Marginalized Flying Pigs: User Loss and Recurring Marketing Controversies

![]() 12/23 2024

12/23 2024

![]() 760

760

Recently, China Railway 12306 publicly rebuked Flying Pigs for promoting the "Spring Festival travel ticket rush" campaign. China Railway 12306 openly stated that the announcement of the "Spring Festival travel ticket rush has begun" was purely a marketing gimmick and demanded that third-party platforms cease such promotional practices.

Stock Star has observed that since the beginning of this year, Flying Pigs has repeatedly faced marketing setbacks, not only being criticized twice by China Railway 12306 but also suffering rebukes from brand owners. This reflects the current dilemma facing Flying Pigs. Since Alibaba's organizational transformation, the company's position within the group has gradually been marginalized. Additionally, the company's user base has declined. Under this dual pressure, the company is accelerating its platform transformation towards an Online Travel Platform (OTP) model. However, this shift has not only failed to narrow the gap with competitors but has instead exposed shortcomings in service quality and operational efficiency.

01. Moving Towards the Margins of Alibaba

Public information indicates that Flying Pigs, formerly known as Taobao Travel, was established in 2010, marking the inception of Alibaba's (hereinafter referred to as Ali) foray into online travel. In 2014, Ali upgraded Taobao Travel to an independent brand, "Ali Travel - Qunar," positioning it as one of Ali's business groups. In 2016, Ali rebranded "Ali Travel - Qunar" as "Flying Pigs," emphasizing overseas travel experiences and internet innovation as its core businesses.

Stock Star has noted that after the rebranding to Flying Pigs, the company's management team underwent frequent changes. Before 2018, Li Shaohua led Flying Pigs. Leveraging his extensive experience in the aviation industry, Li Shaohua drove several innovative projects, such as "Future Hotel," "Future Scenic Area," and "Outbound Supermarket."

In March 2018, Li Shaohua was transferred from Flying Pigs, and Zhao Ying, head of Ali's Globalization Leadership Team, took over. This move was interpreted as Ali's desire to rapidly internationalize Flying Pigs. However, after assuming leadership, Zhao Ying did not implement significant reforms or focus on international expansion. Two years later, Flying Pigs underwent another high-level change, with Zhuang Zhuoran becoming the new leader.

Following these frequent leadership changes, Flying Pigs' position within Alibaba gradually diminished. In 2021, Alibaba announced an organizational upgrade, merging Gaode Maps, Local Life, and Flying Pigs into the Local Services segment. Then, in 2023, Alibaba initiated the "1+6+N" organizational transformation, grouping Flying Pigs, Hema Supermarket, RT-Mart, Alibaba Health, and others into the "All Other" segment, effectively removing Flying Pigs from the list of the six core groups.

In Alibaba's Q3 2024 earnings report, Flying Pigs' performance was barely mentioned individually, with only the overall performance of other segment businesses disclosed. The financial report revealed that the business generated revenue of 52.178 billion yuan in the third quarter, a year-on-year increase of 9%, primarily driven by increased revenue from the retail business, including Hema Supermarket and Alibaba Health. The adjusted EBITA loss was 1.582 billion yuan, marking an expansion of losses compared to the same period last year.

As Flying Pigs became marginalized, its user base also declined. According to QuestMobile research data, excluding Meituan from the online travel app rankings, based on the deduplicated total user count in June 2024, the top four apps are Tongcheng, Ctrip, Qunar, and Flying Pigs. Tongcheng and Ctrip have reached a user base of hundreds of millions, with 207 million and 135 million users, respectively. Qunar Travel has 50.75 million users, while Flying Pigs has 29.94 million users, a year-on-year decrease of 15%.

02. Repeated Marketing Controversies

Amid increasing marginalization and a declining user base, Flying Pigs has employed various marketing tactics to attract new customers, but these strategies have frequently resulted in controversies.

The most recent incident occurred on December 9 when Flying Pigs announced on Weibo the start of the Spring Festival travel ticket rush, claiming that reservations could be made up to 90 days in advance. Two days later, China Railway 12306 published an article on its WeChat official account stating that a third-party platform's claim that the "Spring Festival travel ticket rush has begun" and that "reservations can be made up to 90 days in advance" was purely a marketing gimmick unrelated to the China Railway 12306 platform and demanded that third parties cease such exaggerated practices. This article was widely perceived as a direct rebuke to Flying Pigs, which subsequently deleted the relevant Weibo post.

This is not the first time Flying Pigs has been criticized by China Railway 12306. In July this year, Flying Pigs launched a campaign offering a full refund on ticket cancellation fees for air and train tickets purchased on the platform, providing new users with one free train ticket cancellation benefit. Subsequently, China Railway 12306 responded, stating that the platform's promotion of "free cancellation" and "worry-free train ticket cancellation" for train tickets across the network was purely a marketing gimmick to attract new members, misleading consumers into believing that train ticket cancellation fees would be waived.

Furthermore, Flying Pigs has faced multiple rebukes from brand owners. For instance, in March this year, Flying Pigs announced the "Siege Price" campaign, promoting a promotional offer for The Westin Kyoto hotel. However, the hotel subsequently issued a statement stating that it had never authorized the sale of products at the relevant prices on Flying Pigs and had ceased the verification and cancellation of related orders on the platform.

Last September, Flying Pigs was accused of riding on the popularity of Moutai. At that time, Moutai and Luckin Coffee jointly launched the popular "Saucy Latte," prompting Flying Pigs to introduce a "Saucy Queen Room" package starting at 999 yuan per night. However, Moutai quickly clarified that it had not cooperated with Flying Pigs, leading Flying Pigs to eventually remove the "Saucy Queen Room" package from its offerings.

03. Struggling with the OTP Model

Stock Star has observed that at the strategic level, Flying Pigs is accelerating its platform transformation, shifting from the traditional Online Travel Agency (OTA) model to the Online Travel Platform (OTP) model, aiming to create an open travel ecosystem and attract more partners.

In April this year, Flying Pigs made significant adjustments to its membership system for the first time in three years, expanding membership levels from four to six and lowering the threshold for upgrading to the initial membership level. Simultaneously, Flying Pigs also expanded the scope of membership interoperability, allowing direct access to memberships of over 40 cultural and tourism brands such as Marriott, Accor, Hilton, and Mandarin Oriental. This move was also seen as an attempt by Flying Pigs to accelerate its OTP model.

It should be noted that the OTA model adopted by Flying Pigs in its early days was similar to that of most online travel companies like Ctrip and Meituan. In this model, the platform acts as an intermediary, providing consumers with centrally procured hotels, airlines, and other resources, earning commission income from them. Due to the platform's strong bargaining power in centralized procurement, it can better ensure service quality. However, the OTA model incurs higher costs, and the platform must assume the responsibility of performance management and supervision.

In contrast, the OTP model focuses more on providing a platform for third-party merchants without directly participating in product sales. Flying Pigs attracts airlines, hotels, and other suppliers to join and open stores, connecting users with merchants to generate profits. In this model, suppliers have greater pricing autonomy and operational freedom. For consumers, they can freely choose and compare prices on the platform.

However, due to the OTP model's weaker control over suppliers and lack of sufficient bargaining power on both the supply and demand sides, the platform's performance management capabilities are relatively weak, making Flying Pigs inferior to OTA platforms like Ctrip in terms of service quality and operational efficiency.

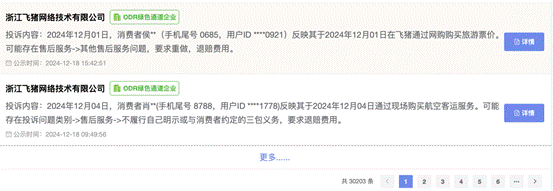

Stock Star has noted that although Flying Pigs' user base is smaller than that of Ctrip and Qunar, its number of complaints is significantly higher. As of December 19, there were over 30,000 complaints about Flying Pigs on the 12315 consumer complaint information disclosure platform, compared to fewer than 2,000 for Ctrip and Qunar.

Although Flying Pigs attempts to differentiate itself from the traditional OTA model by building an open travel ecosystem, industry insiders point out that consumers do not specifically distinguish between the OTP and OTA models. They often categorize platforms like Flying Pigs, Ctrip, and Tongcheng as the same type, considering them essentially comprehensive platforms for booking flights, hotels, and travel products.

In terms of APP layout, the homepages of Flying Pigs, Qunar, and Ctrip are similar, primarily displaying booking options for flights, train tickets, hotels, and travel itineraries.

In terms of market competition, Ctrip and Tongcheng have more targeted market strategies. China Merchants Securities noted in a research report that Ctrip targets high-tier city business travelers, while Tongcheng attracts travelers from lower-tier markets, and it is expected that Ctrip and Tongcheng's market shares will continue to increase in 2024.

In contrast, Flying Pigs relies more on the Taobao 88VIP membership system, with many users choosing Flying Pigs because they have a Taobao 88VIP membership, which allows them to directly receive a "Flying Pigs Money-Saving Card." (This article was originally published on Stock Star, written by Li Ruohan)

- End -