or invest to gradually resolve issues.

Currently, many platforms have adjusted their freight insurance policies.

On September 12, Taobao and Tmall announced the launch of the Return Assurance service, available to all merchants. According to the platform's official statement, this move aims to reduce the burden on merchants. "By subscribing to Return Assurance, merchants can expect a reduction in shipping costs by at least 10%, with a maximum reduction of 30%, potentially saving merchants 2 billion yuan annually."

Douyin has also taken action. According to official Douyin information, eligible merchants can enjoy 100 free freight insurance orders within 30 days for every order sold. Some new merchants may also enjoy 'freight insurance premium discounts' upon receiving an experience score, receiving up to 1000 orders over 30 days for as low as 0.01 yuan per order.

Pinduoduo has adjusted policies for merchant rights. In August this year, Pinduoduo implemented a series of measures, including reducing the service fee for 'buy now, pay later' and merchant deposit fees, and introduced refunds for basic technical service fees and promotion fees. For refunds and returns, without merchant initiation, the platform automatically refunds collected fees, effectively helping merchants reduce operating costs. It also supports merchants in appealing against abnormal orders, with the platform compensating for relevant orders upon successful appeals.

A merchant said in an interview that they now receive cash red envelopes worth thousands of yuan each month from the Pinduoduo platform, providing some financial relief.

Behind these policies, platforms must invest to support merchants to some extent. Faced with significant merchant dissatisfaction, platforms first ended price wars earlier this year and subsequently 'spent money' to appease merchants.

However, all things in the world have their pros and cons. After a series of adjustments by platforms, some merchants have noted a decrease in unopened returns but an increase in used returns. While discontinuing freight insurance has reduced exploitation, merchants now feel a rise in return costs and must bear shipping costs themselves when returns are genuinely necessary.

However, we are currently observing transformations being initiated by platforms and merchant responses. Although these issues won't be resolved overnight, by tackling them methodically, we can progressively steer towards a positive trajectory.