WeChat Revamps "Grass Planting" Strategy: Can "Ask" Evolve into the Next "Little Red Book"?

![]() 12/20 2024

12/20 2024

![]() 512

512

Ask may become a pivotal addition to WeChat's grass planting content strategy.

This is a signal discerned by Tang Chen from recent WeChat activities. One involves participation as an Ask respondent in two themed discussions: "Plant Enthusiasts, Click Here to Restock" and "Gadget Recommendations: Which Digital Products Are Worth Sharing with Family and Friends?" As evident from the titles, both discussions revolve around grass planting. Besides my responses, other users shared their experiences under the same topics, mirroring the "question-and-answer building" seen on Zhihu or Little Red Book.

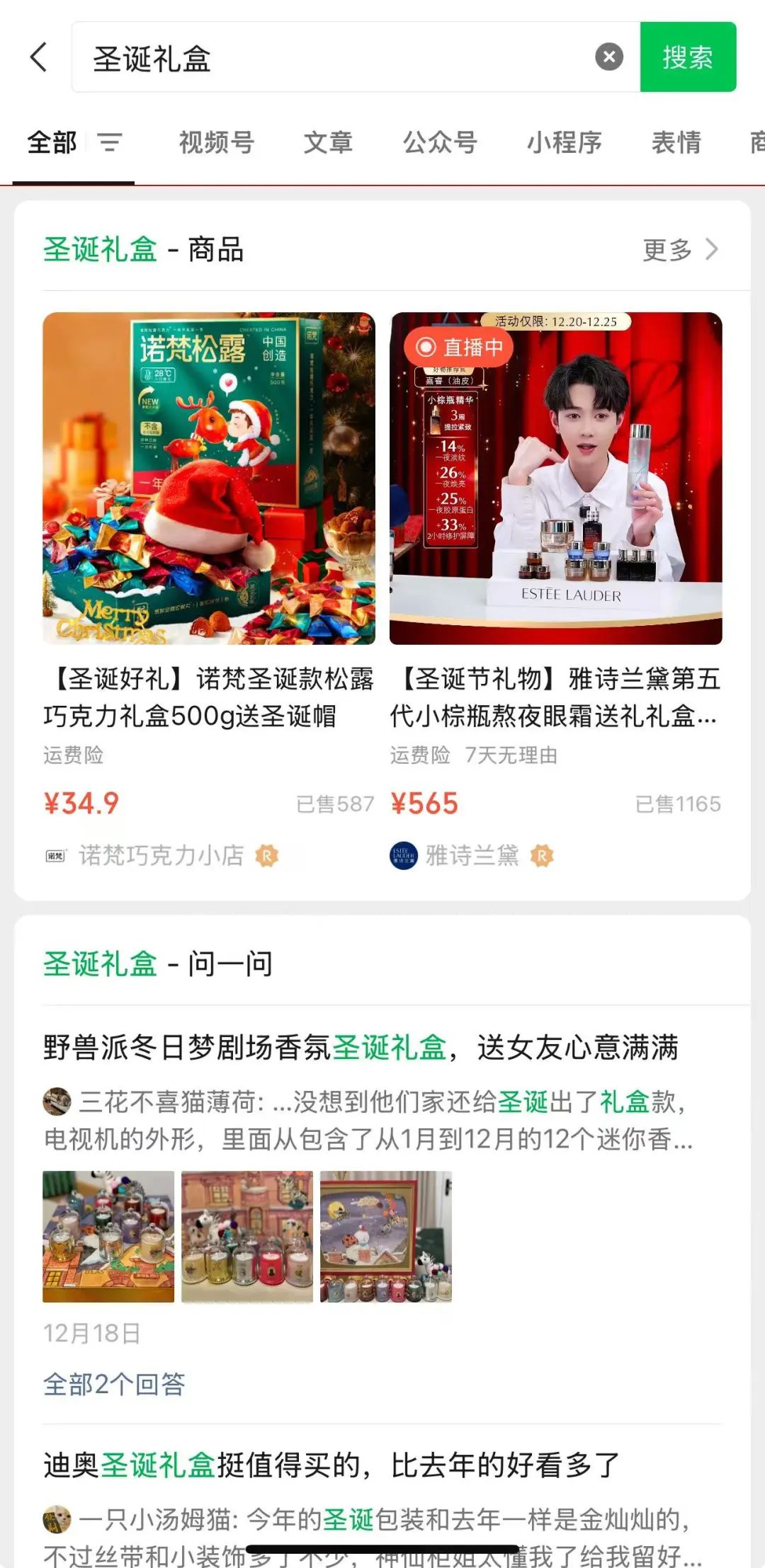

Another instance is a recent 36Kr video, which highlighted the launch of the "Gift Giving" function on the WeChat Store, currently undergoing extensive grayscale testing. Beyond focusing on the significance of the "Gift Giving" function, I noticed a subtle detail in its implementation. When searching for any gift brand or product on WeChat, such as La Mer Concentrate, Christmas gift boxes, chocolates, etc., in addition to displaying related products, high-quality grass planting content related to the searched brand or product is prominently displayed on the search results page with increased prominence.

From this, Tang Chen concludes that Ask is emphasizing grass planting content to validate the "Little Red Book" or "What's Worth Buying" model. By integrating with functions like Search and WeChat Store within the WeChat search system, it attracts more user engagement, becoming a vital component of WeChat's content supply for grass planting akin to Little Red Book. However, will WeChat reap new benefits this time?

WeChat's Two Attempts at Grass Planting

In fact, WeChat has made two notable attempts at grass planting.

As early as 2018, WeChat dipped its toes into grass planting with the launch of "My Shopping List." As a crucial part of WeChat's e-commerce layout, this function resembled Taobao's shopping cart. Users could add interesting products to "My Shopping List" after searching on WeChat, linking to various merchant mini-programs to complete purchases within WeChat.

In 2019, WeChat introduced "Good Things Circle," a shopping-sharing mini-program focused on friends recommending products to each other. It could be seen as a shopping version of "Moments" or simply a WeChat version of Little Red Book, emphasizing grass planting content to guide transactions within WeChat.

Shortly after, "Good Things Circle" was renamed "WeChat Circle," with significant functional changes. "WeChat Circle" appeared as an independent widget, allowing users to join different "circles" based on their preferences and interests to showcase content or products and connect with like-minded individuals. Within the circle, moderators and administrators could manage circle friends and related content.

A more intuitive analogy is that Good Things Circle is the WeChat version of Little Red Book, while WeChat Circle is a community akin to Douban or Tieba, gathering "private domain" traffic within the WeChat ecosystem. At that time, WeChat Circle was the best platform within the WeChat ecosystem to connect "content, social, and commerce," including fashion public accounts like Rebecca Li and Mrs. Ximen, which also opened their own circles.

Functionally, these three products share some continuity but also common drawbacks such as deep entry points, high user participation thresholds, weak community atmospheres, and unappealing content, ultimately failing to become phenomenal products.

For instance, to enter WeChat Circle, users had to navigate through three steps: "Discover - Search - Circle." To view or post content, they first needed to join a "circle" and be approved by the circle owner or administrator.

These hidden thresholds align with WeChat's consistent "grayscale testing" style. This led WeChat Circle to become a self-contained space for WeChat business owners and marketing content. By late 2021, the circle business was officially shut down. WeChat's first significant content community exploration failed.

However, WeChat didn't give up on grass planting content. In 2023, WeChat official accounts upgraded the image message function, almost mirroring Little Red Book in layout and reading style: the character limit for the text below images was expanded from 140 to 1000 characters. Coupled with the WeChat logo color, it was nicknamed "Little Green Book" by netizens.

Zhang Xiaolong once stated, "The original idea of the public platform was to replace SMS as a mass messaging tool based on connecting brands and subscribers, effectively avoiding spam SMS; the content of mass messaging was not the focus, but rather various forms like text, images, videos, etc."

But for a long time, official accounts adhered to a single long image-text format. WeChat's bet on short, notebook-style content for official accounts marked a "return" to Zhang Xiaolong's product vision. Simultaneously, the high-quality content pool of official accounts is a goldmine. How to tap into its commercial value became a question Tencent had to consider. The "grass planting economy" represented by Little Red Book might be a reproducible monetization strategy.

However, official accounts inherently have "defects" in cultivating the "grass planting economy." On one hand, they're limited by their product form, creating a "dammed lake" of traffic with a closed content production model. Despite having the industry's largest creative group, their open rate has gradually declined under the onslaught of "short, flat, and fast" platforms like Douyin, Kuaishou, Little Red Book, and Weibo.

Data shows that the overall open rate of WeChat official accounts dropped from 2.3% in 2018 to 1.1% in 2020. This is the fundamental reason why WeChat, under immense pressure, reformed official accounts multiple times, gradually shifting from the original subscription model to the "Toutiao" model of information flow and algorithmic recommendations.

On the other hand, Little Red Book's high commercialization efficiency stems from the dual drive of "content + social" and "KOL + KOC," boosting purchase conversion and repurchase rates far above industry averages. Behind this lies UGC (User-Generated Content) supply and community interaction fostered by Little Red Book.

WeChat's dilemma also lies here. While the form of grass planting is easy to imitate, it's challenging to simply graft short content supply and community atmosphere creation. Official accounts tend to be more of a media platform, and upgraded image messages merely provide product functionality, reducing the difficulty of creating "notebook-style" content for ordinary users.

Another critical point is that the community is a strongly operated product, while official accounts are weakly operated. Relying solely on creators' "love for their craft," the community atmosphere and topic discussion heat cannot match Little Red Book's impact.

Moreover, interaction in official account comments is not seamless. For example, new official account registrants are initially "unworthy" of commenting, and comments require author backend approval, significantly reducing interaction effectiveness. Notably, on Little Red Book, likes, comments, and other interactions are crucial metrics for evaluating note quality.

Furthermore, introducing grass planting somewhat contradicts the existing content system of WeChat official accounts. Some netizens have questioned why many platforms often rely on homogenization rather than innovation or creating original features to attract users?

May Become a New Piece in WeChat's "Notebook" Content Supply

These drawbacks, paradoxically, become Ask's advantages. From a product perspective, Ask is a question-and-answer platform, akin to Zhihu's model. It encourages users to ask questions and creators to answer them. Multiple answers to a question are ranked based on content quality, response time, and user feedback.

High-quality answers appear at the top of search results when users search related questions. Users can also like, share, or follow creators for their answers.

It's noteworthy that, like Zhihu, there's no clear definition of users or creators participating in question-and-answer sessions: a user can be a creator, and a creator can also be an Ask user. From this angle, if you want a quick impression of Ask, simply comparing it to "Zhihu" is a shortcut. But within the WeChat ecosystem, Ask is not another "Zhihu."

Previously, Tang Chen analyzed in the article "WeChat Wants to Replicate a 'Zhihu' in the Search Box?" that "Ask" is a significant addition to WeChat's search content.

Regarding Search's positioning, Tang Chen observed that relevant WeChat executives have repeatedly mentioned in public classes that WeChat isn't building a purely independent search engine but rather serving as part of the WeChat ecosystem to create more precise connections between better and more suitable content and services with users. The search results are based on content within the WeChat ecosystem, primarily including information, services, and brands.

Obviously, Ask also serves this purpose. In other words, Ask is tailored for WeChat users. On one hand, it can increase user activity and extend retention time; on the other, it enriches search content within the WeChat ecosystem, fostering a more dynamic content ecosystem, especially for hot topic discussions and practical content supply.

Compared to Zhihu, Ask is both closed and open. Being closed means it relies on WeChat's Search ecosystem to provide a Little Red Book-style social and interactive space where users can ask questions, share experiences and knowledge, and interact to obtain answers and likes.

Being open also stems from this. Ask supports logging in with "Official Account" and "Video Account" identities, effectively connecting different plugins within the WeChat ecosystem and integrating private and public domain traffic.

In 2024, WeChat significantly altered "Ask" and began internally testing a creator revenue-sharing plan. This not only underscores the official emphasis on it as a traffic entry point but also sends a crucial signal: when a product has commercialization strategy support, it gains self-sustaining ability. Ask will also receive further reinforcement from WeChat, including exploring engaging user interactions through operational means.

It can be said that, compared to the closed nature of official accounts, Ask is more like a product system facing public domain traffic within the WeChat content ecosystem. This is more conducive to grass planting content creation. Whether it's short content creation or interaction atmosphere, the threshold has been lowered to a level akin to Little Red Book.

In Tang Chen's view, the Ask team needs to "strengthen" these three areas next. It's not impossible for WeChat's "grass planting content" to find a new piece in the puzzle and achieve a comeback similar to "Video Account."

Firstly, solving the creator sourcing issue. A significant portion of Little Red Book's grass planting content creation relies on KOCs. Top influencers and KOLs aren't urgently needed; a wealth of UGC content and interaction sustain its community atmosphere. Similarly, for Ask, the focus should be on mid-level influencers and lowering content creation difficulty for users, engaging over 1.3 billion WeChat users to become the main force in producing grass planting content for Ask.

From Tang Chen's observations, WeChat users have already formed a certain independent content creation atmosphere. For instance, topics like "What's the most valuable digital gadget you bought this year?" and "Senior Mi Fans, show off your 'Xiaomi General Store'!" have ordinary users spontaneously discussing and sharing within their circles, providing a good example for content creation by ordinary users. However, this trend needs to strengthen to form a UGC creation atmosphere.

Secondly, breaking away from WeChat's past path dependency and being more proactive in operational activities, community atmosphere, and other aspects. Zhang Xiaolong is restrained, and WeChat is a super national application, leading to many operational activities feeling ungrounded or overly conservative. As giants tear down walls and new platform forces rise, WeChat also needs to show greater courage and conduct more operational activities to connect with users and creators.

A positive trend is that current Ask topic discussions already exhibit the characteristics of "one question with multiple answers" and "question-and-answer building." Generating such interactive behavior is crucial for fostering a community atmosphere. For example, when searching for data cables to buy, the displayed topic "Which Luvion phone accessories are worth buying?" has many answers, and more brands may recognize Ask's search value.

What it truly highlights is that, leveraging WeChat's vast user base, Ask's "planting content" represents a vast, untapped blue ocean that holds immense potential for both content creators and brands to explore.

Thirdly, it's crucial to seamlessly integrate with WeChat's e-commerce system, thereby achieving the shortest route to monetize planting content, which in turn spurs content creation. At the same time, it's important to avoid regressing to the outdated "Circle" model, where incremental steps fail to lead to significant progress.

From the trajectory of WeChat Store's "Gift Giving" function, one can deduce that WeChat is reinforcing a user logic or instructing users to utilize WeChat Search to find products and brands. This search behavior not only fosters user and content engagement but also provides a steady stream of traffic for Ask's planting content.

Notably, recent data reveals a noteworthy trend: reliable sources indicate that search volume within Little Red Book has reached half that of Baidu. This underscores the growing significance of search within the WeChat ecosystem and even Tencent's overall search business. Consequently, to meet the increasing demand for content, particularly short-form content, Ask's strengths will become increasingly prominent.