Douyin Aims to Penetrate Meituan's Stronghold with a GTV Target of 600 Billion Yuan in Local Services

![]() 12/23 2024

12/23 2024

![]() 636

636

Earlier this year, Zhang Chuan, then President of Meituan's On-site Business Group, penned a rare internal letter, a 4,200-word missive laden with over ten mentions of "battle," "war," and related terminology—terms that Meituan had refrained from using for years.

At the time, Meituan employees perceived the war analogy as a sign that the company was highly vigilant of its competitors, embracing a "winner-takes-all" mindset.

In retrospect, the deeper significance of this internal letter was Meituan sounding the alarm. Following the letter, Meituan embarked on frequent internal organizational restructurings, aimed primarily at countering the aggressive push by Douyin.

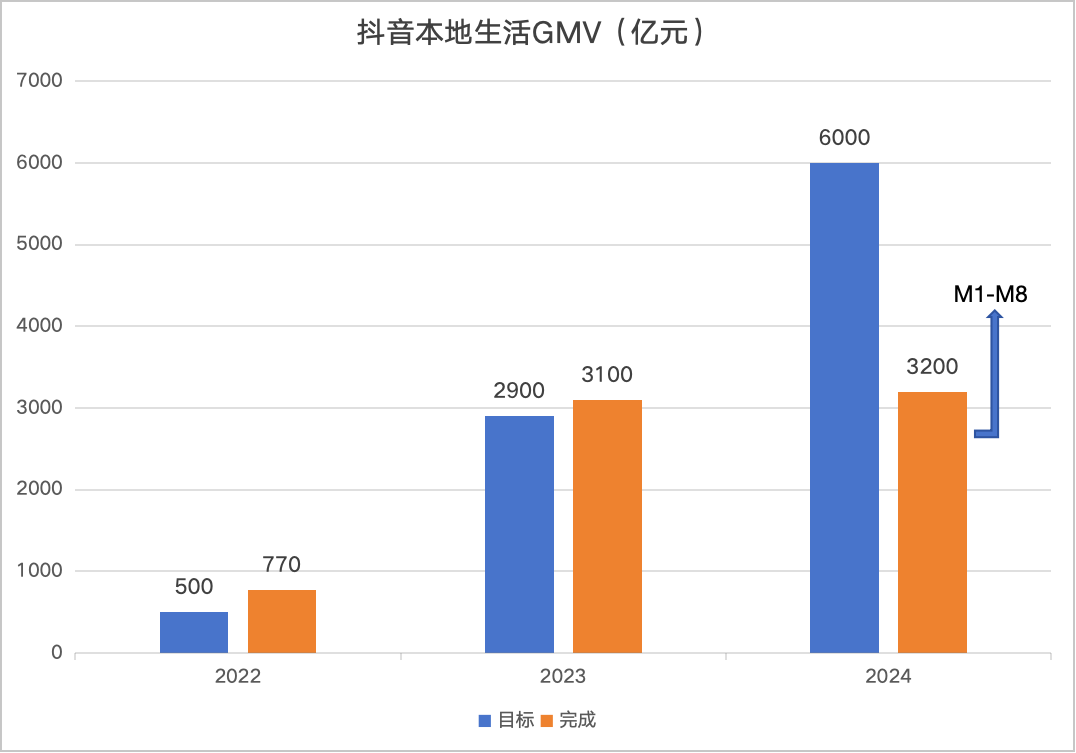

In November 2023, after assuming office, Pu Yanjing, head of Douyin Group's commercialization, immediately set a sales target of 600 billion yuan for the life services business in 2024, marking a near 100% year-on-year increase. In contrast, Meituan's On-site Business, which recorded sales of 700 billion yuan in 2023, aimed for only a 50% growth target for the same period.

Surprisingly, despite substantial growth in transaction volumes on both platforms over the past year, their strategic focus has shifted to revenue and profit growth, leading to increased commission rates and reduced subsidies.

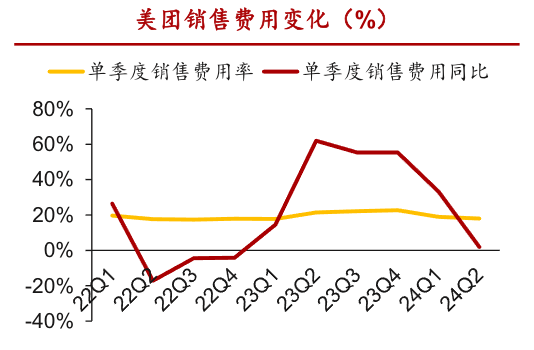

As a result, Meituan's sales and marketing expenses increased by only 1.9% and 6.2% year-on-year in the second and third quarters of this year, respectively, significantly slower than revenue growth rates of 19.3% and 22.4%. However, net profit surged by 142.1% and 258% year-on-year. Similarly, Douyin's life services business has achieved profitability, according to reports from Caizhongshe (note that the free traffic provided by Douyin for this business is not counted as a cost).

This raises the question: What prompted these two platforms to integrate and seek change, transitioning from aggressive expansion to refinement?

1. Meituan: Shifting from Defense to Offense

Since the beginning of this year, Meituan has undergone six significant organizational restructurings. The overarching direction involves integrating and delegating power between home delivery and on-site services, with young managers assuming key positions. The clear goal is to shift from defense to offense.

Before 2023, Meituan did not take significant countermeasures against Douyin because Douyin's local life services transaction volume was relatively small compared to Meituan's, and its primary categories, such as hotel stays and bubble tea, had a low verification rate and did not directly compete with Meituan.

Starting in 2023, Douyin's local life services transaction volume surged, particularly in the dining category, where it began to compete more directly with Meituan. This prompted Meituan to act. Initially, Meituan's strategy was defensive, using high-investment methods such as reducing merchant commissions, subsidizing users, offering low-priced group buys, and live streaming short videos to protect its market share in terms of traffic and supply.

On the traffic front, Meituan invested heavily in live streaming and short videos. It began testing live streaming in March 2023 and upgraded "Meituan Live" to a prominent banner entry on the homepage in July, opening up national traffic to self-broadcasting merchants without charging slot fees or commissions. Simultaneously, the bottom tab was changed to "Video." Meituan also provided support in terms of commissions and traffic diversion, but bridging the gap with Douyin in the short term proved challenging.

On the supply side, leveraging its long-standing merchant partnerships and offline sales team, Meituan aimed to redirect differentiated and low-priced offers that merchants provided on Douyin back to its own platform. It also offered merchants support in terms of commissions and event exposure.

Following these operations, merchant advertising budgets began flowing back to Meituan. From 2022 to the first half of 2023, the commission revenue growth rate of Meituan's core local commerce exceeded that of advertising revenue. However, from the second half of 2023 onwards, the growth rate gap narrowed, with advertising revenue growth surpassing that of commissions.

Nevertheless, Meituan's counterattack achievements were built on substantial investments. While it maintained its transaction volume advantage in 2023, subsidies, marketing, and other measures significantly increased last year's sales and marketing expenses.

By 2024, Meituan realized that this approach was unsustainable and decisively changed its strategic deployment. The frequent organizational restructurings had a clear intention—to identify internal efficiency gains. A prime example was the integration of home delivery and on-site services.

The integrated core local commerce accounts for over 70% of Meituan's total revenue. Wang Puchong was appointed CEO of core local commerce, marking the first time Meituan had two CEOs in its management sequence. This赋予Wang Puchong在人事和财务事务上更多话语权,能够调动更多公司资源。

This underscores Meituan's desire to regain agility and efficiency. On one hand, integrating home delivery and on-site services reduces internal competition, making resource allocation more efficient and reasonable. Home delivery and dining group buys essentially compete for the same wallet, and integration can streamline resource allocation in terms of traffic and products. For instance, the "Special Group Buy" feature once had three primary entry points, but excessive resource allocation may have negatively impacted food delivery. Currently, only the homepage banner remains as an entry point.

On the supply side, merchant resources can also be reused. The integration of highly overlapping home delivery and on-site dining merchants is expected to enhance BD efficiency and increase the penetration rate of on-site merchants. After integrating the membership system, the previously food delivery-only "Super Members" have gradually expanded to cover on-site services.

The most intuitive effect of integration is the potential for streamlining and efficiency gains among field BD personnel and various headquarters positions, further improving personnel efficiency.

Coupled with easing industry competition and reduced subsidies, this series of operations has significantly lowered Meituan's sales and marketing expense ratio. In Q3 2024, its "three expenses" (sales, general, and administrative expenses) totaled 26.043 billion yuan, with a year-on-year increase of only 5%, significantly lower than revenue growth.

2. Douyin: Identifying a Clear Path

Since 2022, Douyin has focused on local life services through live streaming, with deep discounts as its primary weapon. One reason is that during special periods, merchants' core demand is survival, and they are willing to sacrifice profits for significant discounts to attract customers.

Moreover, as a late entrant, Douyin needed deep discounts to capture users' attention. Unlike Meituan's active search model, Douyin's live streaming and short video formats are passive recommendation models with lower user conversion rates, necessitating deep discounts to boost conversions.

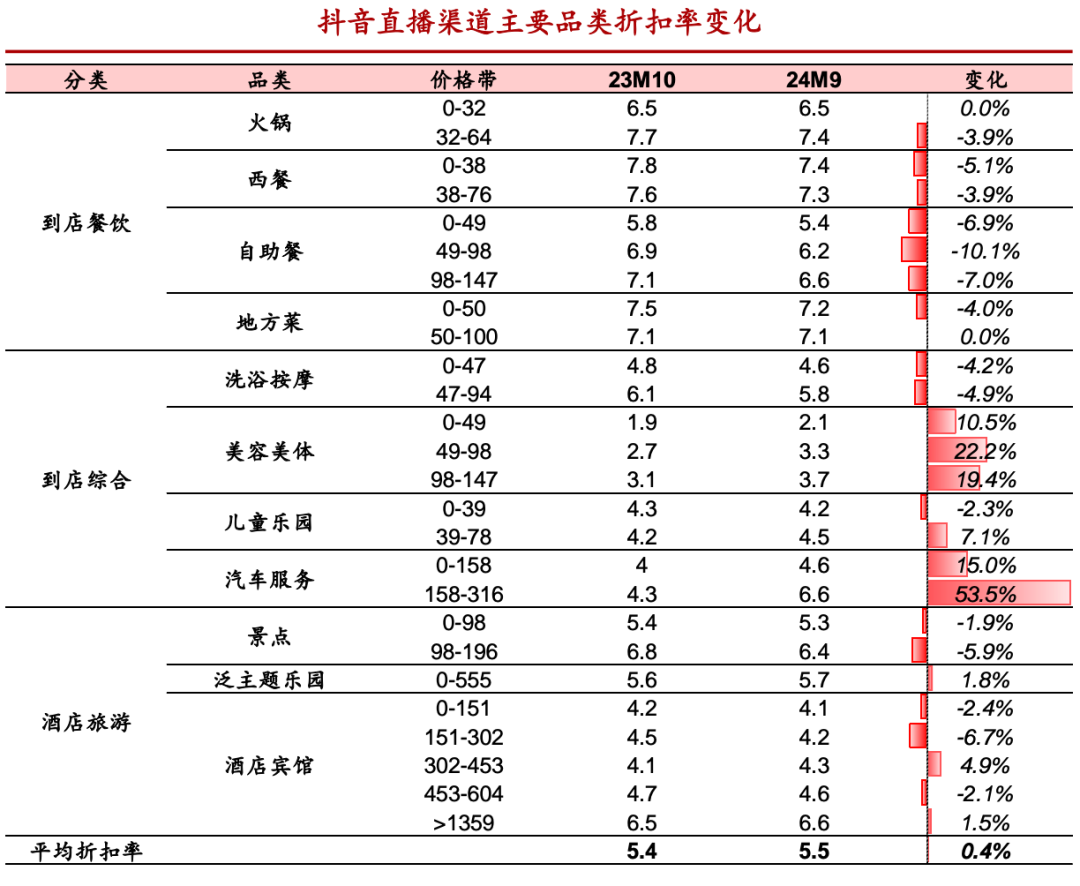

However, since 2023, Douyin has narrowed its discount depth. On one hand, merchants have recovered from operational crises and are pursuing profitability, reducing discounts. On the other hand, Meituan has required merchants to align discounts in response to competition.

There are two internal reasons for Douyin's reduced discounts:

First, catering enterprises have weak profitability and low supply elasticity. Additionally, group buys make price discrimination challenging. While deep discounts can attract customers during specific periods, they are difficult to sustain post-normalization.

Second, Douyin's channel profitability is weak, primarily due to high marketing costs. According to 36Kr reports, Meituan's average take rate in 2023 was approximately 4.5%. Considering advertising fees, the overall merchant sales and marketing expense ratio was in the high single digits. Douyin's catering take rate was 2.5%, slightly lower than Meituan's, but the live streaming + video content format added influencer and service provider links, coupled with advertising fees, resulting in a higher sales and marketing expense ratio for merchants compared to Meituan.

Therefore, from a merchant's perspective, to achieve profitability on Douyin, they must first ensure a sufficient order volume cap. Categories with greater supply elasticity can achieve large sales volumes with small margins, such as beverages and fast food snacks.

Secondly, chain KA stores with high conversion rates, brand awareness, and store density can sell on Douyin without significant discounts and incur lower marketing costs.

Finally, merchants prioritizing marketing over profitability, such as comprehensive on-site merchants accepting non-profitable lead generation orders but earning profits through repeat purchases, and newly opened merchants accepting short-term unprofitability for brand promotion, can also succeed on Douyin.

Douyin's adjustments, such as downplaying food delivery and returning to first- and second-tier cities, center around shifting from a broad approach to focusing on NKA and advertising operations, reflecting a strategic emphasis on commercializing local life services.

In 2024, Douyin's life services department underwent a comprehensive reorganization, transforming the original parallel departments of on-site dining, on-site comprehensive services, and hotel and travel (organized by industry) into three regional divisions for the north, central, and southern regions, as well as an NKA department serving national chain merchants.

Douyin's content operation is relatively cumbersome and has a threshold for merchants. It is challenging for small and medium-sized merchants in lower-tier cities to achieve effective conversions. Therefore, after the organizational restructuring, the strategic focus gradually returned to first- and second-tier cities and NKA customers.

Furthermore, in July this year, Douyin life services increased the commission rate for the accommodation sector from 4.5% to 8%. Besides the high gross margin during the summer hotel season, this increase was also possible due to long-term cooperation agreements between Douyin and multiple hotel groups. Since the catering business lacks similar in-depth cooperation, its commission rate will not be easily adjusted.

Both traffic and product and user subsidies are declining, which users are noticing. Many Douyin group buy coupons are no longer cheaper than those on Meituan. With the decline in price advantage, the sales growth rate of Douyin's life services has also slowed. According to 36Kr, Douyin's life services sales were less than 100 billion yuan in the first quarter and around 110 billion yuan in the second quarter.

3. Epilogue

This year, while setting a higher sales target for life services, Douyin is also striving to achieve break-even as soon as possible. On one hand, it is increasing commissions, and on the other, Douyin's local life services are intensifying monetization through advertising.

Douyin's shift towards commercial monetization amidst slowing transaction volume growth is essentially a land grab post-territorial expansion, identifying its definitive path. However, the threat from Douyin has not diminished for Meituan.

In the organizational restructuring in April this year, the shift from an industry-based to a region-based approach indicates that Douyin intends to enhance sales efficiency and increase merchant supply. In other words, Douyin is striving to cover more small and medium-sized merchants, narrowing the gap with Meituan in terms of merchant supply and strengthening users' perception of Douyin's life services.

As mentioned last year in "Meituan and Douyin: The Deciding Factor in Local Life Services," the core of Douyin's local life services operation revolves around "products" or "group buy packages," lacking the concept of "stores." The single lead generation method makes it challenging to establish a clear user perception, foster long-term repeat purchases, and help merchants accumulate operational assets to form a positive business cycle.

However, starting this year, Douyin has been solidifying its core business while strengthening its supply of small and medium-sized merchants and vigorously promoting the offline consumer mindset of "visiting stores."

Therefore, once Douyin establishes the concept of "stores," Meituan's position as the primary venue for merchant operations will be shaken.

Disclaimer: This article is based on publicly available information or data provided by interviewees. However, Decode and the author do not guarantee the completeness or accuracy of this information. Under no circumstances do the information or opinions expressed herein constitute investment advice.