The Magnification of Commercialization Priority: Xiaohongshu's 2025 Roadmap Unveiled

![]() 12/26 2024

12/26 2024

![]() 732

732

Lu You, in his poem "Reading in Winter Night and Showing to Ziyu," wrote, "What one learns from books is always shallow; to truly understand something, one must experience it oneself." This aptly summarizes the ever-evolving landscape of the internet industry, where "growth" remains a perpetual theme.

As 2024 draws to a close, no player is stagnant; all are actively putting their strategies into practice. Among them, Xiaohongshu, having achieved its first profit in 2023, has embarked on various exploratory ventures.

Image source: pixabay gallery

This year alone, Xiaohongshu has ventured into diverse areas: in April, it explored the integration of trending topics with cultural tourism, launching the "New City Identity" initiative; in July, it revisited "lifestyle e-commerce"; in August, it entered the online novel market; and in September, it delved into local life services, introducing catering group-buying to 49 cities nationwide.

More recently, Xiaohongshu not only announced its three primary commercialization directions for 2025 but also hosted the 2025 WILL Business Conference themed "Seeding, Taking Business Further."

The long-standing dilemma between commercialization and content for Xiaohongshu finally has an answer.

As commercialization accelerates, does Xiaohongshu have a new plan in store?

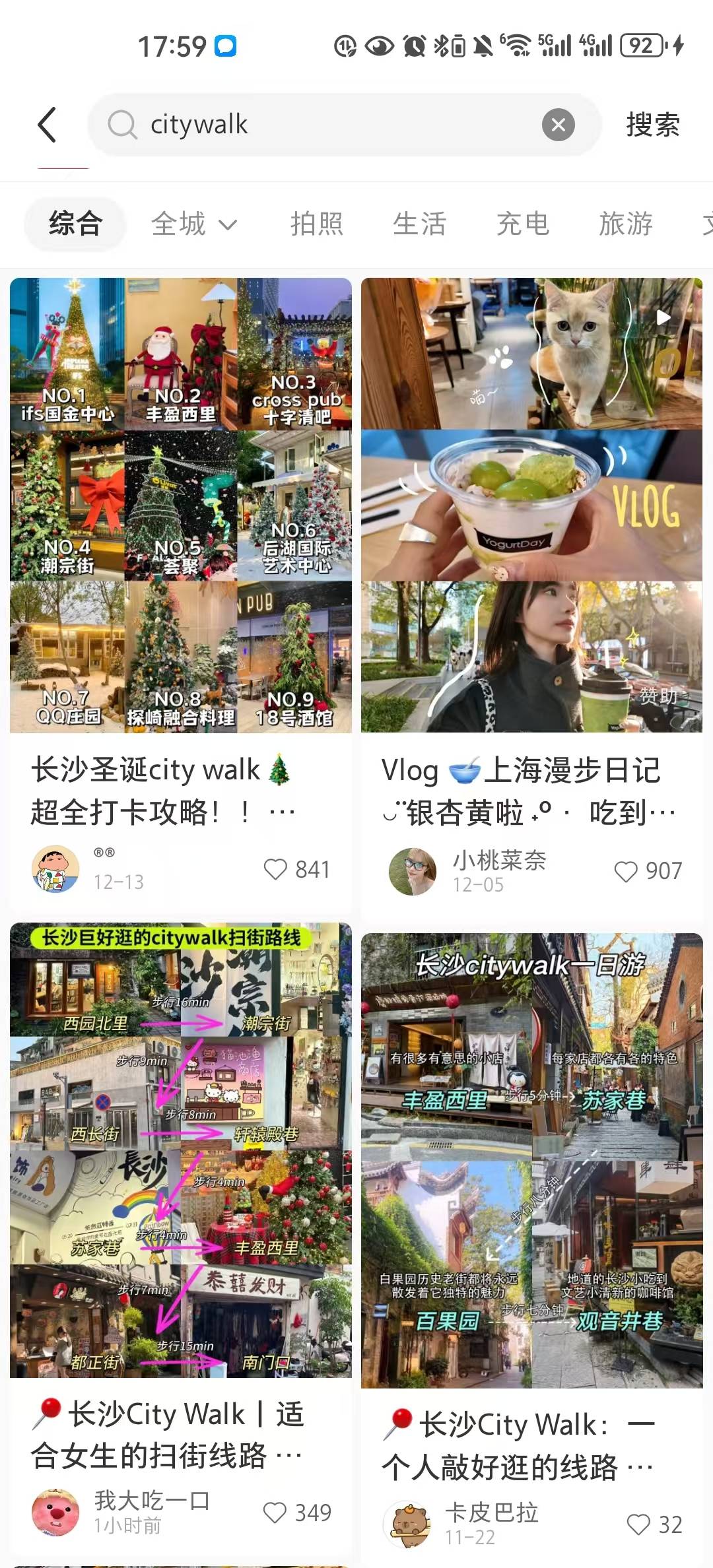

Although Xiaohongshu created buzzwords like "City Walk" in 2023 and sparked the "Barn Style" fashion trend in winter 2024, solidifying its reputation as a trendsetter, it has faced hurdles in practical matters such as community growth. Behind the frequent turnover of community content leaders lies the formidable challenge of meeting stringent monthly active user targets.

Image source: Xiaohongshu

Moreover, Xiaohongshu faces monetization challenges, often functioning as a traffic diversion platform for e-commerce giants like Taobao, JD.com, Pinduoduo, and WeChat, and was once seen as a "search engine" rivaling Baidu for market share.

According to the "Top Ten Search Trends Insights on Xiaohongshu" in the first half of 2024, over 70% of Xiaohongshu's monthly active users utilize the search function, averaging up to six searches daily. The search feature distinctively sets Xiaohongshu apart from other content e-commerce platforms, as its users exhibit stronger subjectivity and clearer content preferences.

However, the search attribute is a double-edged sword for Xiaohongshu. While the subjectivity behind searches helps the platform swiftly capture emerging trends, the ingrained search habit makes it harder to activate users' latent needs.

Not only is the platform hindered by the constraints of the "search" attribute, but its content sections also lag behind in unison. Merchants in lifestyle services, such as travel and home decoration, express dissatisfaction with the platform's inadequate fulfillment of their needs.

Furthermore, merchants joining the platform face uncertainty regarding the key metric—how much sales revenue they can generate across the platform post-advertising on Xiaohongshu.

Historically, Xiaohongshu's advertising metrics have been based on CPM (cost per thousand impressions), exposure, click-through rate, etc., focusing more on process rather than outcome. While these metrics are quantifiable, they do not directly correlate with merchants' final conversion rates. To assess advertising effectiveness, merchants must integrate search and sales growth data from multiple platforms.

This is not the first time Xiaohongshu has addressed product seeding measurement. At the 2023 WILL Business Conference, Xiaohongshu attempted to quantify users' "deep reading" and "deep interaction" behaviors on the platform.

Overall, Xiaohongshu's immediate goal in establishing a commercialization closed loop is to enhance monetization capabilities, with a focus on profitability. This aligns with potential IPO plans in Hong Kong. Market expectations indicate that Xiaohongshu might double its profits in 2024, surpassing the $1 billion mark, paving the way for an initial public offering (IPO).

So, how can Xiaohongshu, with its ambitious goals, turn its dreams into reality?

Amidst numerous challenges, where lies the breakthrough for commercialization?

Throughout its journey, Xiaohongshu has transformed from a content community to a "content e-commerce" platform. Due to its late entry into e-commerce, its commercialization closed loop has always been less than ideal.

However, with years of experience, Xiaohongshu has found a direction to establish a commercialization closed loop. Currently, it needs to make breakthroughs in improving efficiency and expanding coverage.

Firstly, enhancing monetization efficiency is crucial. Only by overcoming monetization hurdles can the full process, from seeding to final sales delivery, be realized in the e-commerce sector.

Considering decision-making cycles and product categories, different products have varying cycles. Without engaging in price wars or prematurely advancing business for merchants, Xiaohongshu aims to provide longer-term, sustainable, and more efficient conversion results.

Here, a simple and accurate measurement process is not the ultimate goal; the purpose is to optimize strategies after clearly understanding patterns.

Moreover, as mentioned, merchants prioritize sales revenue and search conversion post-advertising on the platform. Their essential needs lie in effectiveness, efficiency, and scale.

Therefore, from a business efficiency perspective, the platform must have a nuanced understanding of people, needs, and the scenarios where these needs arise to accurately identify users' purchase intentions. It also needs to make precise matches, pushing suitable products to users through the most suitable influencers, content, and fields to enhance efficiency.

In this direction, Cang Xiang, the head of commercial technology at Xiaohongshu, unveiled a comprehensive solution for measuring product seeding on Xiaohongshu, focusing on two dimensions: the measurement of the seeding process and the measurement of seeding results, primarily emphasizing "how to accurately measure the business value of product seeding," a concern for merchants and enterprises.

Next is expanding content coverage. Based on its high-quality user base and community atmosphere, along with 88% of user searches being active searches, Xiaohongshu has always been regarded as the "preferred platform for users' life decision-making searches."

However, the current imbalance in content sections on the platform has caused frustration for some merchants. Therefore, Xiaohongshu can integrate platform merchant needs, expanding from a focus on consumer goods to satisfying multiple industries, with a particular emphasis on breakthroughs in lifestyle service industries.

Furthermore, in addition to the e-commerce sector, Xiaohongshu's advertising business is also closely related to content monetization. In terms of advertising presentation, AI technology can be applied not only at the content level to enhance advertising creativity but also in advertising placement and marketing strategy customization. With AI technology, efficiency tools can be created to bridge the gap between content quality improvement and monetization efficiency.

The next step is transitioning from "small but beautiful" to "large and comprehensive"

With a clearer vision for commercialization, Xiaohongshu faces a new test—balancing content and commercialization amidst accelerated monetization.

Recently, as the year concludes, Xiaohongshu took a significant step. Nearly 1.26 million users lost their accounts overnight, mostly due to the "Xiaohongshu Black and Grey Industry Account Governance" campaign, prompting complaints from many Xiaohongshu users.

This reflects that, amidst accelerated commercialization, Xiaohongshu has begun making adaptive adjustments to content.

Unlike the past, when Xiaohongshu struggled to balance commercialization with maintaining platform tone, today, platform traffic is clearly tilted towards commercialization, with stricter content review and violation control. This is the most striking aspect of Xiaohongshu in 2024, as it unveils the prelude to comprehensive commercialization, requiring all platform stakeholders to adapt to new rules.

However, this one-size-fits-all approach inevitably causes discomfort. From a user perspective, we observe that everyone has become accustomed to exchanging likes, interactions, and mutual follows for incremental growth. Yet, these "old customs" are now deemed "dishonest" behavior for account nurturing from the platform's new growth perspective.

Faced with user discomfort and the gradual rollout of comprehensive commercialization, Xiaohongshu needs to shift from a "small but beautiful" approach to a new position of "large and comprehensive."

Image source: pixabay gallery

Compared to Douyin's content review, Xiaohongshu lacks a vast content review and customer service team. The original team's focus remains on content dimensions, leading Xiaohongshu's review standards to favor the efficiency brought by "one-size-fits-all" approaches over careful categorization and screening.

This has resulted in any behavior related to "speculation" being indiscriminately treated as Xiaohongshu accelerates its commercialization journey. However, the root cause behind these phenomena is that Xiaohongshu's existing "infrastructure" cannot match the hardware support required for its grand vision.

Compared to Douyin's commercialization system, Xiaohongshu's ecological infrastructure construction lags behind. For instance, return shipping insurance, crucial for consumer trust, was not officially supported by Xiaohongshu until late 2023. The imperfection of the entire ecological infrastructure hinders content and commercialization progress.

Therefore, the most direct way for Xiaohongshu to achieve a delicate balance between content and commercialization at this stage is to improve its "ecological infrastructure."

In 2025, as Xiaohongshu enters the second year of comprehensive commercialization, its profitability monetization capabilities may reach a higher level. In the future, Xiaohongshu will also move closer to the capital market.

Source: HK Stocks Research